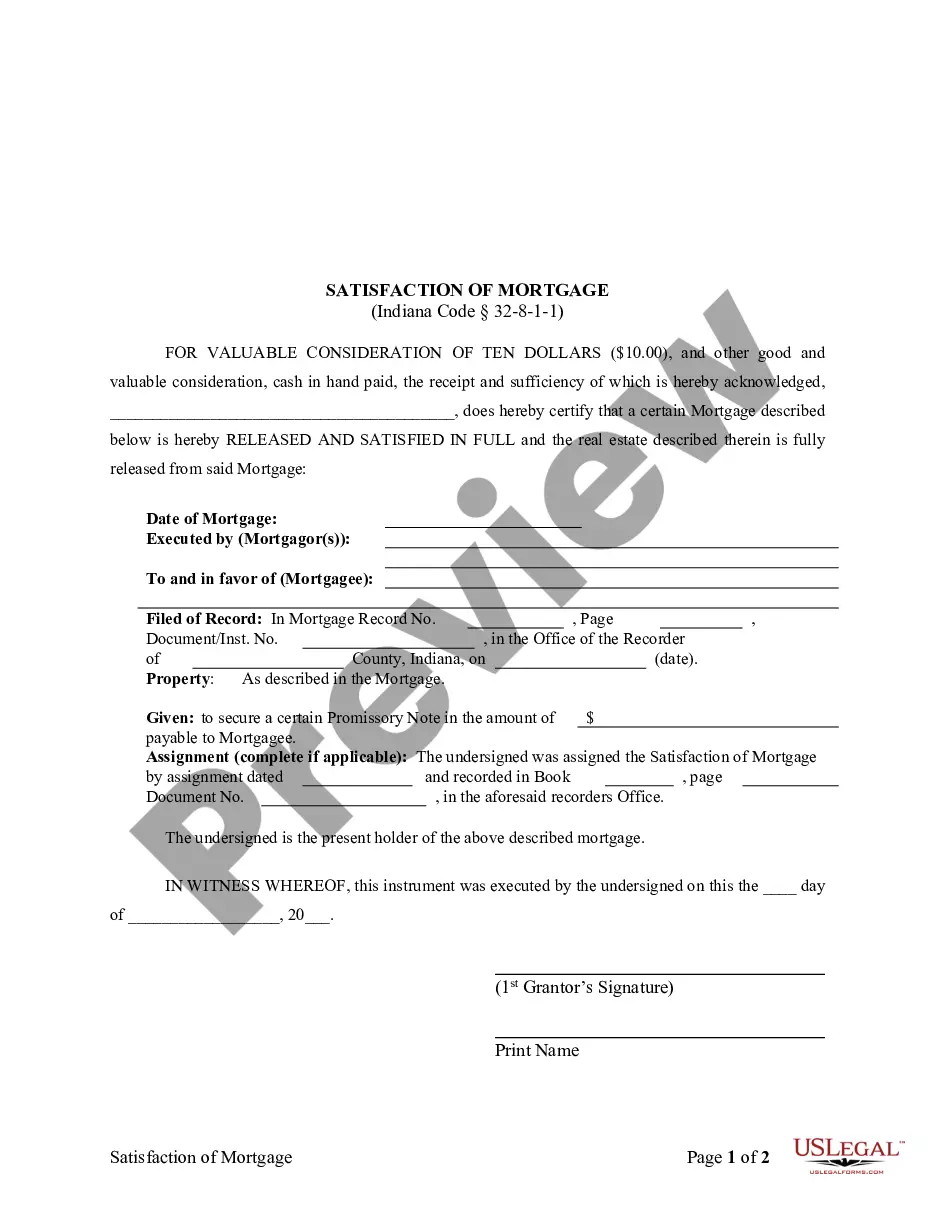

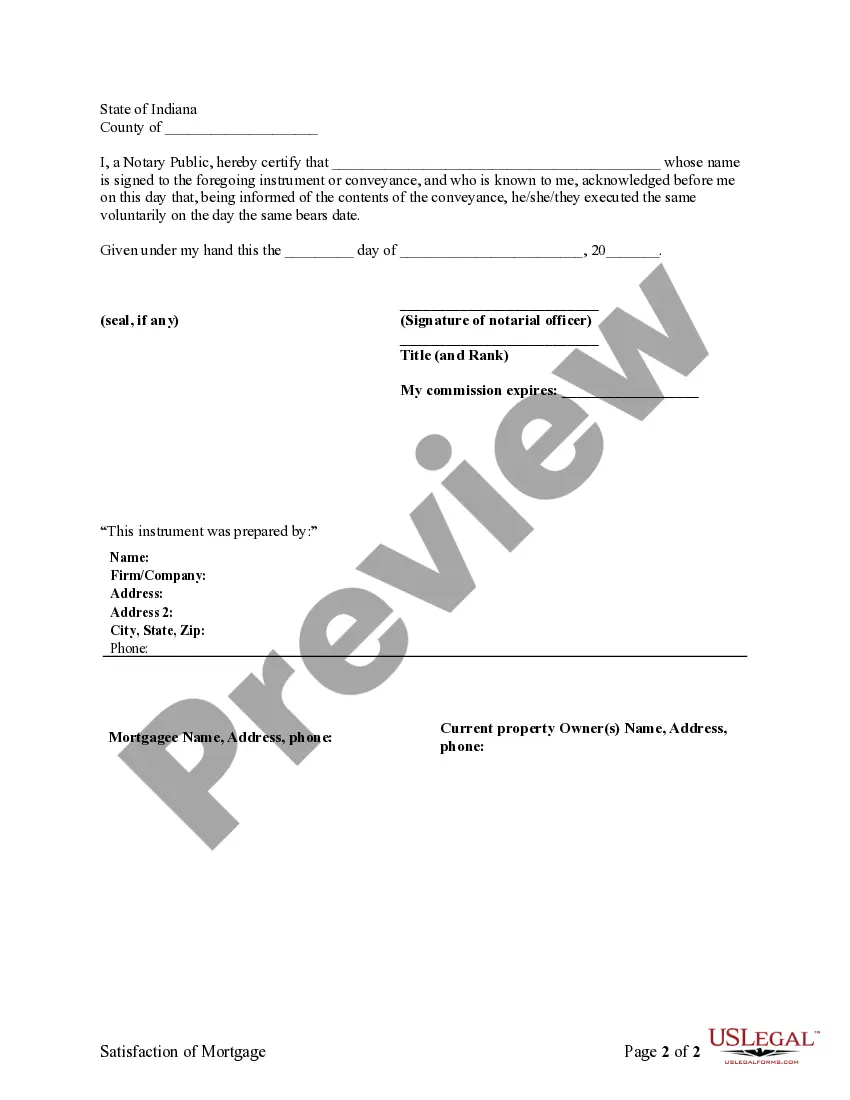

This form is for the satisfaction or release of a mortgage for the state of Indiana by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

The Indianapolis Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual is a legal document used to officially release or cancel a mortgage on a property in Indianapolis, Indiana. This document is typically prepared by the mortgage lender or their authorized representative and is executed by the individual (mortgagee) who originally granted the mortgage. Keywords: Indianapolis Indiana, satisfaction, release, cancellation, mortgage, individual, legal document, property, mortgage lender, mortgagee. When a mortgage is paid off in full or when there is a need to release a mortgage lien, this document is filed with the appropriate county office, such as the Recorder's Office or the County Clerk's Office, where the property is located. It serves as proof that the mortgage has been satisfied, released, or canceled, allowing the property owner to have clear title or ownership rights without any encumbrances caused by the mortgage. There are different types or variations of the Indianapolis Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual, based on specific circumstances or parties involved. These may include: 1. Full Satisfaction of Mortgage: This document states that the mortgage has been fully satisfied, meaning all outstanding principal, interest, and fees have been paid in accordance with the terms of the loan agreement. This type of release indicates that the borrower has fulfilled their obligation and no further payments are required. 2. Partial Satisfaction of Mortgage: In cases where only a portion of the mortgage has been paid off, such as when a property owner refinances or pays down the principal balance, a Partial Satisfaction of Mortgage is used. This document acknowledges the partial payment and releases the mortgage lien on the portion of the property not covered by the remaining balance. 3. Release of Mortgage Lien: When a mortgage is paid off, but the specific language used in the mortgage agreement doesn't require a release or satisfaction document, a Release of Mortgage Lien can be used. It serves the same purpose as a satisfaction document and ensures the mortgage lien is removed from the property's title records. 4. Mortgage Cancellation due to Error: In rare cases, a mortgage may need to be canceled or released due to an error, such as a mistake in the legal description of the property or an incorrect recording of the mortgage. The Mortgage Cancellation due to Error document rectifies such discrepancies and cancels the mortgage accordingly. In conclusion, the Indianapolis Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual is a crucial legal document that ensures the removal of a mortgage lien on a property in Indianapolis. It provides proof that the mortgage has been satisfied, released, or canceled, allowing the property owner to possess clear title and ownership rights without any encumbrances caused by the mortgage. The specific type of document may vary depending on