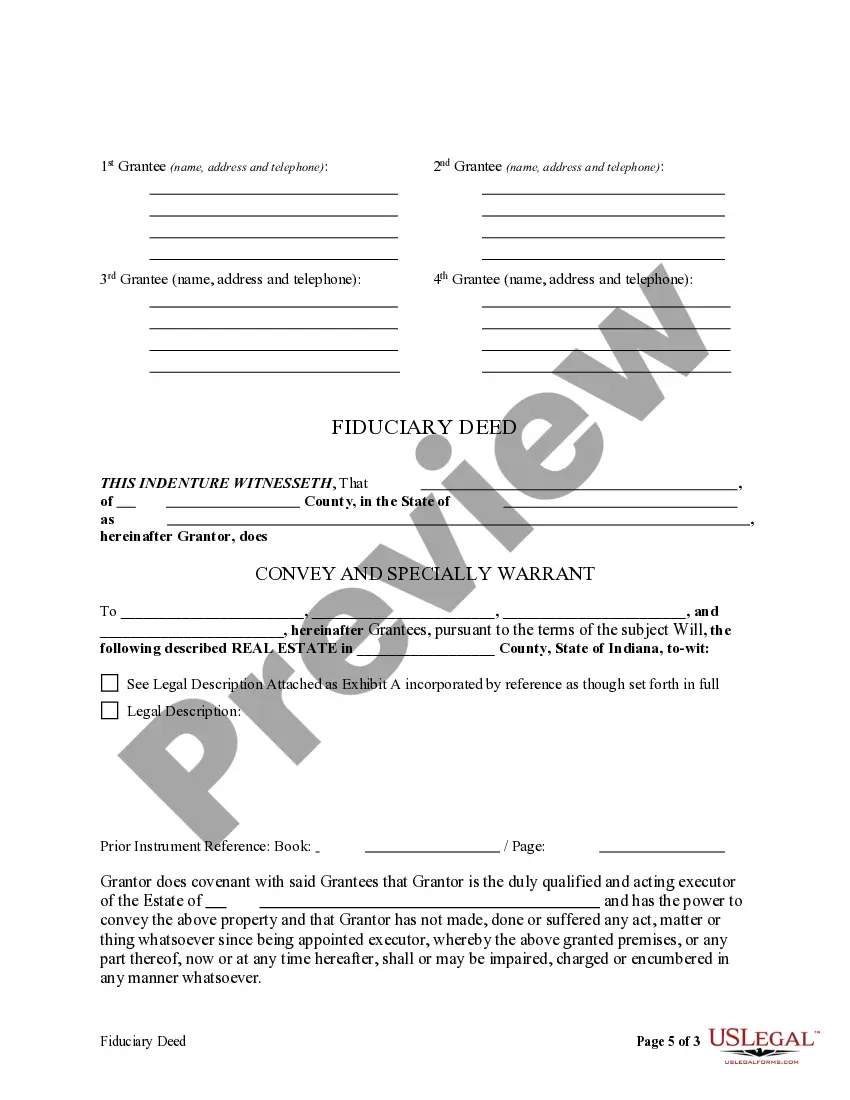

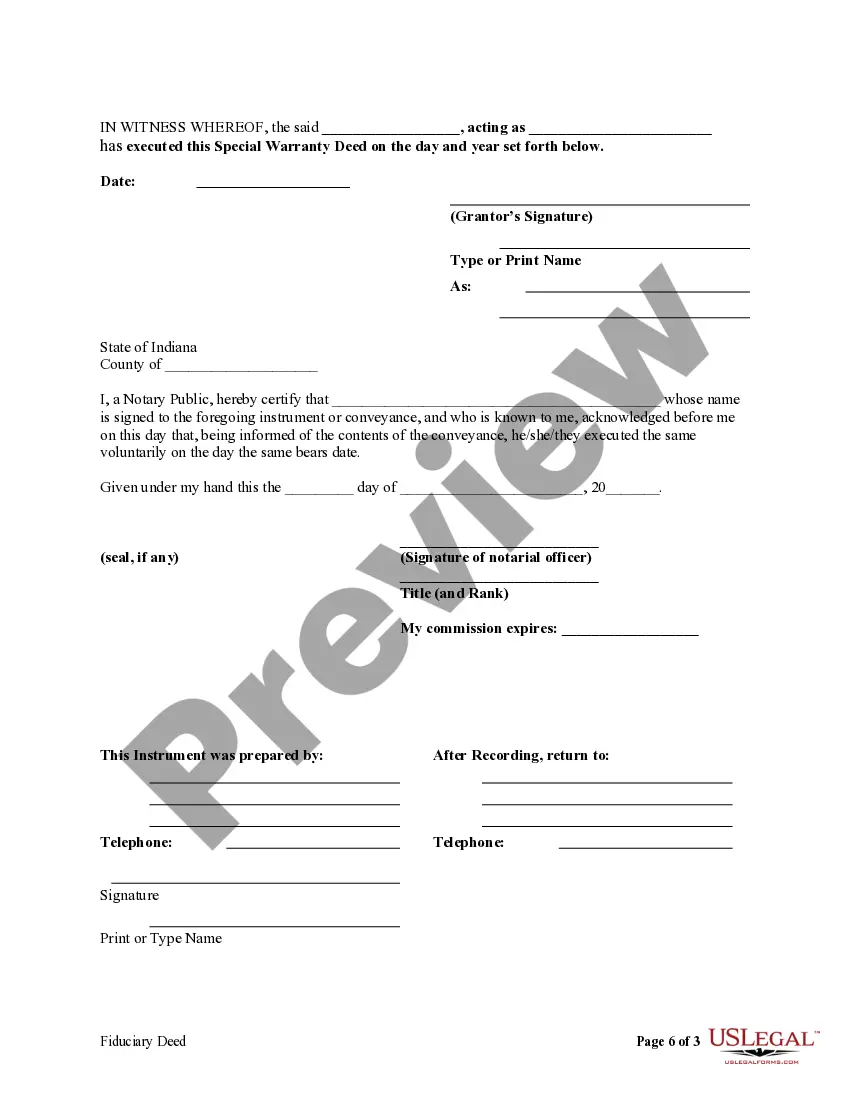

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

South Bend Indiana Fiduciary Deed: A Comprehensive Guide for Executors, Trustees, Trustees, Administrators, and Other Fiduciaries Introduction: A South Bend Indiana Fiduciary Deed is a legal instrument designed specifically for use by Executors, Trustees, Trustees, Administrators, and other Fiduciaries to facilitate the transfer of real estate or property as part of their fiduciary duties. This detailed description aims to provide a comprehensive understanding of the South Bend Indiana Fiduciary Deed, discussing its purpose, key features, requirements, and potential variations based on specific fiduciary roles. Key Features and Purpose: A South Bend Indiana Fiduciary Deed enables fiduciaries to transfer property owned by a deceased individual or estate smoothly and legally. It acts as a binding contract, conveying title ownership rights from the estate or trust to the identified beneficiary or recipient. The purpose of this document is to ensure a seamless transfer process while safeguarding the interests of the parties involved. Requirements: To execute a valid South Bend Indiana Fiduciary Deed, several requirements must be met: 1. Legal Authority: Fiduciaries must possess the legal authority through probate court, trust agreements, or other applicable laws to execute the transfer of property. 2. Proper Documentation: Fiduciaries are usually required to provide supporting documents, such as Letters Testamentary (for Executors), Letters of Administration (for Administrators), or Trust Agreements (for Trustees), indicating their appointment and authority. 3. Property Description: A detailed and accurate description of the property to be transferred must be included in the deed. This typically includes the legal description, such as lot numbers, boundaries, and other geographic identifiers. 4. Identifying the Parties: The South Bend Indiana Fiduciary Deed should clearly identify the fiduciary, their role (Executor, Trustee, etc.), and the beneficiary or recipient of the property. Types of Fiduciary Deeds: 1. Executor's Fiduciary Deed: This deed is used when an Executor, appointed by the probate court, needs to transfer property from the estate of a deceased person to the designated beneficiaries. 