Satisfaction, Release or Cancellation of Mortgage by Individual

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

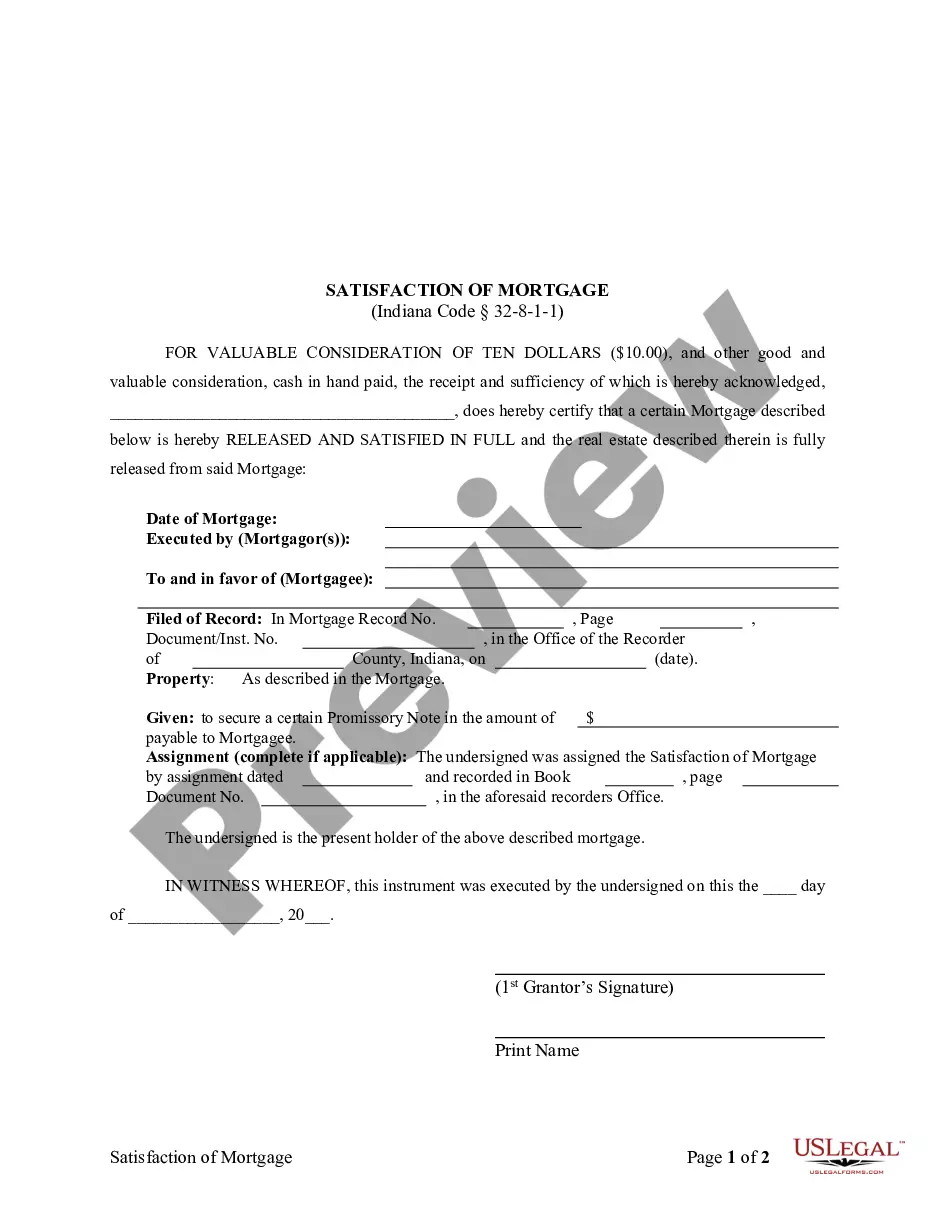

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Indiana Law

Execution of Assignment or Satisfaction: Must be signed by mortgagee.

Assignment: An assignment must be in writing and recorded either upon the margin of the record where such mortgage is recorded or by written instrument, and cause the same to be duly acknowledged.

Demand to Satisfy: Upon full payoff of the mortgage, mortgagor may request, by written demand in registered or certified mail with return receipt requested, that mortgagee record satisfaction thereof, whereupon mortgagee has 15 days to comply or suffer liablity.

Recording Satisfaction: Every mortgagee of lands whose mortgage has been recorded, having received full payment of the sum or sums of money therein specified from the mortgagor, shall, at the request of such mortgagor, enter satisfaction on the margin or other proper place in the record of such mortgage, which shall operate as a complete release and discharge thereof.

