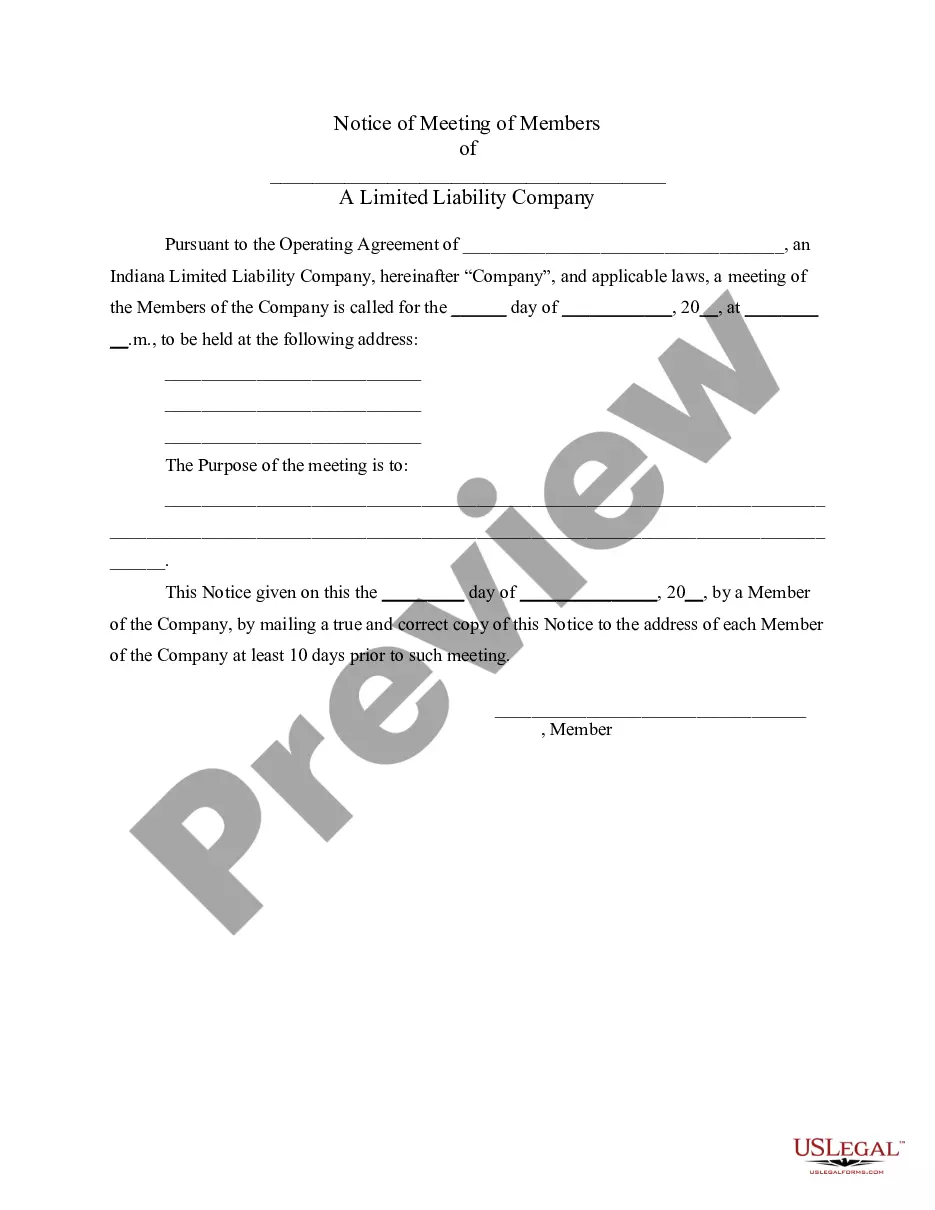

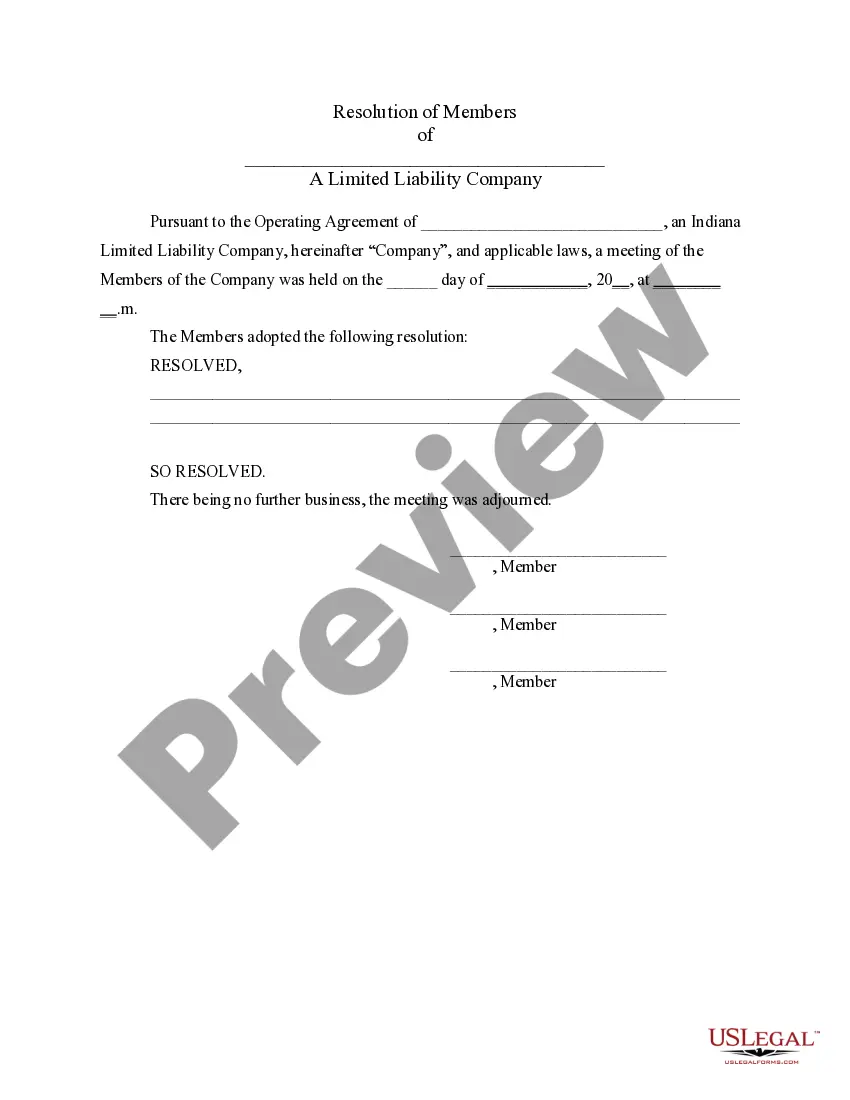

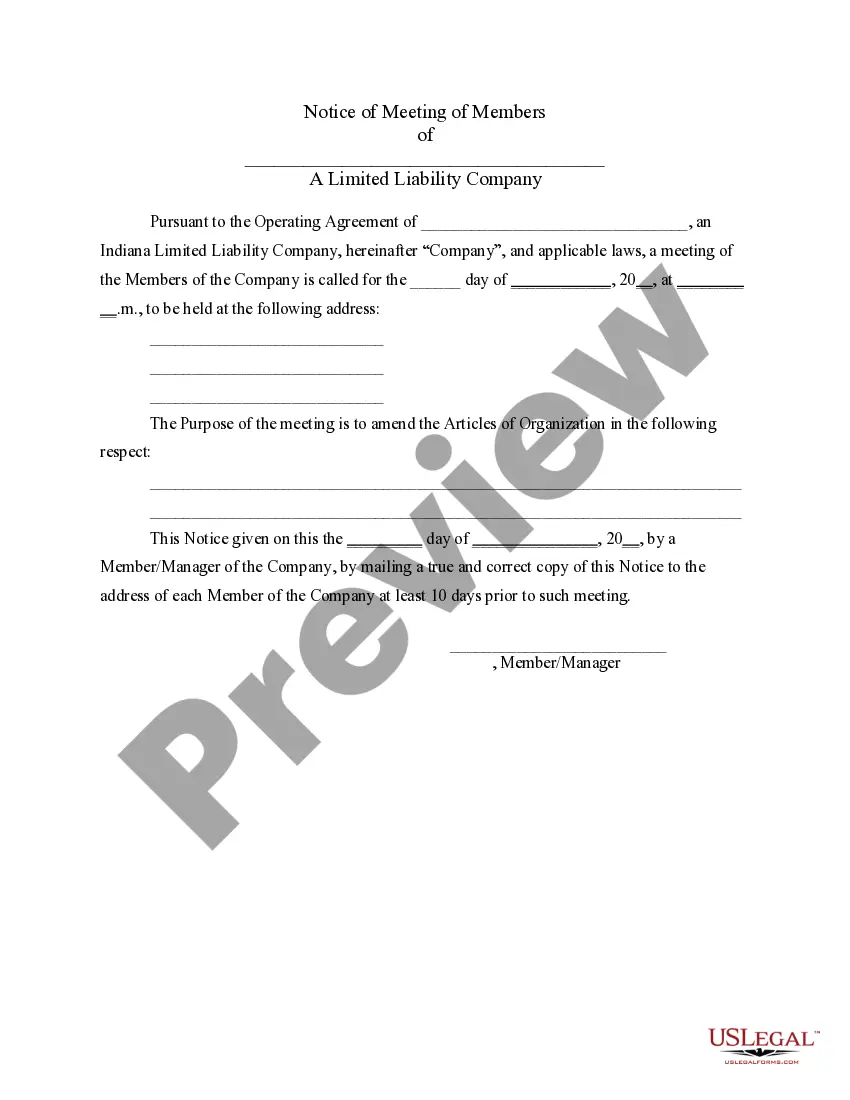

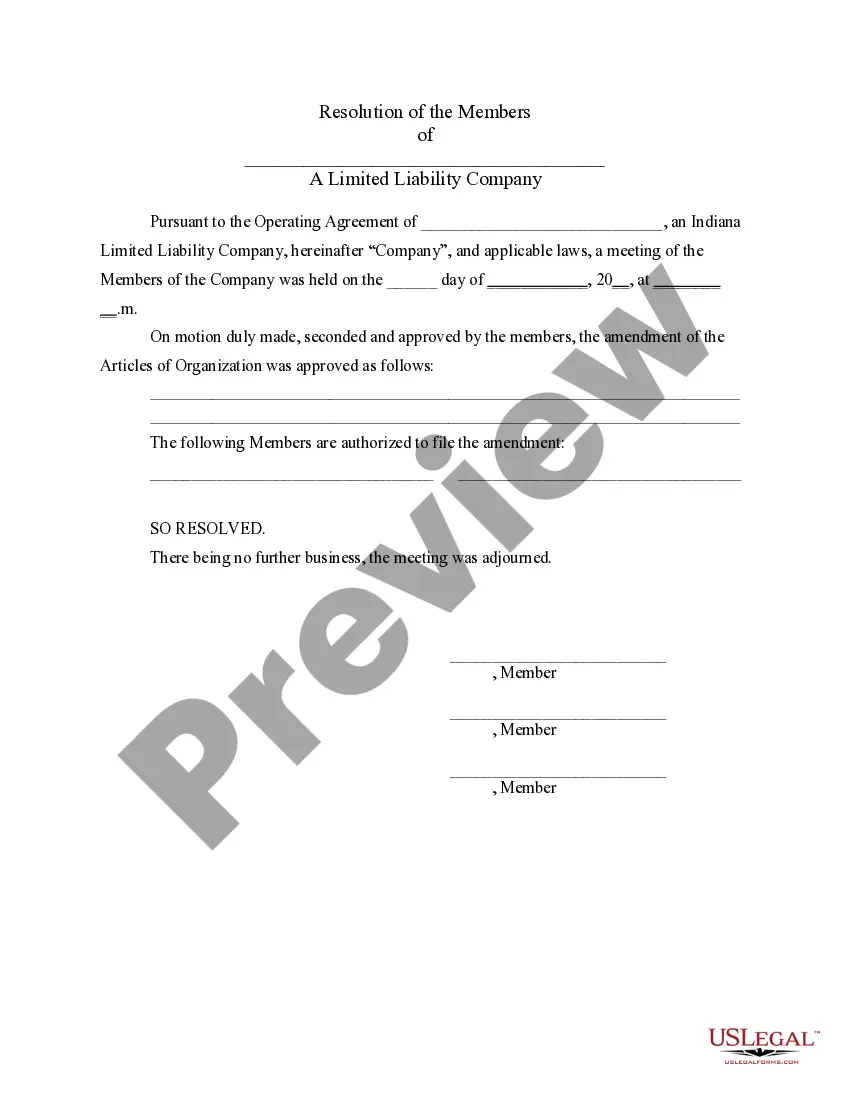

