The Tax-Free Exchange Package contains essential forms to successfully complete a tax-free exchange of like-kind property.

This package contains the following forms:

(1) Exchange Agreement

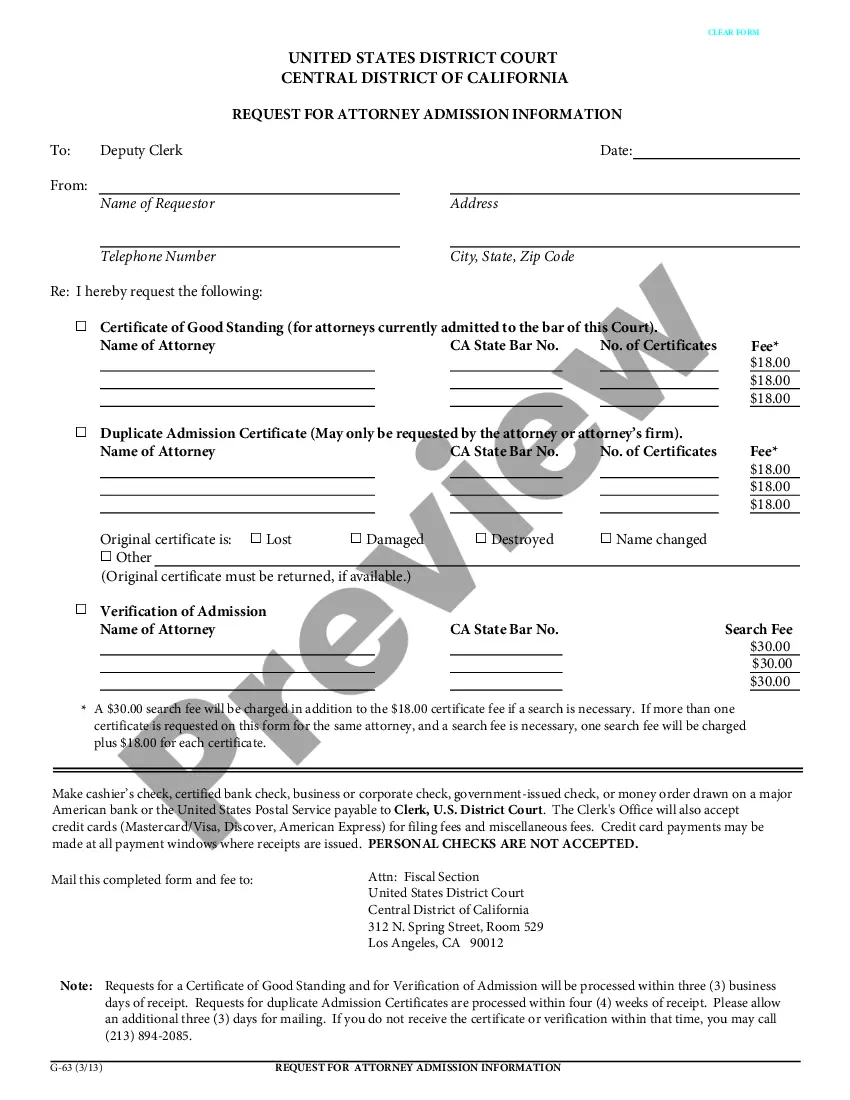

(2) Exchange Addendum

(3) Certification Of No Info Reporting On Sale Of Exchange

(4) Like-Kind Exchanges

(5) Sale of Business Property

(6) Personal Planning Information and Document Inventory Worksheets

Detailed Information on each form:

