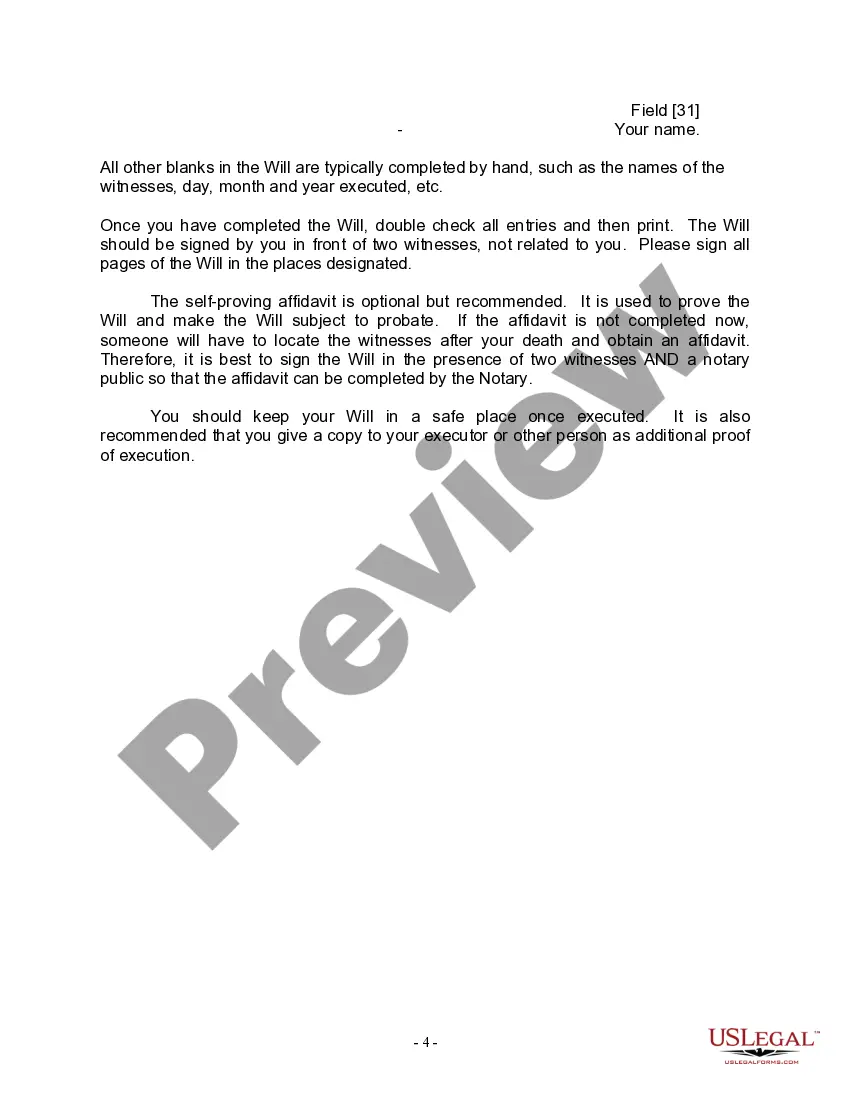

The Will you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

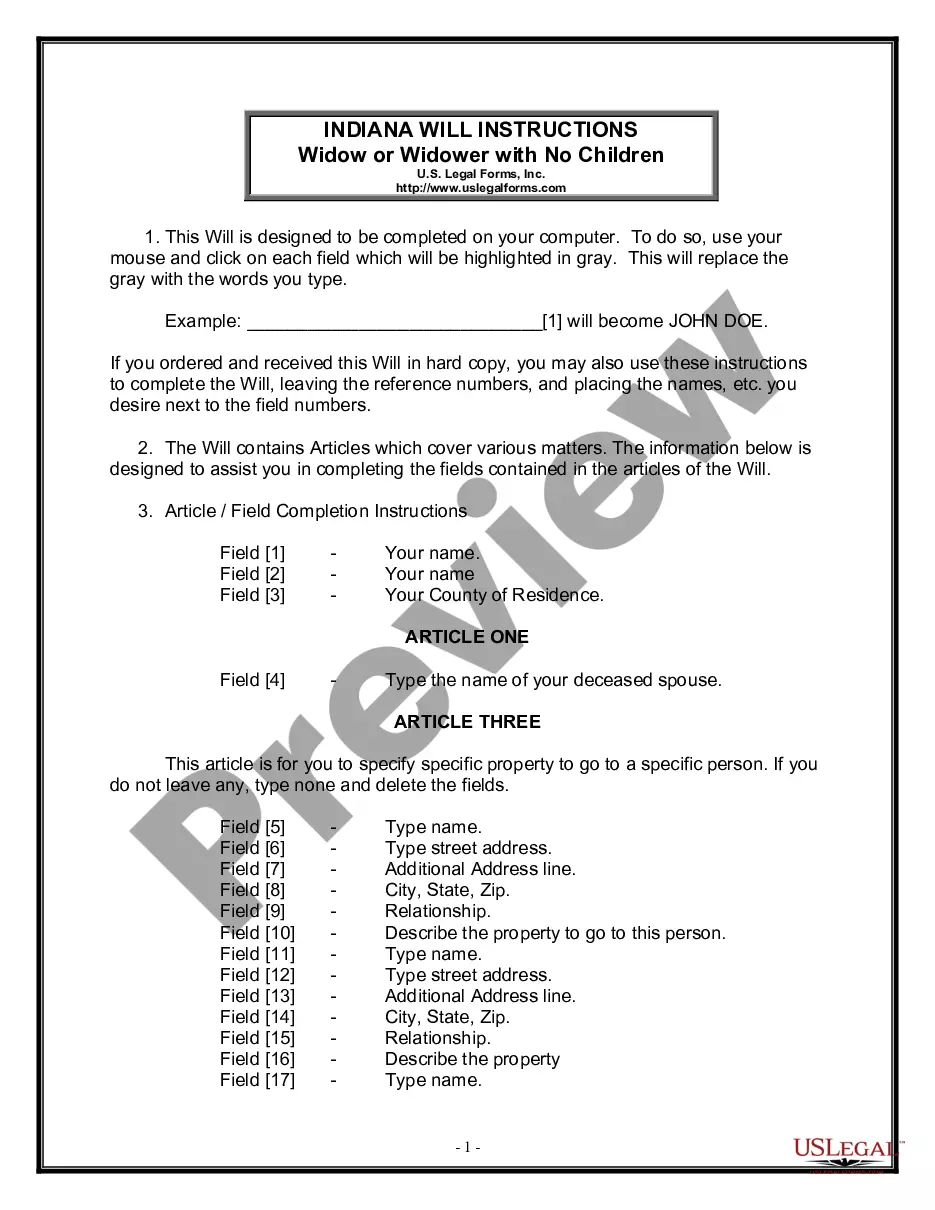

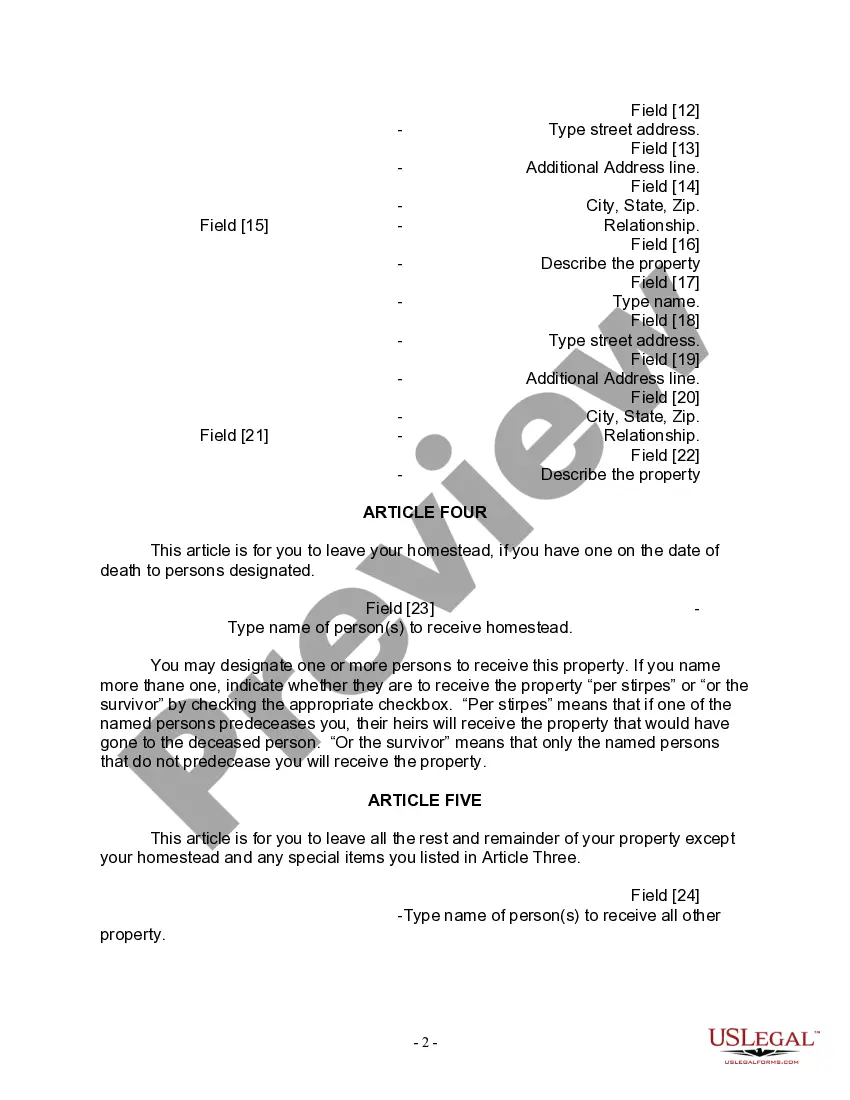

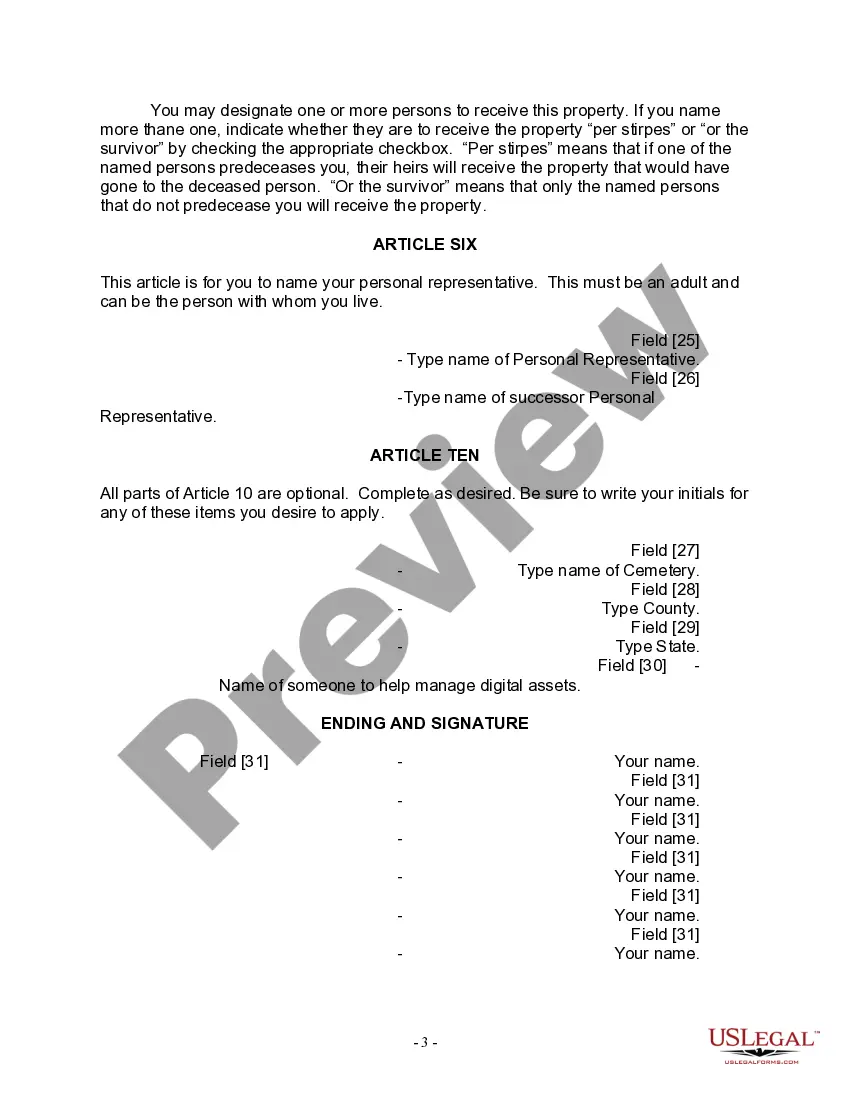

Carmel Indiana Legal Last Will Form for a Widow or Widower with no Children is a legal document that allows individuals in the state of Indiana who have lost their spouses and do not have any children to dictate how their assets will be distributed upon their death. This detailed description will provide insights into the purpose, features, and potential variations of this legal document. In Carmel, Indiana, it is crucial for widows or widowers without children to have a Last Will Form to ensure that their property and possessions are distributed according to their wishes and in compliance with the state's laws. This legal document can provide peace of mind, allowing individuals to make informed decisions about their estates and assets. The Carmel Indiana Legal Last Will Form for a Widow or Widower with no Children typically includes various essential elements. Firstly, it will require the individual to identify themselves, providing their full legal name and residential address. Next, the document will often require the individual to designate an executor or personal representative, who will be responsible for managing the estate and overseeing the distribution of assets. Additionally, the Last Will Form will allow the individual to specify how their assets, including property, money, investments, and personal belongings, should be distributed after their passing. This may involve bequeathing assets to specific family members, friends, charitable