Marginal Satisfaction: Marginal satisfaction is allowed only if attested by the recorder, clerk, or other officer having custody of the record of the lien (unless recorder requires separate document for satisfactions).

Penalty: If mortgagee fails to timely record satisfaction, he shall suffer liability of up to five hundred dollars ($500) for such failure, neglect, or refusal, which sum may be recovered by suit in any court of competent jurisdiction, together with the costs and reasonable attorney's fees.

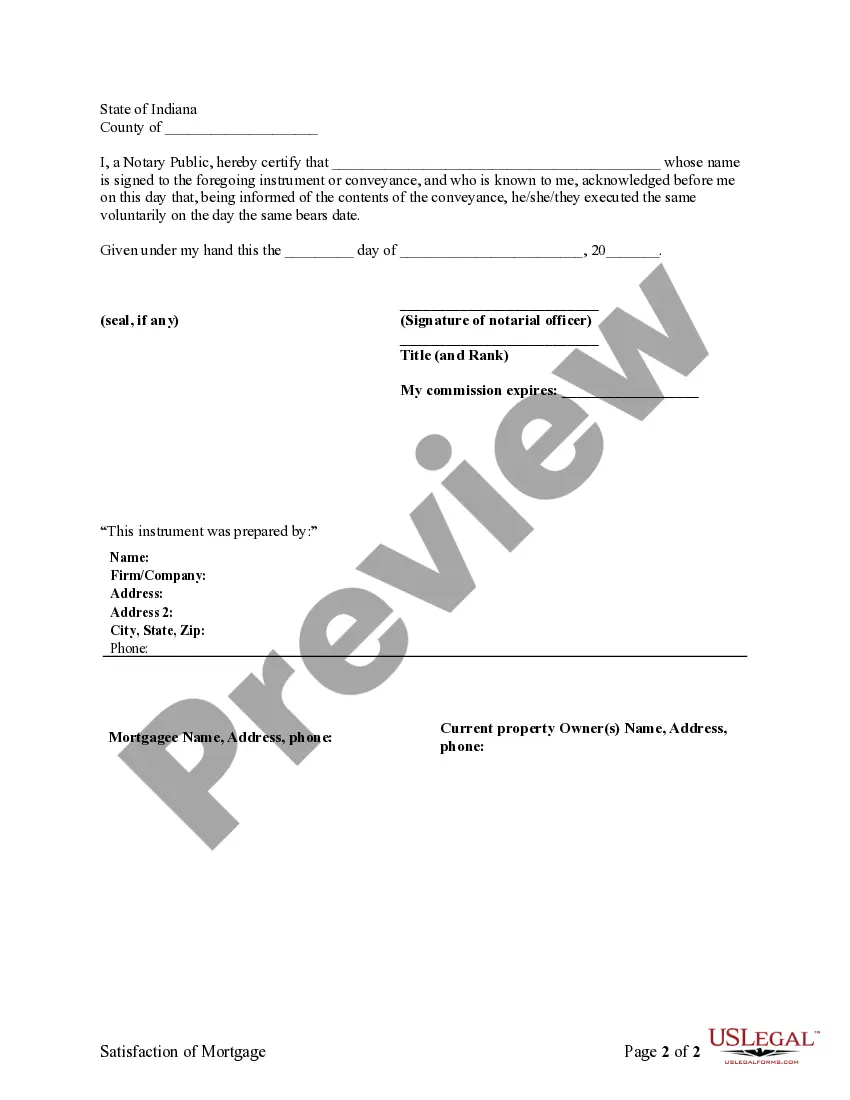

Acknowledgment: An assignment or satisfaction must contain a proper Indiana acknowledgment, or other acknowledgment approved by Statute.

Indiana Statutes

IC 32-8-1-1

Sec. 1.

(a) It is the duty of every person, firm, limited liability company, corporation, copartnership, association, administrator, executor, guardian, trustee, or other person, who is the owner, holder, or custodian of any mortgage, mechanic's lien, judgment, or other lien which is recorded in the state of Indiana, to release, discharge, and satisfy of record, such mortgage, mechanic's lien, judgment, or other lien, when the debt or obligation, together with the interest thereon, which such mortgage, mechanic's lien, judgment, or other lien was made to secure shall have been fully paid, lawfully tendered, and discharged.

(b) When the release, discharge, or satisfaction is a release, discharge, or satisfaction in part, the instrument must state on its face that it is a partial release, partial discharge, or partial satisfaction and describe what portion of the mortgage, mechanic's lien, judgment, or other lien is released, discharged, or satisfied.

