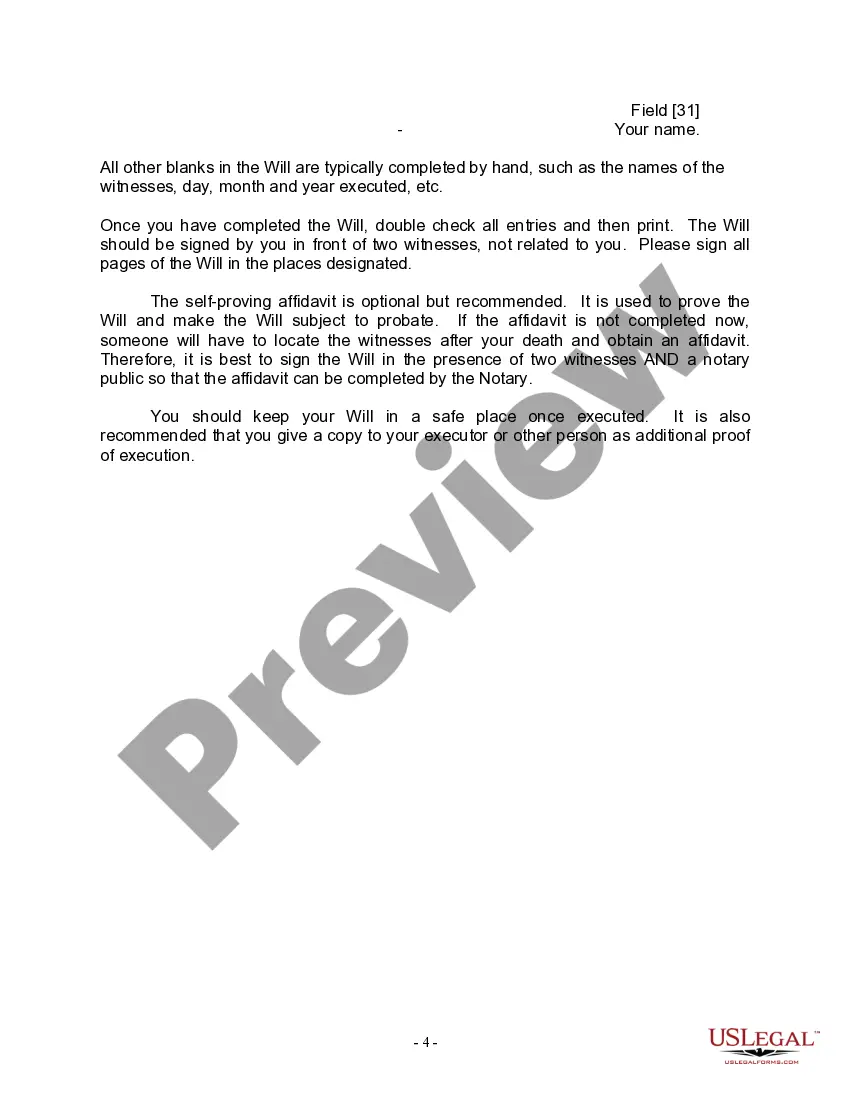

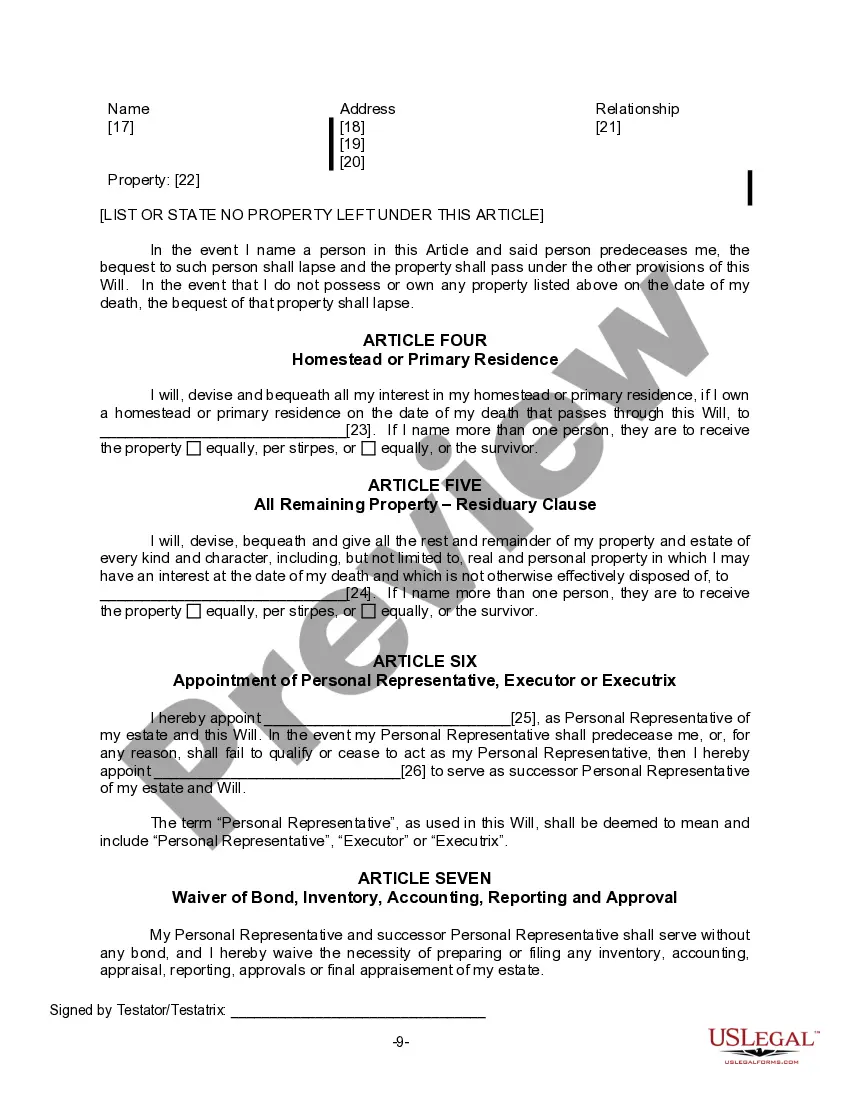

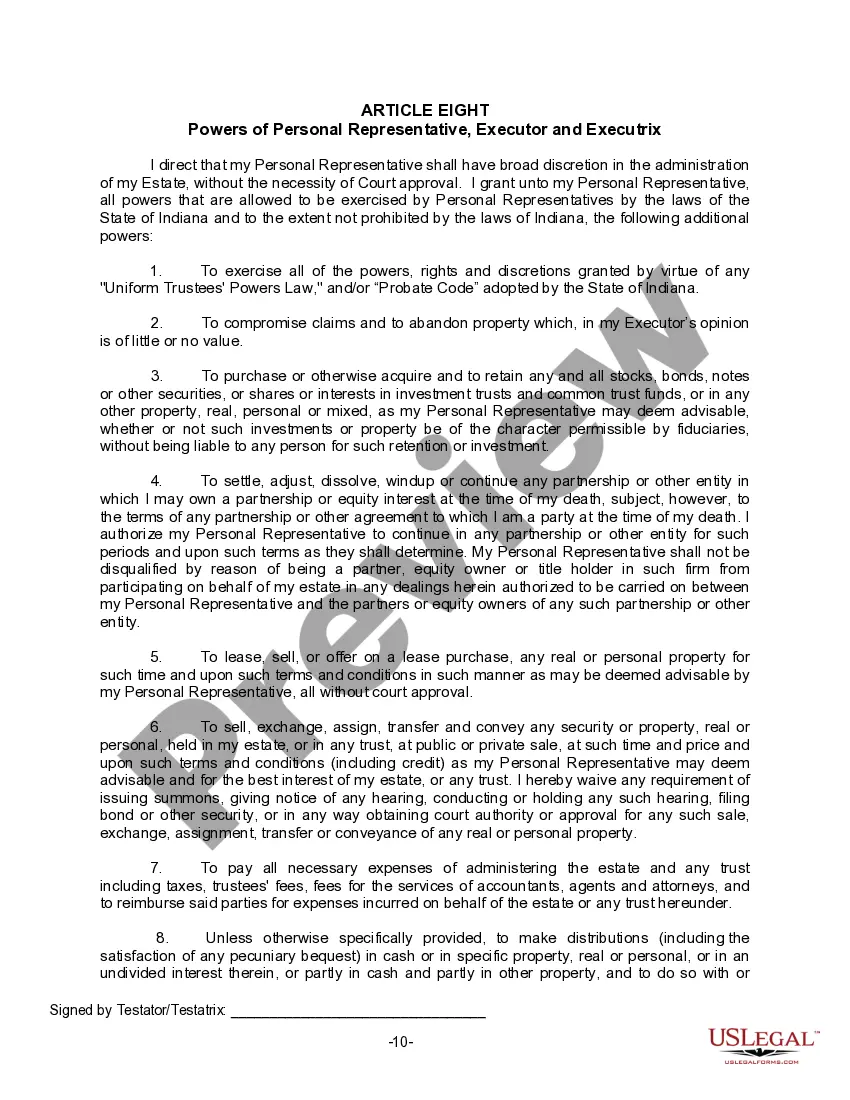

The Will you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

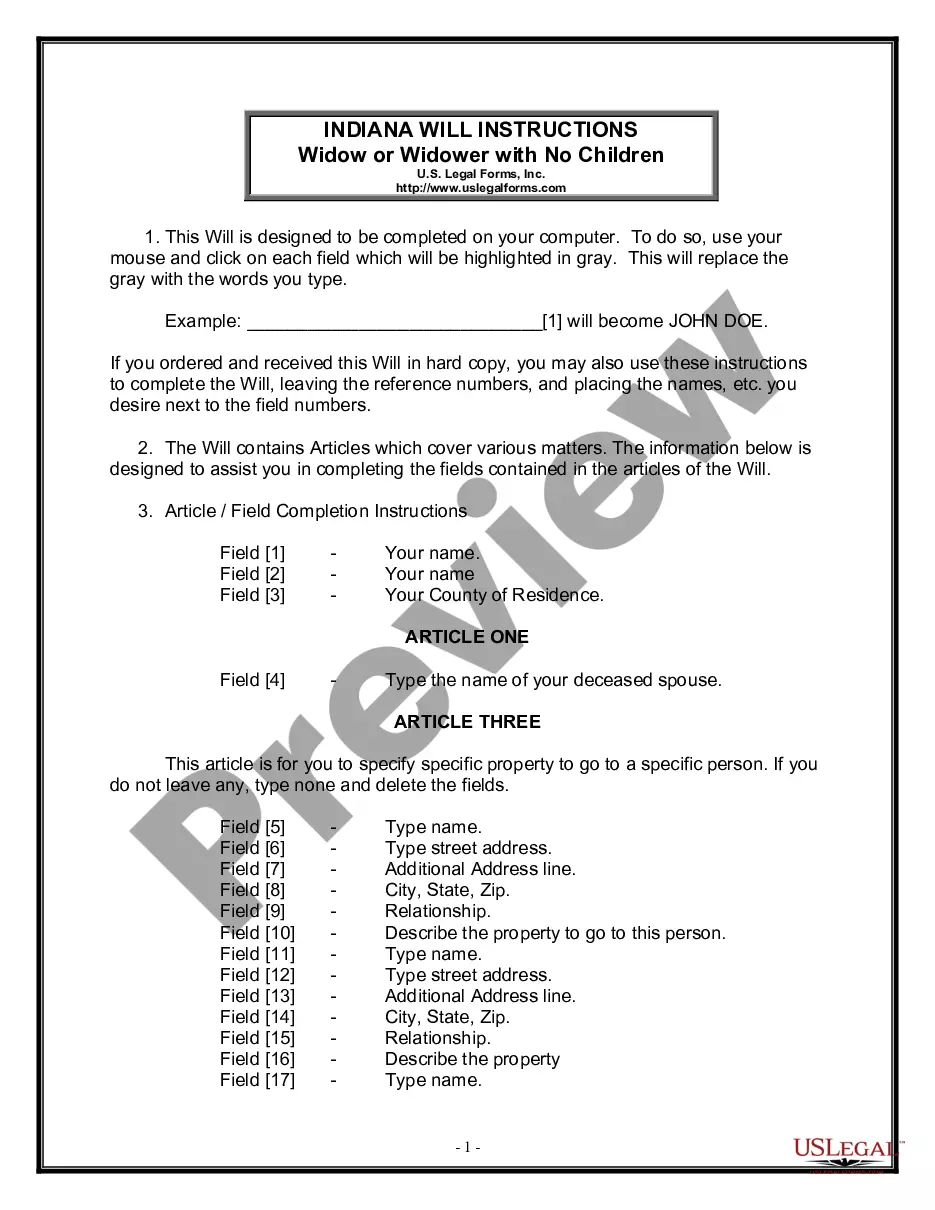

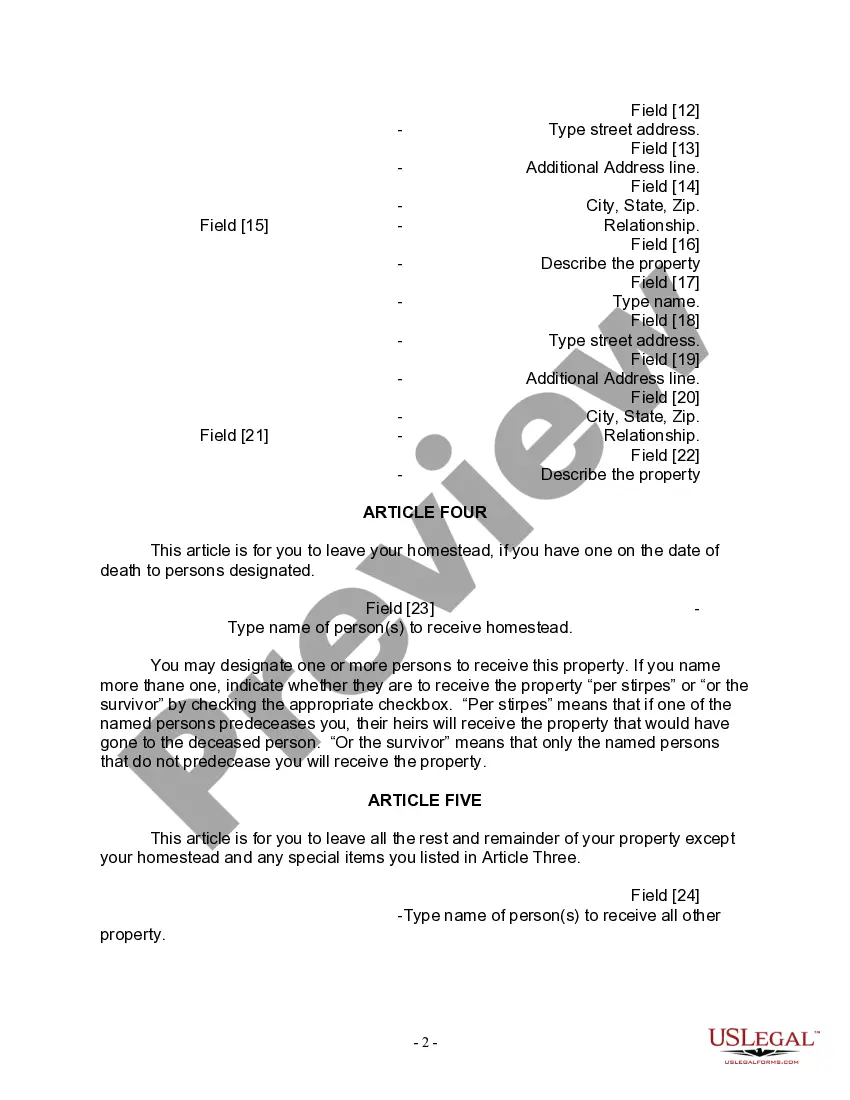

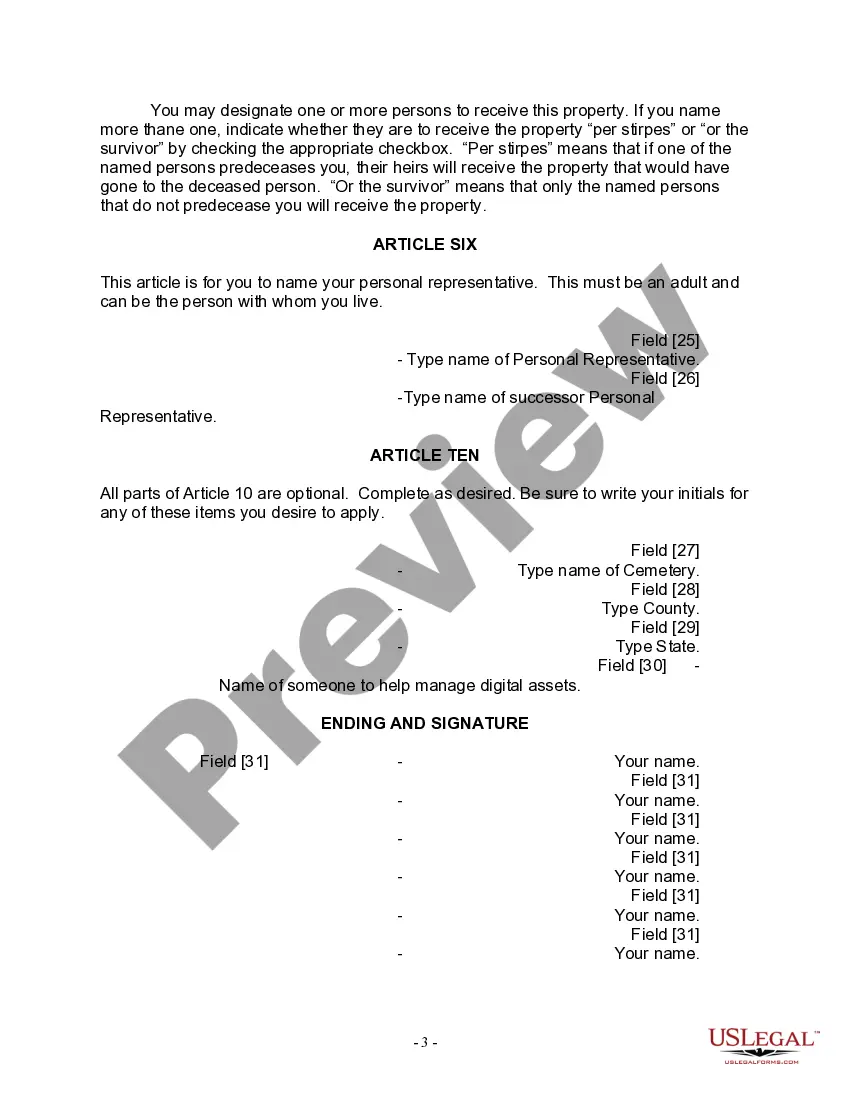

A South Bend Indiana Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals who have lost their spouse and do not have any children to ensure their assets are distributed according to their wishes after their passing. This type of will form ensures that the estate is protected and helps avoid potential disputes among family members or other interested parties. When creating a Last Will Form for a Widow or Widower with no Children in South Bend, there may be variations to consider depending on the specific needs or circumstances of the individual. Here are a few types of Last Will Forms that may be relevant: 1. Simple