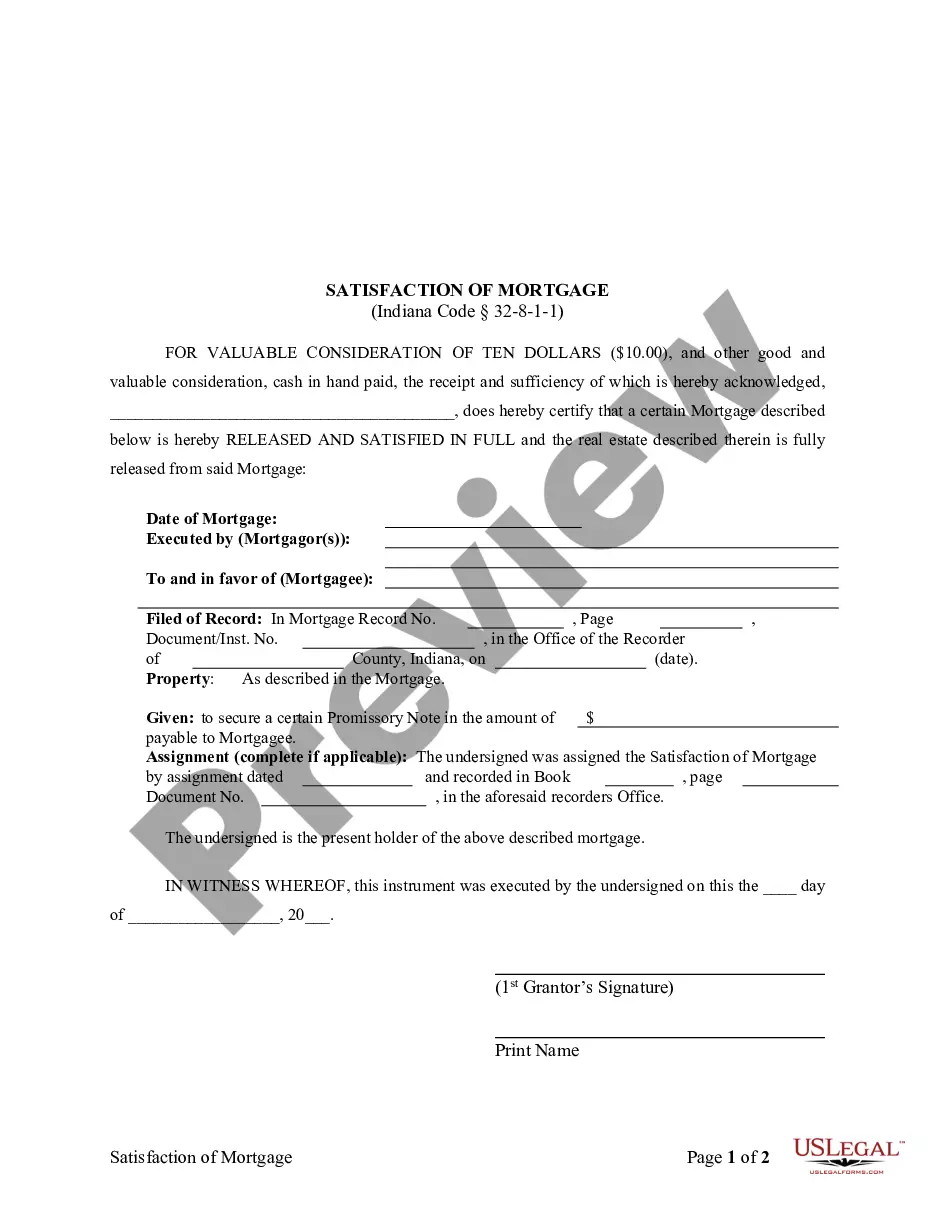

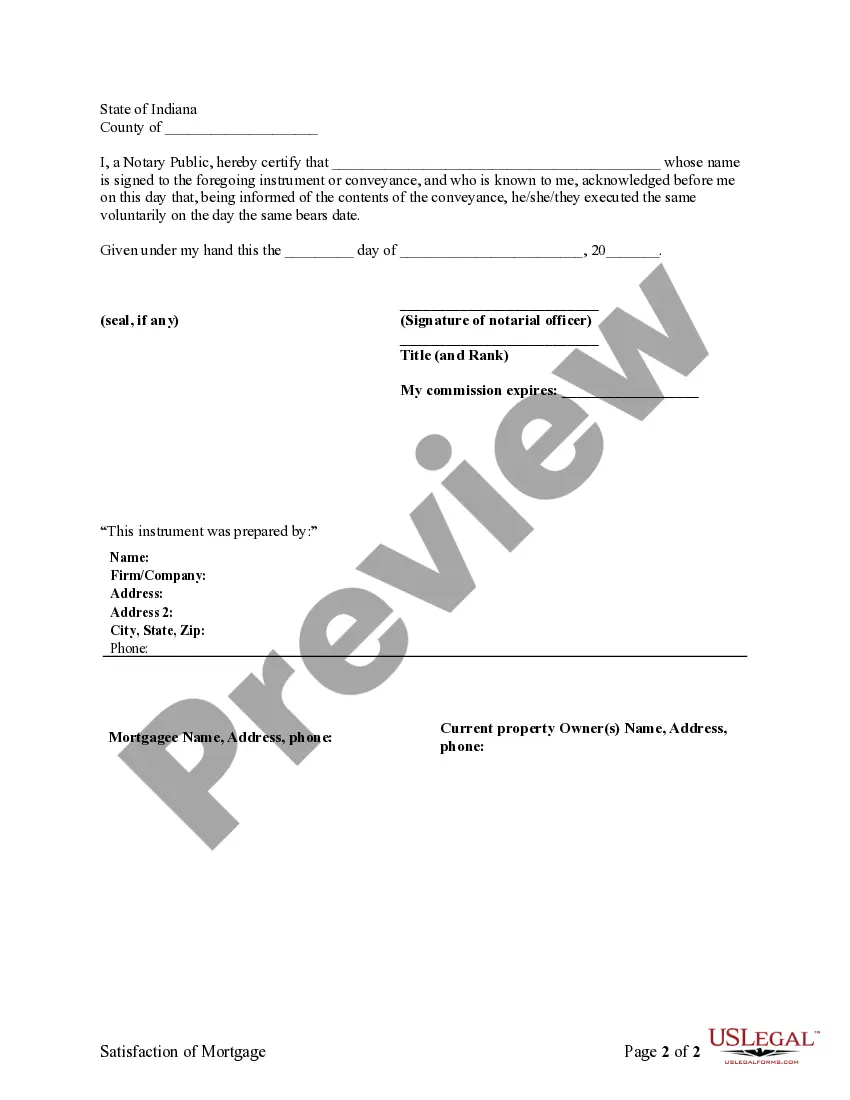

This form is for the satisfaction or release of a mortgage for the state of Indiana by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Carmel, Indiana Satisfaction, Release or Cancellation of Mortgage by Individual: Detailed Description and Types In Carmel, Indiana, the Satisfaction, Release, or Cancellation of Mortgage by an Individual refers to the process of officially declaring a mortgage debt as paid off and releasing the property from any lien or encumbrance. When a homeowner or individual borrower successfully pays off their mortgage in Carmel, they receive a satisfaction, release, or cancellation document that serves as evidence of the debt being fully settled. This document provides legal protection to the individual and ensures their property ownership remains unencumbered. Keywords: Carmel, Indiana, satisfaction, release, cancellation, mortgage, individual, lien, encumbrance, debt, property ownership, legal protection. Types of Carmel, Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual: 1. Voluntary Satisfaction: This type of satisfaction occurs when the mortgage holder (individual borrower) repays the entire loan amount in full and requests the lender to issue a Satisfaction, Release, or Cancellation of Mortgage document. The lender, upon verifying the payment and ensuring no outstanding obligations, releases the lien on the property. Keywords: voluntary, repayment, loan amount, lender, lien, property. 2. Prepayment Satisfaction: In some cases, borrowers may choose to prepay their mortgage loan before the agreed-upon term. They can provide a lump sum payment or may make extra payments over time to reduce the principal amount. Once the total mortgage debt is paid off, the borrower can request the release of the mortgage lien. Keywords: prepayment, mortgage loan, lump sum, principal amount, release, lien. 3. Refinancing Satisfaction: When a homeowner refinances their mortgage, they pay off the existing loan with a new one. Upon successfully refinancing, the new lender arranges for the old mortgage to be paid off and provides the borrower with a Satisfaction, Release, or Cancellation of Mortgage document. Keywords: refinancing, existing loan, new lender, paid off. 4. Assumed