Sec. 2. Any such owner, holder, or custodian who shall fail, neglect, or refuse to release, discharge, and satisfy of record any such mortgage, mechanic's lien, judgment, or other lien, when the debt or obligation thereby secured, together with the interest thereon, shall have been fully paid, and after fifteen (15) days written demand by registered or certified mail with return receipt requested has been made to do so, shall forfeit and pay to the mortgagor, or other person, having the right to demand the release of such mortgage or lien, a sum not to exceed five hundred dollars ($500) for such failure, neglect, or refusal, which sum may be recovered by suit in any court of competent jurisdiction, together with the costs and reasonable attorney's fees, if an attorney has been employed, incurred in the enforcement of such release, discharge, or satisfaction, and such court trying the case, shall in its finding, if it be in favor of the plaintiff, grant a reasonable attorney fee and the costs of such action as a part of the judgment. The court is hereby authorized and empowered to appoint a commissioner and to authorize and direct such commissioner to release and satisfy such mortgage, mechanic's lien, judgment, or other lien, and the costs incurred in connection therewith shall be taxed as a part of the costs of such action. Such owner, holder, or custodian, by virtue of having recorded his mortgage, mechanic's lien, judgment, or other lien in the state of Indiana, submits to the jurisdiction of the courts of the state of Indiana as to any action arising under this section.

IC 32-8-12-1

Sec. 1. It shall be the duty of each and every firm, person, limited liability company, or corporation who transfers or assigns any mortgage upon real estate within the state of Indiana securing the payment of any sum or sums of money, to sell, transfer or assign the same in writing, either upon the margin of the record where such mortgage is recorded or by written instrument, and cause the same to be duly acknowledged before some officer authorized to take acknowledgments of the execution of such mortgages.

IC 32-8-12-2

Sec. 2. In order to be recorded, a written instrument that transfers or assigns a mortgage under this chapter must state the location and business address of the firm, person, limited liability company, or corporation to which the mortgage is transferred or assigned.

IC 32-8-13-1

Sec. 1. On and after March 4, 1897, each release of mortgage, lease or other instrument required by law to be recorded, written upon the margin, or upon the record, of any mortgage in the several counties of the state of Indiana, by the party legally authorized to release the same, shall not be deemed a valid satisfaction of said mortgage, lease or other instrument, unless the same is attested upon the record thereof by the recorder or deputy recorder of the county in which said mortgage is recorded.

IC 32-8-15-1

Sec. 1.

(a) It shall be lawful for:

(1) the president, vice president, cashier, secretary, treasurer, ttorney-in-fact, or other authorized representative of any national bank, state bank, trust company, or savings bank; or

(2) the president, vice president, general manager, secretary, treasurer, attorney-in-fact, or other authorized representative of any other corporation doing business in Indiana; to release upon the record mortgages, judgments, and other record liens, upon the payment of the debts secured by the liens.

(b) Such a release, when made upon the margin or face of the record of the mortgage, judgment, or other lien, and attested by the recorder, clerk, or other officer having custody of the record of the lien, shall operate as a full discharge and satisfaction of the lien.

(c) The recorder of each county may require that each release, discharge, or satisfaction of a mortgage, judgment, or lien, or any partial release of any of these, be recorded on a separate written instrument. If a recorder does so, an instrument presented for recordation in that county may not contain more than one (1) release, discharge, or satisfaction. If a recorder allows an instrument to contain more than one (1) release, discharge, or satisfaction, the fee for recording that instrument is provided in IC 36-2-7-10(b)(3).

(d) Such a national bank, state bank, trust company, or savings bank, or other corporation may, in like manner, release and discharge mortgages, judgments, and other record liens each by a separate written instrument signed by its corporate name, its president, vice president, cashier, secretary, treasurer, attorney-in-fact, or authorized representative of such national bank, state bank, trust company, or savings bank, or the president, vice president, general manager, secretary, treasurer, attorney-in-fact, or authorized representative of such other corporation, which release shall be recorded by the recorder, clerk, or other officer having custody of the record of the lien, with a reference on the margin of the record of the lien to the place where the release is recorded. This release, when recorded, shall operate as a full discharge and satisfaction of the lien, or portion of the lien, as indicated in a partial release. However, no release by the attorney-in-fact shall be entitled to record until an instrument in writing duly signed and acknowledged by any two (2) officers of the national bank, state bank, trust company, savings bank, or any other corporation granting authority, particularly setting forth and specifying the power or authority given, granted, or conferred, shall have been duly recorded in the recorder’s office of the county where the release is to be recorded.

(e) The party conferring the power shall be bound thereby as to all acts done and performed prior to notice of revoking of the authority, which notice may be given by a memorandum thereof entered on the margin of the record of the power of attorney, duly attested by the recorder, or by a copy of a duly acknowledged memorandum entered and attested as provided by this section.