This sample Operating Agreement describes the rules by which the Members agree to govern the company. Modify to suit your needs.

Indianapolis Indiana Sample Operating Agreement for Professional Limited Liability Company PLLC

Description

How to fill out Indiana Sample Operating Agreement For Professional Limited Liability Company PLLC?

If you are looking for a legitimate document, it's exceedingly difficult to locate a superior source than the US Legal Forms website – likely the most substantial online collections.

With this collection, you can obtain numerous document samples for commercial and personal uses categorized by types and states, or keywords.

With our enhanced search capability, locating the latest Indianapolis Indiana Sample Operating Agreement for Professional Limited Liability Company PLLC is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Specify the file format and download it to your device.

- Additionally, the accuracy of each document is confirmed by a team of proficient attorneys who regularly assess the templates on our site and update them in alignment with the latest state and county regulations.

- If you are already familiar with our service and possess a registered account, all you need to acquire the Indianapolis Indiana Sample Operating Agreement for Professional Limited Liability Company PLLC is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have accessed the form you need. Review its details and utilize the Preview option (if available) to examine its content. If it doesn’t meet your requirements, use the Search function located at the top of the page to find the suitable document.

- Verify your choice. Select the Buy now button. After that, choose your desired subscription plan and provide information to register for an account.

Form popularity

FAQ

Indiana professional corporations (PCs) are owned and operated by licensed professionals. Only those who perform services that require a state license may form a PC in Indiana.

In addition to articles of organization, Missouri statute requires all limited liability companies to have an operating agreement.

Indiana allows professionals, such as accountants, attorneys, and physicians, to form an LLC. Indiana's statutes do not provide for a professional limited liability company (PLLC).

