The Will you have found is for a single person (never married) with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

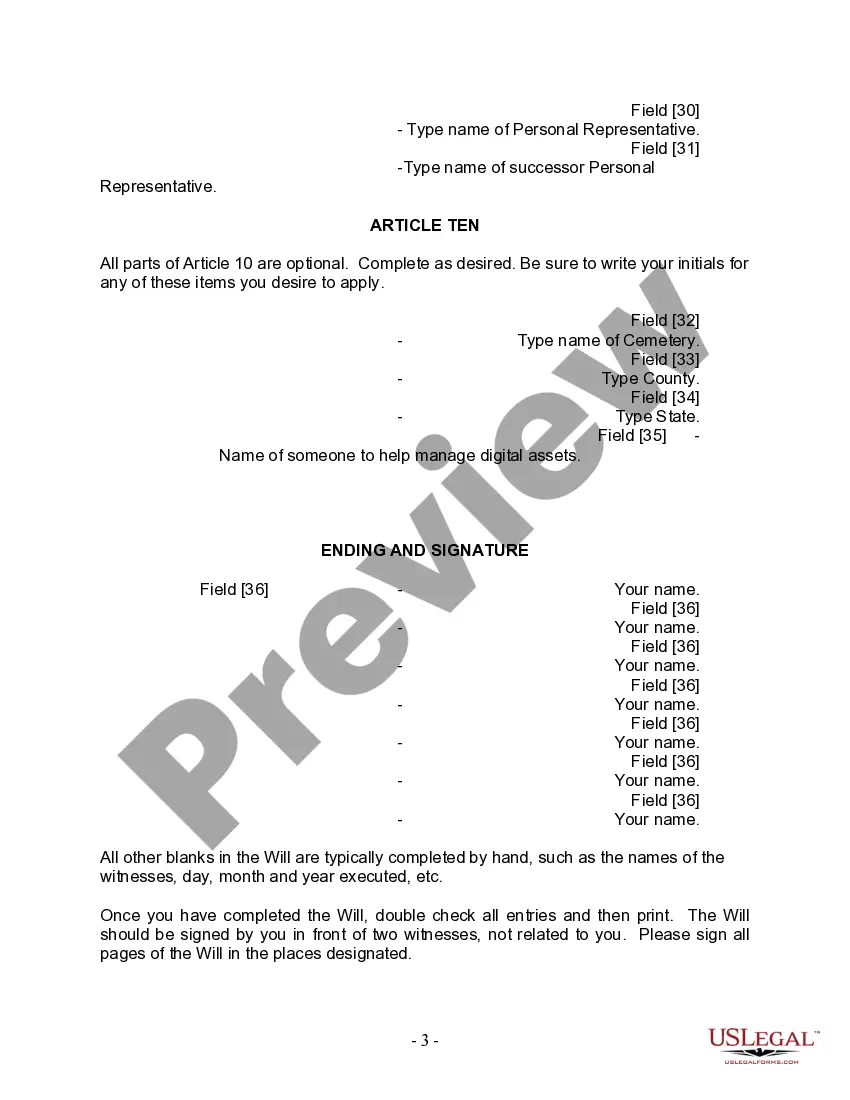

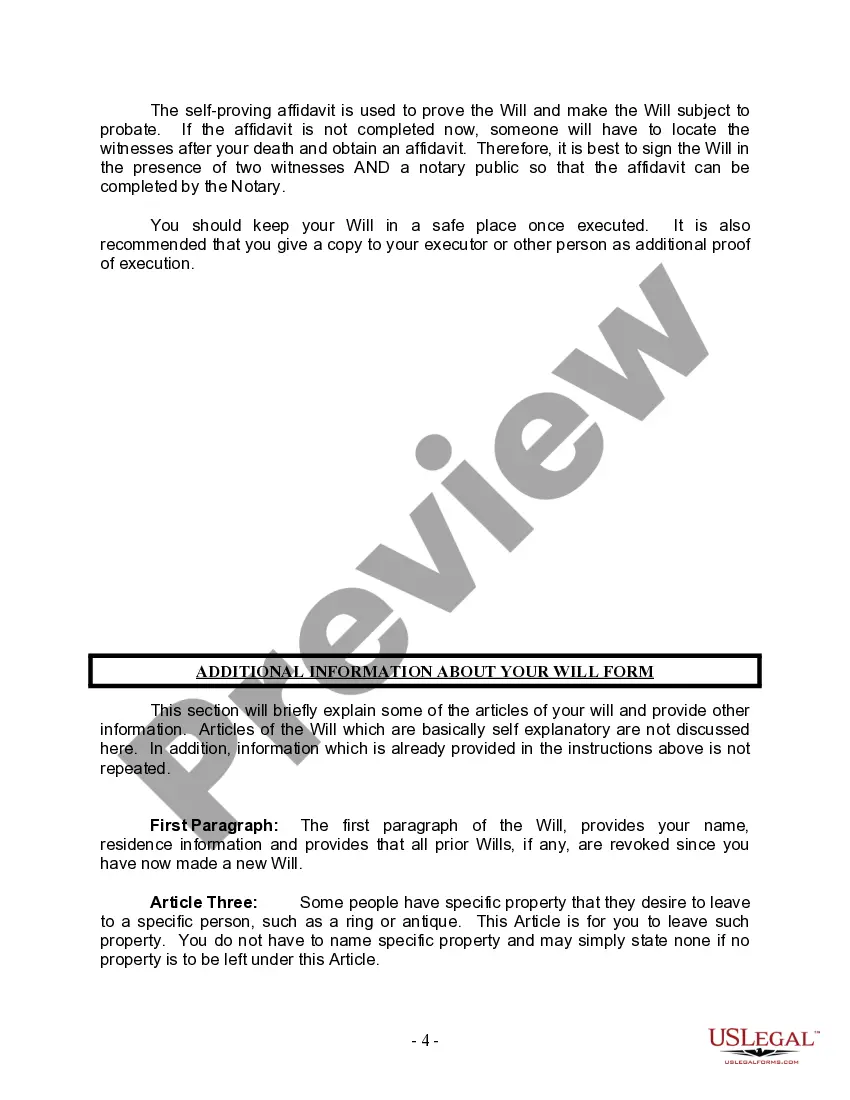

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

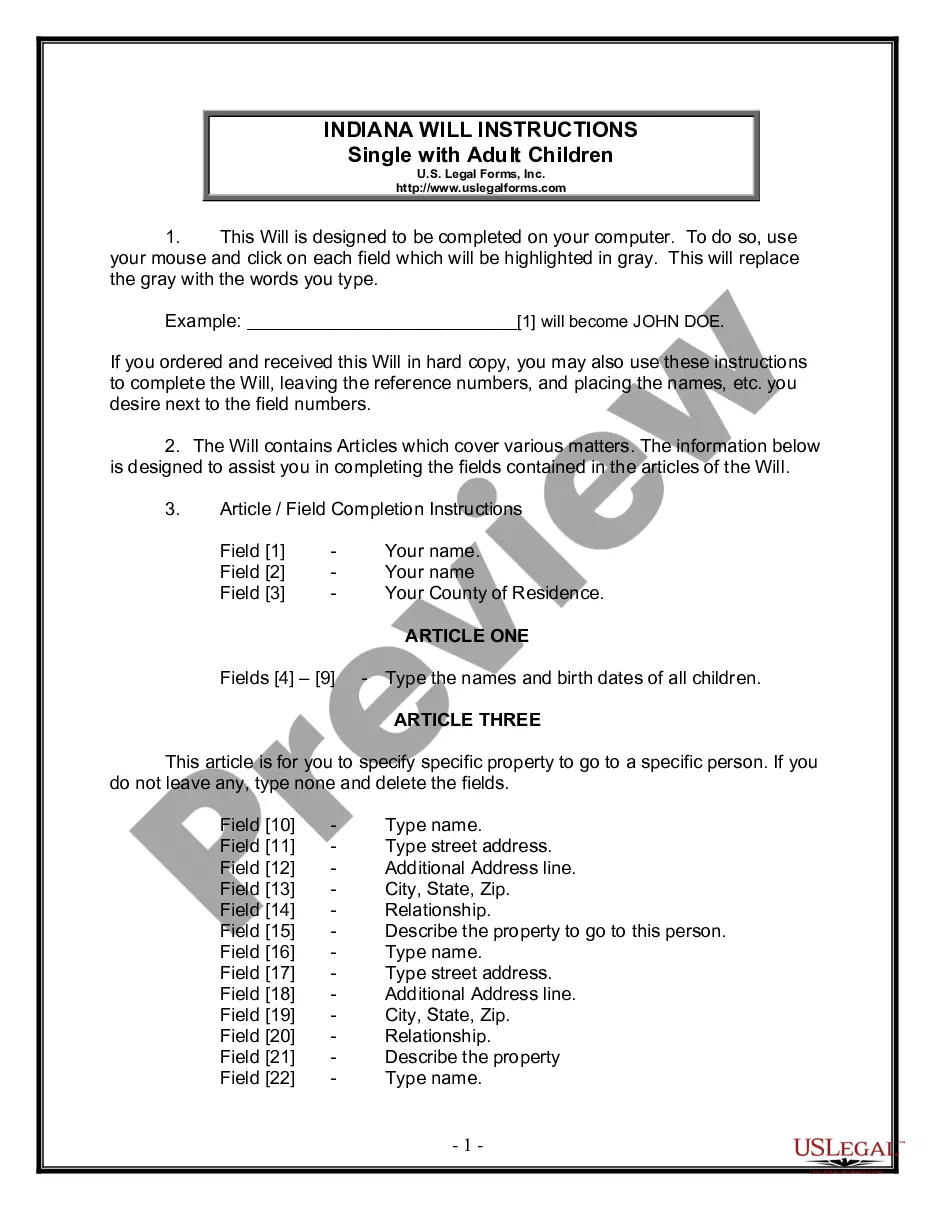

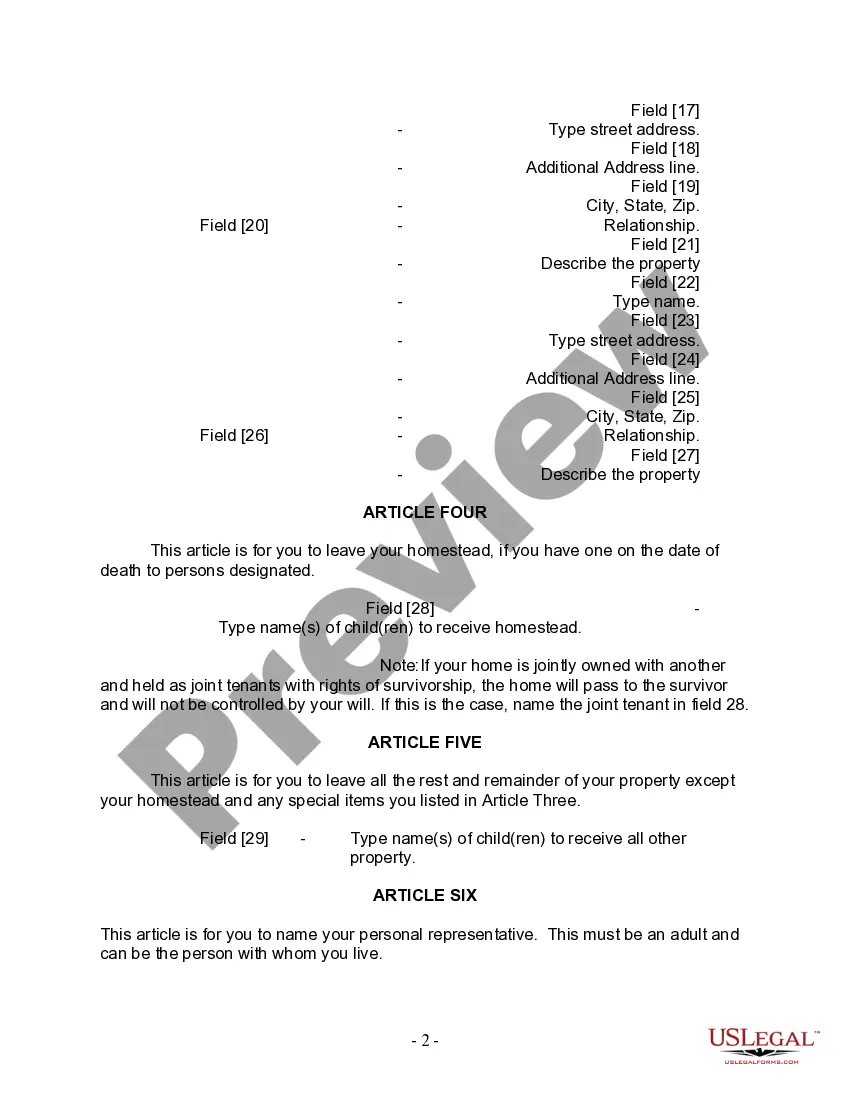

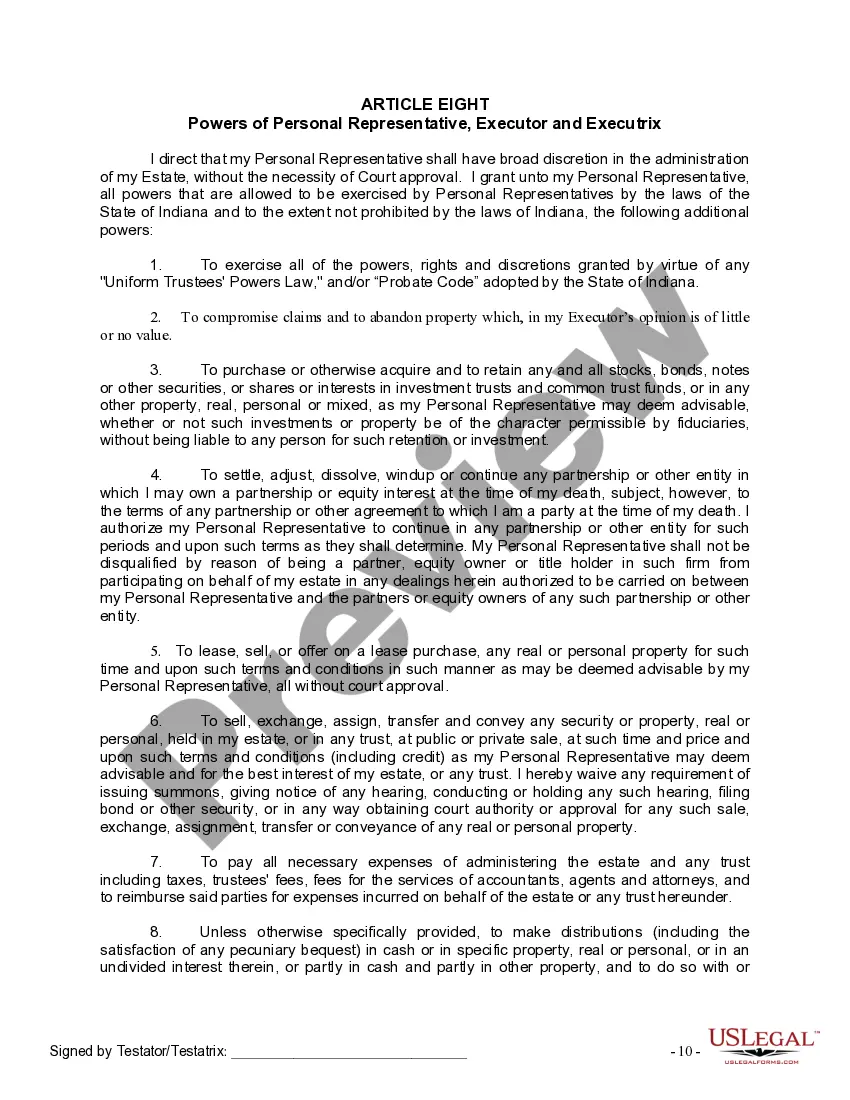

The Indianapolis Indiana Legal Last Will and Testament Form for a Single Person with Adult Children is a legally binding document that allows an individual who is single and has adult children to outline their final wishes regarding the distribution of their assets and the care of any minor children or dependents upon their death. This form follows the specific legal requirements of the state of Indiana and ensures that the wishes of the person drafting the will are properly documented and respected. Keywords: Indianapolis Indiana, Legal, Last Will and Testament Form, Single Person, Adult Children, Assets, Care, Minor Children, Dependents. This document is designed for individuals who are currently single and have adult children, which means offspring who have reached the age of majority. It is important to note that if the person drafting the will has any minor children (under the age of 18), a separate legal document such as a guardianship form should be completed to specify the appointed guardian(s) who will care for