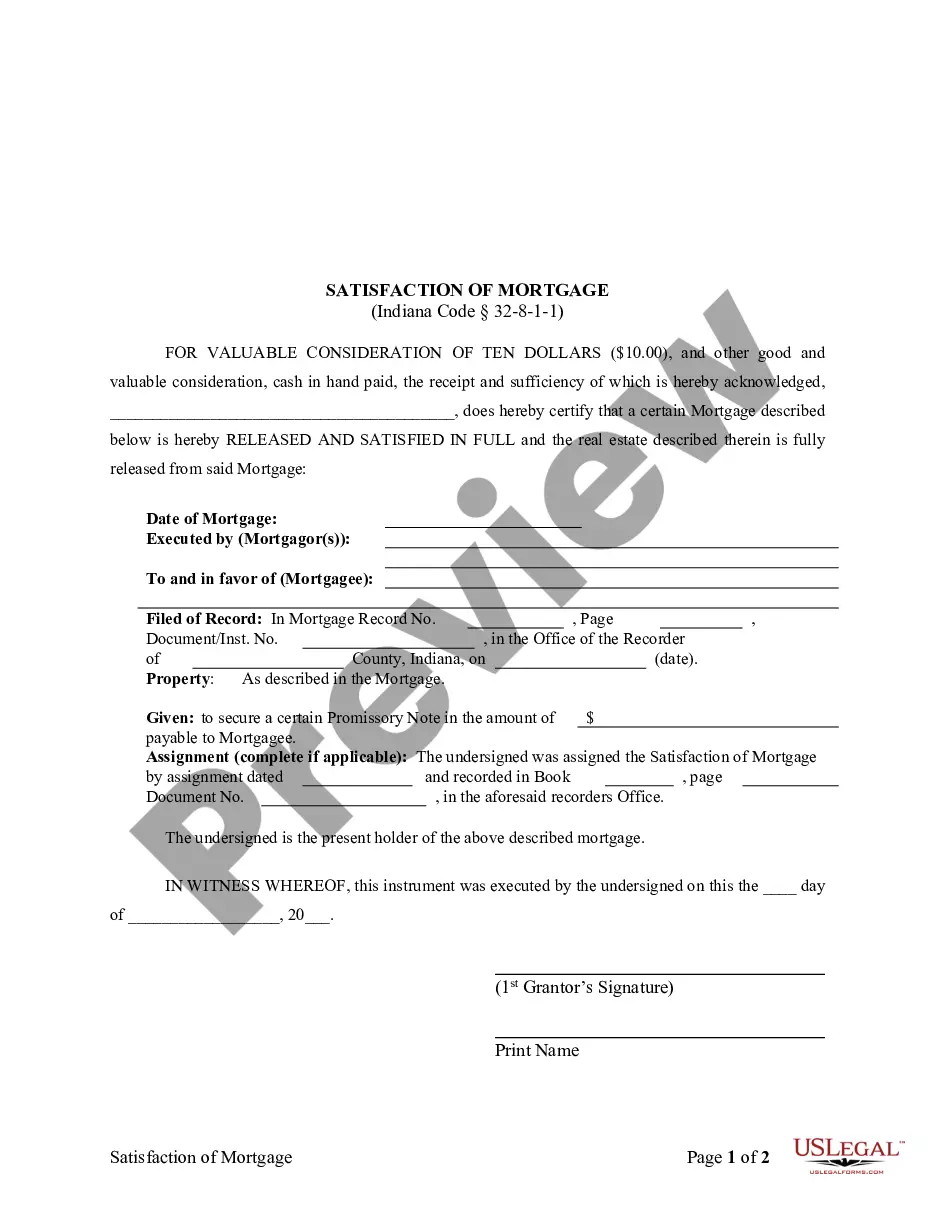

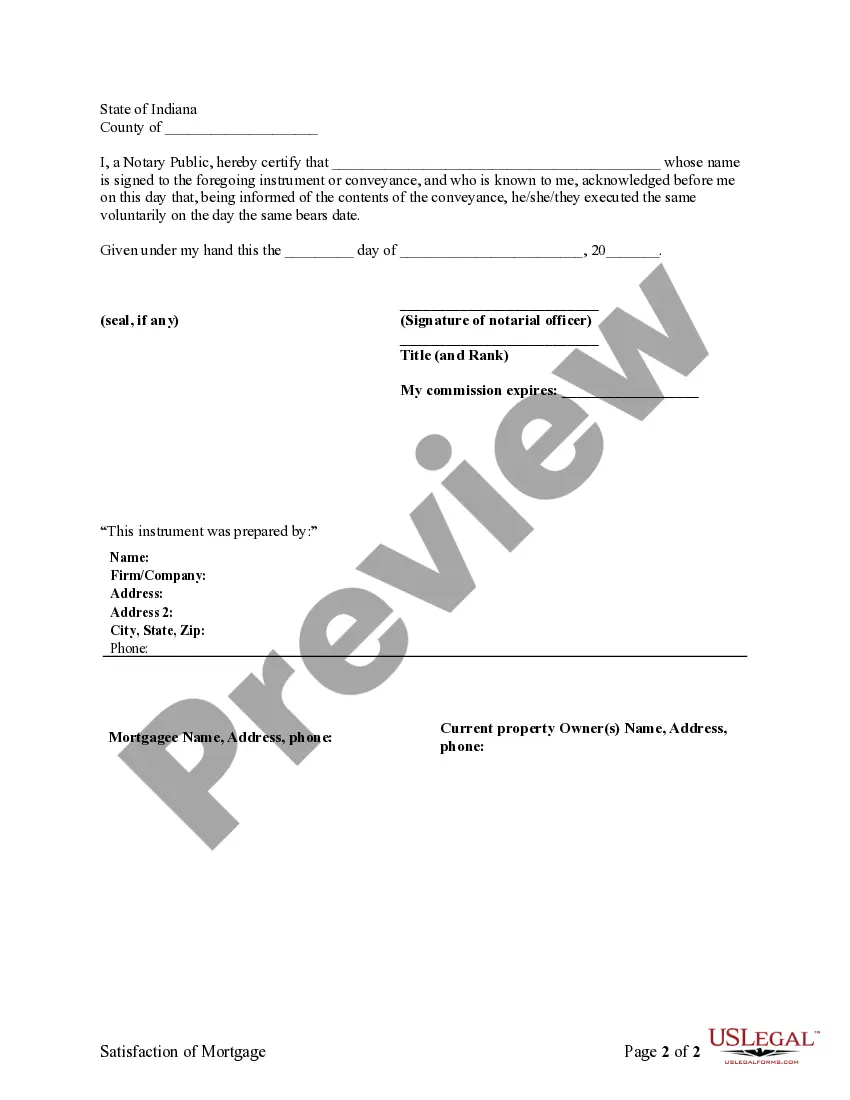

This form is for the satisfaction or release of a mortgage for the state of Indiana by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

In South Bend, Indiana, the Satisfaction, Release, or Cancellation of Mortgage by Individual is an essential legal process that signifies the completion of a mortgage obligation. This documentation releases the lien on the property, providing satisfaction and peace of mind to both the borrower and lender. Whether you are a homeowner seeking to clear your mortgage or a potential buyer interested in a property with an existing mortgage, understanding this procedure is crucial. One type of South Bend Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual is a voluntary release. This occurs when a borrower fulfills their mortgage payments and requests the lender to release the lien on the property. Typically, the lender will prepare a Release of Mortgage document acknowledging the borrower's full repayment and satisfaction of the loan. Once signed and notarized, the release is recorded at the county recorder's office, officially canceling the mortgage and providing the borrower with a clear title. Another situation where this process is applicable is when a property is sold, and the mortgage needs to be satisfied. In this case, the seller's lender will prepare and issue a Satisfaction or Release of Mortgage document, indicating that the outstanding balance has been paid in full upon the property's sale. The buyer can request a copy of the recorded document to confirm the mortgage cancellation and ensure they obtain a clear title. To initiate the South Bend Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual, certain documents are typically required, such as the original mortgage agreement, promissory note, and property description. Additionally, the lender may conduct a title search to verify the borrower's ownership and any potential claims or liens on the property. The satisfaction or release documents should contain relevant keywords to ensure their effectiveness and legal validity. These keywords may include "Satisfaction of Mortgage South Bend Indiana," "Release of Lien South Bend," "Cancellation of Mortgage by Individual," "Recorded Release of Mortgage South Bend," and "Clearing Mortgage Lien South Bend Indiana." It is crucial to consult with legal professionals or title companies experienced in South Bend Indiana real estate transactions to properly handle the Satisfaction, Release, or Cancellation of Mortgage by Individual. This process ensures a smooth