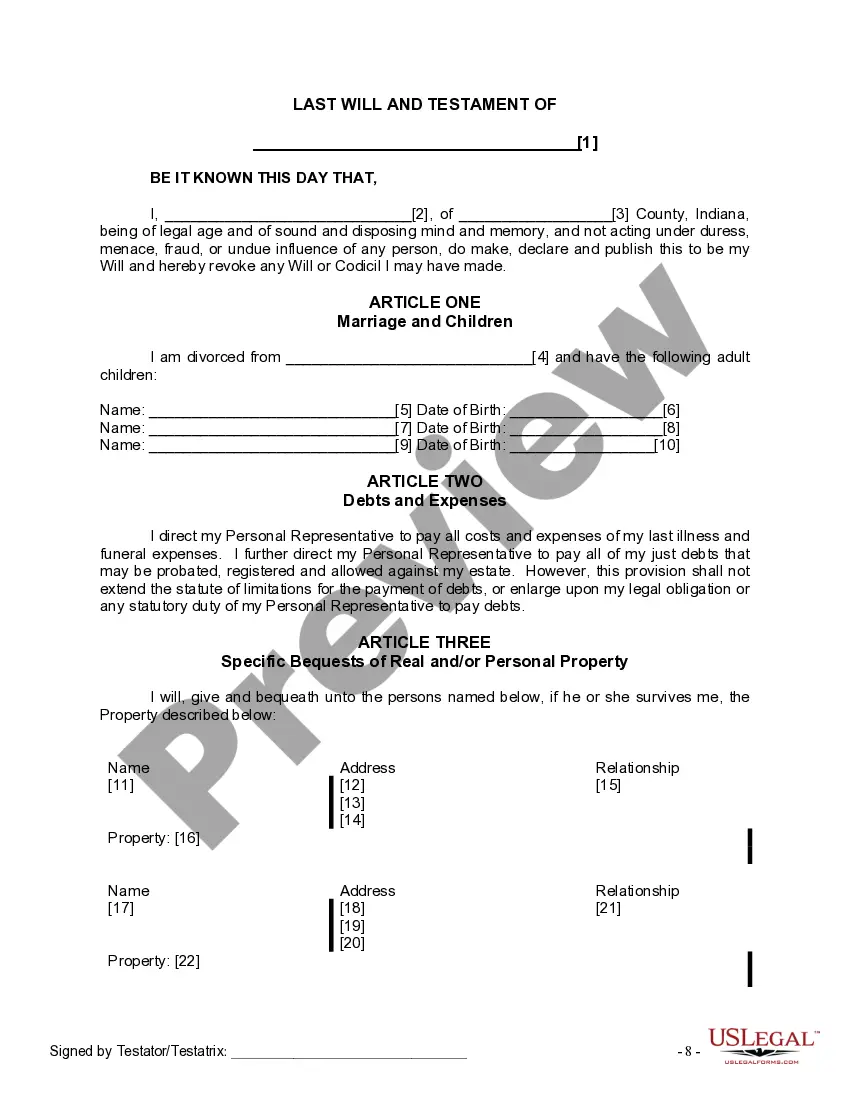

The Will you have found is for a divorced person, not remarried with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

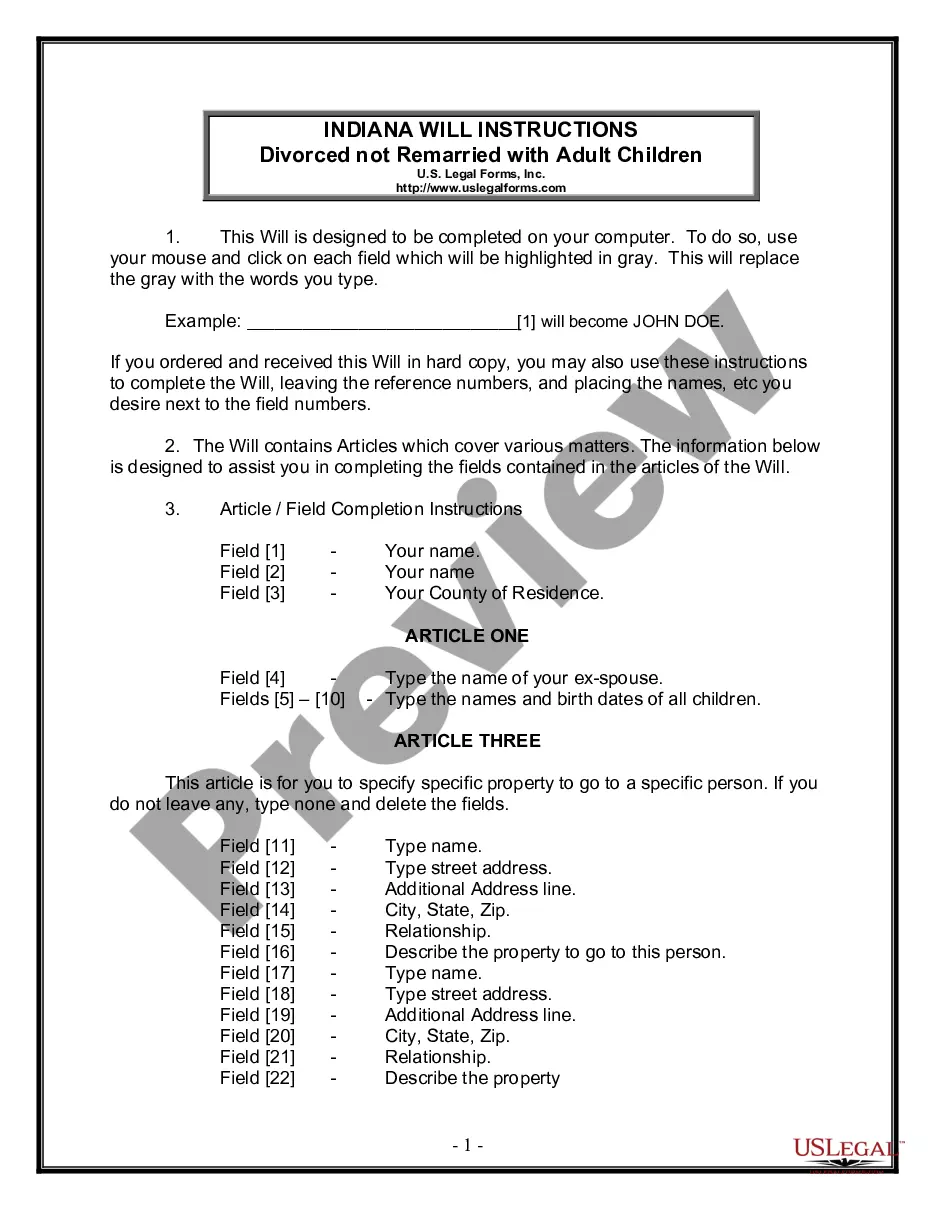

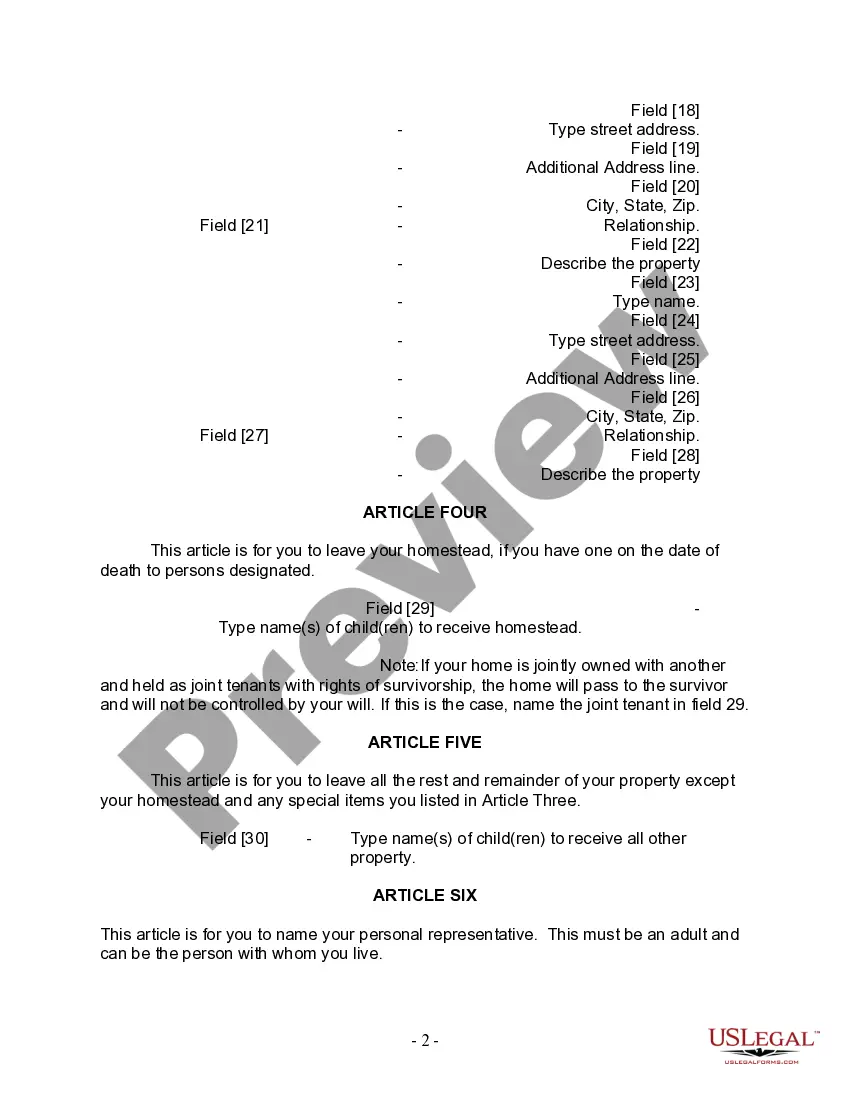

Evansville Indiana Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children is a legal document specifically designed to ensure that the assets and properties of a divorced individual with adult children are appropriately distributed after their demise. This comprehensive form serves as a testamentary declaration of the person's final wishes and enables them to have control over the distribution of their estate. Some key factors to consider when creating an Evansville Indiana Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children include: 1. Assets Distribution: This legal document allows the divorcing person to outline how their assets should be divided among their adult children. It provides clear instructions on the percentage or specific items that each child should receive, ensuring a fair and equitable distribution. 2. Executor Appointment: They will form allows for the appointment of an executor, typically a trusted family member or close friend, who will be responsible for administering the estate. The appointed executor will handle tasks such as paying outstanding debts, filing taxes, and distributing assets as stated in the will. 3. Guardianship Designation: In cases where the adult children of the divorcing individual have underage children of their own, the will form provides the opportunity to designate a guardian for these grandchildren. This ensures that there is a plan in place for their care and upbringing if their parents are unable to fulfill this responsibility. 4. Specific Bequests: The will form may also include provisions for specific bequests or gifts. This allows the divorcing person to leave particular items, such as heirlooms or sentimental possessions, to specific individuals or organizations. 