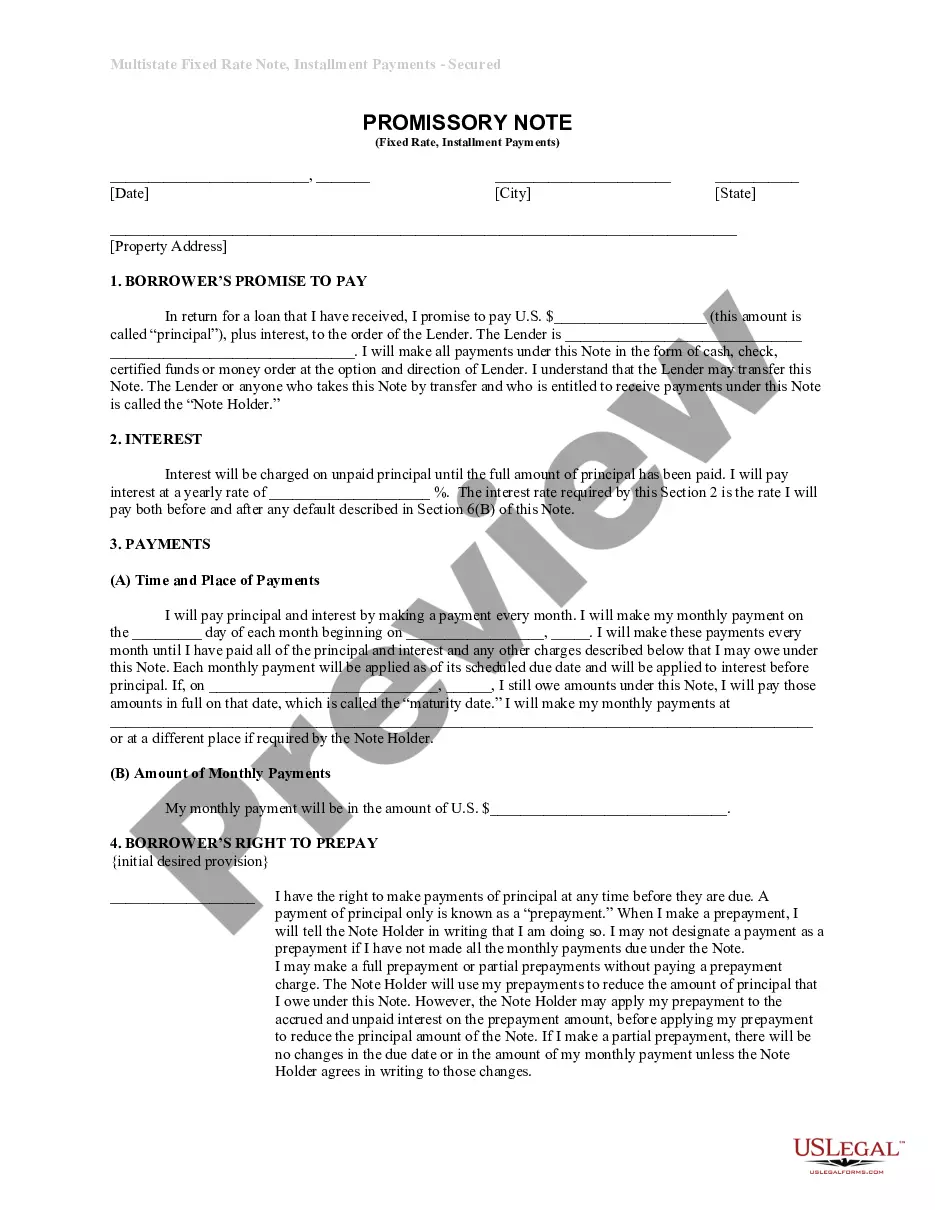

This is a form of Promissory Note for use where residential property is security for the loan. A separate deed of trust or mortgage is also required.

