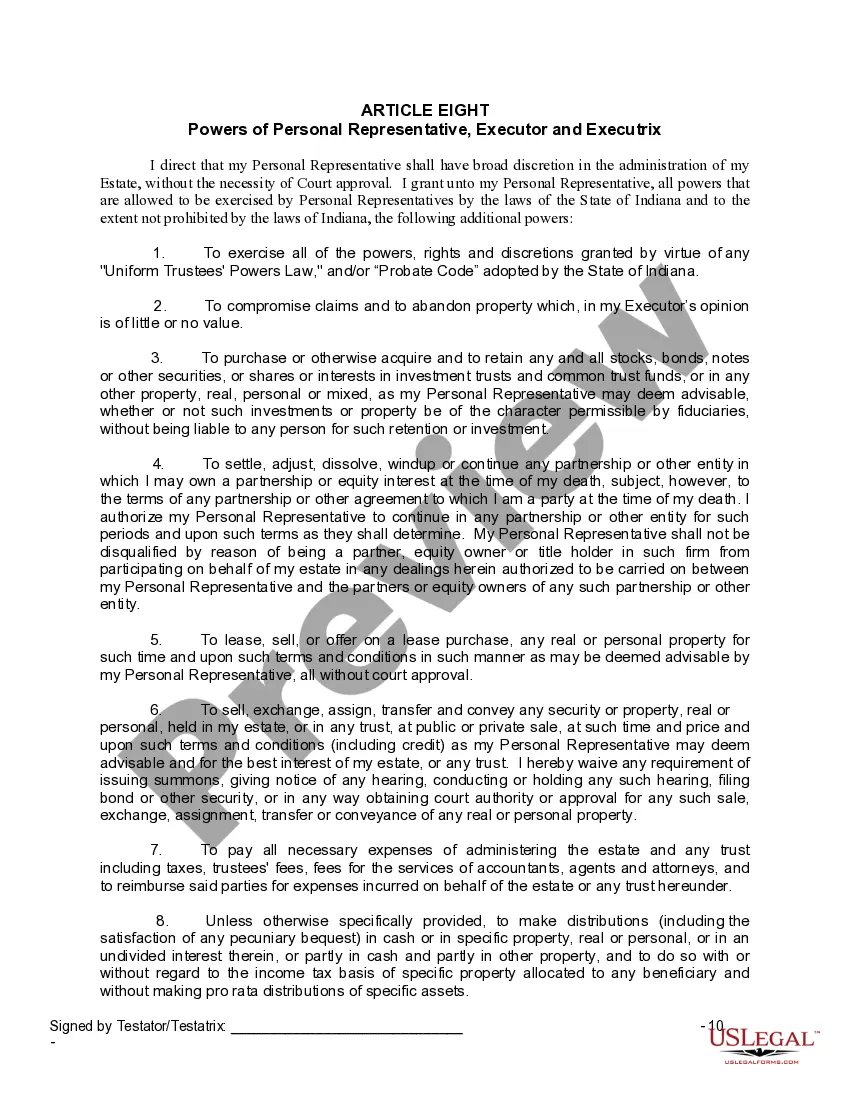

The Will you have found is for a widow or widower with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your adult children. This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

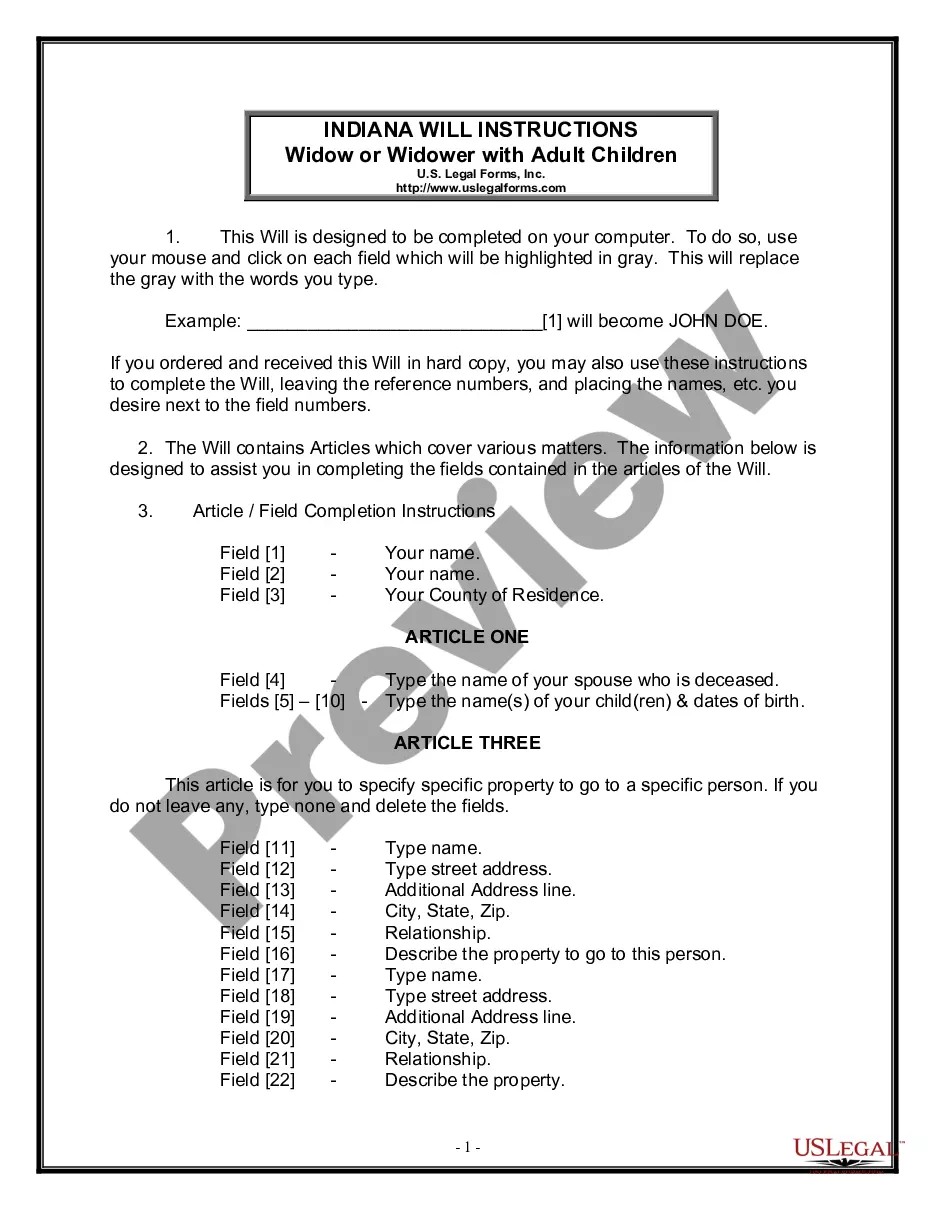

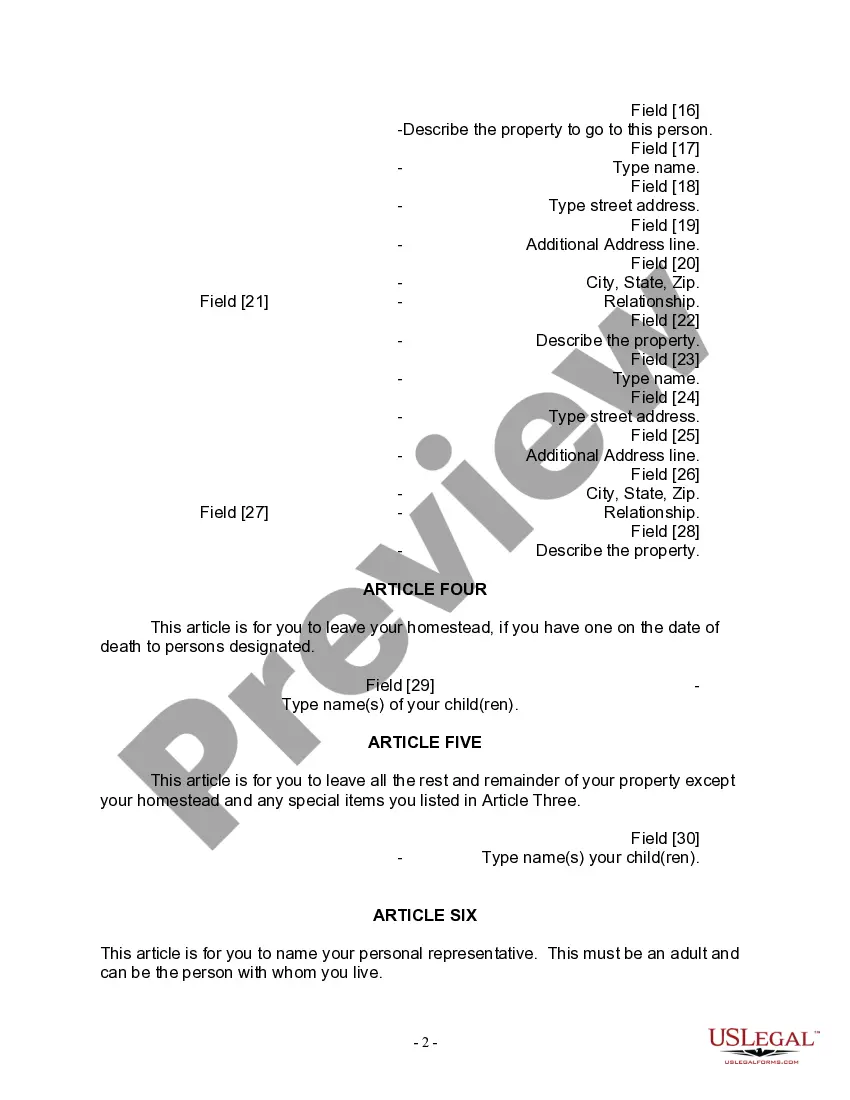

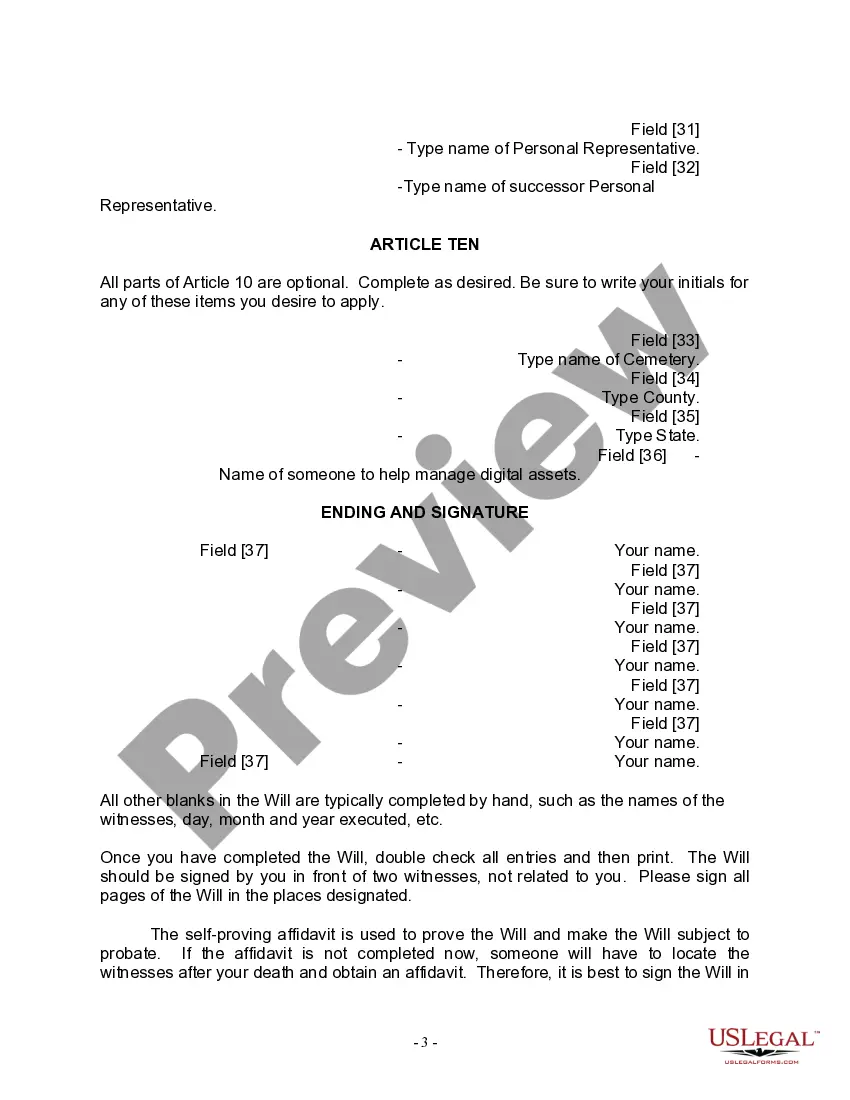

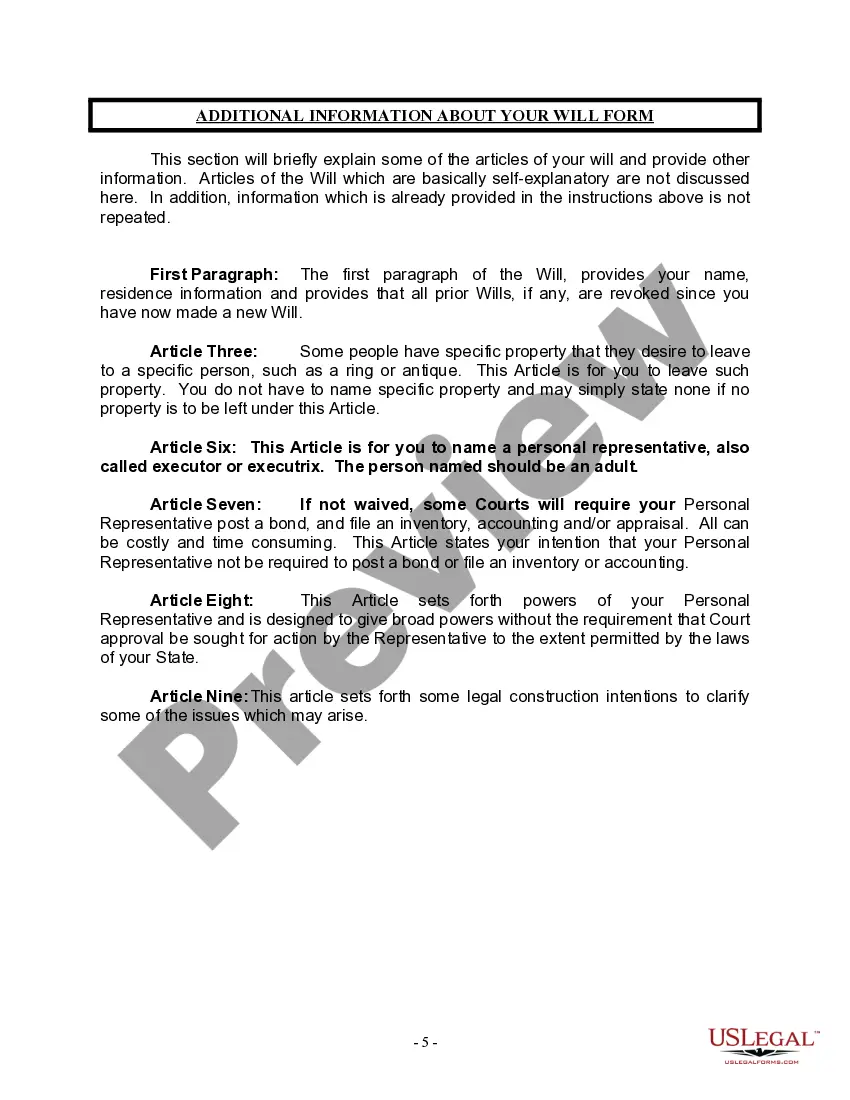

The Indianapolis Indiana Legal Last Will and Testament Form for a Widow or Widower with Adult Children is a legally binding document that allows individuals who have lost their spouse and have adult children to specify how their assets and estate should be distributed after their death. This specialized type of last will and testament form is designed specifically for widows or widowers residing in the city of Indianapolis, Indiana, and provides a comprehensive framework to ensure that their final wishes are respected and executed. Keywords for this form include "Indianapolis Indiana," signifying the specific jurisdiction where the will is legally binding, "legal last will and testament," indicating it is a formal document governed by the state's probate laws, "widow or widower," referring to the individual who has lost their spouse, and "adult children," highlighting the category of beneficiaries mentioned in the will. The Indianapolis Indiana Legal Last Will and Testament Form for a Widow