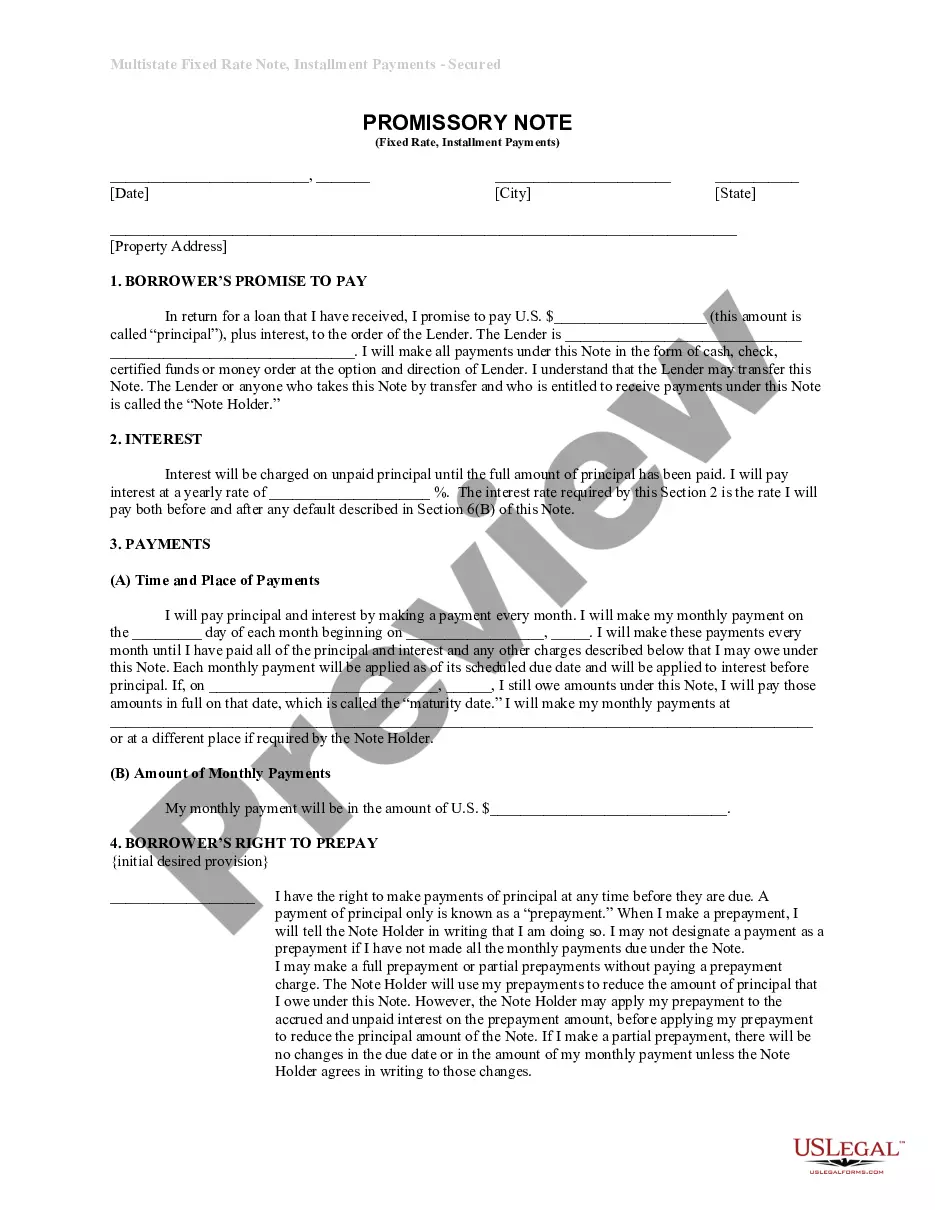

This is a form of Promissory Note for use where residential property is security for the loan. A separate deed of trust or mortgage is also required.

