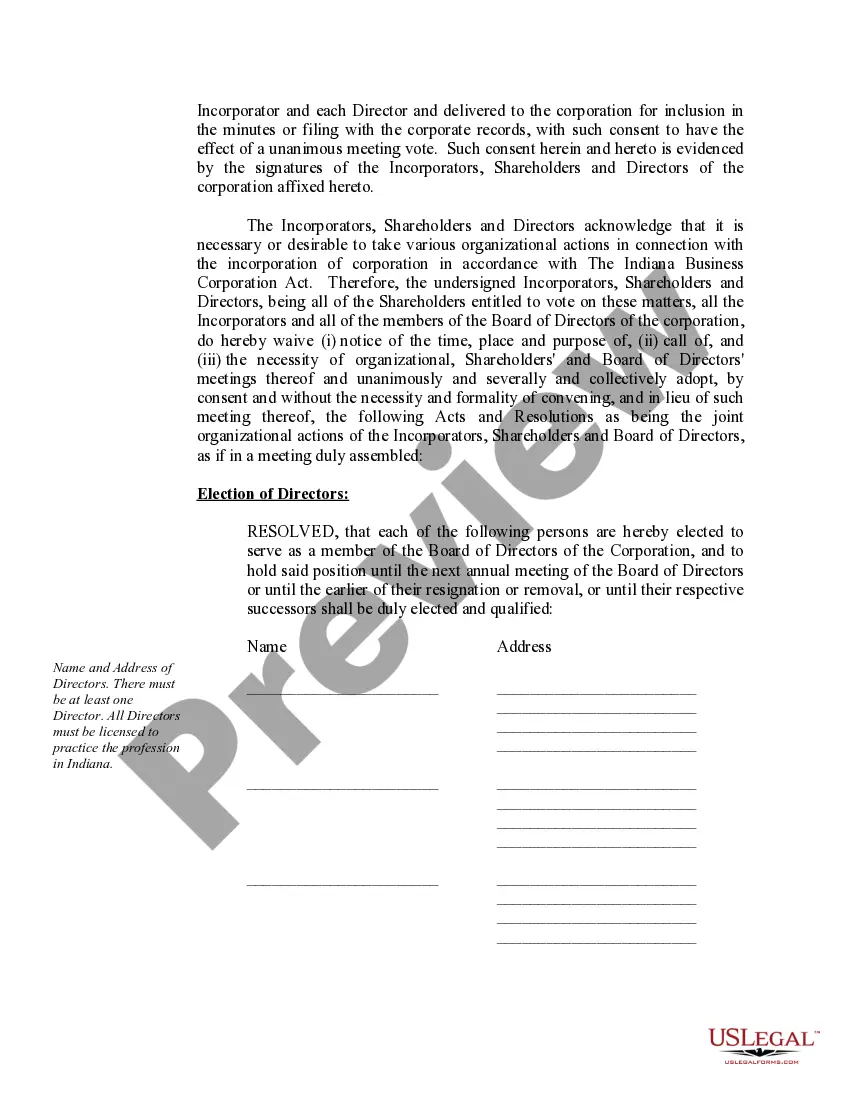

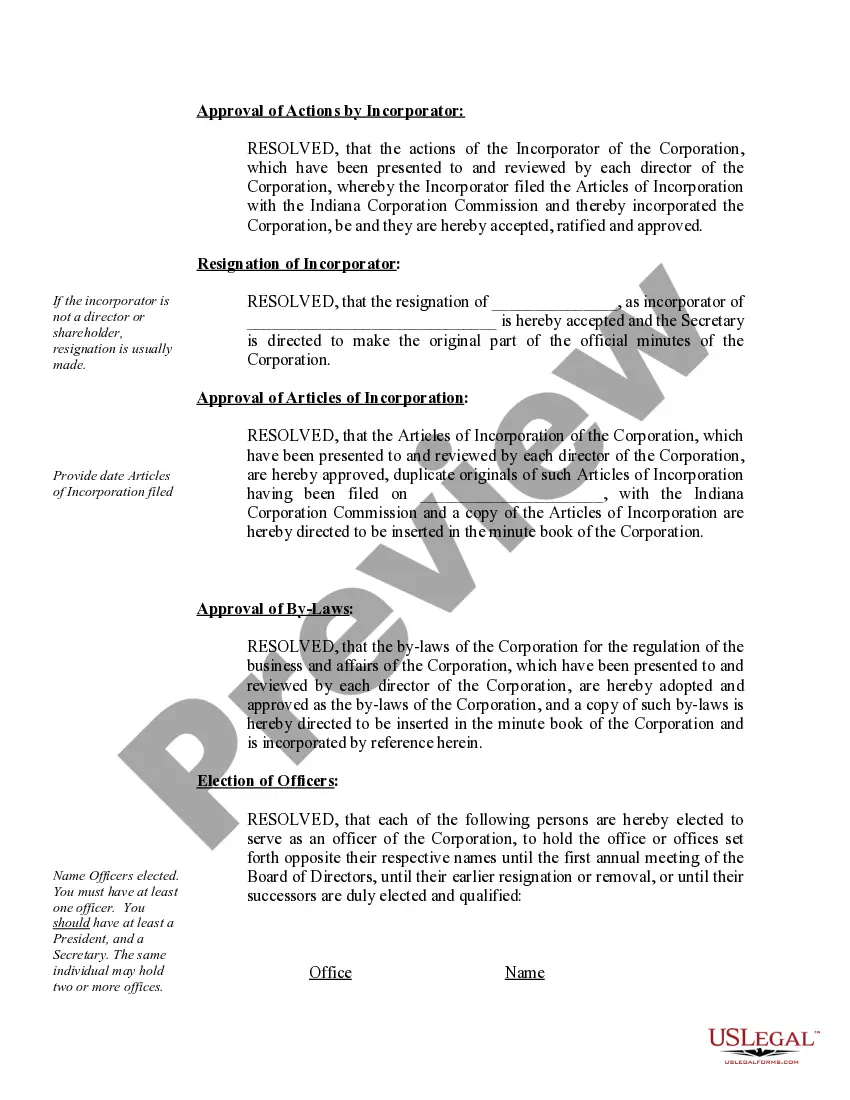

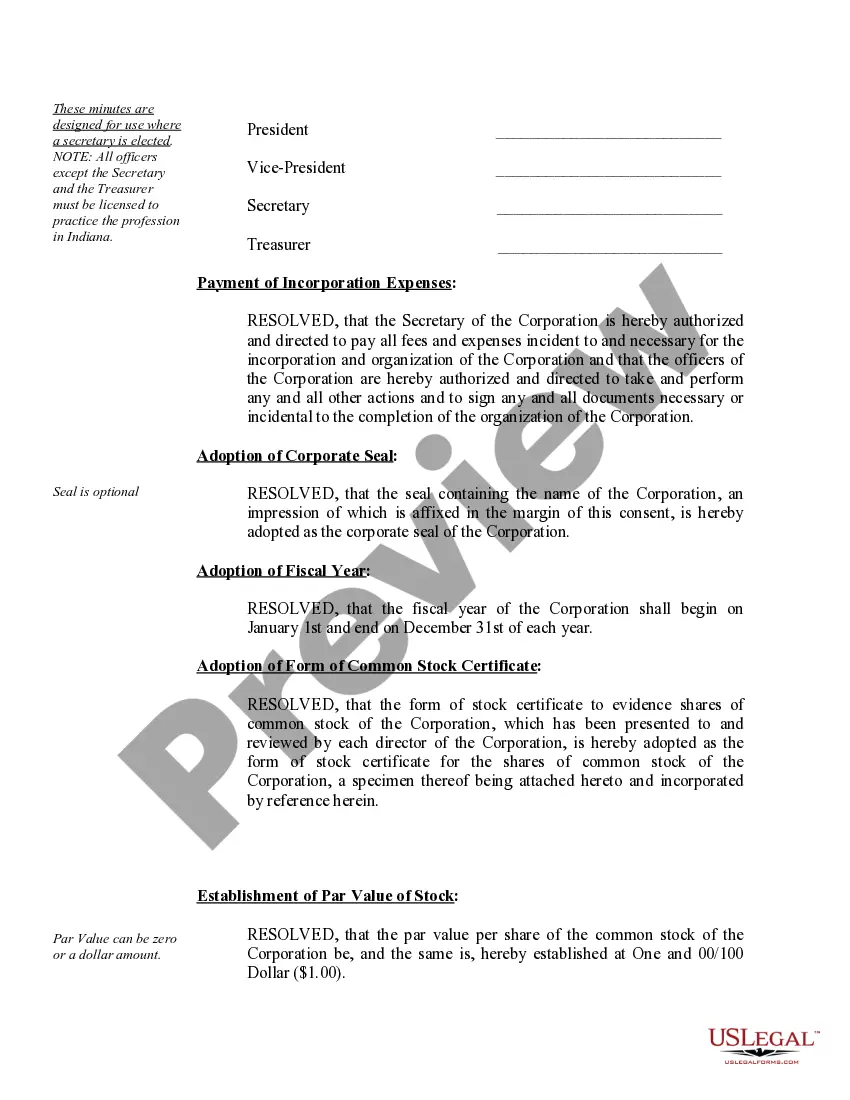

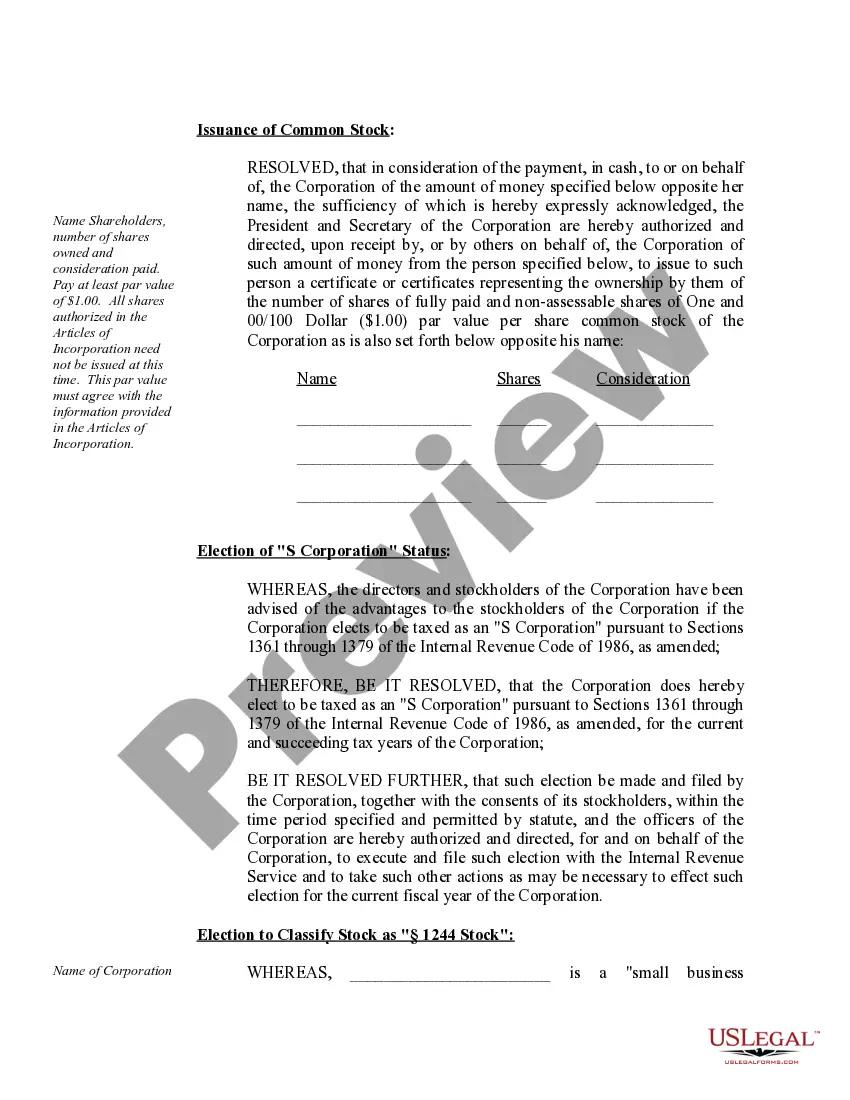

Carmel Sample Organizational Minutes for an Indiana Professional Corporation serve as crucial documentation that outlines important decisions, processes, and actions taken during the formation and early stages of a professional corporation in Indiana. These minutes ensure legal compliance and transparency while establishing the corporation's structure, rules, and procedures. Here is a comprehensive breakdown of the key components and types of Carmel Sample Organizational Minutes for an Indiana Professional Corporation: 1. Introduction: The minutes begin by clearly stating the name, date, and location of the meeting, along with a list of attendees including directors, officers, and shareholders present. 2. Appointment of Chairperson: The minutes specify the election or appointment of a chairperson who will preside over the meeting and facilitate discussions. 3. Adoption of Bylaws: It is crucial to record the adoption of the corporation's bylaws during the organizational meeting. The minutes should outline the bylaws' content, including specific provisions related to the corporation's purpose, governance, voting procedures, and shareholders' rights. 4. Establishment of Directors and Officers: The minutes document the appointment or election of directors and officers, including the board chairman, CEO, CFO, secretary, and any other positions specified in the corporation's bylaws. 5. Equity Distribution: If applicable, the minutes should detail the distribution of shares or stock options among the initial shareholders of the professional corporation. This section may also include any restrictions or conditions placed on the transfer of shares. 