the circumstances, such as full or partial satisfaction, release of mortgage lien, or cancellation due to error.The Indianapolis Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual is a legal document used to officially release or cancel a mortgage on a property in Indianapolis, Indiana. This document is typically prepared by the mortgage lender or their authorized representative and is executed by the individual (mortgagee) who originally granted the mortgage. Keywords: Indianapolis Indiana, satisfaction, release, cancellation, mortgage, individual, legal document, property, mortgage lender, mortgagee. When a mortgage is paid off in full or when there is a need to release a mortgage lien, this document is filed with the appropriate county office, such as the Recorder's Office or the County Clerk's Office, where the property is located. It serves as proof that the mortgage has been satisfied, released, or canceled, allowing the property owner to have clear title or ownership rights without any encumbrances caused by the mortgage. There are different types or variations of the Indianapolis Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual, based on specific circumstances or parties involved. These may include: 1. Full Satisfaction of Mortgage: This document states that the mortgage has been fully satisfied, meaning all outstanding principal, interest, and fees have been paid in accordance with the terms of the loan agreement. This type of release indicates that the borrower has fulfilled their obligation and no further payments are required. 2. Partial Satisfaction of Mortgage: In cases where only a portion of the mortgage has been paid off, such as when a property owner refinances or pays down the principal balance, a Partial Satisfaction of Mortgage is used. This document acknowledges the partial payment and releases the mortgage lien on the portion of the property not covered by the remaining balance. 3. Release of Mortgage Lien: When a mortgage is paid off, but the specific language used in the mortgage agreement doesn't require a release or satisfaction document, a Release of Mortgage Lien can be used. It serves the same purpose as a satisfaction document and ensures the mortgage lien is removed from the property's title records. 4. Mortgage Cancellation due to Error: In rare cases, a mortgage may need to be canceled or released due to an error, such as a mistake in the legal description of the property or an incorrect recording of the mortgage. The Mortgage Cancellation due to Error document rectifies such discrepancies and cancels the mortgage accordingly. In conclusion, the Indianapolis Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual is a crucial legal document that ensures the removal of a mortgage lien on a property in Indianapolis. It provides proof that the mortgage has been satisfied, released, or canceled, allowing the property owner to possess clear title and ownership rights without any encumbrances caused by the mortgage. The specific type of document may vary depending on the circumstances, such as full or partial satisfaction, release of mortgage lien, or cancellation due to error.