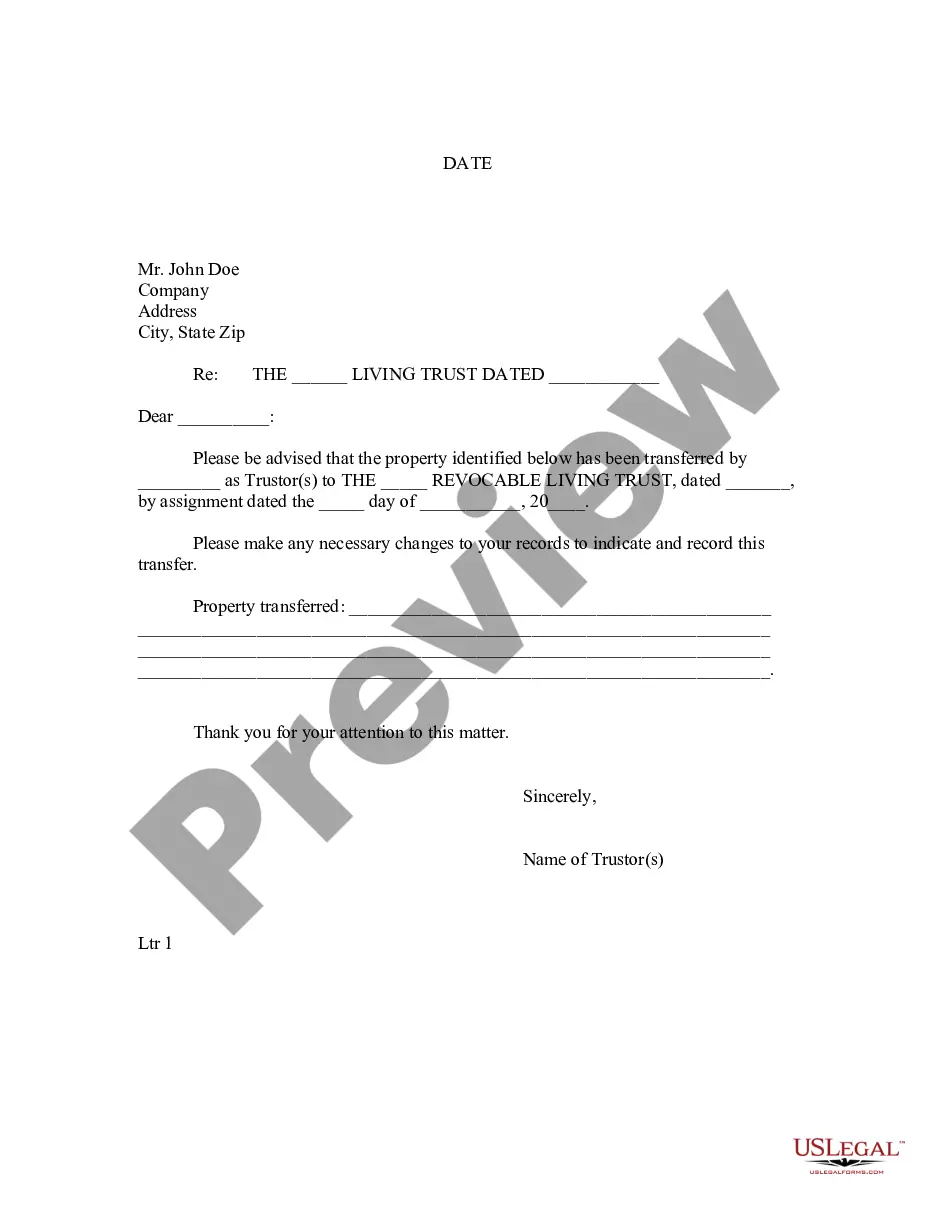

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

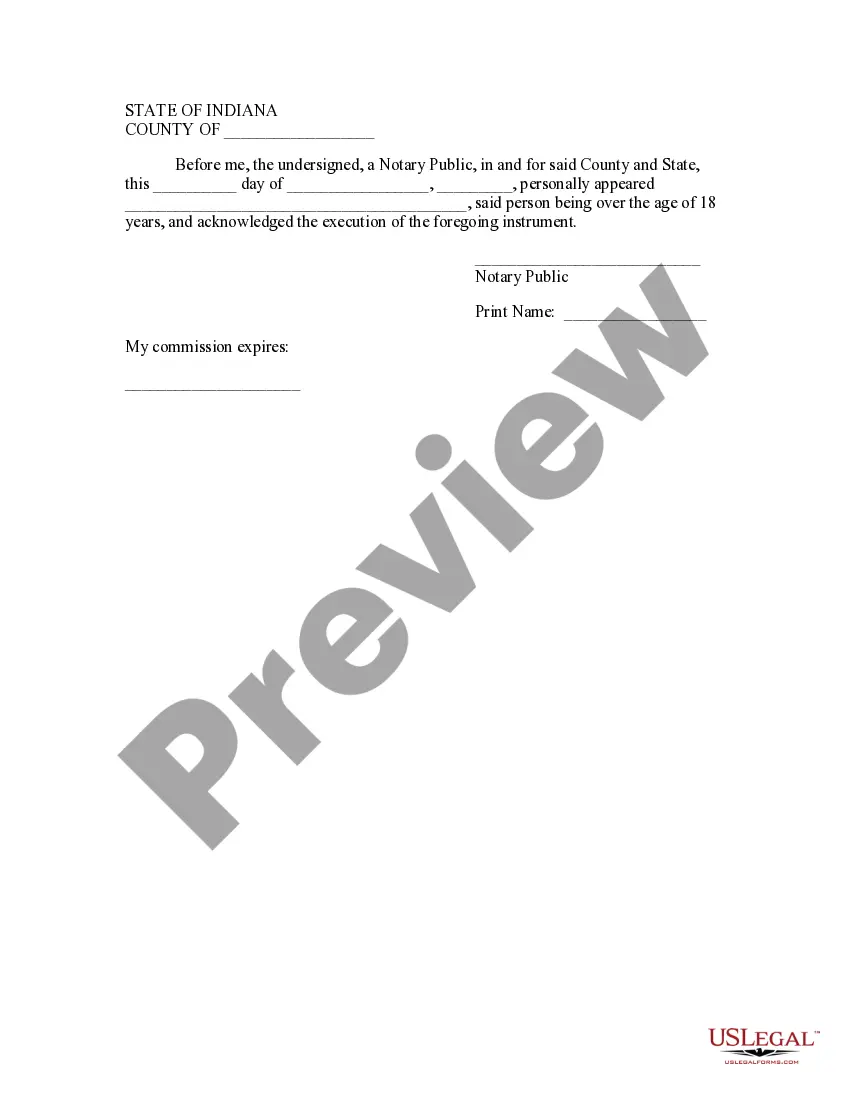

Title: South Bend, Indiana Letter to Lien holder to Notify of Trust — A Comprehensive Guide Introduction: A South Bend, Indiana letter to a lien holder is a formal correspondence that notifies a lien holder about the creation of a trust. This legally binding document provides specific information about the trust, including its purpose, the trustee, the assets involved, and any relevant details regarding the lien holder's interests. By notifying the lien holder of the trust, all parties involved are aware of the trust's existence and the potential impact it may have on any liens or encumbrances held by the lien holder. Keywords: South Bend, Indiana, letter to lien holder, notify, trust, purpose, trustee, assets, liens, encumbrances. Main Body: I. Understanding South Bend, Indiana Letters to Lien holders: A. South Bend, Indiana: Briefly discuss South Bend's location and its jurisdiction so that the reader understands the context. B. Lien holder: Define a lien holder as a party who holds a valid lien (or claim) on an individual's or entity's property to enforce a debt repayment. C. Letter to Lien holder: Explain that this correspondence serves as an official notification to the lien holder about the creation of a trust. II. Contents of the South Bend, Indiana Letter to Lien holder: A. Identifying information: Include the legal names and addresses of all parties involved: the lien holder, the trust or (creator of the trust), and the trustee. B. Purpose of the Trust: Clearly state the primary objective of the trust, whether it is for asset protection, estate planning, or any other related intent. C. Trustee Information: Provide detailed information about the appointed trustee, including their name, address, contact information, and any relevant qualifications. D. Asset Listing: Enumerate all the assets placed within the trust, highlighting their specifics and values. E. Liens and Encumbrances: Specify any existing liens or encumbrances related to the assets, and acknowledge that the lien holder's interests may be affected by the trust's establishment. F. Effective Date: Clearly indicate the date on which the trust became effective to ensure