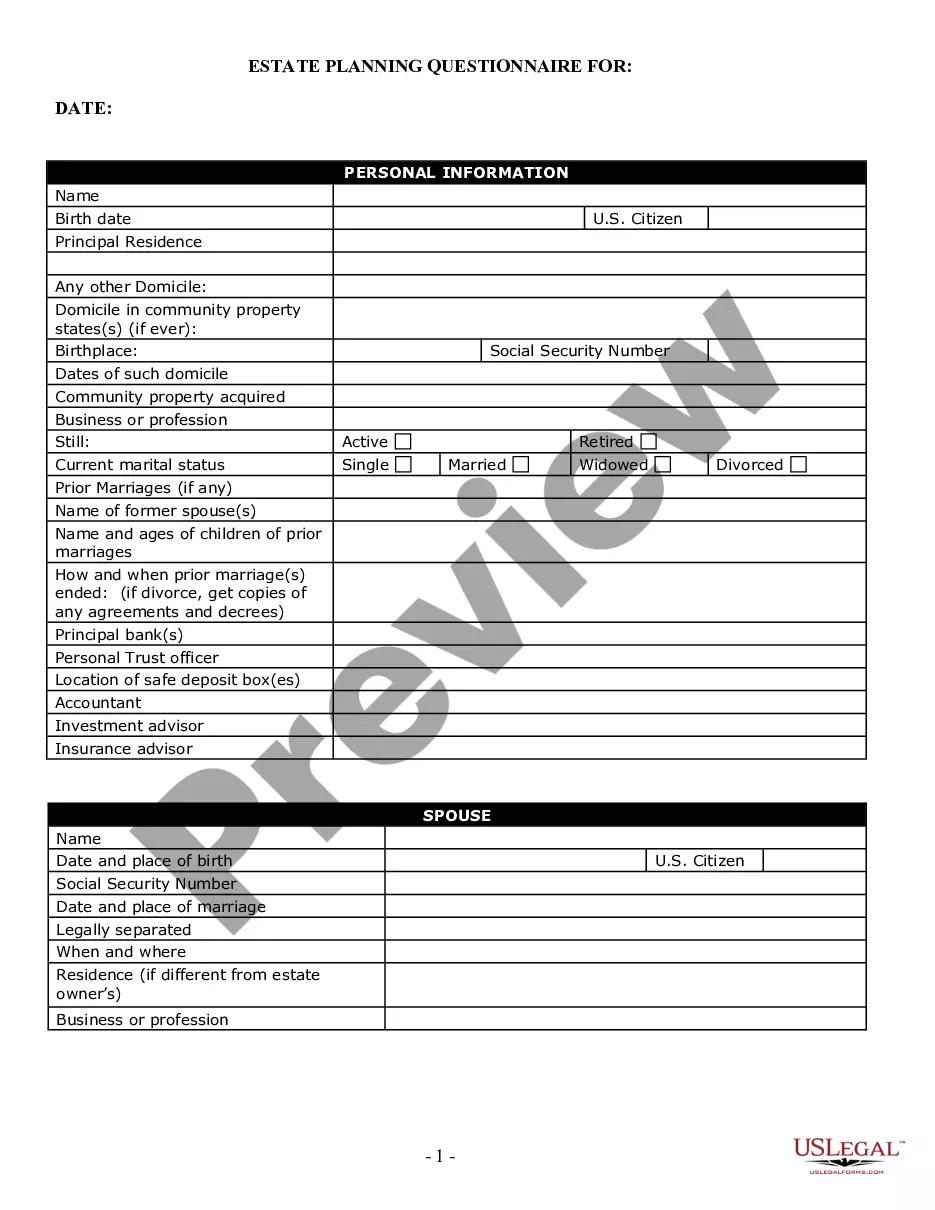

This form is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

Carmel Indiana Estate Planning Questionnaire and Worksheets are comprehensive tools designed to assist individuals and families in effectively planning their estate. These documents provide a structured framework to gather and organize essential information required for estate planning purposes. By utilizing the Carmel Indiana Estate Planning Questionnaire and Worksheets, individuals can ensure that their wishes regarding their assets, finances, healthcare decisions, and beneficiaries are accurately recorded and legally binding. The Carmel Indiana Estate Planning Questionnaire and Worksheets consist of various sections and questions tailored to cover all aspects of estate planning. These include: 1. Personal Information: Capturing essential details such as full legal name, contact information, date of birth, and social security number of the individual. 2. Family Members and Beneficiaries: Documenting information about immediate family members, extended relatives, and intended beneficiaries, including their names, relationships, and contact details. 3. Assets and Liabilities: Gathering data on all types of assets owned, such as real estate, bank accounts, investments, retirement accounts, insurance policies, valuable possessions, and any outstanding debts or liabilities. 4. Financial Affairs: Here, individuals provide detailed information regarding their income sources, debts, mortgages, loans, credit cards, and outstanding financial obligations. 5. Healthcare Preferences: This section covers instructions related to healthcare decisions, including desires regarding medical treatments, end-of-life care, organ donation preferences, and designation of healthcare proxies. 6. Executor and Trustee Designation: Allowing individuals to designate a trusted person or professional entity responsible for managing their estate and ensuring the proper distribution of assets. 7. Guardianship of Minor Children: If applicable, individuals can name a guardian who would care for their minor children in the event of their incapacitation or demise. 8. Special Instructions and Wishes: This section provides an opportunity to include any specific requests, personalized messages, and funeral or memorial service preferences. The Carmel Indiana Estate Planning Questionnaire and Worksheets aim to streamline the estate planning process by ensuring that individuals thoroughly consider all crucial aspects. It helps avoid overlooking important details and enables attorneys or legal professionals to efficiently create customized estate planning documents, such as wills, trusts, power of attorney, and advanced healthcare directives. These worksheets can be tailored to the unique needs of each individual or family, making them versatile and adaptable. Overall, the Carmel Indiana Estate Planning Questionnaire and Worksheets simplify the often complex and overwhelming estate planning process, offering a user-friendly approach to secure one's assets, ensure personal wishes