organizations, or other beneficiaries. The document may also include provisions for alternate beneficiaries in case a designated beneficiary is unable or unwilling to inherit. Furthermore, the Carmel Indiana Legal Last Will Form for a Widow or Widower with no Children may provide an opportunity for the individual to name guardians for any dependents or pets they may have, ensuring their well-being and care. It may also address funeral wishes and any specific instructions regarding burial or cremation arrangements. It is important to note that there may be variations of the Carmel Indiana Legal Last Will Form for a Widow or Widower with no Children, depending on specific circumstances or preferences. Some possible variations may include: 1. Simple Last Will Form: This basic form may be suitable for individuals with straightforward estate plans. It provides a clear distribution of assets and nominations for executor and guardian roles. 2. Testamentary Trust Last Will Form: This form includes the establishment of a trust, allowing for the management and distribution of assets over an extended period. 3. Living Will Form: This document allows individuals to express their healthcare preferences in case they become incapacitated, ensuring their wishes are respected when it comes to medical treatments and end-of-life decisions. In conclusion, the Carmel Indiana Legal Last Will Form for a Widow or Widower with no Children is a vital legal document that enables individuals in Indiana to dictate the distribution of their assets and specify various instructions upon their death. Whether it is a simple last will, testamentary trust, or living will form, having an