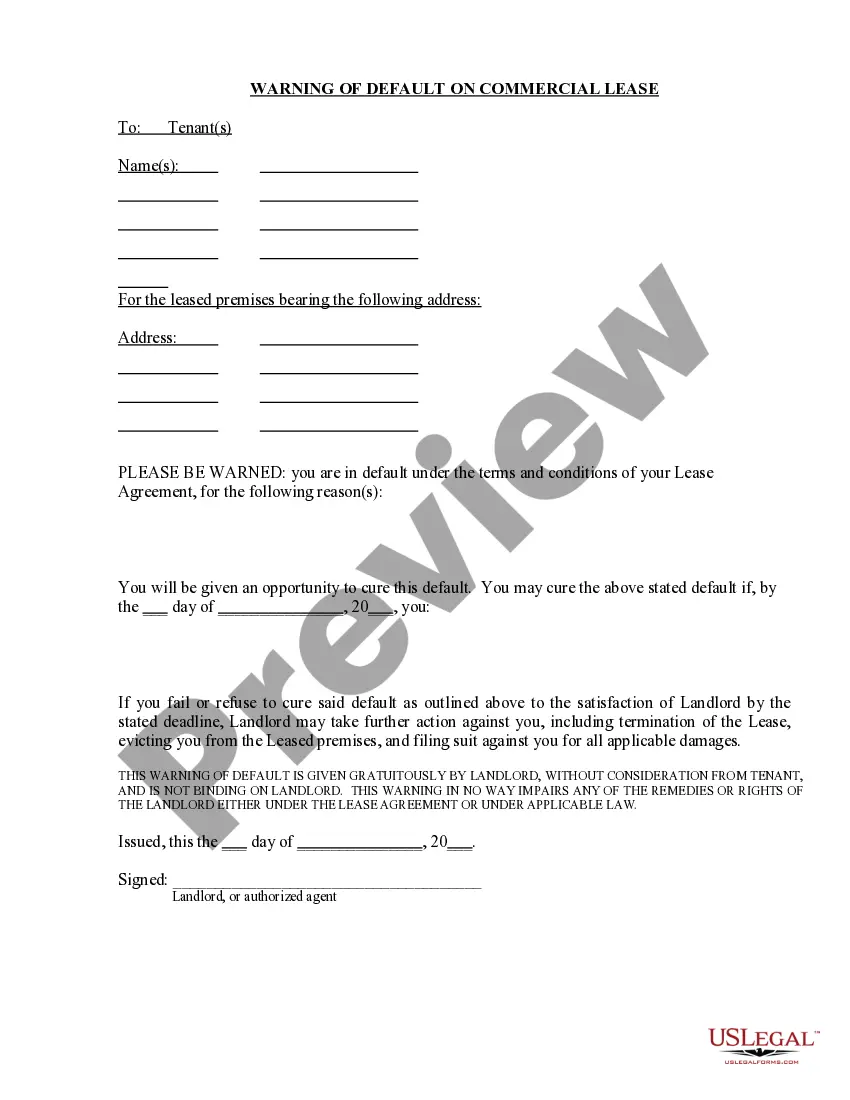

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

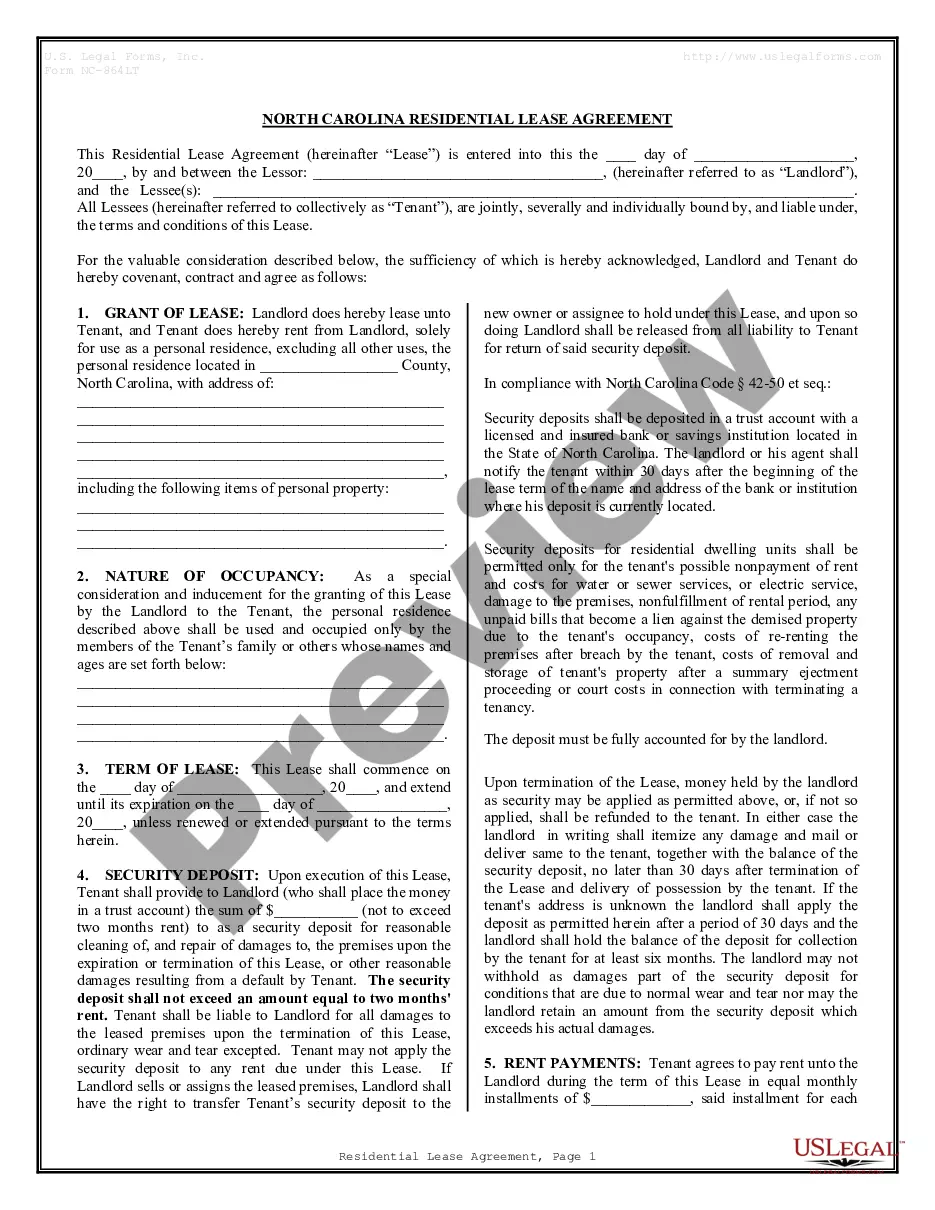

An Indiana operating agreement is a legally binding contract between members that establishes the rules and procedures for your LLC. The operating agreement determines how your LLC will handle key procedures like voting, transferring membership interest, allocating profits and losses, and dissolving the business.

A professional limited liability company (?PLLC?) is simply an LLC for businesses involving professional services.

As a licensed professional in Illinois you can structure your business as an Illinois professional limited liability company (PLLC). This will give you protection from several important types of liability. It also may provide certain tax advantages compared to other ways of structuring your business.

Professional Limited Liability Companies With an LLC, anyone can be a member, or owner, of the business. State PLLC laws often provide that only licensed professionals can be members, or that a certain number of members must be licensed professionals.

Although not required by law, an LLC should operate under an Operating Agreement which is like a Partnership Agreement.

Prepare an Operating Agreement An LLC operating agreement is not required in Illinois, but is highly recommended. This is an internal document that establishes how you will run your LLC. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.