5. Alternate Beneficiaries: In case any of the adult children named as beneficiaries of the estate predecease the divorcing person, the will form permits the designation of alternate beneficiaries. This ensures that the estate distribution plan remains intact even if the original beneficiaries are no longer alive. It is important to note that while the overall purpose of an Evansville Indiana Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children remains the same, there may be various variations or specific forms available depending on the preferences of the divorcing individual and specific state laws. These forms may include different provisions or considerations tailored to individual circumstances. For example, some variations of the Evansville Indiana Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children may include provisions for specific charitable donations, establishment of testamentary trusts, or considerations for tax implications. These specific forms supplement the basic Last Will and Testament, providing additional options and customization to meet the unique requirements of the individual and their family's needs. When creating a Last Will and Testament form, it is advisable to consult an experienced estate planning attorney who is well-versed in the laws of Evansville, Indiana. They can provide guidance and ensure that the document adheres to all necessary legal requirements while accurately reflecting the divorcing person's intentions and wishes.Evansville Indiana Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children is a legal document specifically designed to ensure that the assets and properties of a divorced individual with adult children are appropriately distributed after their demise. This comprehensive form serves as a testamentary declaration of the person's final wishes and enables them to have control over the distribution of their estate. Some key factors to consider when creating an Evansville Indiana Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children include: 1. Assets Distribution: This legal document allows the divorcing person to outline how their assets should be divided among their adult children. It provides clear instructions on the percentage or specific items that each child should receive, ensuring a fair and equitable distribution. 