6. Authorization of Bank Accounts: The minutes should record the authorization of opening bank accounts on behalf of the corporation. This may include specifying the authorized signatories and any limitations on financial transactions. 7. State Filings: If required by Indiana law, the minutes should document the approval and filing of necessary documents with the Indiana Secretary of State, such as the Articles of Incorporation, a Certificate of Existence, or other relevant forms. 8. Adoption of a Corporate Seal: If the corporation intends to use a corporate seal, the minutes should outline the adoption and approval of its design. 9. Approval of Initial Expenses: Any initial expenses incurred during the corporation's formation should be outlined and approved within the minutes. This may include legal fees, accounting services, initial marketing costs, or other necessary expenses. 10. Adjournment: The minutes should record the official adjournment of the organizational meeting. Different types of Carmel Sample Organizational Minutes for an Indiana Professional Corporation may include variations in content based on the specific needs and structure of each professional corporation. However, the common elements mentioned above typically remain consistent across versions.

Carmel Sample Organizational Minutes for an Indiana Professional Corporation

State:

Indiana

City:

Carmel

Control #:

IN-PC-OM

Format:

Word

Instant download

Description

Organizational Minutes document the activities associated with the creation of the professional corporation.

Carmel Sample Organizational Minutes for an Indiana Professional Corporation serve as crucial documentation that outlines important decisions, processes, and actions taken during the formation and early stages of a professional corporation in Indiana. These minutes ensure legal compliance and transparency while establishing the corporation's structure, rules, and procedures. Here is a comprehensive breakdown of the key components and types of Carmel Sample Organizational Minutes for an Indiana Professional Corporation: 1. Introduction: The minutes begin by clearly stating the name, date, and location of the meeting, along with a list of attendees including directors, officers, and shareholders present. 2. Appointment of Chairperson: The minutes specify the election or appointment of a chairperson who will preside over the meeting and facilitate discussions. 3. Adoption of Bylaws: It is crucial to record the adoption of the corporation's bylaws during the organizational meeting. The minutes should outline the bylaws' content, including specific provisions related to the corporation's purpose, governance, voting procedures, and shareholders' rights. 4. Establishment of Directors and Officers: The minutes document the appointment or election of directors and officers, including the board chairman, CEO, CFO, secretary, and any other positions specified in the corporation's bylaws. 5. Equity Distribution: If applicable, the minutes should detail the distribution of shares or stock options among the initial shareholders of the professional corporation. This section may also include any restrictions or conditions placed on the transfer of shares. 