up-to-date and legally binding document provides peace of mind and ensures that an individual's wishes are respected.Carmel Indiana Legal Last Will Form for a Widow or Widower with no Children is a legal document that allows individuals in the state of Indiana who have lost their spouses and do not have any children to dictate how their assets will be distributed upon their death. This detailed description will provide insights into the purpose, features, and potential variations of this legal document. In Carmel, Indiana, it is crucial for widows or widowers without children to have a Last Will Form to ensure that their property and possessions are distributed according to their wishes and in compliance with the state's laws. This legal document can provide peace of mind, allowing individuals to make informed decisions about their estates and assets. The Carmel Indiana Legal Last Will Form for a Widow or Widower with no Children typically includes various essential elements. Firstly, it will require the individual to identify themselves, providing their full legal name and residential address. Next, the document will often require the individual to designate an executor or personal representative, who will be responsible for managing the estate and overseeing the distribution of assets. Additionally, the Last Will Form will allow the individual to specify how their assets, including property, money, investments, and personal belongings, should be distributed after their passing. This may involve bequeathing assets to specific family members, friends, charitable organizations, or other beneficiaries. The document may also include provisions for alternate beneficiaries in case a designated beneficiary is unable or unwilling to inherit. Furthermore, the Carmel Indiana Legal Last Will Form for a Widow or Widower with no Children may provide an opportunity for the individual to name guardians for any dependents or pets they may have, ensuring their well-being and care. It may also address funeral wishes and any specific instructions regarding burial or cremation arrangements. It is important to note that there may be variations of the Carmel Indiana Legal Last Will Form for a Widow or Widower with no Children, depending on specific circumstances or preferences. Some possible variations may include: 1. Simple Last Will Form: This basic form may be suitable for individuals with straightforward estate plans. It provides a clear distribution of assets and nominations for executor and guardian roles. 2. Testamentary Trust Last Will Form: This form includes the establishment of a trust, allowing for the management and distribution of assets over an extended period. 3. Living Will Form: This document allows individuals to express their healthcare preferences in case they become incapacitated, ensuring their wishes are respected when it comes to medical treatments and end-of-life decisions. In conclusion, the Carmel Indiana Legal Last Will Form for a Widow or Widower with no Children is a vital legal document that enables individuals in Indiana to dictate the distribution of their assets and specify various instructions upon their death. Whether it is a simple last will, testamentary trust, or living will form, having an up-to-date and legally binding document provides peace of mind and ensures that an individual's wishes are respected.