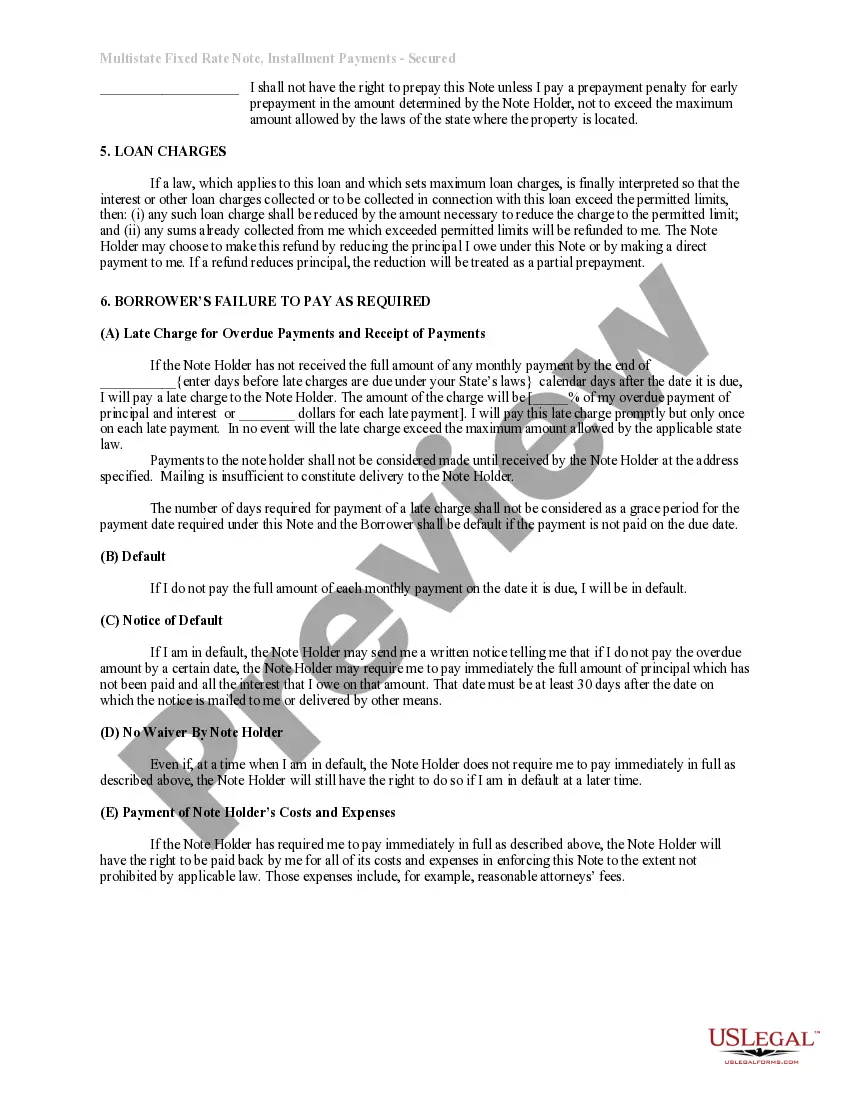

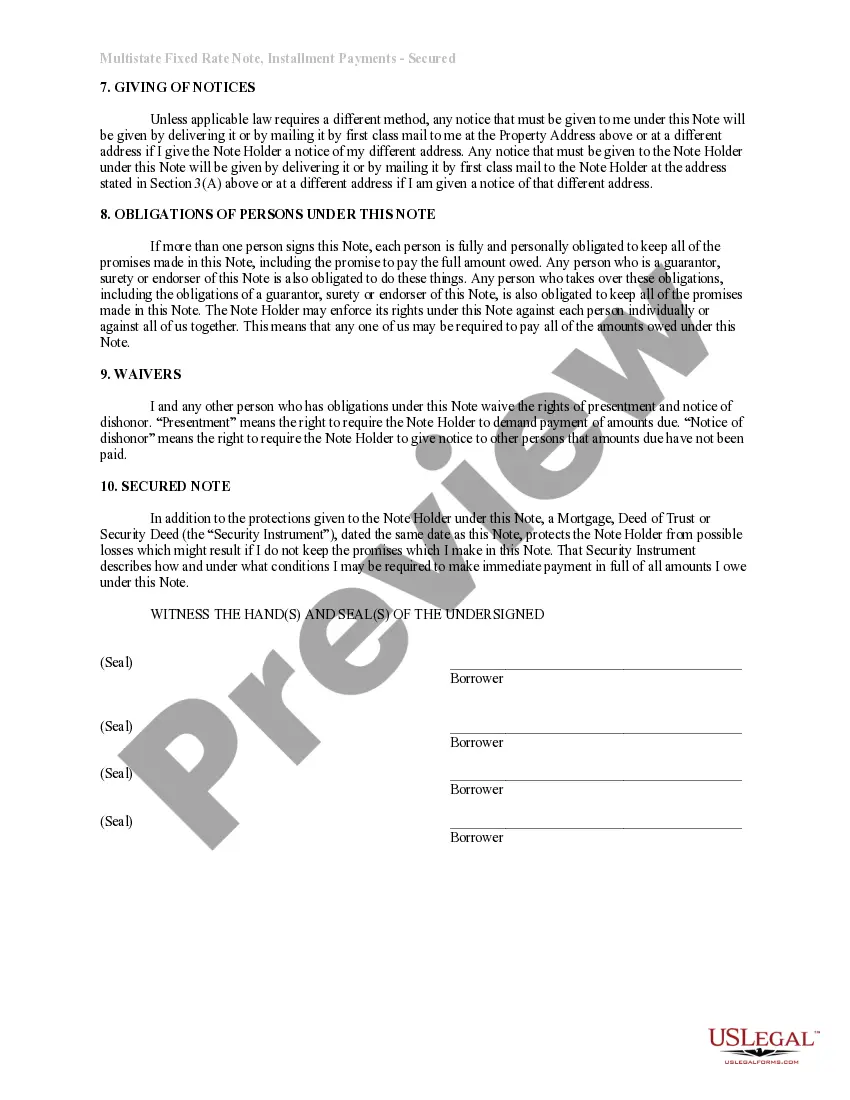

A Fort Wayne Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan secured by a residential property in Fort Wayne, Indiana. This type of promissory note is commonly used in real estate transactions, where the borrower (also known as the mortgagee) agrees to pay back the lender (mortgagor) a certain amount of money over a fixed period of time. The Fort Wayne Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate typically includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late or missed payments. By signing this document, the borrower is legally bound to fulfill their obligations in making regular payments until the loan is fully repaid. There are different variations of the Fort Wayne Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate, which may include: 1. Fixed Rate Promissory Note: This type of promissory note has a fixed interest rate throughout the loan term, ensuring that the borrower knows exactly how much they need to pay each month. 2. Adjustable Rate Promissory Note: In this case, the interest rate on the loan may change at certain intervals, usually based on an external financial index. 3. Balloon Payment Promissory Note: This type of promissory note requires the borrower to make regular payments for a specific period, usually with lower monthly payments. However, at the end of the term, a final "balloon" payment will be due, which is a larger lump sum amount. 4. Interest-Only Promissory Note: With this variation, the borrower only pays the interest on the loan for a certain period, typically the initial years of the loan term. After this period, regular principal and interest payments will be due. 5. Amortized Promissory Note: This type of note requires the borrower to make regular payments that cover both the principal and interest, ensuring that the loan is fully repaid within the agreed-upon term. Securing the promissory note with residential real estate means that the lender has a legal claim on the property in case of default. This provides additional protection for the lender and often leads to more favorable interest rates for the borrower. In summary, a Fort Wayne Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal agreement establishing the terms of a loan secured by residential property in Fort Wayne. By understanding the different variations of this promissory note, both borrowers and lenders can negotiate terms