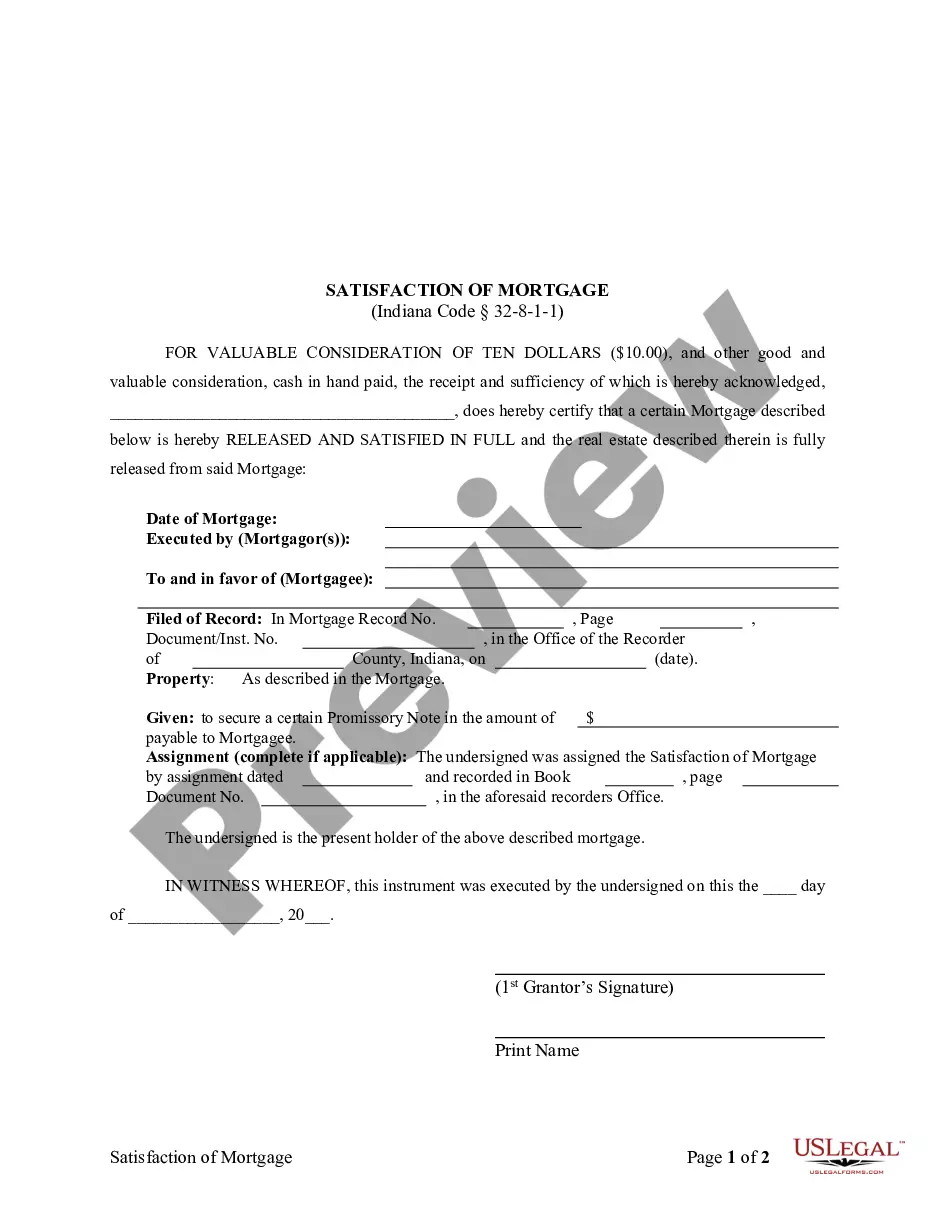

This form is for the satisfaction or release of a mortgage for the state of Indiana by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Fort Wayne, Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual In Fort Wayne, Indiana, the process of Satisfaction, Release, or Cancellation of Mortgage by Individual plays a crucial role in finalizing mortgage transactions. This important legal procedure serves to formally discharge the mortgage obligation and ensures the ownership of the property is transferred to the borrower. Keywords: Fort Wayne, Indiana, Satisfaction, Release, Cancellation, Mortgage, Individual Types of Fort Wayne Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual: 1. Full Satisfaction: This type of mortgage release occurs when the borrower has successfully repaid the entire mortgage amount along with any accrued interest. Upon completion of the final payment, the lender issues a Satisfaction of Mortgage, indicating that the loan has been fully satisfied. 2. Partial Satisfaction: In certain cases, a borrower may decide to repay a portion of the mortgage balance, either voluntarily or as part of a refinancing arrangement. When this happens, the lender issues a Partial Satisfaction of Mortgage, releasing the lien on the specific amount paid off while keeping the remaining balance intact. 3. Mortgage Release upon Sale: When a property securing a mortgage is sold, the seller, who was the borrower, requests a Mortgage Release or Satisfaction from the lender. This document confirms that the mortgage has been discharged, allowing the smooth transfer of ownership to the buyer. 4. Mortgage Cancellation due to Refinancing: Refinancing refers to obtaining a new loan to replace the original mortgage. In such cases, the borrower repays the existing mortgage using the refinancing funds. Once the lender receives the full payment, a Mortgage Cancellation is issued, stating that the original mortgage is no longer in force. 5. Mortgage Cancellation due to Loan Assumption: When a property changes hands, the new buyer may choose to assume the existing mortgage rather than obtaining a new loan. In this scenario, the lender provides a Mortgage Cancellation upon the completion of paperwork, reflecting the transfer of responsibility from the original borrower to the new homeowner. 6. Mortgage Cancellation due to Prepayment: Borrowers may opt to make additional payments, often referred to as prepayments, toward their mortgage to reduce the principal balance or pay off the loan earlier. Upon full repayment or prepayment of the remaining balance, the lender issues a Mortgage Cancellation, thereby releasing the lien on the property. In Fort Wayne, Indiana, the Satisfaction, Release, or Cancellation of Mortgage by Individual helps ensure transparency, protect property rights, and provide legal assurance to both borrowers and lenders. It is essential for individuals involved in mortgage transactions to be familiar with the