the children in the event of their passing. The Indianapolis Indiana Legal Last Will and Testament Form for a Single Person with Adult Children includes various sections that cover different aspects of an individual's estate planning. These sections may include but are not limited to: 1. Personal Information: This section will require the individual to provide their full name, address, and other identifying details. 2. Appointment of Executor: The individual will name an executor, who will be responsible for handling all the administrative tasks of the estate upon the person's death. The executor is entrusted with tasks such as asset distribution, debt settlement, and final tax filings. 3. Distribution of Assets: The individual can specify how their assets, including real estate, investments, personal belongings, and funds, should be distributed among their adult children. They can allocate specific items or provide general instructions for an equal division among their children. 4. Specific Bequests: This section allows the person writing the will to name specific beneficiaries and allocate certain assets or sums of money to them. These beneficiaries may include family members or charitable organizations. 5. Digital Assets: Given the prevalence of digital assets in today's society, this section enables the person to designate a trusted person to manage and distribute their digital assets, including passwords, social media accounts, or online financial accounts. 6. Residual Estate: The residual estate refers to any remaining assets after specific bequests and distributions. The individual can outline how they want these assets distributed, either equally among their adult children or as per their specific wishes. 7. Funeral and Burial Instructions: This section lets the person express their preferences related to their funeral arrangements, including burial or cremation, burial site, or other specific instructions. It is essential to consult with an attorney or legal professional to ensure that the Indianapolis Indiana Legal Last Will and Testament Form for a Single Person with Adult Children adheres to the state's specific legal requirements. It is also worth noting that there might be variations of this form available depending on the specific needs or circumstances of the individual.The Indianapolis Indiana Legal Last Will and Testament Form for a Single Person with Adult Children is a legally binding document that allows an individual who is single and has adult children to outline their final wishes regarding the distribution of their assets and the care of any minor children or dependents upon their death. This form follows the specific legal requirements of the state of Indiana and ensures that the wishes of the person drafting the will are properly documented and respected. Keywords: