The Will you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

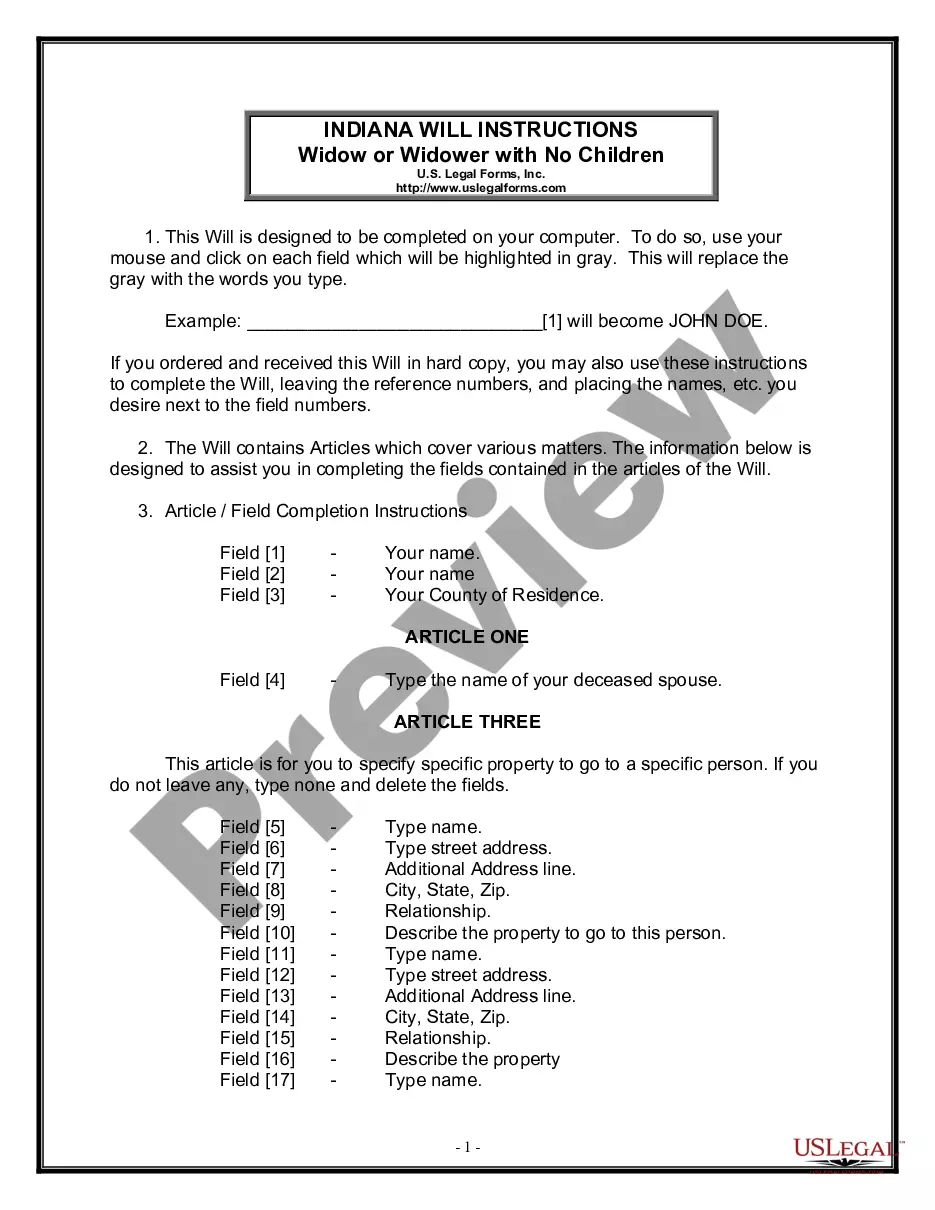

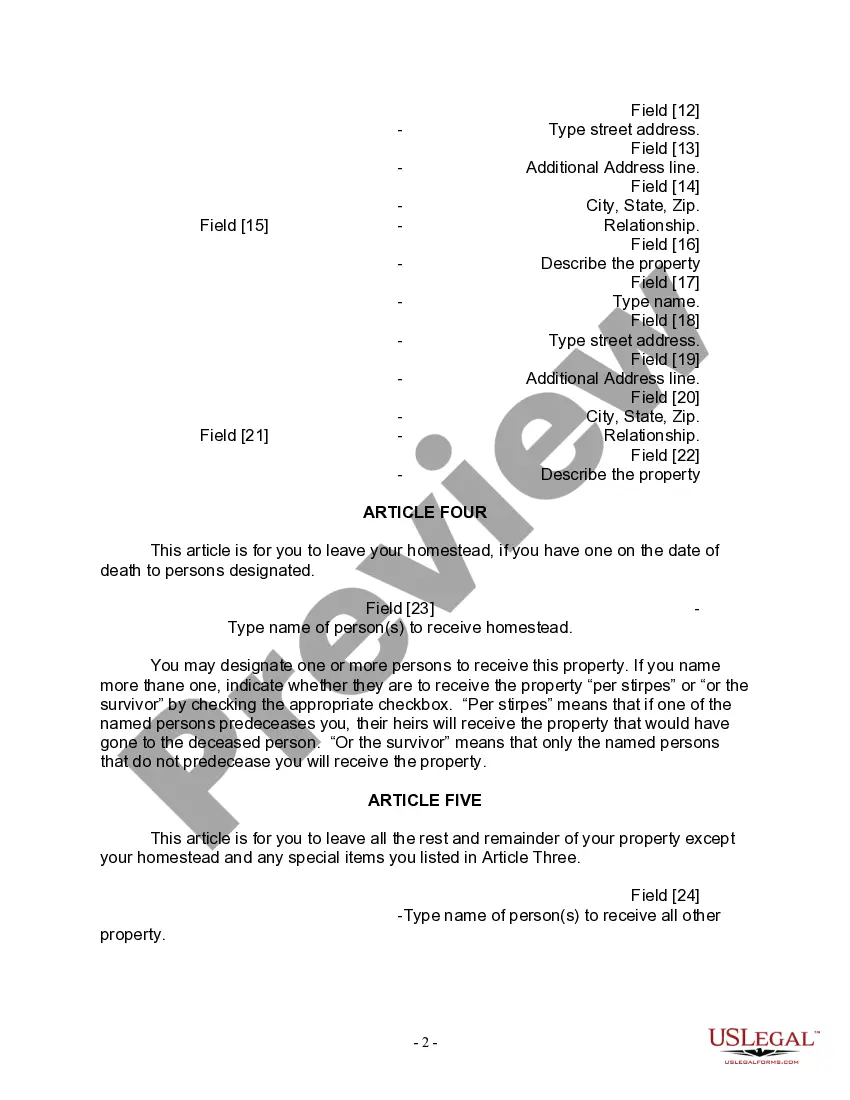

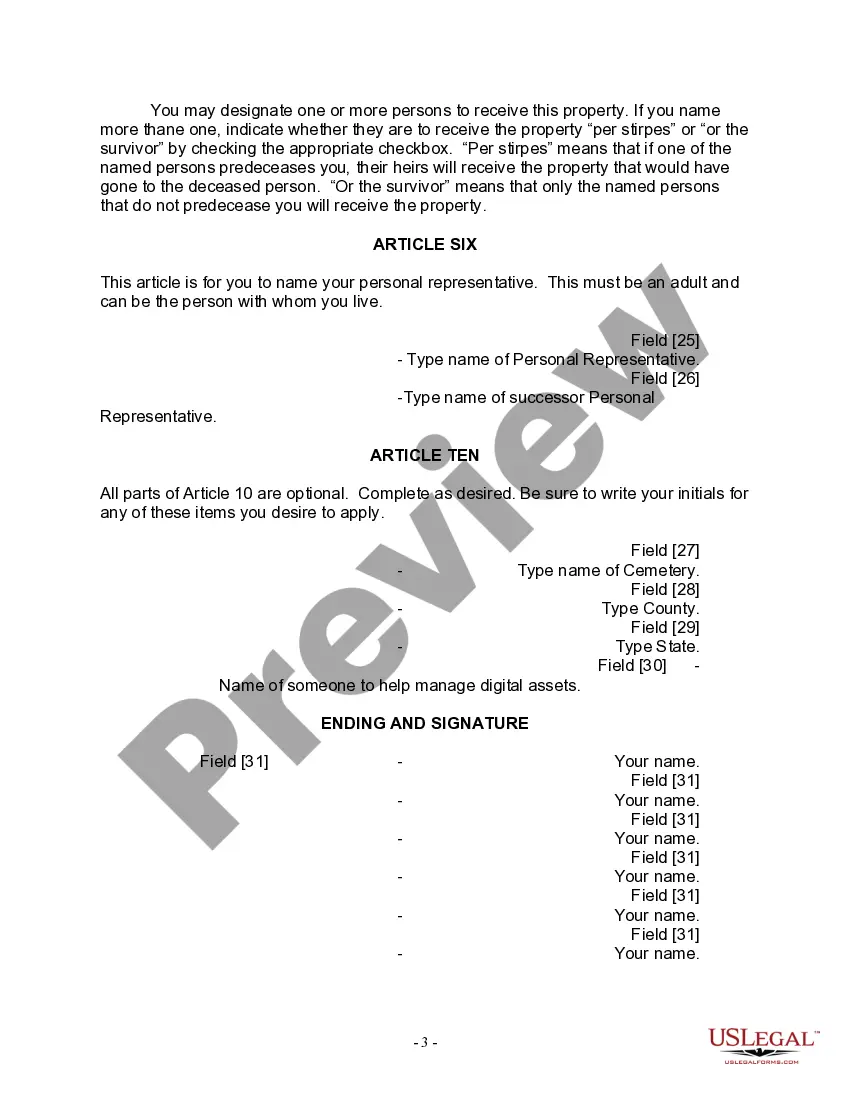

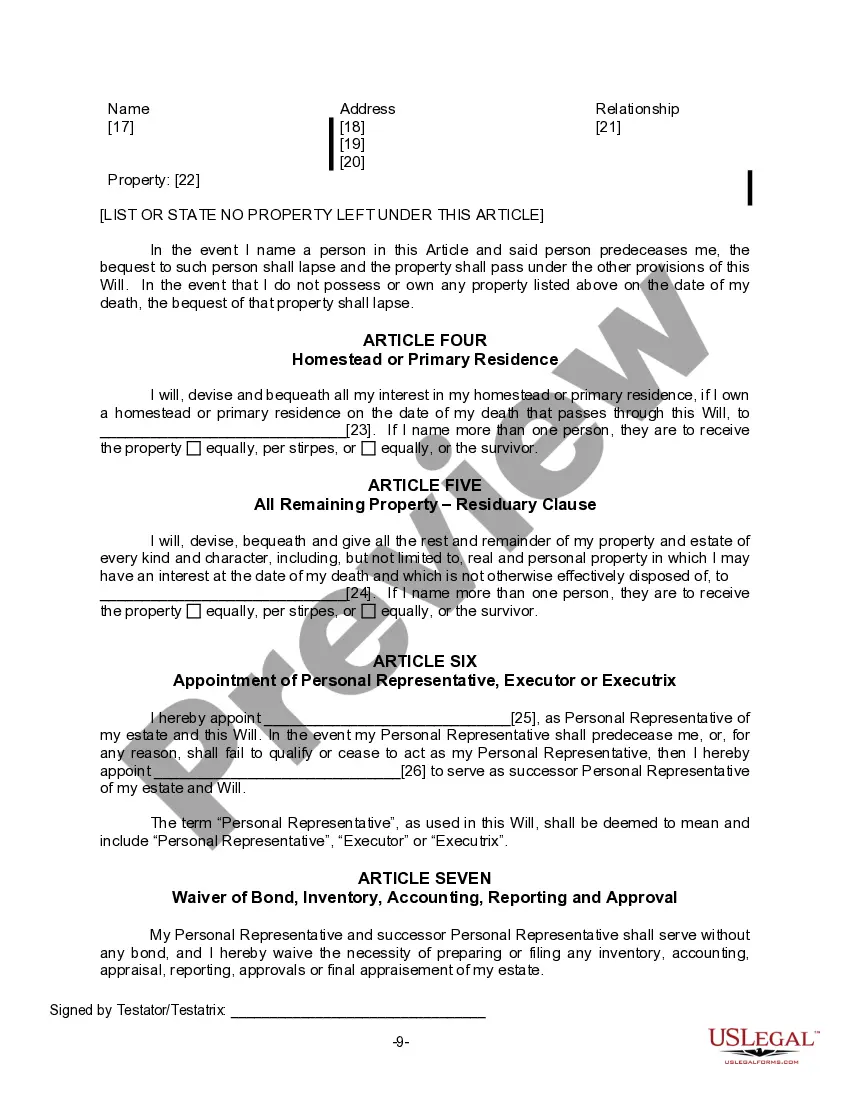

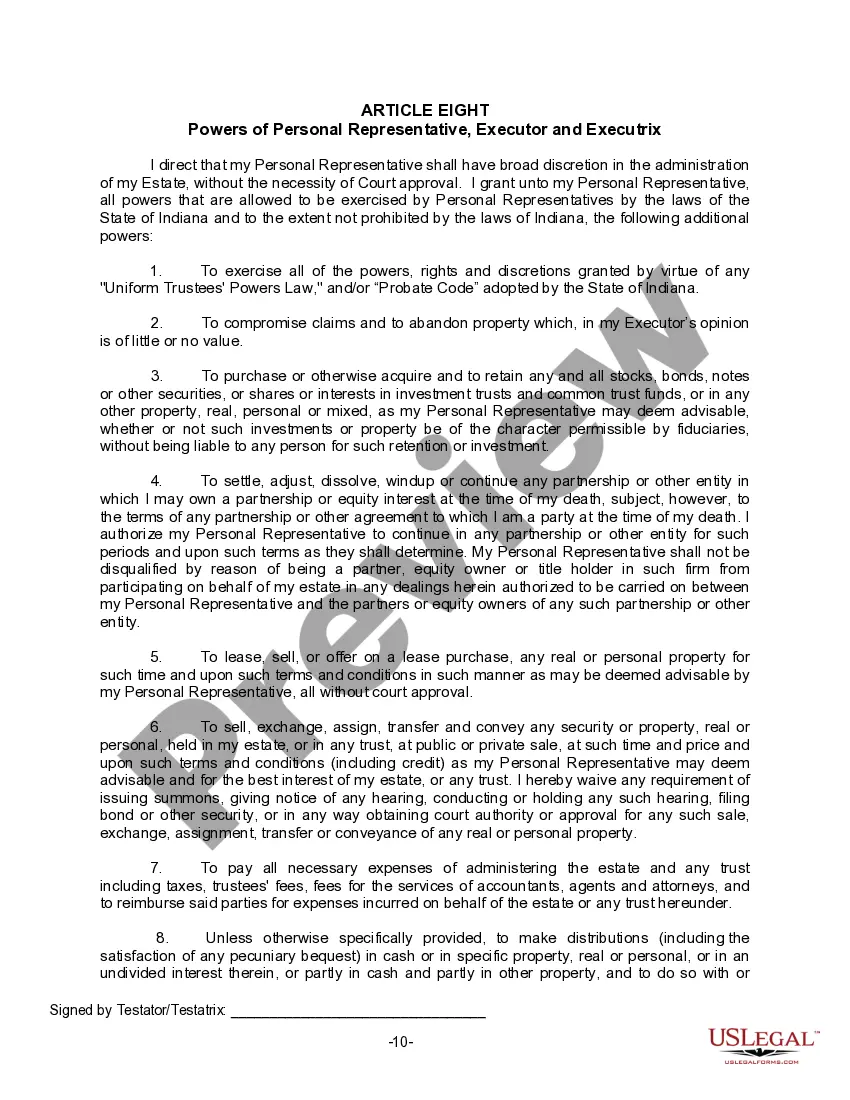

The Indianapolis Indiana Legal Last Will Form for a Widow or Widower with no Children is a legal document designed to provide individuals who have lost their spouse and do not have any children with a means to express their final wishes regarding the distribution of their estate. This form allows residents of Indianapolis, Indiana, to ensure that their assets are distributed according to their specific instructions after their passing. This legal document typically begins with a declaration of the individual's full legal name, address, and marital status as a widow or widower with no children. It may also include details about the predeceased spouse, such as their name and the date of their passing. They will form will then proceed to outline the appointment of an executor, who will be responsible for carrying out the wishes specified in the will. The executor is usually a trusted person, such as a family member, friend, or attorney. It is essential