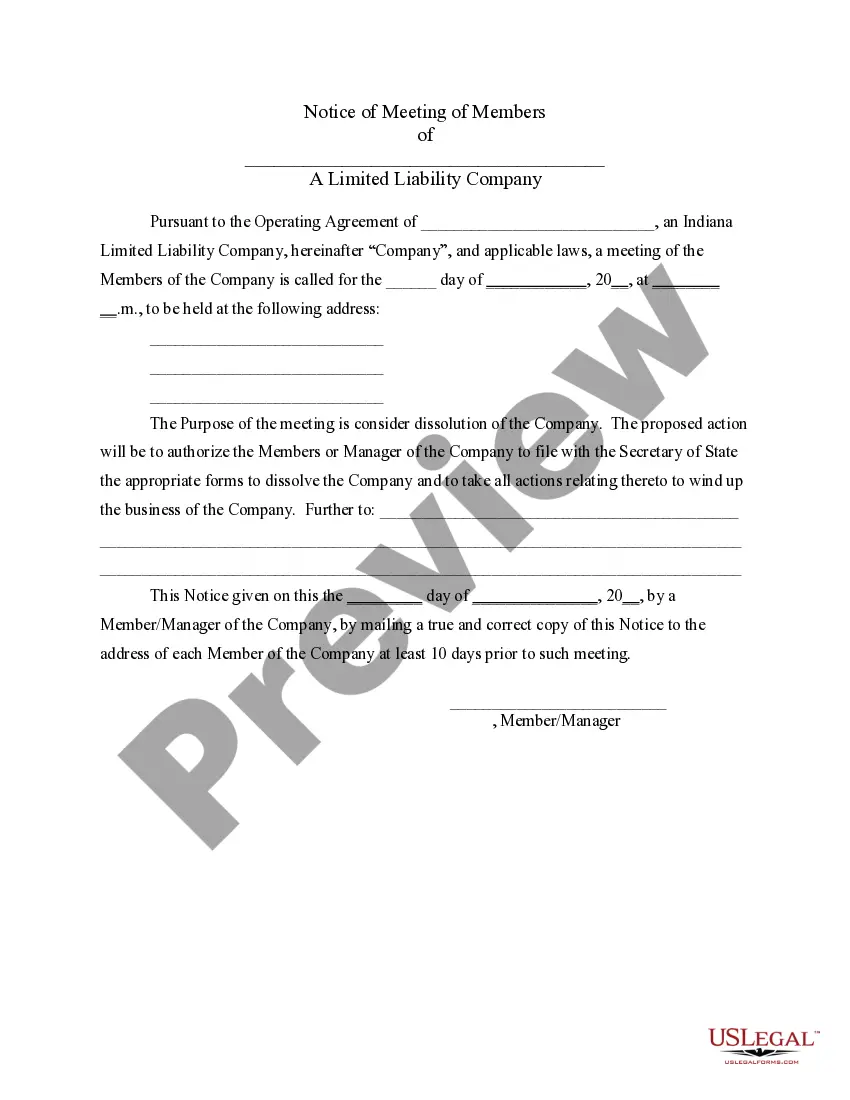

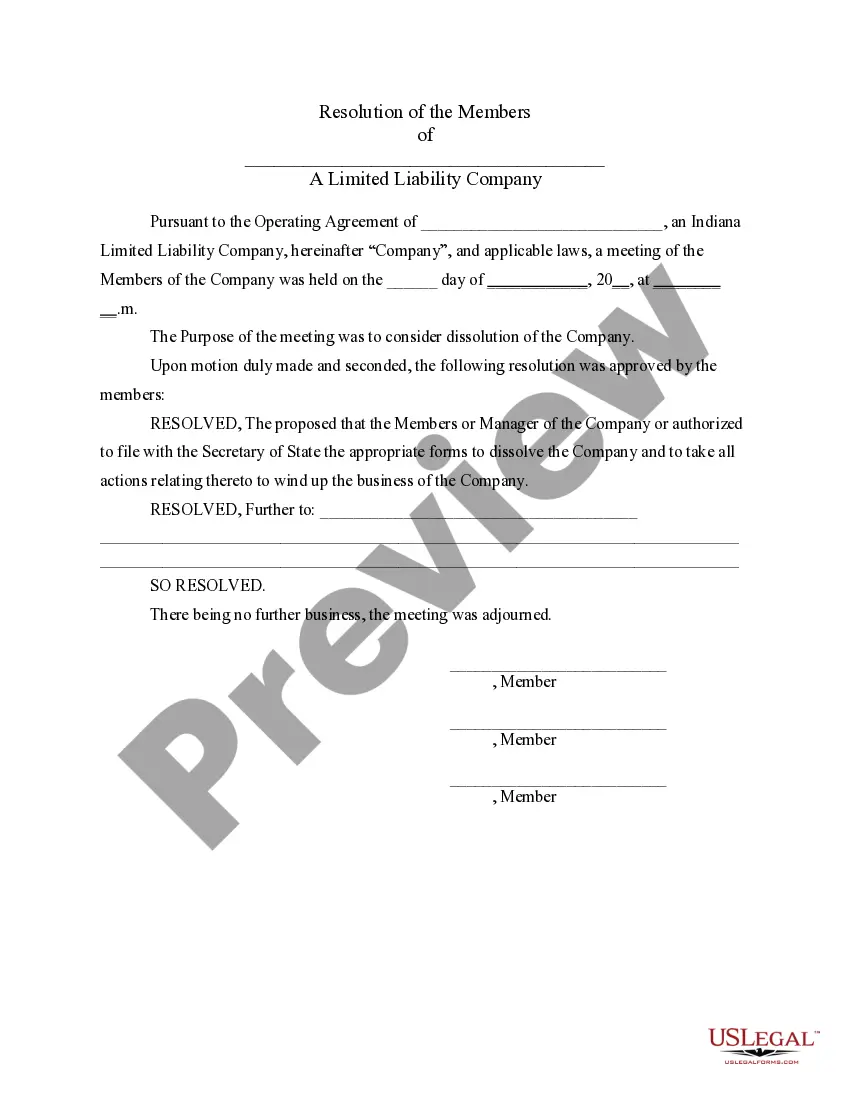

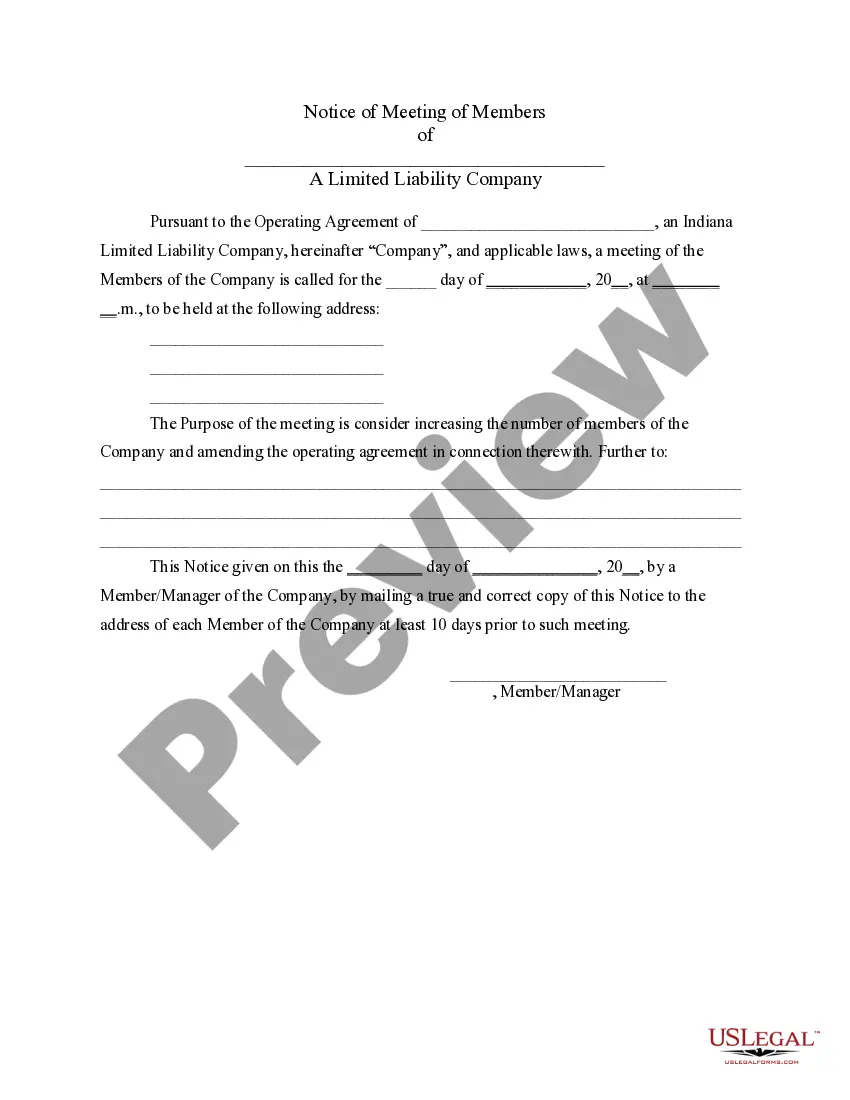

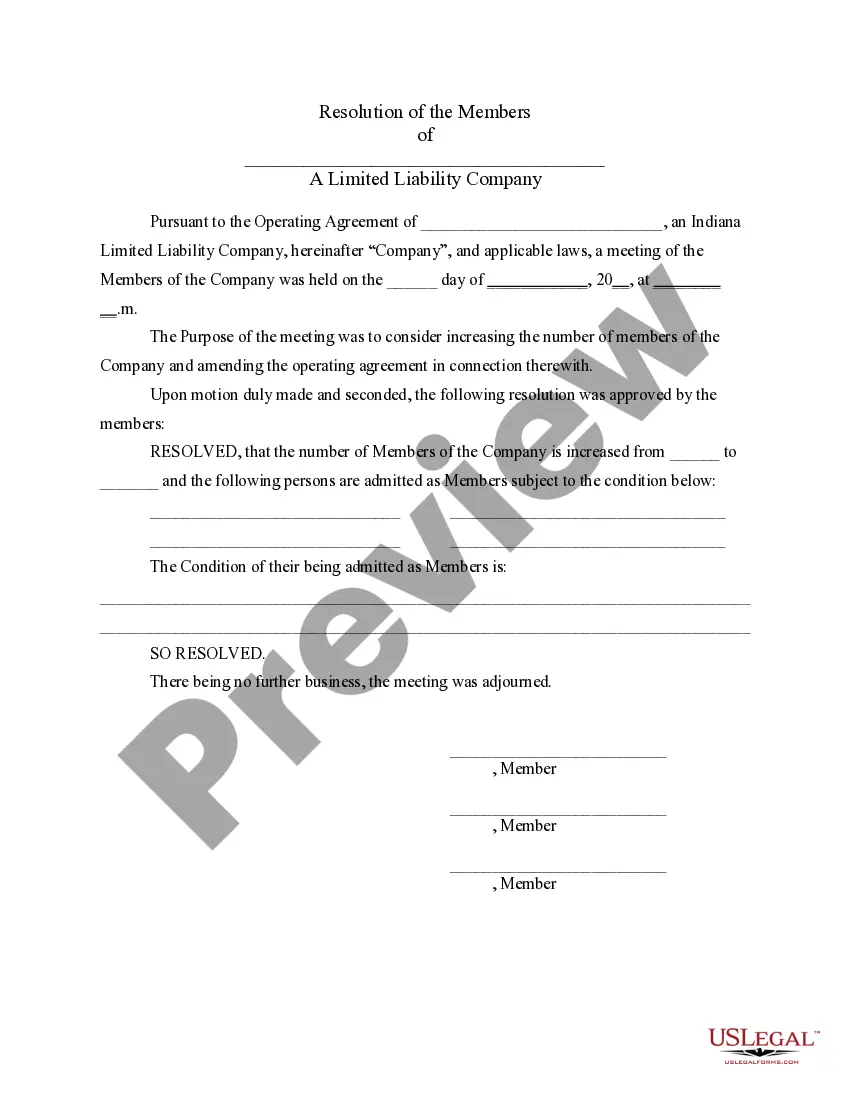

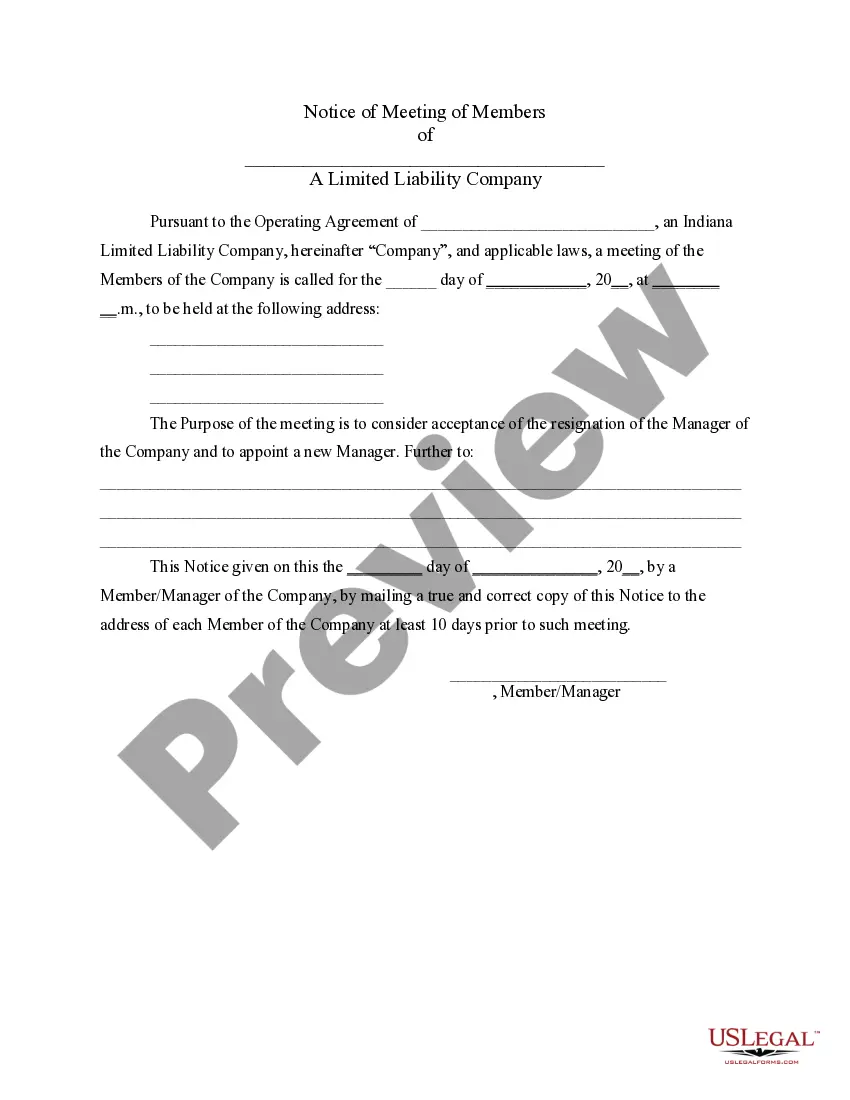

