The Will you have found is for a single person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

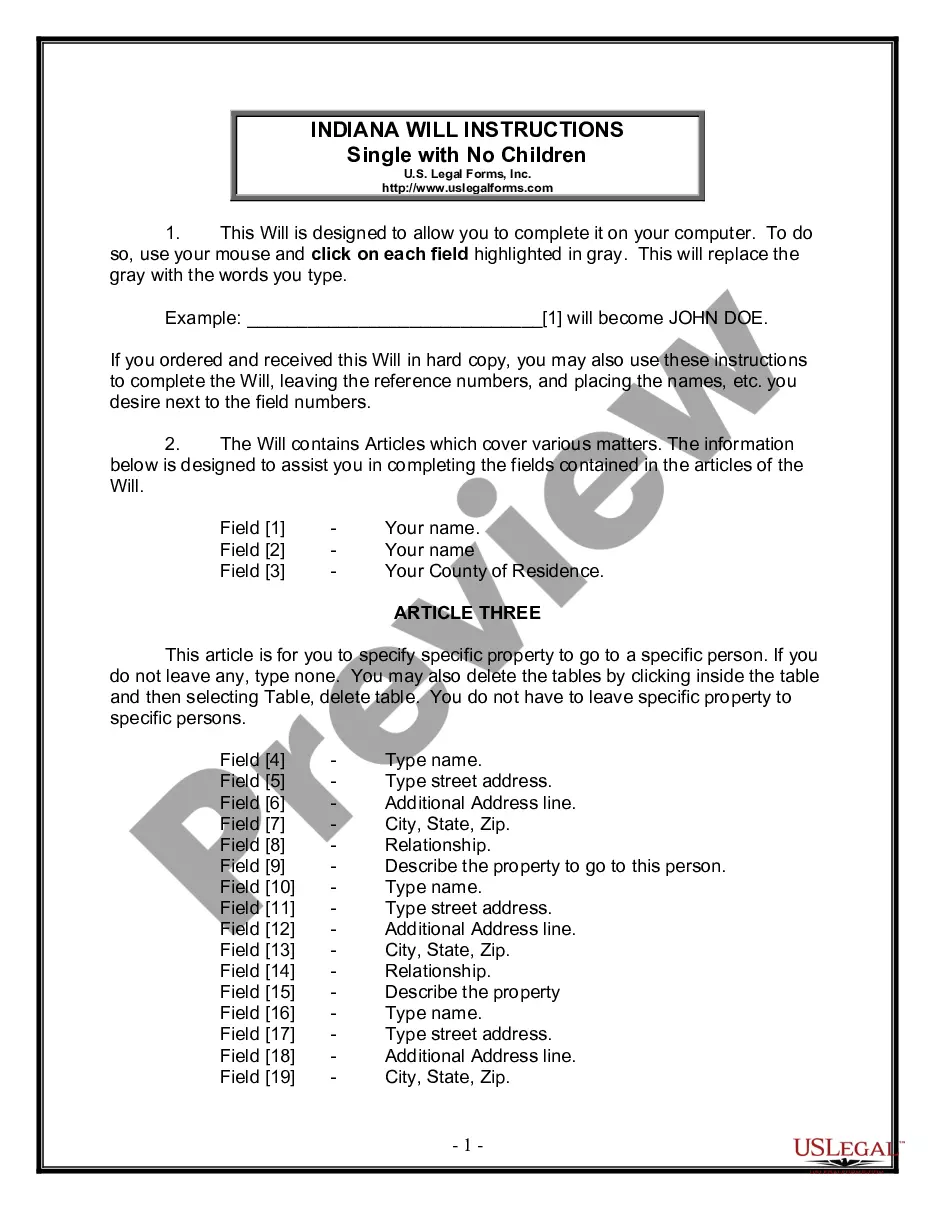

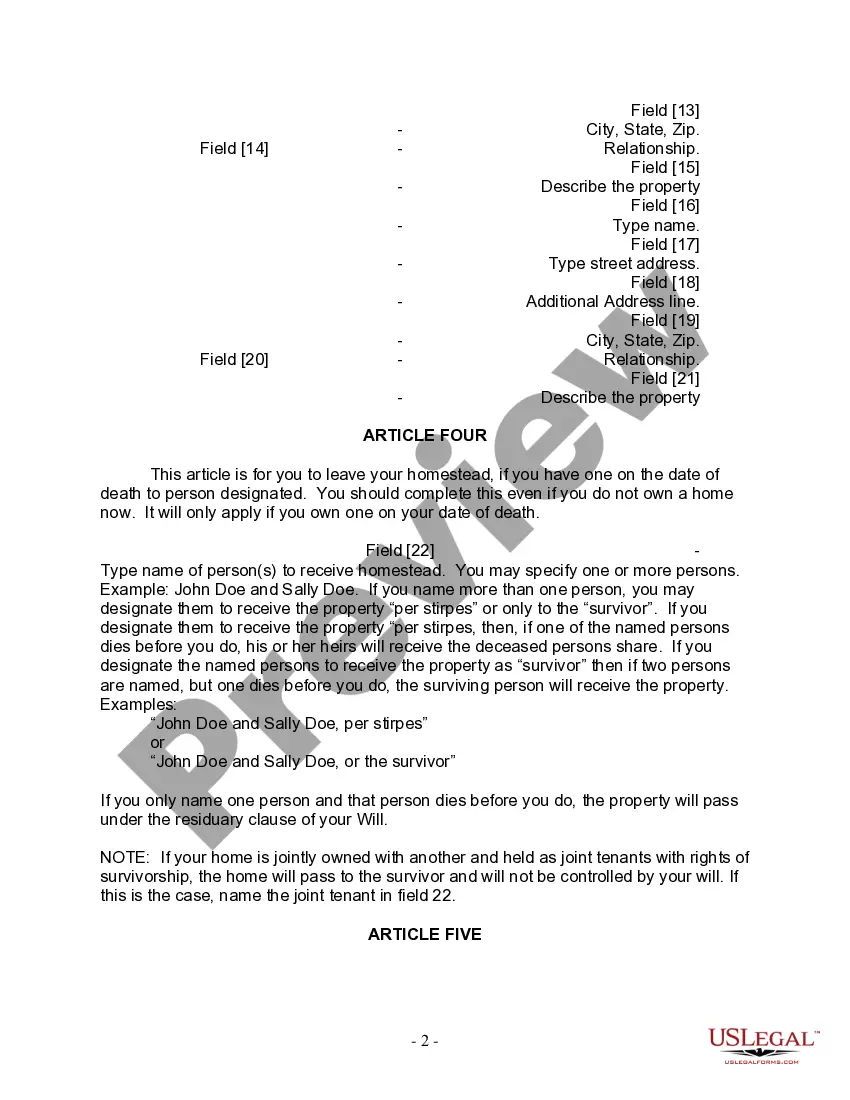

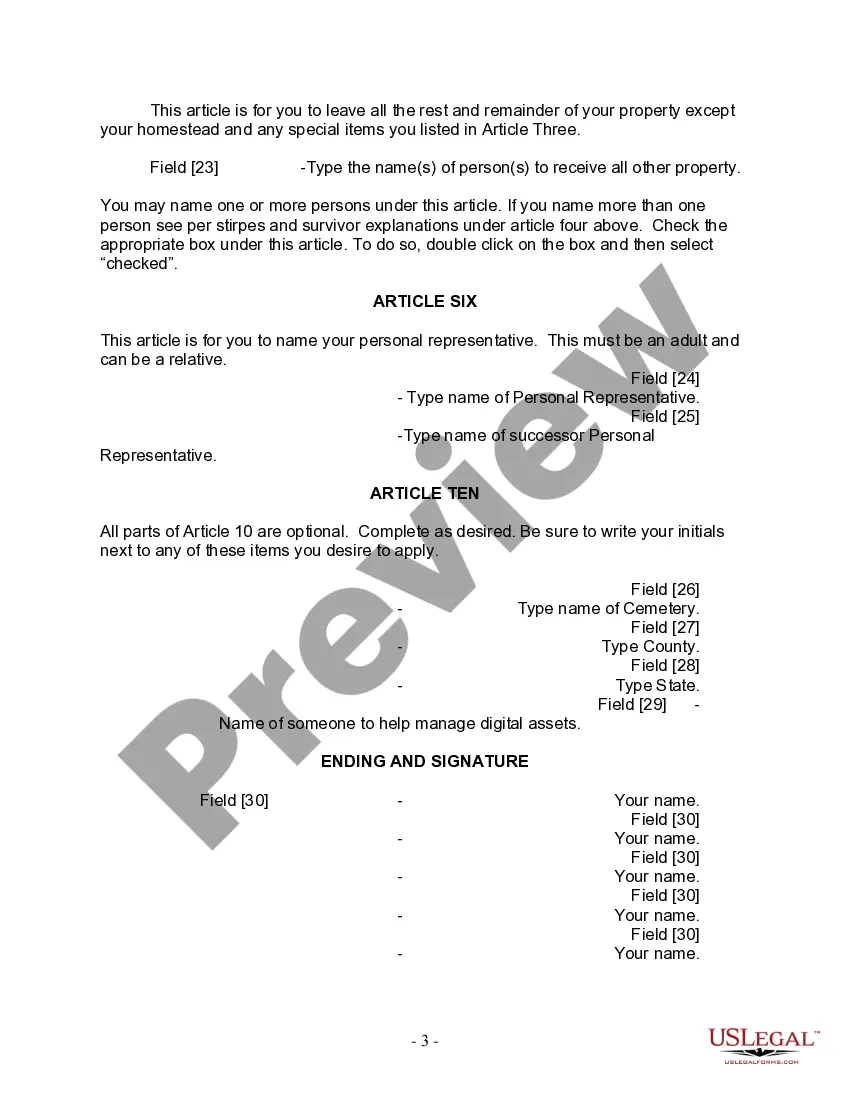

Title: South Bend Indiana Legal Last Will and Testament Form for Single Person with No Children Introduction: In South Bend, Indiana, individuals who are single and have no children can secure their assets and ensure their wishes are carried out after they pass away by utilizing a Legal Last Will and Testament Form. This legal document holds significant importance as it outlines the distribution of properties, identifies beneficiaries, designates an executor, and addresses various specific wishes of the testator. Key elements of the South Bend Indiana Legal Last Will and Testament Form for Single Person with No Children: 1. Declaration of Testator's Identity: — The form requires the testator to provide personal information such as their full legal name, date of birth, and current address. 2. Appointment of Executor: — The testator designates an executor, who will be responsible for managing and administering the will according to the testator's wishes. — The executor is entrusted with distributing assets, paying debts and taxes, and handling any legal matters related to the estate. 3. Disposition of Assets: — The will allows the testator to specify how their assets should be distributed upon their death. — It may include details regarding real estate properties, bank accounts, investments, personal belongings, and any other significant assets. 4. Beneficiaries and Alternate Beneficiaries: — The testator identifies individuals or organizations who will inherit their assets, referred to as beneficiaries. — In case the primary beneficiaries pass away before the testator or disclaim their inheritance, alternate beneficiaries are named. 5. Guardianship: — If the testator has minor dependents (such as siblings, nieces, or nephews), the will permits the appointment of a guardian who will be responsible for their care and well-being. 