or Widower with Adult Children may vary depending on certain circumstances, such as the number of adult children or complex asset distribution requirements. Some variants might include: 1. Simple Last Will and Testament: This form is suitable for individuals with straightforward wishes, where the estate consists of a few assets, and the distribution plan is relatively simple. 2. Complex Last Will and Testament: This form is designed for widows or widowers with considerable assets or properties, ensuring a more intricate distribution plan to accommodate detailed instructions, such as asset management, trusts, or establishing guardianship for minor children or dependents. 3. Living Will: While not part of the last will and testament, a living will, can often be included as an additional document alongside the traditional will. A living will helps individuals express their healthcare preferences, end-of-life treatment decisions, or appointing a healthcare proxy to make medical decisions on their behalf if they become incapacitated. Regardless of the specific variant, the Indianapolis Indiana Legal Last Will and Testament Form for a Widow or Widower with Adult Children provides individuals an opportunity to establish: 1. Executors: Appointing an executor(s) who will be responsible for carrying out the instructions specified in the will, including asset distribution, debt payment, and finalizing legal matters. 2. Asset Distribution: Outlining how the assets, including personal belongings, financial accounts, real estate properties, investments, and other possessions, should be divided among the adult children. 3. Debts and Taxes: Addressing any outstanding debts or tax obligations, ensuring that they are identified, managed, and paid off using the estate's assets. 4. Guardianship: If there are minor children or dependents involved, the will can appoint a guardian who will be responsible for their care and well-being in the event of the widow or widower's death. It is important to consult with an attorney specializing in estate planning to ensure the Indianapolis Indiana Legal Last Will and Testament Form for a Widow or Widower with Adult Children meets all legal requirements and effectively reflects the individual's wishes regarding the distribution of their estate.The Indianapolis Indiana Legal Last Will and Testament Form for a Widow or Widower with Adult Children is a legally binding document that allows individuals who have lost their spouse and have adult children to specify how their assets and estate should be distributed after their death. This specialized type of last will and testament form is designed specifically for widows or widowers residing in the city of Indianapolis, Indiana, and provides a comprehensive framework to ensure that their final