accuracy and legal compliance. G. Notification Acknowledgment: Request the lien holder's confirmation of receipt and acknowledgment of the trust's creation within a reasonable timeframe. III. Types of South Bend, Indiana Letters to Lien holder: A. Irrevocable Trust Notification: Detail the process and specific content required when notifying a lien holder about an irrevocable trust, where the trust or relinquishes their control over the assets. B. Revocable Trust Notification: Explain the differences when notifying a lien holder about a revocable trust, which allows the trust or to retain control and amend the trust's terms during their lifetime. Conclusion: A South Bend, Indiana letter to a lien holder to notify them of a trust is a crucial step in establishing open communication between all relevant parties. By correctly notifying the lien holder, both the trust or and the trustee ensure transparency and clarity regarding the trust's existence and potential impacts on any liens or encumbrances. Adhering to these legal procedures further protects the interests of all parties involved. Keywords: South Bend, Indiana, letter to lien holder, notify, trust, communication, transparency, interests, legal procedures.Title: South Bend, Indiana Letter to Lien holder to Notify of Trust — A Comprehensive Guide Introduction: A South Bend, Indiana letter to a lien holder is a formal correspondence that notifies a lien holder about the creation of a trust. This legally binding document provides specific information about the trust, including its purpose, the trustee, the assets involved, and any relevant details regarding the lien holder's interests. By notifying the lien holder of the trust, all parties involved are aware of the trust's existence and the potential impact it may have on any liens or encumbrances held by the lien holder. Keywords: South Bend, Indiana, letter to lien holder, notify, trust, purpose, trustee, assets, liens, encumbrances. Main Body: I. Understanding South Bend, Indiana Letters to Lien holders: A. South Bend, Indiana: Briefly discuss South Bend's location and its jurisdiction so that the reader understands the context. B. Lien holder: Define a lien holder as a party who holds a valid lien (or claim) on an individual's or entity's property to enforce a debt