are honored, and provide peace of mind for the future.Carmel Indiana Estate Planning Questionnaire and Worksheets are comprehensive tools designed to assist individuals and families in effectively planning their estate. These documents provide a structured framework to gather and organize essential information required for estate planning purposes. By utilizing the Carmel Indiana Estate Planning Questionnaire and Worksheets, individuals can ensure that their wishes regarding their assets, finances, healthcare decisions, and beneficiaries are accurately recorded and legally binding. The Carmel Indiana Estate Planning Questionnaire and Worksheets consist of various sections and questions tailored to cover all aspects of estate planning. These include: 1. Personal Information: Capturing essential details such as full legal name, contact information, date of birth, and social security number of the individual. 2. Family Members and Beneficiaries: Documenting information about immediate family members, extended relatives, and intended beneficiaries, including their names, relationships, and contact details. 3. Assets and Liabilities: Gathering data on all types of assets owned, such as real estate, bank accounts, investments, retirement accounts, insurance policies, valuable possessions, and any outstanding debts or liabilities. 4. Financial Affairs: Here, individuals provide detailed information regarding their income sources, debts, mortgages, loans, credit cards, and outstanding financial obligations. 5. Healthcare Preferences: This section covers instructions related to healthcare decisions, including desires regarding medical treatments, end-of-life care, organ donation preferences, and designation of healthcare proxies. 6. Executor and Trustee Designation: Allowing individuals to designate a trusted person or professional entity responsible for managing their estate and ensuring the proper distribution of assets. 7. Guardianship of Minor Children: If applicable, individuals can name a guardian who would care for their minor children in the event of their incapacitation or demise. 8. Special Instructions and Wishes: This section provides an opportunity to include any specific requests, personalized messages, and funeral or memorial service preferences. The Carmel Indiana Estate Planning Questionnaire and Worksheets aim to streamline the estate planning process by ensuring that individuals thoroughly consider all crucial aspects. It helps avoid overlooking important details and enables attorneys or legal professionals to efficiently create customized estate planning documents, such as wills, trusts, power of attorney, and advanced healthcare directives. These worksheets can be tailored to the unique needs of each individual or family, making them versatile and adaptable. Overall, the Carmel Indiana Estate Planning Questionnaire and Worksheets simplify the often complex and overwhelming estate planning process, offering a user-friendly approach to secure one's assets, ensure personal wishes are honored, and provide peace of mind for the future.