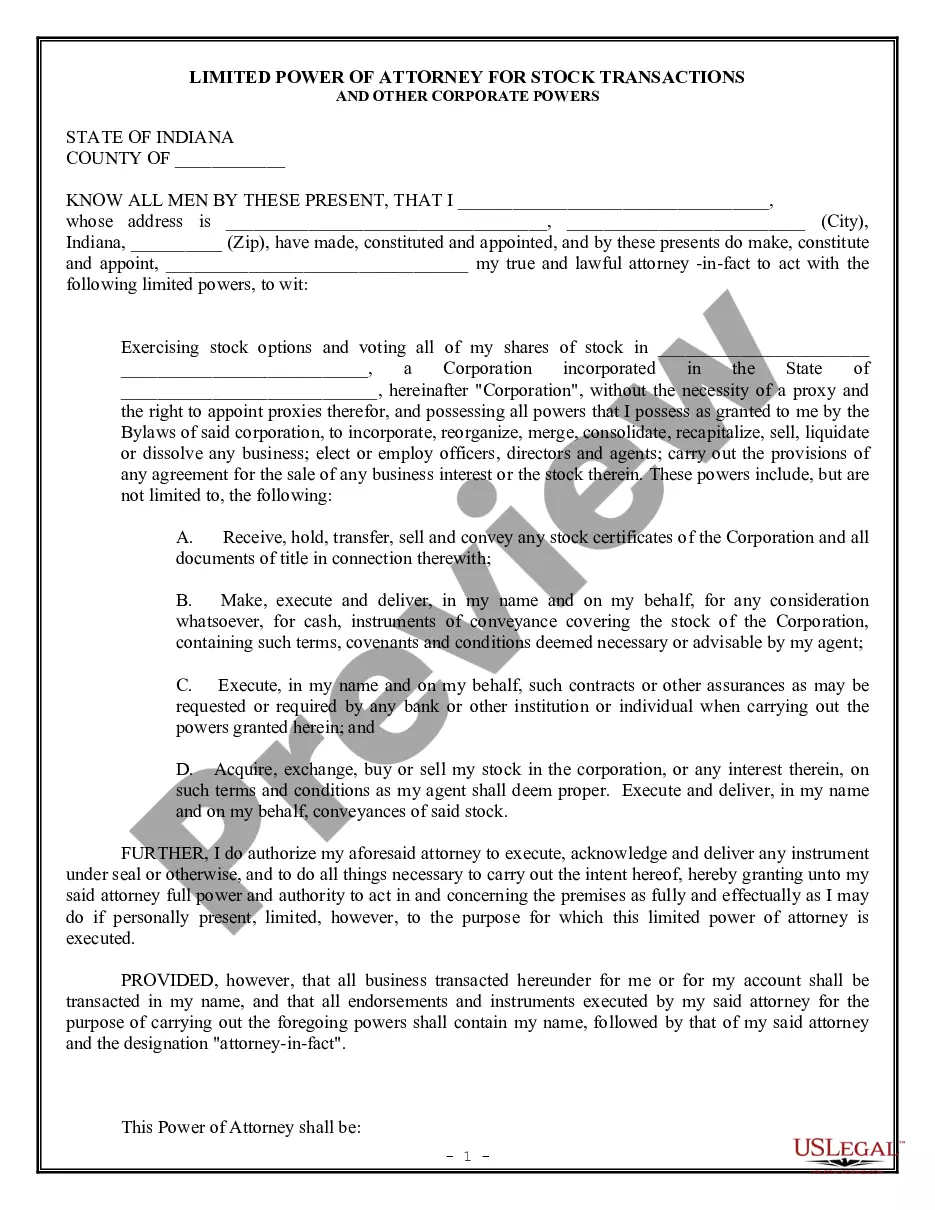

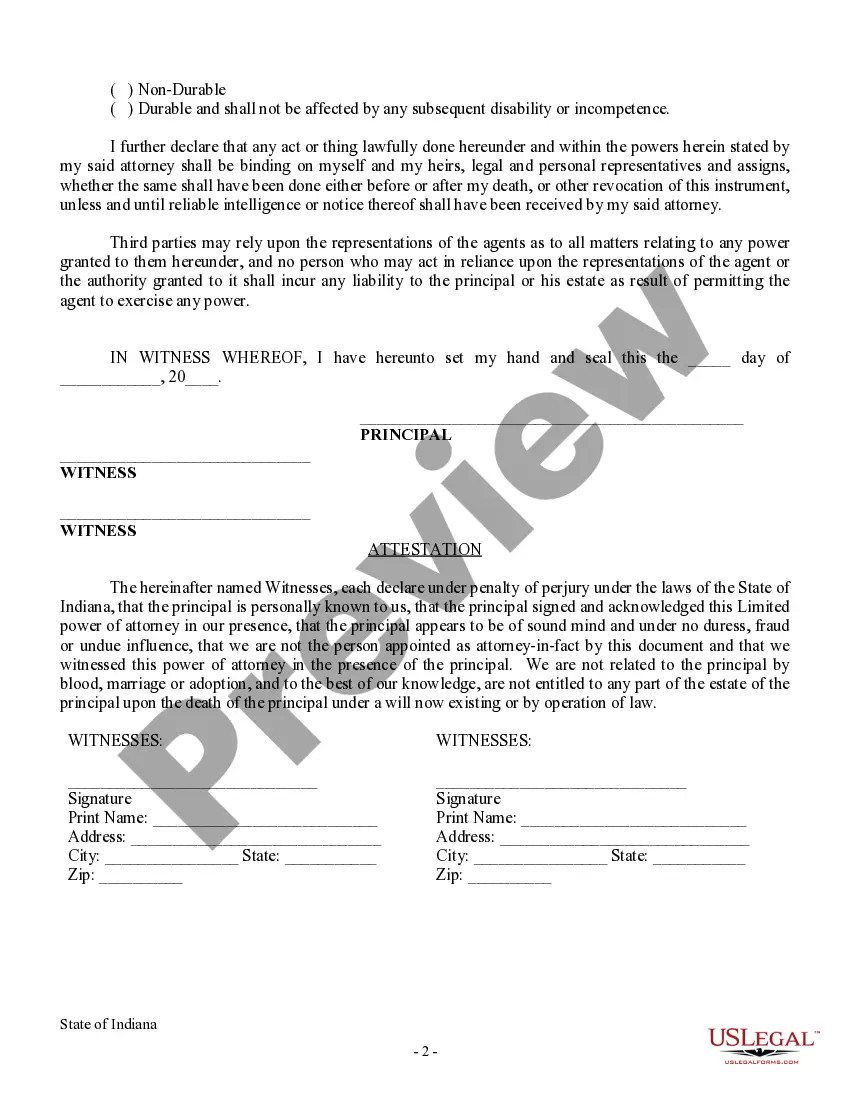

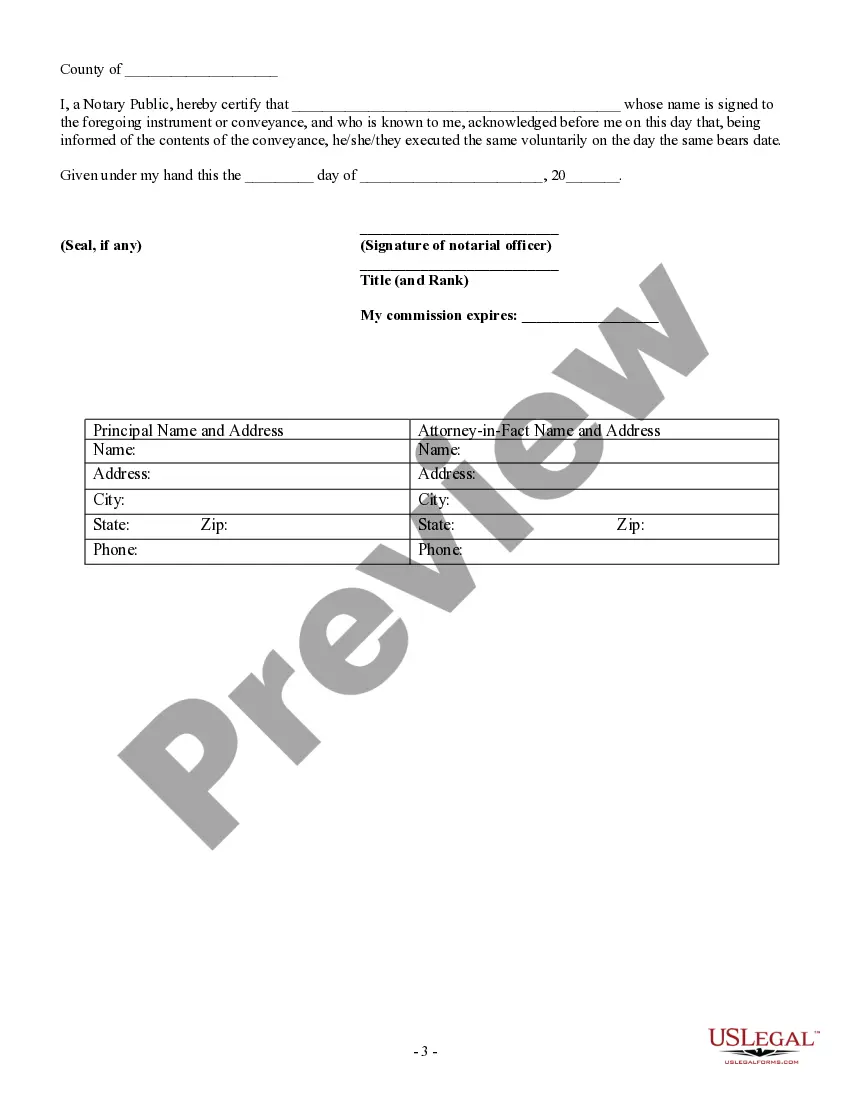

This Limited Power of Attorney form provides for a limited power of attorney for stock transactions only. It used by a shareholder to authorize another person to vote stock and to conduct other corporate powers. The document must be signed before two witnesses.

Evansville Indiana Limited Power of Attorney for Stock Transactions and Corporate Powers is a legal document that grants an individual the authority to make specific decisions and carry out transactions related to stocks and corporate affairs on behalf of another person or entity. This document is commonly used in Evansville, Indiana, to facilitate efficient stock trading and the execution of corporate powers. The Limited Power of Attorney for Stock Transactions and Corporate Powers in Evansville, Indiana, enables the designated person, referred to as the attorney-in-fact, to act on behalf of the principal (the person or entity granting the power) within certain limitations and defined scope. This legally binding agreement outlines the specific powers