Satisfaction: In cases where a new buyer assumes the existing mortgage loan on a property, a satisfaction, release, or cancellation of mortgage is required to transfer the legal ownership smoothly. The original borrower's liability is released, and the new buyer assumes responsibility for the mortgage debt. Keywords: assumed, new buyer, transfer, legal ownership, liability. 5. Mortgage Discharge: A mortgage discharge is a type of satisfaction that occurs when a mortgage loan is fully paid off but without a formal release of the mortgage lien. Although the discharge does not remove the lien from public records, it indicates that the lender no longer has any interest in the property. However, homeowners may choose to obtain a formal release document to completely clear the title of their property. Keywords: discharge, paid off, formal release, mortgage lien, public records, clear title. Understanding the various types of Carmel, Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual is crucial for homeowners and borrowers as it ensures the proper documentation and legal protection of their property ownership. It is advised to consult with legal professionals or mortgage lenders for further guidance and support in completing this process accurately.Carmel, Indiana Satisfaction, Release or Cancellation of Mortgage by Individual: Detailed Description and Types In Carmel, Indiana, the Satisfaction, Release, or Cancellation of Mortgage by an Individual refers to the process of officially declaring a mortgage debt as paid off and releasing the property from any lien or encumbrance. When a homeowner or individual borrower successfully pays off their mortgage in Carmel, they receive a satisfaction, release, or cancellation document that serves as evidence of the debt being fully settled. This document provides legal protection to the individual and ensures their property ownership remains unencumbered. Keywords: Carmel, Indiana, satisfaction, release, cancellation, mortgage, individual, lien, encumbrance, debt, property ownership, legal protection. Types of Carmel, Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual: 1. Voluntary Satisfaction: This type of satisfaction occurs when the mortgage holder (individual borrower) repays the entire loan amount in full and requests the lender to issue a Satisfaction, Release, or Cancellation of Mortgage document. The lender, upon verifying the payment and ensuring no outstanding obligations, releases the lien on the property. Keywords: voluntary, repayment, loan amount, lender, lien, property. 