wishes are respected and executed. Keywords for this form include "Indianapolis Indiana," signifying the specific jurisdiction where the will is legally binding, "legal last will and testament," indicating it is a formal document governed by the state's probate laws, "widow or widower," referring to the individual who has lost their spouse, and "adult children," highlighting the category of beneficiaries mentioned in the will. The Indianapolis Indiana Legal Last Will and Testament Form for a Widow or Widower with Adult Children may vary depending on certain circumstances, such as the number of adult children or complex asset distribution requirements. Some variants might include: 1. Simple Last Will and Testament: This form is suitable for individuals with straightforward wishes, where the estate consists of a few assets, and the distribution plan is relatively simple. 2. Complex Last Will and Testament: This form is designed for widows or widowers with considerable assets or properties, ensuring a more intricate distribution plan to accommodate detailed instructions, such as asset management, trusts, or establishing guardianship for minor children or dependents. 3. Living Will: While not part of the last will and testament, a living will, can often be included as an additional document alongside the traditional will. A living will helps individuals express their healthcare preferences, end-of-life treatment decisions, or appointing a healthcare proxy to make medical decisions on their behalf if they become incapacitated. Regardless of the specific variant, the Indianapolis Indiana Legal Last Will and Testament Form for a Widow or Widower with Adult Children provides individuals an opportunity to establish: 1. Executors: Appointing an executor(s) who will be responsible for carrying out the instructions specified in the will, including asset distribution, debt payment, and finalizing legal matters. 2. Asset Distribution: Outlining how the assets, including personal belongings, financial accounts, real estate properties, investments, and other possessions, should be divided among the adult children. 3. Debts and Taxes: Addressing any outstanding debts or tax obligations, ensuring that they are identified, managed, and paid off using the estate's assets. 4. Guardianship: If there are minor children or dependents involved, the will can appoint a guardian who will be responsible for their care and well-being in the event of the widow or widower's death. It is important to consult with an attorney specializing in estate planning to ensure the Indianapolis Indiana Legal Last Will and Testament Form for a Widow or Widower with Adult Children meets all legal requirements and effectively reflects the individual's wishes regarding the distribution of their estate.