and responsibilities granted to the attorney-in-fact, ensuring transparency and adherence to legal norms. By executing the Limited Power of Attorney, the principal conveys the authority to the attorney-in-fact to buy or sell stocks, make investment decisions, manage financial accounts, handle dividend payments, attend shareholders' meetings, and vote on behalf of the principal, among other related powers. This empowers the attorney-in-fact to act efficiently and effectively, without requiring constant consultation with the principal for every transaction or decision. There may be different types or variations of Limited Power of Attorney for Stock Transactions and Corporate Powers, tailored to specific situations or preferences. Some common variations include: 1. Financial Limited Power of Attorney for Stock Transactions: This type of power of attorney is solely focused on stock transactions and financial decision-making powers. It grants the attorney-in-fact the authority to buy, sell, and manage stocks on behalf of the principal. This document could also include the power to manage related financial accounts, dividends, and investment portfolio. 2. Corporate Limited Power of Attorney: This type of power of attorney is specifically designed for corporate powers and responsibilities. It authorizes the attorney-in-fact to act on behalf of the principal in various corporate matters, such as attending board meetings, voting on corporate resolutions, signing contracts, engaging in negotiations, and managing corporate accounts. 3. General Limited Power of Attorney for Stock Transactions and Corporate Powers: This type of power of attorney combines both the financial and corporate powers discussed above. It grants the attorney-in-fact the broad authority to manage stock transactions, make investment decisions, handle financial accounts, and participate in corporate affairs. In summary, the Evansville Indiana Limited Power of Attorney for Stock Transactions and Corporate Powers is a crucial legal document that streamlines stock trading and enables the efficient management of corporate powers. It allows an attorney-in-fact to act on behalf of a principal for designated purposes, ensuring smooth decision-making and execution of transactions within the defined scope.