2. Trustee's Fiduciary Deed: When a Trustee has been granted authority through a trust agreement, this deed allows them to transfer property owned by the trust to beneficiaries or other identified parties. 3. Administrator's Fiduciary Deed: Administrators, appointed by the probate court to handle estates without valid wills, use this deed to transfer property in accordance with intestacy laws. 4. Guardian's Fiduciary Deed: In cases where a legal guardian has been appointed for a minor or incapacitated individual, this specific deed may be utilized to transfer property on their behalf. Conclusion: Understanding the South Bend Indiana Fiduciary Deed is crucial for Executors, Trustees, Trustees, Administrators, and other Fiduciaries to ensure they fulfill their legal obligations while effecting property transfers. By adhering to the outlined requirements and utilizing the appropriate type of fiduciary deed, these individuals can navigate the transfer process with confidence, protecting the interests of all parties involved.South Bend Indiana Fiduciary Deed: A Comprehensive Guide for Executors, Trustees, Trustees, Administrators, and Other Fiduciaries Introduction: A South Bend Indiana Fiduciary Deed is a legal instrument designed specifically for use by Executors, Trustees, Trustees, Administrators, and other Fiduciaries to facilitate the transfer of real estate or property as part of their fiduciary duties. This detailed description aims to provide a comprehensive understanding of the South Bend Indiana Fiduciary Deed, discussing its purpose, key features, requirements, and potential variations based on specific fiduciary roles. Key Features and Purpose: A South Bend Indiana Fiduciary Deed enables fiduciaries to transfer property owned by a deceased individual or estate smoothly and legally. It acts as a binding contract, conveying title ownership rights from the estate or trust to the identified beneficiary or recipient. The purpose of this document is to ensure a seamless transfer process while safeguarding the interests of the parties involved. Requirements: To execute a valid South Bend Indiana Fiduciary Deed, several requirements must be met: 1. Legal Authority: Fiduciaries must possess the legal authority through probate court, trust agreements, or other applicable laws to execute the transfer of property. 