transfer of property ownership and provides the necessary documentation for a clear title conveyance.In South Bend, Indiana, the Satisfaction, Release, or Cancellation of Mortgage by Individual is an essential legal process that signifies the completion of a mortgage obligation. This documentation releases the lien on the property, providing satisfaction and peace of mind to both the borrower and lender. Whether you are a homeowner seeking to clear your mortgage or a potential buyer interested in a property with an existing mortgage, understanding this procedure is crucial. One type of South Bend Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual is a voluntary release. This occurs when a borrower fulfills their mortgage payments and requests the lender to release the lien on the property. Typically, the lender will prepare a Release of Mortgage document acknowledging the borrower's full repayment and satisfaction of the loan. Once signed and notarized, the release is recorded at the county recorder's office, officially canceling the mortgage and providing the borrower with a clear title. Another situation where this process is applicable is when a property is sold, and the mortgage needs to be satisfied. In this case, the seller's lender will prepare and issue a Satisfaction or Release of Mortgage document, indicating that the outstanding balance has been paid in full upon the property's sale. The buyer can request a copy of the recorded document to confirm the mortgage cancellation and ensure they obtain a clear title. To initiate the South Bend Indiana Satisfaction, Release, or Cancellation of Mortgage by Individual, certain documents are typically required, such as the original mortgage agreement, promissory note, and property description. Additionally, the lender may conduct a title search to verify the borrower's ownership and any potential claims or liens on the property. The satisfaction or release documents should contain relevant keywords to ensure their effectiveness and legal validity. These keywords may include "Satisfaction of Mortgage South Bend Indiana," "Release of Lien South Bend," "Cancellation of Mortgage by Individual," "Recorded Release of Mortgage South Bend," and "Clearing Mortgage Lien South Bend Indiana." It is crucial to consult with legal professionals or title companies experienced in South Bend Indiana real estate transactions to properly handle the Satisfaction, Release, or Cancellation of Mortgage by Individual. This process ensures a smooth transfer of property ownership and provides the necessary documentation for a clear title conveyance.