6. Funeral Arrangements: — The testator can express their desired funeral arrangements, including burial, cremation, or any specific wishes. 7. Specific Bequests and Legacies: — The testator has the option to make specific bequests, such as leaving sentimental items or monetary gifts to individuals or charities. Different types of South Bend Indiana Legal Last Will and Testament Form for Single Person with No Children: 1. Basic Last Will and Testament Form: — This form covers the fundamental elements of a will, including asset distribution, appointment of executor, and designation of beneficiaries. 2. Advanced Last Will and Testament Form: — This form encompasses all the aspects of the basic form while including additional provisions, such as trusts, charitable gifts, and more complex financial situations. 3. Living Will Form: — Although not a traditional last will and testament, a living will form allows individuals to express their wishes regarding medical treatment and end-of-life decisions if they become incapacitated. Note: It is advisable to consult with a qualified attorney when drafting or executing a Last Will and Testament to ensure compliance with all legal requirements and to address any specific considerations.Title: South Bend Indiana Legal Last Will and Testament Form for Single Person with No Children Introduction: In South Bend, Indiana, individuals who are single and have no children can secure their assets and ensure their wishes are carried out after they pass away by utilizing a Legal Last Will and Testament Form. This legal document holds significant importance as it outlines the distribution of properties, identifies beneficiaries, designates an executor, and addresses various specific wishes of the testator. Key elements of the South Bend Indiana Legal Last Will and Testament Form for Single Person with No Children: 1. Declaration of Testator's Identity: — The form requires the testator to provide personal information such as their full legal name, date of birth, and current address. 2. Appointment of Executor: — The testator designates an executor, who will be responsible for managing and administering the will according to the testator's wishes. — The executor is entrusted with distributing assets, paying debts and taxes, and handling any legal matters related to the estate. 