to name an alternate executor as well, in case the initial choice is unable or unwilling to fulfill the duties. Next, the will form will address the distribution of assets. This section provides an opportunity for the testator (the person making the will) to determine how their estate will be divided among beneficiaries. A widow or widower with no children might choose to leave their assets to extended family members, close friends, charities, or any other beneficiary of their choice. It is vital to name these beneficiaries explicitly, providing their full names and any other identifying information to prevent any confusion. Furthermore, the will form may include specific bequests, which are detailed instructions for the distribution of certain personal belongings or specific assets. These bequests can range from sentimental items, such as family heirlooms or jewelry, to financial assets like bank accounts, investment portfolios, or real estate properties. It is worth noting that there may be different types of Indianapolis Indiana Legal Last Will Forms for a Widow or Widower with no Children, depending on the specific needs and circumstances of the individual. For instance, some versions of the form may include provisions for a testamentary trust, which allows for the management and distribution of assets over time, particularly if the widow or widower wishes to provide for other family members, friends, or charitable organizations in a structured manner. In conclusion, the Indianapolis Indiana Legal Last Will Form for a Widow or Widower with no Children is a crucial legal document that allows individuals in such circumstances to ensure their final wishes for the distribution of their estate are followed. It provides an opportunity to appoint an executor, identify beneficiaries, distribute assets, and make specific bequests as desired. Different variations of this form may exist depending on additional considerations, such as the need for a testamentary trust.The Indianapolis Indiana Legal Last Will Form for a Widow or Widower with no Children is a legal document designed to provide individuals who have lost their spouse and do not have any children with a means to express their final wishes regarding the distribution of their estate. This form allows residents of Indianapolis, Indiana, to ensure that their assets are distributed according to their specific instructions after their passing. This legal document typically begins with