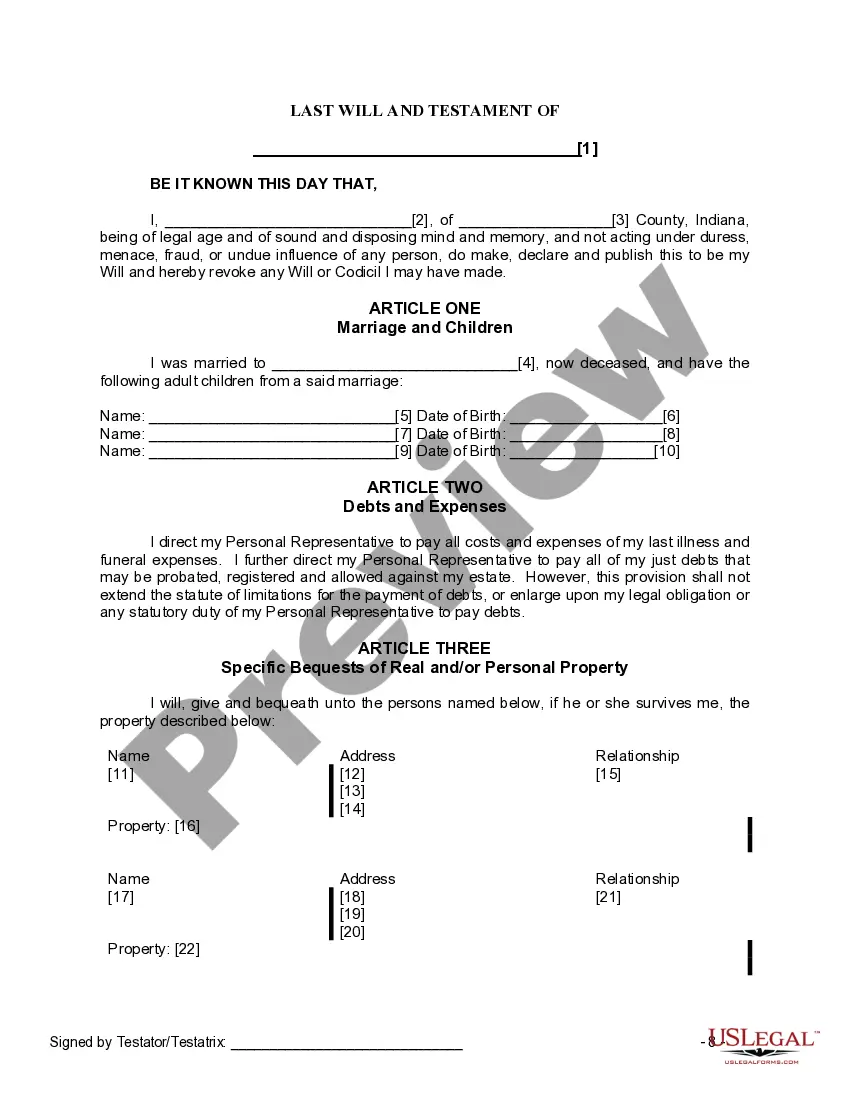

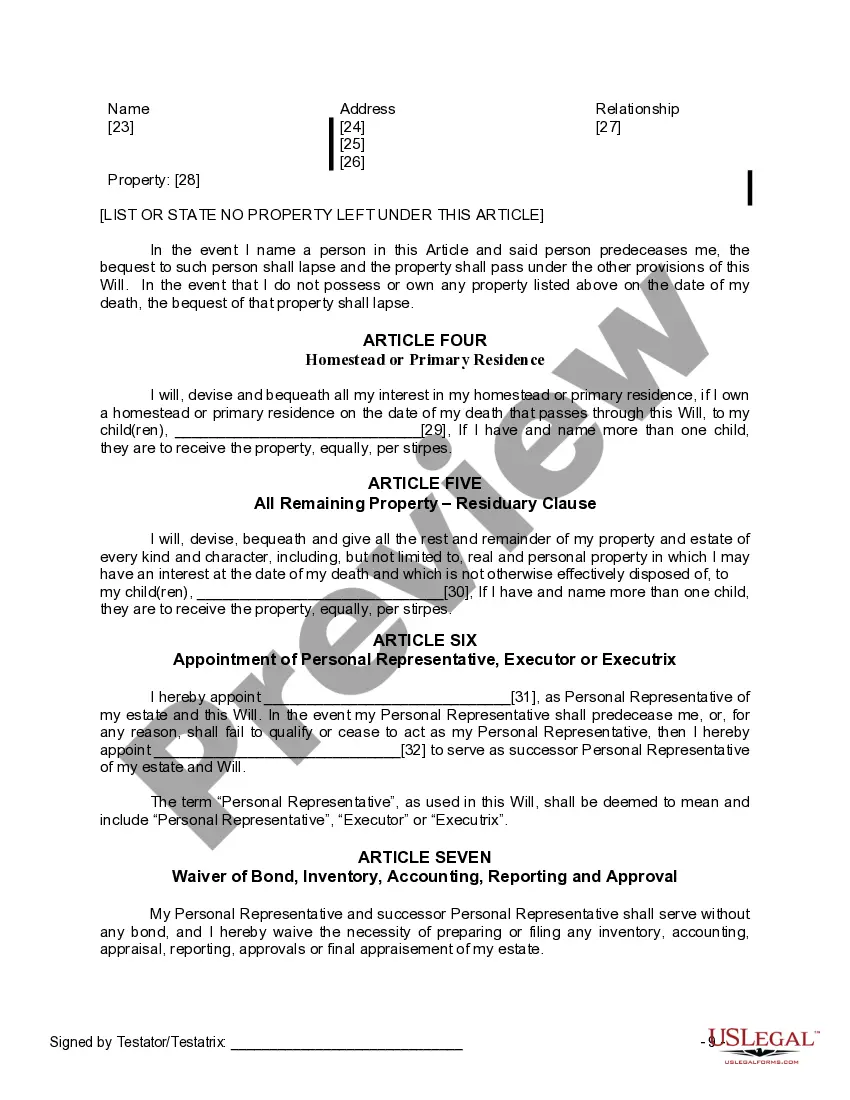

The Will you have found is for a widow or widower with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your adult children. This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

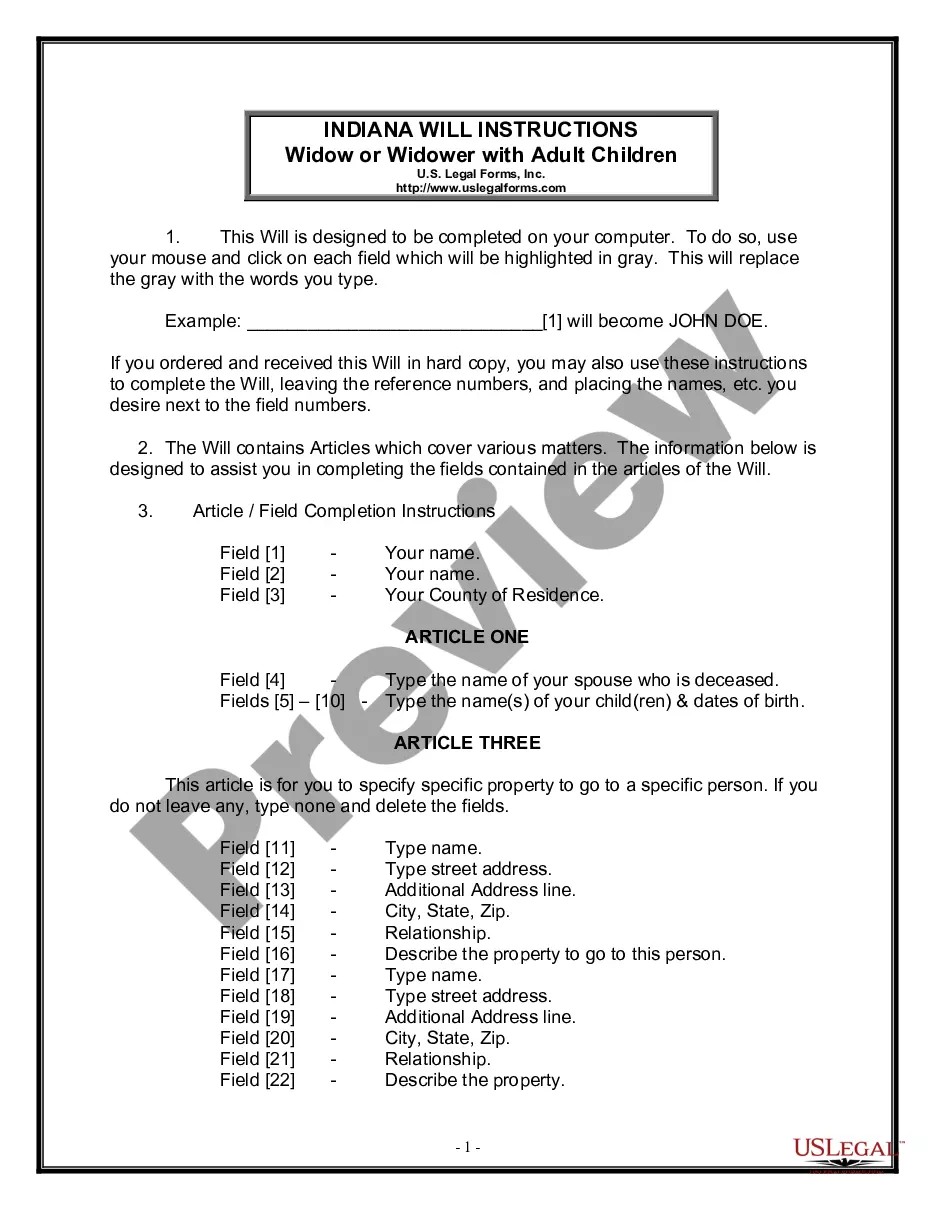

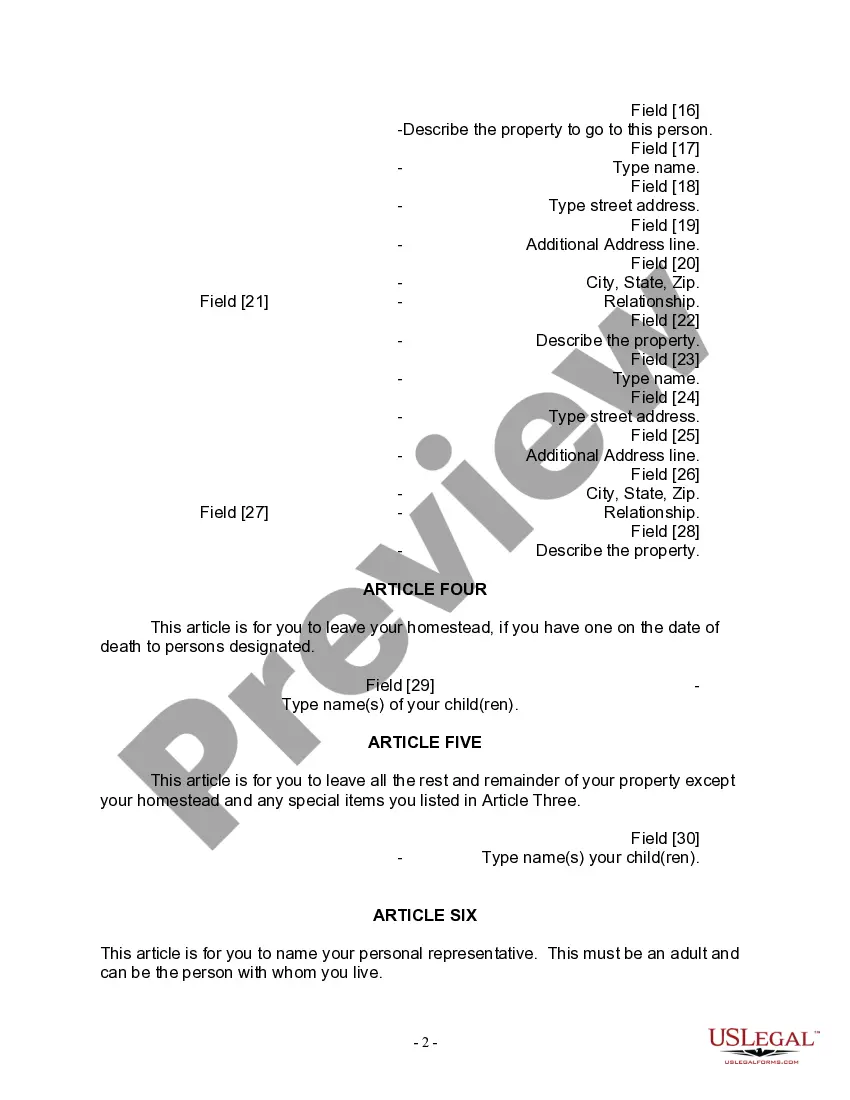

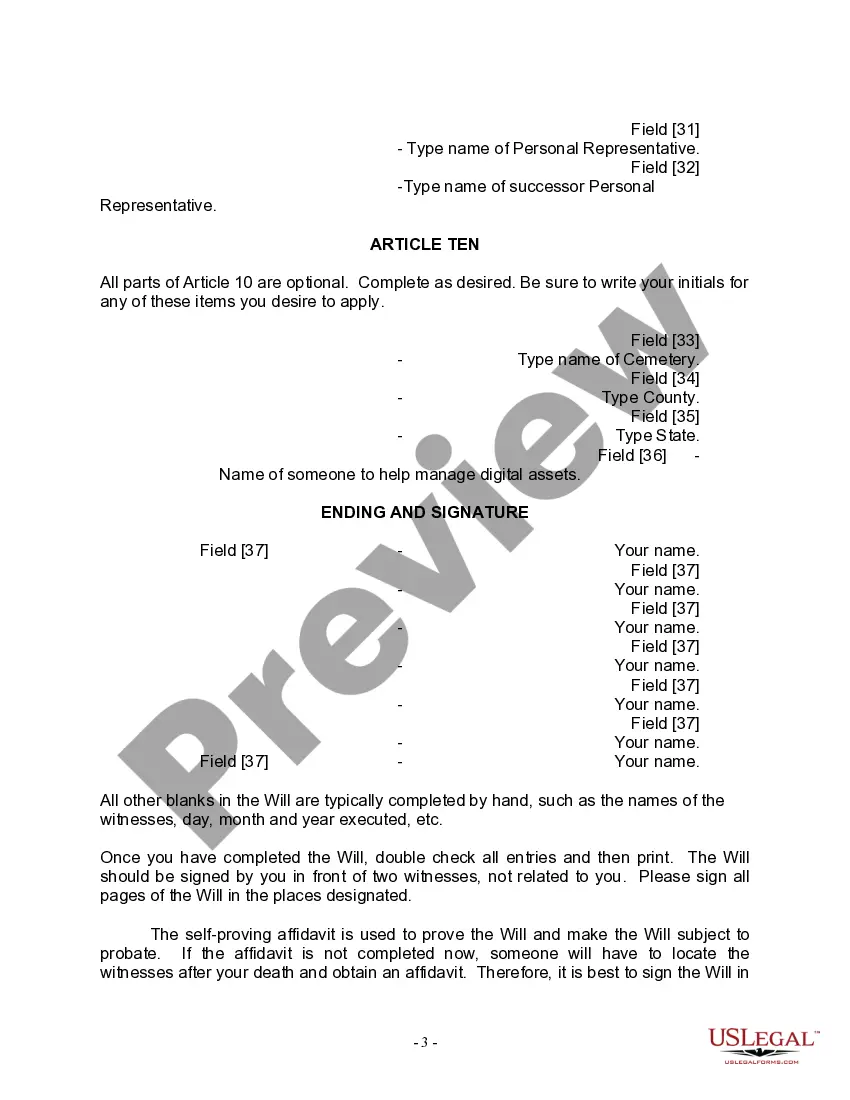

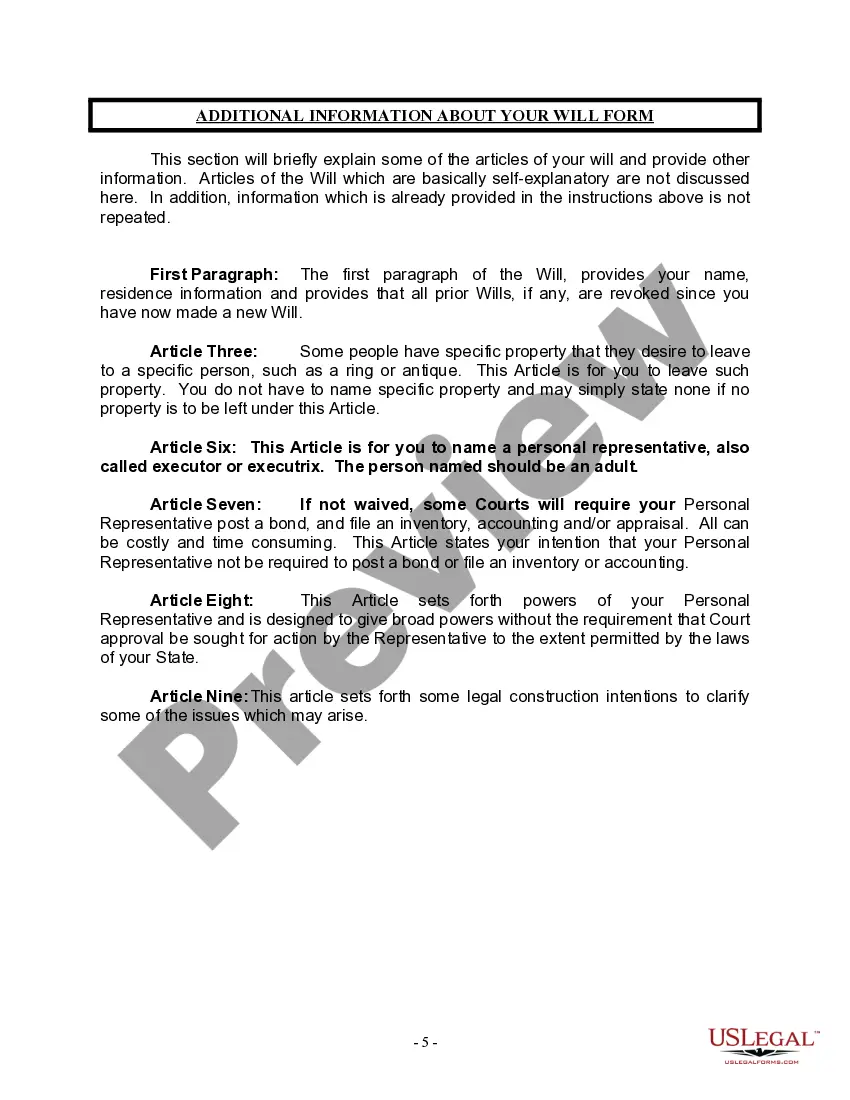

Keywords: South Bend Indiana, Legal Last Will and Testament Form, Widow, Widower, Adult Children Description: The South Bend Indiana Legal Last Will and Testament Form for a Widow or Widower with Adult Children is a crucial legal document that allows individuals in this specific situation to outline their final wishes and distribute their assets upon their passing. This form offers detailed provisions and guidelines to ensure that the testator's estate is distributed precisely as