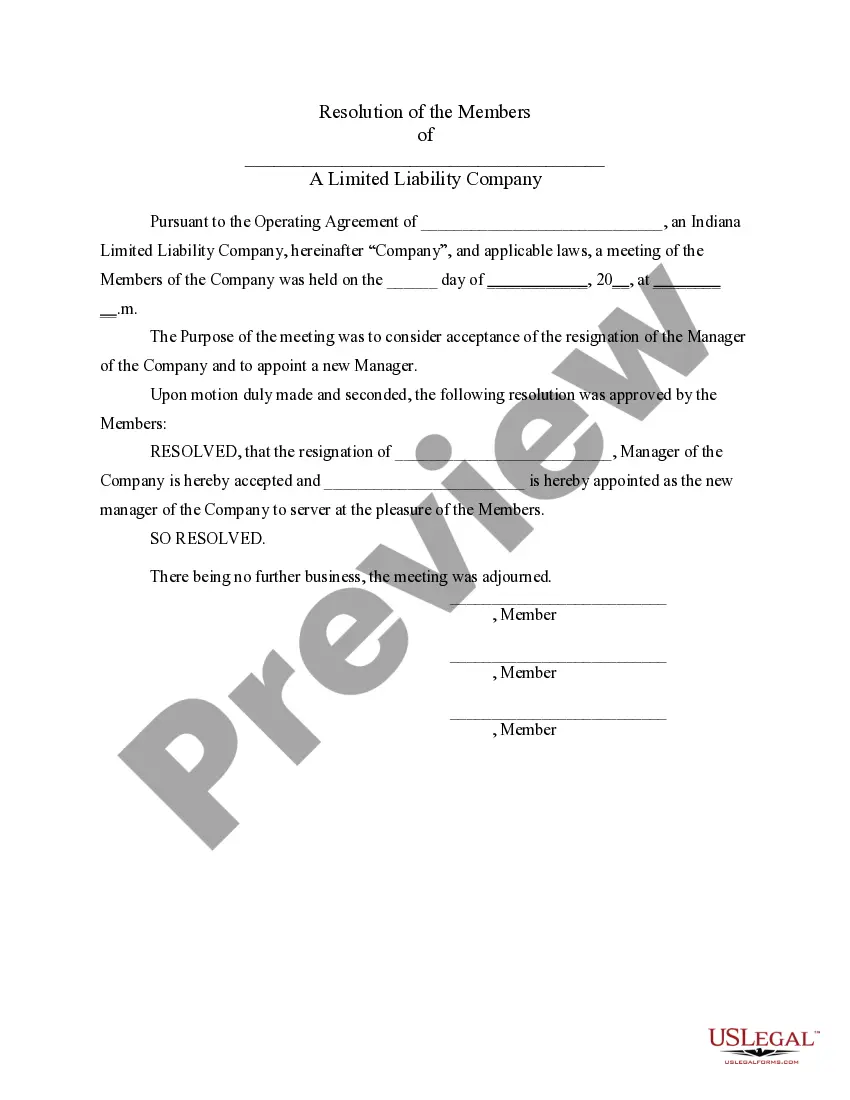

These PLLC Notices & Resolutions collection contains over 15 forms for use in connection with the operation of a PLLC, including the following: (1) Notice of Meeting for General Purpose, (2) Resolution of Meeting for General Purpose, (3) Notice of Meeting to Amend Articles of Organization, (4) Resolution to Amend Articles of Organization, (5) Notice of Meeting to Consider Dissolution, (6) Resolution Regarding Dissolution, (7) Notice to Admit New Members, (8) Resolution Concerning Admitting New Members, (9) Notice of Meeting Concerning Accepting Resignation of Manager, (10) Resolution Accepting Resignation of Manager, (11) Notice of Meeting to Remove Manager, (12) Resolution Concerning Removal of Manager, (13) Notice of Meeting to Consider Disbursements to Members, (14) Resolution Concerning Disbursements, (15) Assignment of Member Interest, and (16) Demand for Indemnity by Member/Manager.