3. Disposition of Assets: — The will allows the testator to specify how their assets should be distributed upon their death. — It may include details regarding real estate properties, bank accounts, investments, personal belongings, and any other significant assets. 4. Beneficiaries and Alternate Beneficiaries: — The testator identifies individuals or organizations who will inherit their assets, referred to as beneficiaries. — In case the primary beneficiaries pass away before the testator or disclaim their inheritance, alternate beneficiaries are named. 5. Guardianship: — If the testator has minor dependents (such as siblings, nieces, or nephews), the will permits the appointment of a guardian who will be responsible for their care and well-being. 6. Funeral Arrangements: — The testator can express their desired funeral arrangements, including burial, cremation, or any specific wishes. 7. Specific Bequests and Legacies: — The testator has the option to make specific bequests, such as leaving sentimental items or monetary gifts to individuals or charities. Different types of South Bend Indiana Legal Last Will and Testament Form for Single Person with No Children: 1. Basic Last Will and Testament Form: — This form covers the fundamental elements of a will, including asset distribution, appointment of executor, and designation of beneficiaries. 2. Advanced Last Will and Testament Form: — This form encompasses all the aspects of the basic form while including additional provisions, such as trusts, charitable gifts, and more complex financial situations. 3. Living Will Form: — Although not a traditional last will and testament, a living will form allows individuals to express their wishes regarding medical treatment and end-of-life decisions if they become incapacitated. Note: It is advisable to consult with a qualified attorney when drafting or executing a Last Will and Testament to ensure compliance with all legal requirements and to address any specific considerations.