2. Prepayment Satisfaction: In some cases, borrowers may choose to prepay their mortgage loan before the agreed-upon term. They can provide a lump sum payment or may make extra payments over time to reduce the principal amount. Once the total mortgage debt is paid off, the borrower can request the release of the mortgage lien. Keywords: prepayment, mortgage loan, lump sum, principal amount, release, lien. 3. Refinancing Satisfaction: When a homeowner refinances their mortgage, they pay off the existing loan with a new one. Upon successfully refinancing, the new lender arranges for the old mortgage to be paid off and provides the borrower with a Satisfaction, Release, or Cancellation of Mortgage document. Keywords: refinancing, existing loan, new lender, paid off. 4. Assumed Satisfaction: In cases where a new buyer assumes the existing mortgage loan on a property, a satisfaction, release, or cancellation of mortgage is required to transfer the legal ownership smoothly. The original borrower's liability is released, and the new buyer assumes responsibility for the mortgage debt. Keywords: assumed, new buyer, transfer, legal ownership, liability. 5. Mortgage Discharge: A mortgage discharge is a type of satisfaction that occurs when a mortgage loan is fully paid off but without a formal release of the mortgage lien. Although the discharge does not remove the lien from public records, it indicates that the lender no longer has any interest in the property. However, homeowners may choose to obtain a formal release document to completely clear the title of their property. Keywords: discharge, paid off, formal release, mortgage lien, public records, clear title. Understanding the various types of Carmel, Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual is crucial for homeowners and borrowers as it ensures the proper documentation and legal protection of their property ownership. It is advised to consult with legal professionals or mortgage lenders for further guidance and support in completing this process accurately.