2. Executor Appointment: They will form allows for the appointment of an executor, typically a trusted family member or close friend, who will be responsible for administering the estate. The appointed executor will handle tasks such as paying outstanding debts, filing taxes, and distributing assets as stated in the will. 3. Guardianship Designation: In cases where the adult children of the divorcing individual have underage children of their own, the will form provides the opportunity to designate a guardian for these grandchildren. This ensures that there is a plan in place for their care and upbringing if their parents are unable to fulfill this responsibility. 4. Specific Bequests: The will form may also include provisions for specific bequests or gifts. This allows the divorcing person to leave particular items, such as heirlooms or sentimental possessions, to specific individuals or organizations. 5. Alternate Beneficiaries: In case any of the adult children named as beneficiaries of the estate predecease the divorcing person, the will form permits the designation of alternate beneficiaries. This ensures that the estate distribution plan remains intact even if the original beneficiaries are no longer alive. It is important to note that while the overall purpose of an Evansville Indiana Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children remains the same, there may be various variations or specific forms available depending on the preferences of the divorcing individual and specific state laws. These forms may include different provisions or considerations tailored to individual circumstances. For example, some variations of the Evansville Indiana Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children may include provisions for specific charitable donations, establishment of testamentary trusts, or considerations for tax implications. These specific forms supplement the basic Last Will and Testament, providing additional options and customization to meet the unique requirements of the individual and their family's needs. When creating a Last Will and Testament form, it is advisable to consult an experienced estate planning attorney who is well-versed in the laws of Evansville, Indiana. They can provide guidance and ensure that the document adheres to all necessary legal requirements while accurately reflecting the divorcing person's intentions and wishes.