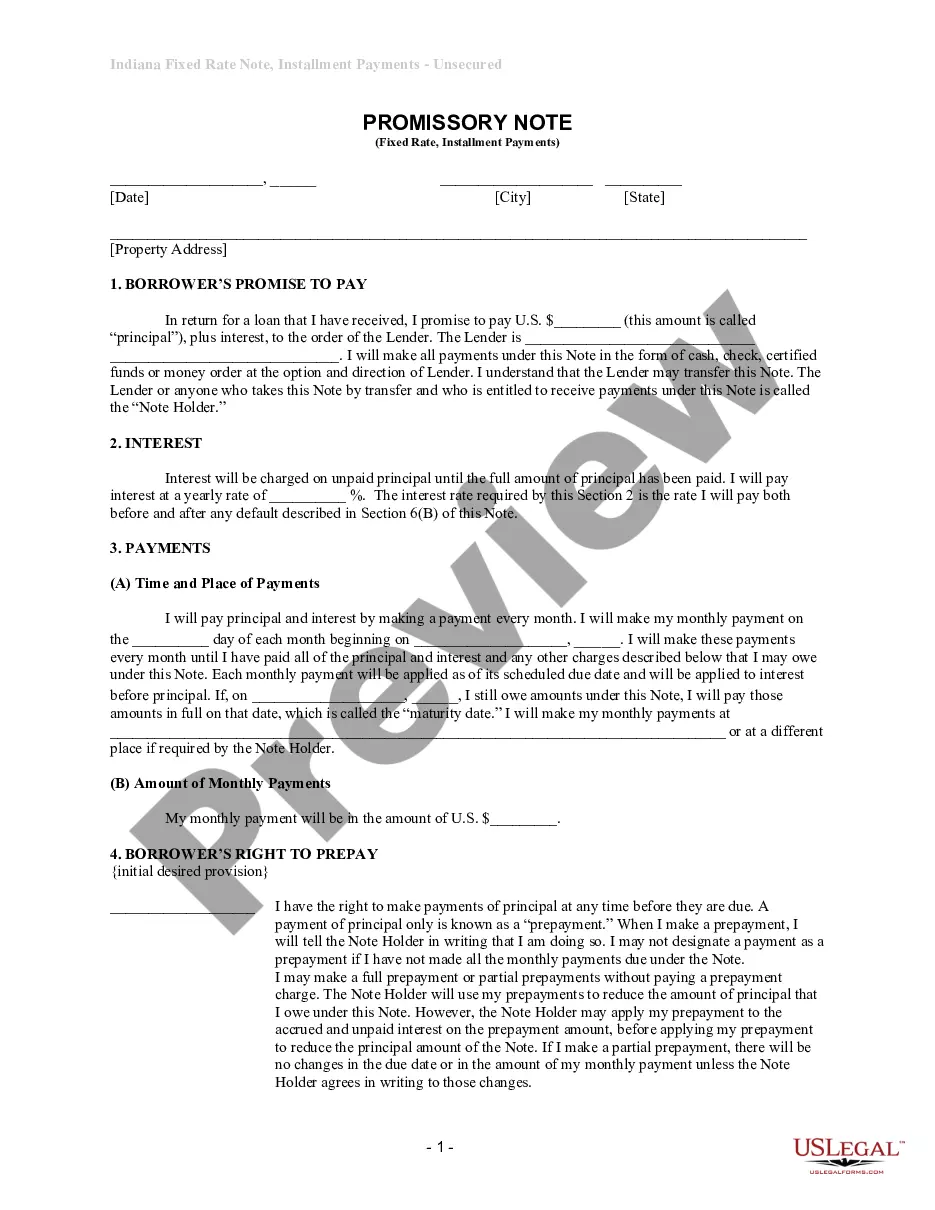

This form is a Promissory Note for the state of Indiana. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

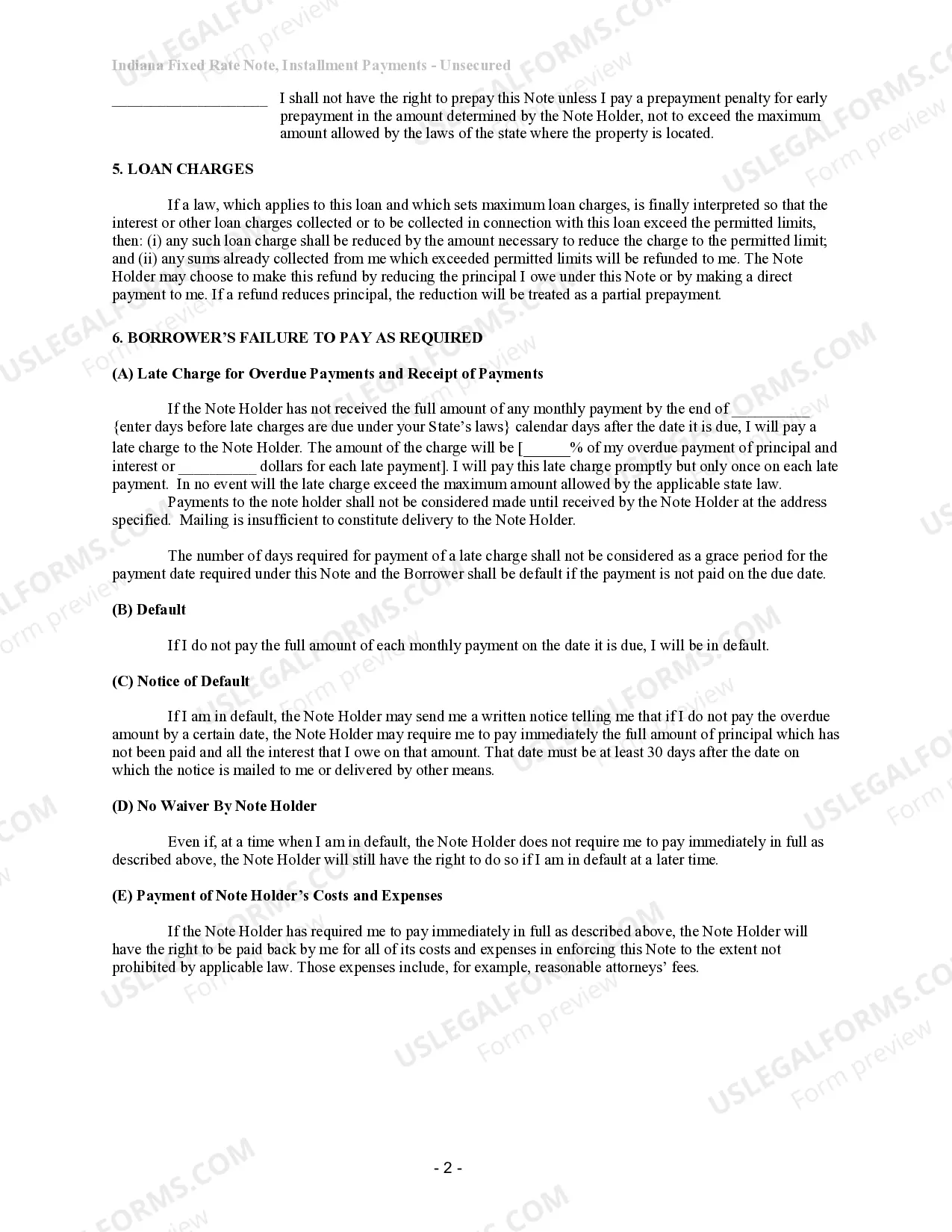

Evansville, Indiana Unsecured Installment Payment Promissory Note for Fixed Rate is a legal contract that outlines the terms and conditions of a loan agreement between a lender and a borrower. This promissory note serves as evidence of a debt and provides assurance that the borrower will repay the loan according to the agreed-upon terms. Keywords: Evansville Indiana, Unsecured Installment Payment, Promissory Note, Fixed Rate The Evansville Indiana Unsecured Installment Payment Promissory Note for Fixed Rate is commonly used for personal loans, educational loans, or small business financing. This document is specifically designed to protect both the lender and the borrower in cases of default or non-payment. By clearly defining the loan amount, repayment schedule, and interest rate, this promissory note offers security and accountability for both parties involved. The main characteristics of this promissory note are as follows: 1. Loan Amount: This section states the specific amount of money borrowed by the borrower from the lender. It is crucial to include this information accurately, as it will determine the total repayment amount. 2. Interest Rate: The promissory note will include the fixed interest rate agreed upon by both parties. This rate remains constant throughout the repayment term, ensuring predictability and consistency in installment amounts. 3. Repayment Schedule: The note outlines the installment payment plan, including the frequency (monthly, quarterly, etc.) and the due dates of payments. This schedule ensures that the loan is repaid within the agreed-upon timeframe. 