6. Authorization of Bank Accounts: The minutes should record the authorization of opening bank accounts on behalf of the corporation. This may include specifying the authorized signatories and any limitations on financial transactions. 7. State Filings: If required by Indiana law, the minutes should document the approval and filing of necessary documents with the Indiana Secretary of State, such as the Articles of Incorporation, a Certificate of Existence, or other relevant forms. 8. Adoption of a Corporate Seal: If the corporation intends to use a corporate seal, the minutes should outline the adoption and approval of its design. 9. Approval of Initial Expenses: Any initial expenses incurred during the corporation's formation should be outlined and approved within the minutes. This may include legal fees, accounting services, initial marketing costs, or other necessary expenses. 10. Adjournment: The minutes should record the official adjournment of the organizational meeting. Different types of Carmel Sample Organizational Minutes for an Indiana Professional Corporation may include variations in content based on the specific needs and structure of each professional corporation. However, the common elements mentioned above typically remain consistent across versions.

Free preview

How to fill out Carmel Sample Organizational Minutes For An Indiana Professional Corporation?

If you’ve already utilized our service before, log in to your account and download the Carmel Sample Organizational Minutes for an Indiana Professional Corporation on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make sure you’ve found a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Carmel Sample Organizational Minutes for an Indiana Professional Corporation. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!