they desire, providing peace of mind for both the individual and their family. The South Bend Indiana Legal Last Will and Testament Form for a Widow or Widower with Adult Children caters specifically to those who have lost their spouse and have adult children. It acknowledges the unique circumstances faced by widows or widowers in this situation, offering provisions that address their specific needs. Some key elements covered in this legal form include: 1. Appointment of an Executor: The form allows the testator, i.e., the person making the will, to appoint a trusted individual as the executor of their estate. The executor is responsible for ensuring that the testator's wishes are carried out according to the will's instructions. 2. Distribution of Assets: The Last Will and Testament Form enables the testator to determine how their assets, including property, financial accounts, investments, and personal belongings, are to be distributed among their adult children. They can specify specific bequests or establish percentages for distribution. 3. Guardianship of Minor Children: If there are minor children involved, this form allows the testator to designate a guardian who will assume responsibility for their care and well-being in the event of their death. 4. Alternate Beneficiaries: In case any of the named beneficiaries predecease the testator, the form provides the option to name alternate beneficiaries who will receive the assets intended for the original beneficiaries. 5. Special Instructions: The South Bend Indiana Legal Last Will and Testament Form allows the testator to include any other special instructions or conditions they wish to impose on the distribution of their estate. It's important to note that depending on an individual's specific circumstances, there may be variations or additional forms available, such