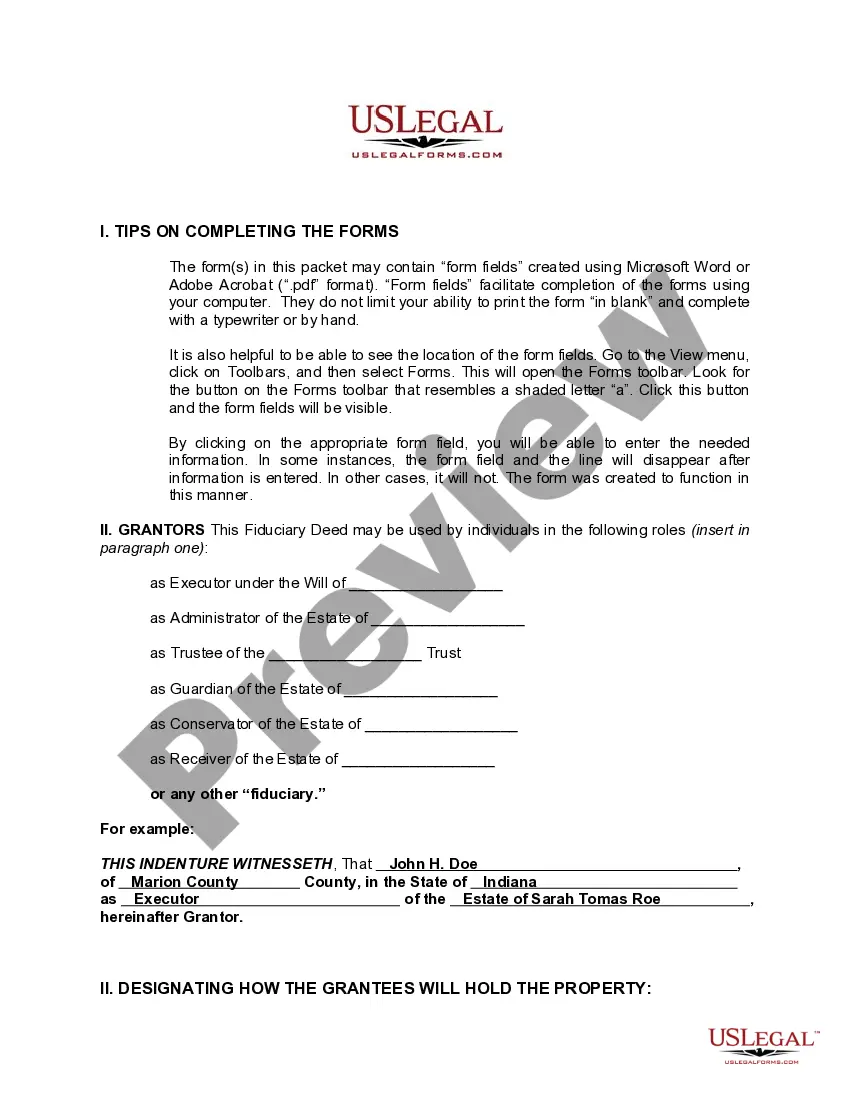

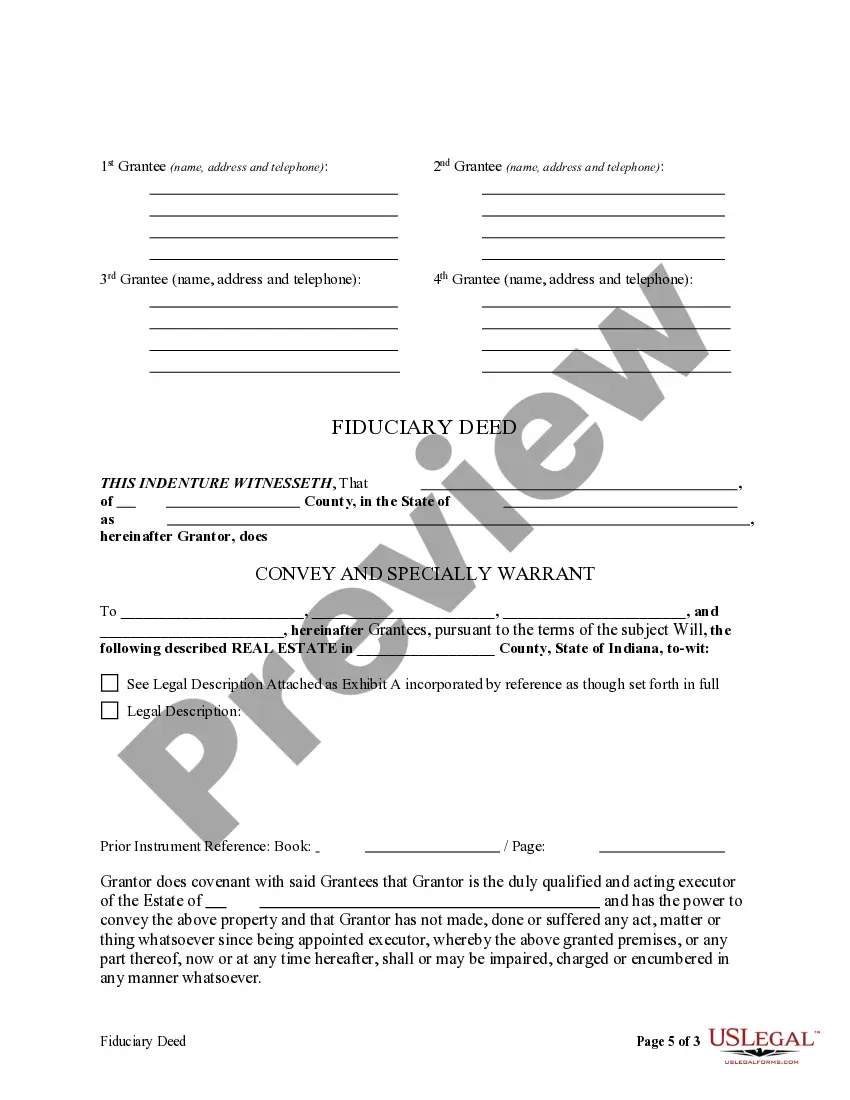

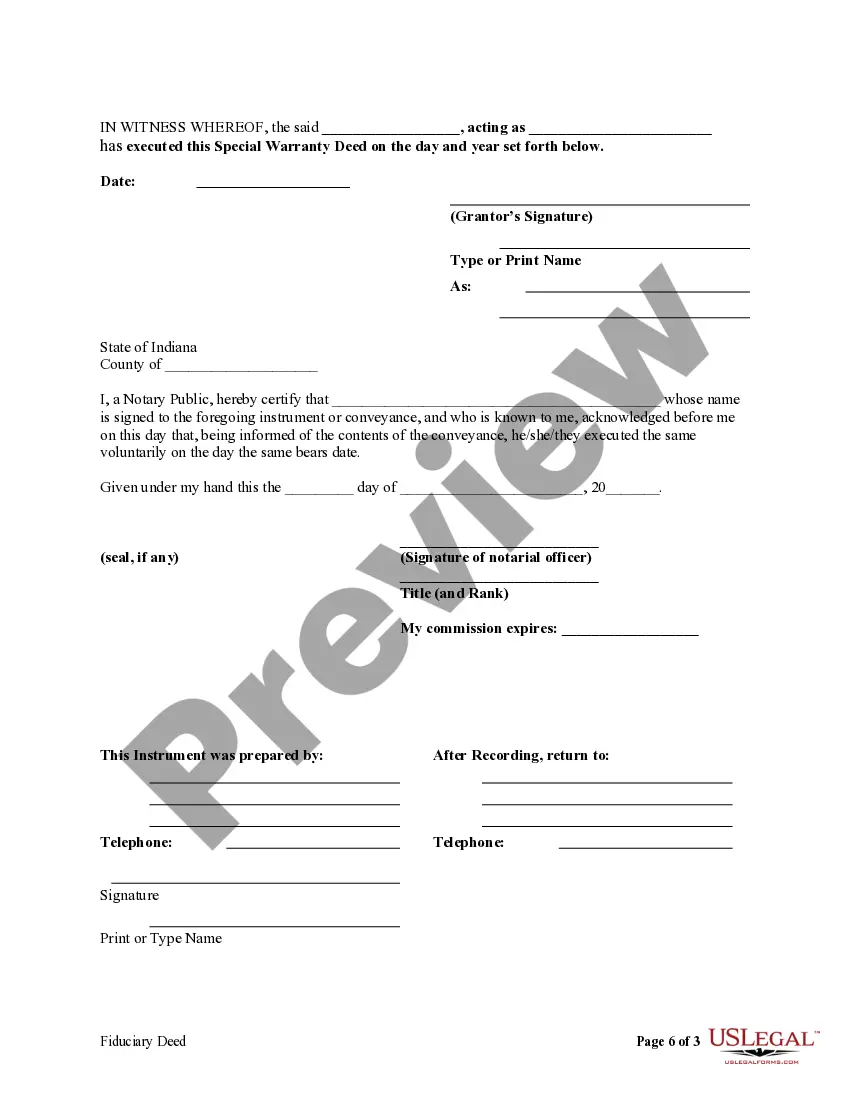

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

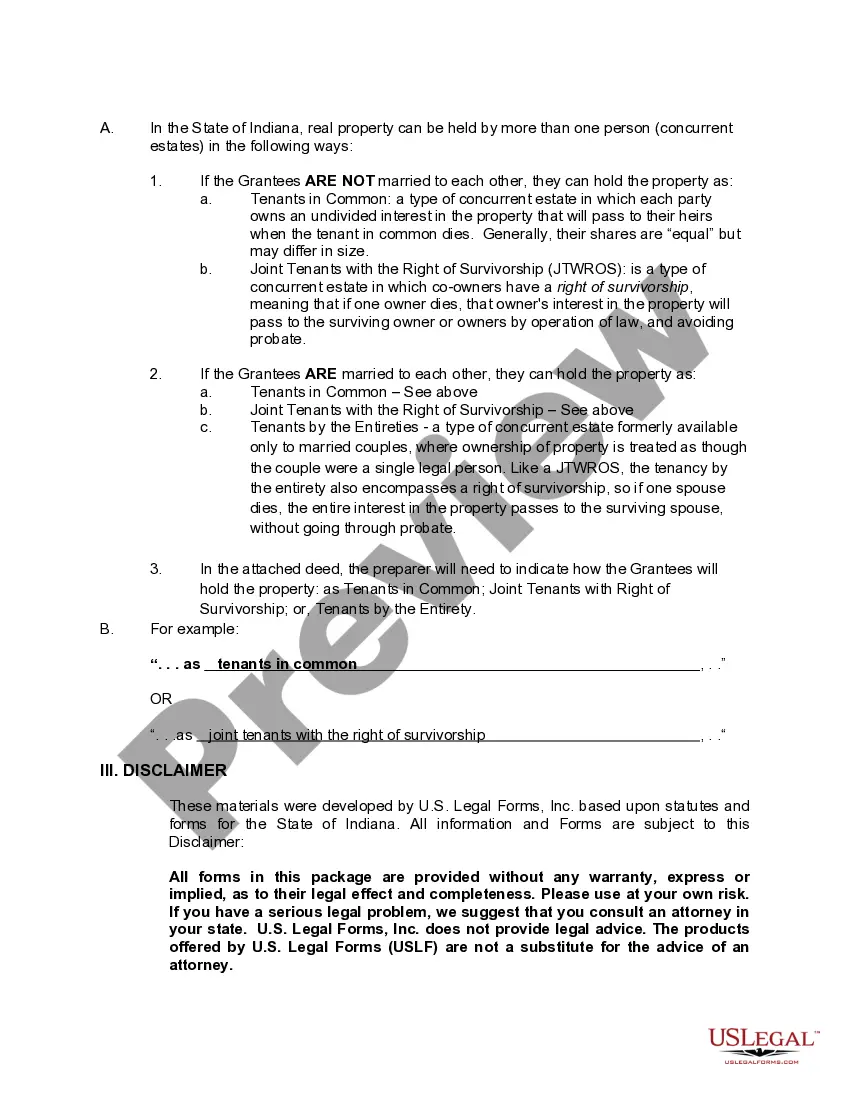

A Carmel Indiana Fiduciary Deed is a legal document specifically designed for use by Executors, Trustees, Trustees, Administrators, and other Fiduciaries in the state of Indiana. This deed allows these individuals to transfer the ownership of real property from the estate or trust they manage to the intended recipient or beneficiary. Executors, Trustees, Trustees, Administrators, and other Fiduciaries may encounter various situations that require the use of a Fiduciary Deed. Some common scenarios where a Fiduciary Deed is typically used include: 1. Estate Administration: When an Executor is responsible for distributing real property as part of the probate process, a Fiduciary Deed acts as the legal instrument to transfer the ownership from the deceased's estate to the designated heirs or beneficiaries. 2. Trust Management: Trustees appointed to administer trusts often need to execute Fiduciary Deeds to transfer real estate assets held in the trust to the beneficiaries in accordance with the trust document. 3. Trust or Transfers: In situations where a Trust or, the creator of a trust, wishes to transfer property held in the trust to another individual or entity, they may utilize a Fiduciary Deed to effectuate the transfer, ensuring a legally binding and transparent transaction. 