Indianapolis Indiana, Legal, Last Will and Testament Form, Single Person, Adult Children, Assets, Care, Minor Children, Dependents. This document is designed for individuals who are currently single and have adult children, which means offspring who have reached the age of majority. It is important to note that if the person drafting the will has any minor children (under the age of 18), a separate legal document such as a guardianship form should be completed to specify the appointed guardian(s) who will care for the children in the event of their passing. The Indianapolis Indiana Legal Last Will and Testament Form for a Single Person with Adult Children includes various sections that cover different aspects of an individual's estate planning. These sections may include but are not limited to: 1. Personal Information: This section will require the individual to provide their full name, address, and other identifying details. 2. Appointment of Executor: The individual will name an executor, who will be responsible for handling all the administrative tasks of the estate upon the person's death. The executor is entrusted with tasks such as asset distribution, debt settlement, and final tax filings. 3. Distribution of Assets: The individual can specify how their assets, including real estate, investments, personal belongings, and funds, should be distributed among their adult children. They can allocate specific items or provide general instructions for an equal division among their children. 4. Specific Bequests: This section allows the person writing the will to name specific beneficiaries and allocate certain assets or sums of money to them. These beneficiaries may include family members or charitable organizations. 5. Digital Assets: Given the prevalence of digital assets in today's society, this section enables the person to designate a trusted person to manage and distribute their digital assets, including passwords, social media accounts, or online financial accounts. 6. Residual Estate: The residual estate refers to any remaining assets after specific bequests and distributions. The individual can outline how they want these assets distributed, either equally among their adult children or as per their specific wishes. 7. Funeral and Burial Instructions: This section lets the person express their preferences related to their funeral arrangements, including burial or cremation, burial site, or other specific instructions. It is essential to consult with an attorney or legal professional to ensure that the Indianapolis Indiana Legal Last Will and Testament Form for a Single Person with Adult Children adheres to the state's specific legal requirements. It is also worth noting that there might be variations of this form available depending on the specific needs or circumstances of the individual.