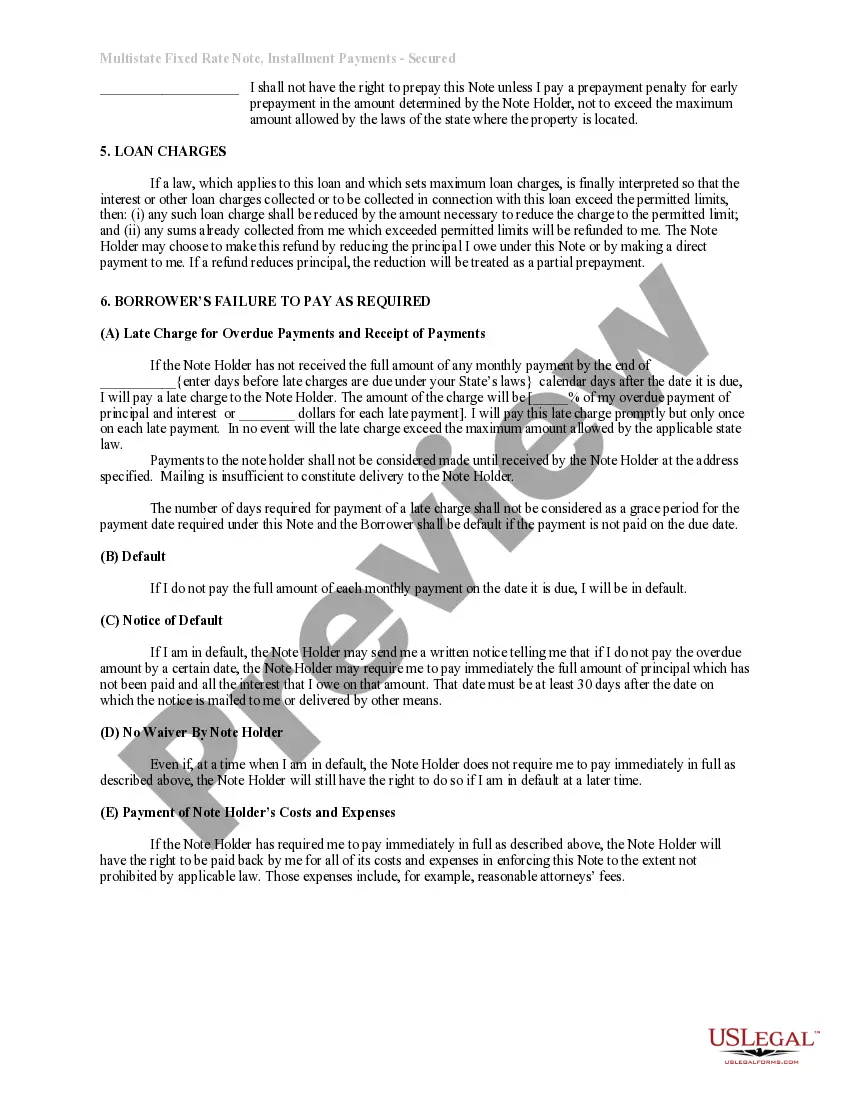

Evansville Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a financial instrument commonly used in real estate transactions. It is a legal document that outlines the terms and conditions of a loan provided to a borrower, with their residential property acting as collateral. The key features of an Evansville Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate are as follows: 1. Loan Amount: This refers to the total amount of money borrowed by the borrower from the lender, which is usually determined by the value of the residential property. 2. Installments: These are regular payments made by the borrower to the lender over a predetermined period. The installments are fixed and remain the same throughout the term of the loan. 3. Fixed Interest Rate: The interest rate charged on the loan is fixed, meaning it remains constant over the loan's lifespan. This provides stability for both the borrower and the lender, as the borrower can predict their monthly payments and financial obligations. 4. Promissory Note: This document acts as an acknowledgment of the borrower's debt and includes the terms and conditions of the loan, such as the repayment schedule, interest rate, and consequences of default. 5. Secured by Residential Real Estate: The loan is secured by the residential property owned by the borrower. If the borrower fails to repay the loan, the lender has the right to foreclose on the property and sell it to recover their investment. Different types of Evansville Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate include: 1. First Lien Promissory Note: In this type, the loan is given priority over any other liens or claims against the residential property. This makes it the primary debt to be repaid in case of default. 2. Second Lien Promissory Note: This type of promissory note is subordinate to a previous loan on the property. In case of default, the first lien debt needs to be repaid before the second lien debt. 3. Balloon Promissory Note: This type of note has a fixed interest rate and regular installments for a specific period, usually 5-7 years. However, at the end of the loan term, a final balloon payment becomes due, which is significantly higher than the regular installments. 4. Interest-Only Promissory Note: With this type of note, the borrower is required to make interest-only payments for a specified period, typically 5-10 years. After that, regular installments comprising both principal and interest, or a balloon payment, may be required. The Evansville Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate provides a structured and legally binding agreement between lenders and borrowers, ensuring that both parties understand their rights and obligations. It offers stability, predictability, and security in real estate financing transactions.Evansville Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a financial instrument commonly used in real estate transactions. It is a legal document that outlines the terms and conditions of a loan provided to a borrower, with their residential property acting as collateral. The key features of an Evansville Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate are as follows: 1. Loan Amount: This refers to the total amount of money borrowed by the borrower from the lender, which is usually determined by the value of the residential property. 2. Installments: These are regular payments made by the borrower to the lender over a predetermined period. The installments are fixed and remain the same throughout the term of the loan. 3. Fixed Interest Rate: The interest rate charged on the loan is fixed, meaning it remains constant over the loan's lifespan. This provides stability for both the borrower and the lender, as the borrower can predict their monthly payments and financial obligations. 4. Promissory Note: This document acts as an acknowledgment of the borrower's debt and includes the terms and conditions of the loan, such as the repayment schedule, interest rate, and consequences of default. 5. Secured by Residential Real Estate: The loan is secured by the residential property owned by the borrower. If the borrower fails to repay the loan, the lender has the right to foreclose on the property and sell it to recover their investment. Different types of Evansville Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate include: 1. First Lien Promissory Note: In this type, the loan is given priority over any other liens or claims against the residential property. This makes it the primary debt to be repaid in case of default. 2. Second Lien Promissory Note: This type of promissory note is subordinate to a previous loan on the property. In case of default, the first lien debt needs to be repaid before the second lien debt. 3. Balloon Promissory Note: This type of note has a fixed interest rate and regular installments for a specific period, usually 5-7 years. However, at the end of the loan term, a final balloon payment becomes due, which is significantly higher than the regular installments. 4. Interest-Only Promissory Note: With this type of note, the borrower is required to make interest-only payments for a specified period, typically 5-10 years. After that, regular installments comprising both principal and interest, or a balloon payment, may be required. The Evansville Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate provides a structured and legally binding agreement between lenders and borrowers, ensuring that both parties understand their rights and obligations. It offers stability, predictability, and security in real estate financing transactions.