4. Administrator's Duties: Administrators of estates without a will, or situations where the will does not specifically address the transfer of real property, can make use of a Fiduciary Deed to distribute real estate assets to appropriate heirs according to state laws. Different types of Carmel Indiana Fiduciary Deeds may exist based on the specifics and requirements of each fiduciary situation. Here are a few potential variations: 1. Executor's Fiduciary Deed: Used by Executors during the probate process to transfer ownership of real property from the deceased's estate to the designated beneficiaries. 2. Trustee's Fiduciary Deed: Utilized by Trustees to transfer real estate assets held in a trust to the beneficiaries as outlined in the trust document. 3. Trust or's Fiduciary Deed: Executed by a Trust or when they wish to transfer real property held in their trust to an individual or entity, adhering to the terms and conditions specified within the trust. 4. Administrator's Fiduciary Deed: Employed by Administrators when transferring real estate assets from an estate without a will or in cases where the will does not address property distribution. In any fiduciary situation, it is crucial to consult with an experienced attorney specializing in estate planning, probate, or trust law to ensure the correct type of Carmel Indiana Fiduciary Deed is used and all legal obligations and requirements are met.A Carmel Indiana Fiduciary Deed is a legal document specifically designed for use by Executors, Trustees, Trustees, Administrators, and other Fiduciaries in the state of Indiana. This deed allows these individuals to transfer the ownership of real property from the estate or trust they manage to the intended recipient or beneficiary. Executors, Trustees, Trustees, Administrators, and other Fiduciaries may encounter various situations that require the use of a Fiduciary Deed. Some common scenarios where a Fiduciary Deed is typically used include: 1. Estate Administration: When an Executor is responsible for distributing real property as part of the probate process, a Fiduciary Deed acts as the legal instrument to transfer the ownership from the deceased's estate to the designated heirs or beneficiaries. 2. Trust Management: Trustees appointed to administer trusts often need to execute Fiduciary Deeds to transfer real estate assets held in the trust to the beneficiaries in accordance with the trust document. 3. Trust or Transfers: In situations where a Trust or, the creator of a trust, wishes to transfer property held in the trust to another individual or entity, they may utilize a Fiduciary Deed to effectuate the transfer, ensuring a legally binding and transparent transaction. 4. Administrator's Duties: Administrators of estates without a will, or situations where the will does not specifically address the transfer of real property, can make use of a Fiduciary Deed to distribute real estate assets to appropriate heirs according to state laws. Different types of Carmel Indiana Fiduciary Deeds may exist based on the specifics and requirements of each fiduciary situation. Here are a few potential variations: 1. Executor's Fiduciary Deed: Used by Executors during the probate process to transfer ownership of real property from the deceased's estate to the designated beneficiaries. 2. Trustee's Fiduciary Deed: Utilized by Trustees to transfer real estate assets held in a trust to the beneficiaries as outlined in the trust document. 3. Trust or's Fiduciary Deed: Executed by a Trust or when they wish to transfer real property held in their trust to an individual or entity, adhering to the terms and conditions specified within the trust. 4. Administrator's Fiduciary Deed: Employed by Administrators when transferring real estate assets from an estate without a will or in cases where the will does not address property distribution. In any fiduciary situation, it is crucial to consult with an experienced attorney specializing in estate planning, probate, or trust law to ensure the correct type of Carmel Indiana Fiduciary Deed is used and all legal obligations and requirements are met.