2. Proper Documentation: Fiduciaries are usually required to provide supporting documents, such as Letters Testamentary (for Executors), Letters of Administration (for Administrators), or Trust Agreements (for Trustees), indicating their appointment and authority. 3. Property Description: A detailed and accurate description of the property to be transferred must be included in the deed. This typically includes the legal description, such as lot numbers, boundaries, and other geographic identifiers. 4. Identifying the Parties: The South Bend Indiana Fiduciary Deed should clearly identify the fiduciary, their role (Executor, Trustee, etc.), and the beneficiary or recipient of the property. Types of Fiduciary Deeds: 1. Executor's Fiduciary Deed: This deed is used when an Executor, appointed by the probate court, needs to transfer property from the estate of a deceased person to the designated beneficiaries. 2. Trustee's Fiduciary Deed: When a Trustee has been granted authority through a trust agreement, this deed allows them to transfer property owned by the trust to beneficiaries or other identified parties. 3. Administrator's Fiduciary Deed: Administrators, appointed by the probate court to handle estates without valid wills, use this deed to transfer property in accordance with intestacy laws. 4. Guardian's Fiduciary Deed: In cases where a legal guardian has been appointed for a minor or incapacitated individual, this specific deed may be utilized to transfer property on their behalf. Conclusion: Understanding the South Bend Indiana Fiduciary Deed is crucial for Executors, Trustees, Trustees, Administrators, and other Fiduciaries to ensure they fulfill their legal obligations while effecting property transfers. By adhering to the outlined requirements and utilizing the appropriate type of fiduciary deed, these individuals can navigate the transfer process with confidence, protecting the interests of all parties involved.