specific type of satisfaction or release they require based on their unique circumstances.Fort Wayne, Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual In Fort Wayne, Indiana, the process of Satisfaction, Release, or Cancellation of Mortgage by Individual plays a crucial role in finalizing mortgage transactions. This important legal procedure serves to formally discharge the mortgage obligation and ensures the ownership of the property is transferred to the borrower. Keywords: Fort Wayne, Indiana, Satisfaction, Release, Cancellation, Mortgage, Individual Types of Fort Wayne Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual: 1. Full Satisfaction: This type of mortgage release occurs when the borrower has successfully repaid the entire mortgage amount along with any accrued interest. Upon completion of the final payment, the lender issues a Satisfaction of Mortgage, indicating that the loan has been fully satisfied. 2. Partial Satisfaction: In certain cases, a borrower may decide to repay a portion of the mortgage balance, either voluntarily or as part of a refinancing arrangement. When this happens, the lender issues a Partial Satisfaction of Mortgage, releasing the lien on the specific amount paid off while keeping the remaining balance intact. 3. Mortgage Release upon Sale: When a property securing a mortgage is sold, the seller, who was the borrower, requests a Mortgage Release or Satisfaction from the lender. This document confirms that the mortgage has been discharged, allowing the smooth transfer of ownership to the buyer. 4. Mortgage Cancellation due to Refinancing: Refinancing refers to obtaining a new loan to replace the original mortgage. In such cases, the borrower repays the existing mortgage using the refinancing funds. Once the lender receives the full payment, a Mortgage Cancellation is issued, stating that the original mortgage is no longer in force. 5. Mortgage Cancellation due to Loan Assumption: When a property changes hands, the new buyer may choose to assume the existing mortgage rather than obtaining a new loan. In this scenario, the lender provides a Mortgage Cancellation upon the completion of paperwork, reflecting the transfer of responsibility from the original borrower to the new homeowner. 6. Mortgage Cancellation due to Prepayment: Borrowers may opt to make additional payments, often referred to as prepayments, toward their mortgage to reduce the principal balance or pay off the loan earlier. Upon full repayment or prepayment of the remaining balance, the lender issues a Mortgage Cancellation, thereby releasing the lien on the property. In Fort Wayne, Indiana, the Satisfaction, Release, or Cancellation of Mortgage by Individual helps ensure transparency, protect property rights, and provide legal assurance to both borrowers and lenders. It is essential for individuals involved in mortgage transactions to be familiar with the specific type of satisfaction or release they require based on their unique circumstances.