South Bend Indiana LLC Notices and Resolutions play a crucial role in the functioning and decision-making process of limited liability companies (LCS) in South Bend, Indiana. These official documents serve as a means of communication among members, managers, and stakeholders of an LLC. Through notices and resolutions, important information, decisions, and actions taken by the company are documented and shared, ensuring transparency and legal compliance. Notices issued by South Bend Indiana PLL Cs are vital for disseminating information regarding upcoming meetings, changes in company policies, financial matters, legal requirements, and any other important developments. Notices can be sent in various forms like email, postal mail, or posted on the company's website or notice board. They typically include details such as the meeting date, time, location, agenda, and any supporting documents or materials that members need to review beforehand. Resolutions, on the other hand, refer to formal statements documenting the decisions made during LLC meetings. They serve as legally binding evidence of the actions taken by the LLC, capturing matters such as the approval of financial statements, amendments to the operating agreement, changes in management structure, authorization of contracts, and other significant business decisions. Resolutions often include specific details about the decision, the date it was made, the individuals present at the meeting, and their voting outcome. In South Bend Indiana, there can be various types of LLC Notices and Resolutions based on the specific requirements and circumstances of the LLC. Some common types include: 1. Meeting Notices: These notices notify members of upcoming meetings, such as annual general meetings, extraordinary meetings, or special purpose meetings. Meeting notices ensure that all relevant stakeholders are informed and given the opportunity to participate, discuss matters, and vote on important issues affecting the LLC. 2. Financial Notices: PLL Cs may issue notices related to financial matters to keep members updated on financial statements, audits, tax filings, and distributions. These notices ensure transparency and enable members to stay informed about the financial health of the company. 3. Operating Agreement Notices: When changes are proposed to the LLC's operating agreement, LLC Notices and Resolutions are used to inform members about the proposed modifications. These notices provide members with an opportunity to review the proposed changes, ask questions, and potentially vote on accepting or rejecting the amendments. 4. Managerial Resolutions: Resolutions can be adopted during meetings to make decisions related to the appointment, removal, or change of managers and officers within the LLC. These resolutions formalize changes in the organization's structure and leadership and ensure compliance with legal requirements. 5. Compliance Notices: Notices issued by South Bend Indiana PLL Cs help ensure compliance with local, state, and federal regulations. These notices may include information about licensing requirements, changes in tax codes, or any other legal obligations that the LLC must adhere to. In conclusion, South Bend Indiana LLC Notices and Resolutions are essential tools for LCS operating in the area. These documents help facilitate effective communication, decision-making, and legal compliance within the company. Whether it's meeting notices, financial notices, notices related to operating agreement changes, managerial resolutions, or compliance notices, each serves a specific purpose in keeping LLC members informed and enabling them to actively participate in the company's affairs.South Bend Indiana LLC Notices and Resolutions play a crucial role in the functioning and decision-making process of limited liability companies (LCS) in South Bend, Indiana. These official documents serve as a means of communication among members, managers, and stakeholders of an LLC. Through notices and resolutions, important information, decisions, and actions taken by the company are documented and shared, ensuring transparency and legal compliance. Notices issued by South Bend Indiana PLL Cs are vital for disseminating information regarding upcoming meetings, changes in company policies, financial matters, legal requirements, and any other important developments. Notices can be sent in various forms like email, postal mail, or posted on the company's website or notice board. They typically include details such as the meeting date, time, location, agenda, and any supporting documents or materials that members need to review beforehand. Resolutions, on the other hand, refer to formal statements documenting the decisions made during LLC meetings. They serve as legally binding evidence of the actions taken by the LLC, capturing matters such as the approval of financial statements, amendments to the operating agreement, changes in management structure, authorization of contracts, and other significant business decisions. Resolutions often include specific details about the decision, the date it was made, the individuals present at the meeting, and their voting outcome. In South Bend Indiana, there can be various types of LLC Notices and Resolutions based on the specific requirements and circumstances of the LLC. Some common types include: 1. Meeting Notices: These notices notify members of upcoming meetings, such as annual general meetings, extraordinary meetings, or special purpose meetings. Meeting notices ensure that all relevant stakeholders are informed and given the opportunity to participate, discuss matters, and vote on important issues affecting the LLC. 2. Financial Notices: PLL Cs may issue notices related to financial matters to keep members updated on financial statements, audits, tax filings, and distributions. These notices ensure transparency and enable members to stay informed about the financial health of the company. 3. Operating Agreement Notices: When changes are proposed to the LLC's operating agreement, LLC Notices and Resolutions are used to inform members about the proposed modifications. These notices provide members with an opportunity to review the proposed changes, ask questions, and potentially vote on accepting or rejecting the amendments. 4. Managerial Resolutions: Resolutions can be adopted during meetings to make decisions related to the appointment, removal, or change of managers and officers within the LLC. These resolutions formalize changes in the organization's structure and leadership and ensure compliance with legal requirements. 5. Compliance Notices: Notices issued by South Bend Indiana PLL Cs help ensure compliance with local, state, and federal regulations. These notices may include information about licensing requirements, changes in tax codes, or any other legal obligations that the LLC must adhere to. In conclusion, South Bend Indiana LLC Notices and Resolutions are essential tools for LCS operating in the area. These documents help facilitate effective communication, decision-making, and legal compliance within the company. Whether it's meeting notices, financial notices, notices related to operating agreement changes, managerial resolutions, or compliance notices, each serves a specific purpose in keeping LLC members informed and enabling them to actively participate in the company's affairs.