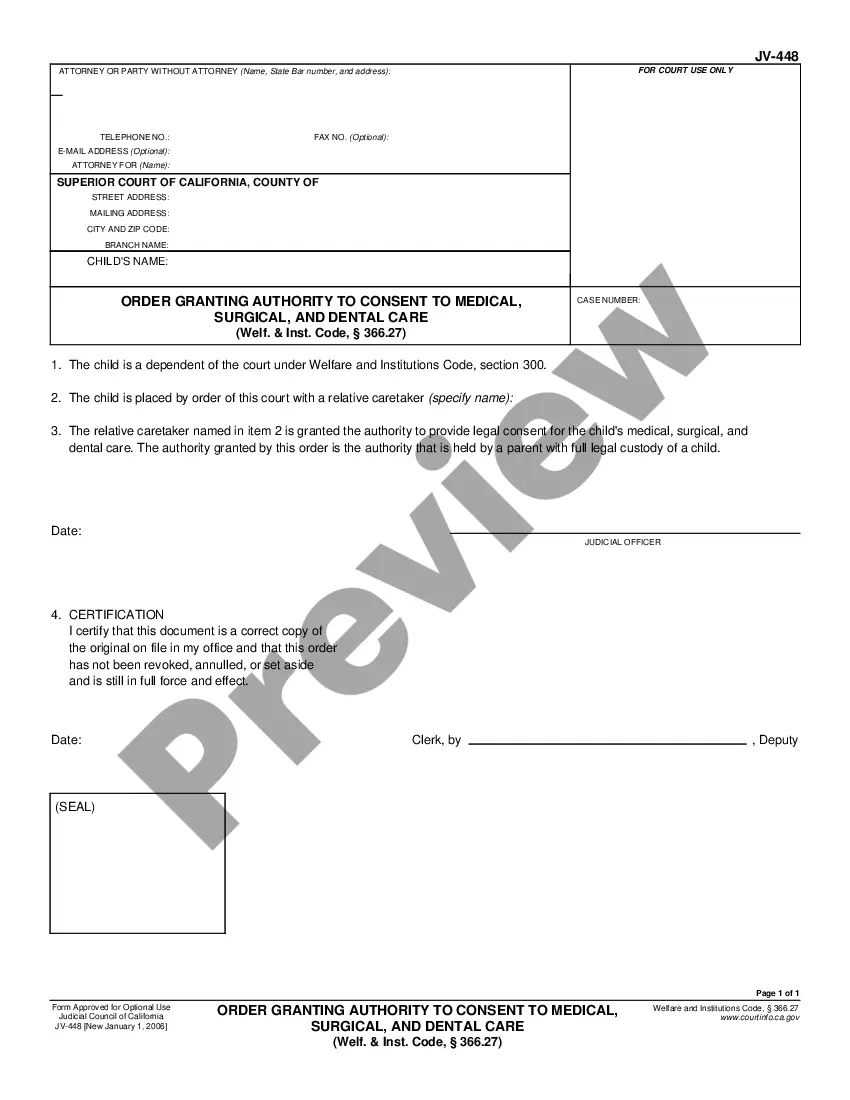

1. Exchange Agreement - This form is used to establish the intent to enter into an exchange agreement and to otherwise qualify the contemplated transactions under the qualified intermediary safe harbor.

2. Exchange Addendum - In this form, the parties amend an existing contract to buy and sell real estate and agree that the Exchanging Party's rights under the contract are assignable prior to closing to structure an exchange of the property under Section 1031. The Cooperating Party agrees to reasonably cooperate in such exchange with the Exchanging Party.

3. Certification Of No Info Reporting On Sale Of Exchange - Complete this form to determine whether the sale or exchange should be reported to the seller, and to the Internal Revenue Service on Form 1099-S, Proceeds From Real Estate Transactions.

4. Like-Kind Exchanges - This form is used to report each exchange of business or investment property for property of a like kind to the Internal Revenue Service.

5. Sale of Business Property - This form is used to report gains, losses and recapture amounts from the sale of business property and involuntary conversions.

The Indianapolis Indiana Tax Free Exchange Package refers to a set of programs and initiatives designed to assist taxpayers in deferring capital gains taxes on the sale of investment or business properties by facilitating a like-kind exchange. This type of exchange allows individuals or businesses to swap one property for another, while deferring the tax liability associated with the capital gain. The Indianapolis Indiana Tax Free Exchange Package encompasses various types of like-kind exchanges, including the most commonly used one: the 1031 exchange. Under this provision, taxpayers can exchange a property used for investment or business purposes for another property of the same nature, without incurring immediate tax liability on the realized gain. This allows taxpayers to leverage their investments and potentially acquire higher-value properties while maintaining the deferral of capital gains taxes. In addition to the 1031 exchange, the Indianapolis Indiana Tax Free Exchange Package may include other variations of tax-deferred exchanges, such as the 1033 exchange. The 1033 exchange applies to properties that have been involuntarily converted or destroyed due to natural disasters or eminent domain takings. Similarly to the 1031 exchange, the taxpayer can defer the capital gains tax by reinvesting the proceeds from the sale into a replacement property. The Tax Free Exchange Package may also offer assistance and guidance for taxpayers navigating the complex rules and regulations governing like-kind exchanges. This could include access to educational resources, seminars, or consultations with tax professionals who specialize in tax-deferred transactions. By providing these resources, the package aims to ensure taxpayers are well-informed and can make informed decisions when engaging in tax-free exchanges. Overall, the Indianapolis Indiana Tax Free Exchange Package is a comprehensive set of measures and resources that aim to promote the use of tax-free exchanges to defer capital gains taxes. By encouraging property owners to reinvest their gains into other properties within the Indianapolis area, the package can stimulate economic development, incentivize real estate transactions, and support the growth of businesses and investments in the region.