4. Late Payments and Default: This section describes the consequences of late payments or default. It may include penalties, additional interest, collection costs, or even legal actions that the lender can initiate to recover the debt. 5. Prepayment: The promissory note may include provisions for prepayment, allowing the borrower to repay the loan in full before the scheduled maturity date. This section outlines any fees or conditions associated with early payment. Different types of Evansville Indiana Unsecured Installment Payment Promissory Notes for Fixed Rate may be categorized based on loan purpose or specific terms agreed upon: 1. Personal Loan Promissory Note: Used for loans between individuals or from an individual to a small business for personal use. 2. Educational Loan Promissory Note: Specifically designed for financing education expenses, such as tuition fees, books, or living costs. Often used by students or parents seeking financial aid. 3. Small Business Loan Promissory Note: Used for financing small business operations, providing necessary funds for expansion, equipment purchase, or working capital. In conclusion, the Evansville Indiana Unsecured Installment Payment Promissory Note for Fixed Rate is an integral legal document that establishes the terms and conditions of a loan agreement. It ensures transparency, clarity, and protection for both the lender and the borrower, promoting a mutually beneficial lending relationship.Evansville, Indiana Unsecured Installment Payment Promissory Note for Fixed Rate is a legal contract that outlines the terms and conditions of a loan agreement between a lender and a borrower. This promissory note serves as evidence of a debt and provides assurance that the borrower will repay the loan according to the agreed-upon terms. Keywords: Evansville Indiana, Unsecured Installment Payment, Promissory Note, Fixed Rate The Evansville Indiana Unsecured Installment Payment Promissory Note for Fixed Rate is commonly used for personal loans, educational loans, or small business financing. This document is specifically designed to protect both the lender and the borrower in cases of default or non-payment. By clearly defining the loan amount, repayment schedule, and interest rate, this promissory note offers security and accountability for both parties involved. The main characteristics of this promissory note are as follows: 1. Loan Amount: This section states the specific amount of money borrowed by the borrower from the lender. It is crucial to include this information accurately, as it will determine the total repayment amount. 