Last Will Form: This is the most common type of will and is suitable for individuals with straightforward estates. It allows the widow or widower to specify their beneficiaries, designate an executor, and outline how their assets should be distributed upon their death. 2. Living Will Form: Also known as an advanced healthcare directive, a Living Will allows individuals to outline their medical treatment preferences in the event they become terminally ill or incapacitated. 3. Pour-Over Will Form: This type of will work in conjunction with a trust. It ensures that any assets not specifically designated in the trust are transferred to the trust upon the individual's death. This can be beneficial if the widow or widower has established a trust to manage their assets efficiently. 4. Testamentary Trust Will Form: If the widow or widower wishes to create a trust to hold and distribute their assets after their passing, a Testamentary Trust Will Form is required. This document outlines the details of the trust, including the trustee's responsibilities and the beneficiaries' rights. When preparing a South Bend Indiana Legal Last Will Form for a Widow or Widower with no Children, it is essential to consult with an attorney specializing in estate planning. They can provide guidance based on local laws and help tailor the will to reflect the individual's specific needs and wishes. Note: Ensure the content generated follows legal guidelines and best practices. It is always recommended consulting with a professional attorney for accurate advice and personalized documents.A South Bend Indiana Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals who have lost their spouse and do not have any children to ensure their assets are distributed according to their wishes after their passing. This type of will form ensures that the estate is protected and helps avoid potential disputes