that best suit their financial needs.A Fort Wayne Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan secured by a residential property in Fort Wayne, Indiana. This type of promissory note is commonly used in real estate transactions, where the borrower (also known as the mortgagee) agrees to pay back the lender (mortgagor) a certain amount of money over a fixed period of time. The Fort Wayne Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate typically includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late or missed payments. By signing this document, the borrower is legally bound to fulfill their obligations in making regular payments until the loan is fully repaid. There are different variations of the Fort Wayne Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate, which may include: 1. Fixed Rate Promissory Note: This type of promissory note has a fixed interest rate throughout the loan term, ensuring that the borrower knows exactly how much they need to pay each month. 2. Adjustable Rate Promissory Note: In this case, the interest rate on the loan may change at certain intervals, usually based on an external financial index. 3. Balloon Payment Promissory Note: This type of promissory note requires the borrower to make regular payments for a specific period, usually with lower monthly payments. However, at the end of the term, a final "balloon" payment will be due, which is a larger lump sum amount. 4. Interest-Only Promissory Note: With this variation, the borrower only pays the interest on the loan for a certain period, typically the initial years of the loan term. After this period, regular principal and interest payments will be due. 5. Amortized Promissory Note: This type of note requires the borrower to make regular payments that cover both the principal and interest, ensuring that the loan is fully repaid within the agreed-upon term. Securing the promissory note with residential real estate means that the lender has a legal claim on the property in case of default. This provides additional protection for the lender and often leads to more favorable interest rates for the borrower. In summary, a Fort Wayne Indiana Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal agreement establishing the terms of a loan secured by residential property in Fort Wayne. By understanding the different variations of this promissory note, both borrowers and lenders can negotiate terms that best suit their financial needs.