repayment. C. Letter to Lien holder: Explain that this correspondence serves as an official notification to the lien holder about the creation of a trust. II. Contents of the South Bend, Indiana Letter to Lien holder: A. Identifying information: Include the legal names and addresses of all parties involved: the lien holder, the trust or (creator of the trust), and the trustee. B. Purpose of the Trust: Clearly state the primary objective of the trust, whether it is for asset protection, estate planning, or any other related intent. C. Trustee Information: Provide detailed information about the appointed trustee, including their name, address, contact information, and any relevant qualifications. D. Asset Listing: Enumerate all the assets placed within the trust, highlighting their specifics and values. E. Liens and Encumbrances: Specify any existing liens or encumbrances related to the assets, and acknowledge that the lien holder's interests may be affected by the trust's establishment. F. Effective Date: Clearly indicate the date on which the trust became effective to ensure accuracy and legal compliance. G. Notification Acknowledgment: Request the lien holder's confirmation of receipt and acknowledgment of the trust's creation within a reasonable timeframe. III. Types of South Bend, Indiana Letters to Lien holder: A. Irrevocable Trust Notification: Detail the process and specific content required when notifying a lien holder about an irrevocable trust, where the trust or relinquishes their control over the assets. B. Revocable Trust Notification: Explain the differences when notifying a lien holder about a revocable trust, which allows the trust or to retain control and amend the trust's terms during their lifetime. Conclusion: A South Bend, Indiana letter to a lien holder to notify them of a trust is a crucial step in establishing open communication between all relevant parties. By correctly notifying the lien holder, both the trust or and the trustee ensure transparency and clarity regarding the trust's existence and potential impacts on any liens or encumbrances. Adhering to these legal procedures further protects the interests of all parties involved. Keywords: South Bend, Indiana, letter to lien holder, notify, trust, communication, transparency, interests, legal procedures.