among family members or other interested parties. When creating a Last Will Form for a Widow or Widower with no Children in South Bend, there may be variations to consider depending on the specific needs or circumstances of the individual. Here are a few types of Last Will Forms that may be relevant: 1. Simple Last Will Form: This is the most common type of will and is suitable for individuals with straightforward estates. It allows the widow or widower to specify their beneficiaries, designate an executor, and outline how their assets should be distributed upon their death. 2. Living Will Form: Also known as an advanced healthcare directive, a Living Will allows individuals to outline their medical treatment preferences in the event they become terminally ill or incapacitated. 3. Pour-Over Will Form: This type of will work in conjunction with a trust. It ensures that any assets not specifically designated in the trust are transferred to the trust upon the individual's death. This can be beneficial if the widow or widower has established a trust to manage their assets efficiently. 4. Testamentary Trust Will Form: If the widow or widower wishes to create a trust to hold and distribute their assets after their passing, a Testamentary Trust Will Form is required. This document outlines the details of the trust, including the trustee's responsibilities and the beneficiaries' rights. When preparing a South Bend Indiana Legal Last Will Form for a Widow or Widower with no Children, it is essential to consult with an attorney specializing in estate planning. They can provide guidance based on local laws and help tailor the will to reflect the individual's specific needs and wishes. Note: Ensure the content generated follows legal guidelines and best practices. It is always recommended consulting with a professional attorney for accurate advice and personalized documents.