a declaration of the individual's full legal name, address, and marital status as a widow or widower with no children. It may also include details about the predeceased spouse, such as their name and the date of their passing. They will form will then proceed to outline the appointment of an executor, who will be responsible for carrying out the wishes specified in the will. The executor is usually a trusted person, such as a family member, friend, or attorney. It is essential to name an alternate executor as well, in case the initial choice is unable or unwilling to fulfill the duties. Next, the will form will address the distribution of assets. This section provides an opportunity for the testator (the person making the will) to determine how their estate will be divided among beneficiaries. A widow or widower with no children might choose to leave their assets to extended family members, close friends, charities, or any other beneficiary of their choice. It is vital to name these beneficiaries explicitly, providing their full names and any other identifying information to prevent any confusion. Furthermore, the will form may include specific bequests, which are detailed instructions for the distribution of certain personal belongings or specific assets. These bequests can range from sentimental items, such as family heirlooms or jewelry, to financial assets like bank accounts, investment portfolios, or real estate properties. It is worth noting that there may be different types of Indianapolis Indiana Legal Last Will Forms for a Widow or Widower with no Children, depending on the specific needs and circumstances of the individual. For instance, some versions of the form may include provisions for a testamentary trust, which allows for the management and distribution of assets over time, particularly if the widow or widower wishes to provide for other family members, friends, or charitable organizations in a structured manner. In conclusion, the Indianapolis Indiana Legal Last Will Form for a Widow or Widower with no Children is a crucial legal document that allows individuals in such circumstances to ensure their final wishes for the distribution of their estate are followed. It provides an opportunity to appoint an executor, identify beneficiaries, distribute assets, and make specific bequests as desired. Different variations of this form may exist depending on additional considerations, such as the need for a testamentary trust.