as a Living Will, Medical Power of Attorney, or a Revocable Living Trust. Consulting with a legal professional in South Bend, Indiana, is highly recommended ensuring the appropriate forms are completed correctly.Keywords: South Bend Indiana, Legal Last Will and Testament Form, Widow, Widower, Adult Children Description: The South Bend Indiana Legal Last Will and Testament Form for a Widow or Widower with Adult Children is a crucial legal document that allows individuals in this specific situation to outline their final wishes and distribute their assets upon their passing. This form offers detailed provisions and guidelines to ensure that the testator's estate is distributed precisely as they desire, providing peace of mind for both the individual and their family. The South Bend Indiana Legal Last Will and Testament Form for a Widow or Widower with Adult Children caters specifically to those who have lost their spouse and have adult children. It acknowledges the unique circumstances faced by widows or widowers in this situation, offering provisions that address their specific needs. Some key elements covered in this legal form include: 1. Appointment of an Executor: The form allows the testator, i.e., the person making the will, to appoint a trusted individual as the executor of their estate. The executor is responsible for ensuring that the testator's wishes are carried out according to the will's instructions. 2. Distribution of Assets: The Last Will and Testament Form enables the testator to determine how their assets, including property, financial accounts, investments, and personal belongings, are to be distributed among their adult children. They can specify specific bequests or establish percentages for distribution. 3. Guardianship of Minor Children: If there are minor children involved, this form allows the testator to designate a guardian who will assume responsibility for their care and well-being in the event of their death. 4. Alternate Beneficiaries: In case any of the named beneficiaries predecease the testator, the form provides the option to name alternate beneficiaries who will receive the assets intended for the original beneficiaries. 5. Special Instructions: The South Bend Indiana Legal Last Will and Testament Form allows the testator to include any other special instructions or conditions they wish to impose on the distribution of their estate. It's important to note that depending on an individual's specific circumstances, there may be variations or additional forms available, such as a Living Will, Medical Power of Attorney, or a Revocable Living Trust. Consulting with a legal professional in South Bend, Indiana, is highly recommended ensuring the appropriate forms are completed correctly.