2. Interest Rate: The promissory note will include the fixed interest rate agreed upon by both parties. This rate remains constant throughout the repayment term, ensuring predictability and consistency in installment amounts. 3. Repayment Schedule: The note outlines the installment payment plan, including the frequency (monthly, quarterly, etc.) and the due dates of payments. This schedule ensures that the loan is repaid within the agreed-upon timeframe. 4. Late Payments and Default: This section describes the consequences of late payments or default. It may include penalties, additional interest, collection costs, or even legal actions that the lender can initiate to recover the debt. 5. Prepayment: The promissory note may include provisions for prepayment, allowing the borrower to repay the loan in full before the scheduled maturity date. This section outlines any fees or conditions associated with early payment. Different types of Evansville Indiana Unsecured Installment Payment Promissory Notes for Fixed Rate may be categorized based on loan purpose or specific terms agreed upon: 1. Personal Loan Promissory Note: Used for loans between individuals or from an individual to a small business for personal use. 2. Educational Loan Promissory Note: Specifically designed for financing education expenses, such as tuition fees, books, or living costs. Often used by students or parents seeking financial aid. 3. Small Business Loan Promissory Note: Used for financing small business operations, providing necessary funds for expansion, equipment purchase, or working capital. In conclusion, the Evansville Indiana Unsecured Installment Payment Promissory Note for Fixed Rate is an integral legal document that establishes the terms and conditions of a loan agreement. It ensures transparency, clarity, and protection for both the lender and the borrower, promoting a mutually beneficial lending relationship.