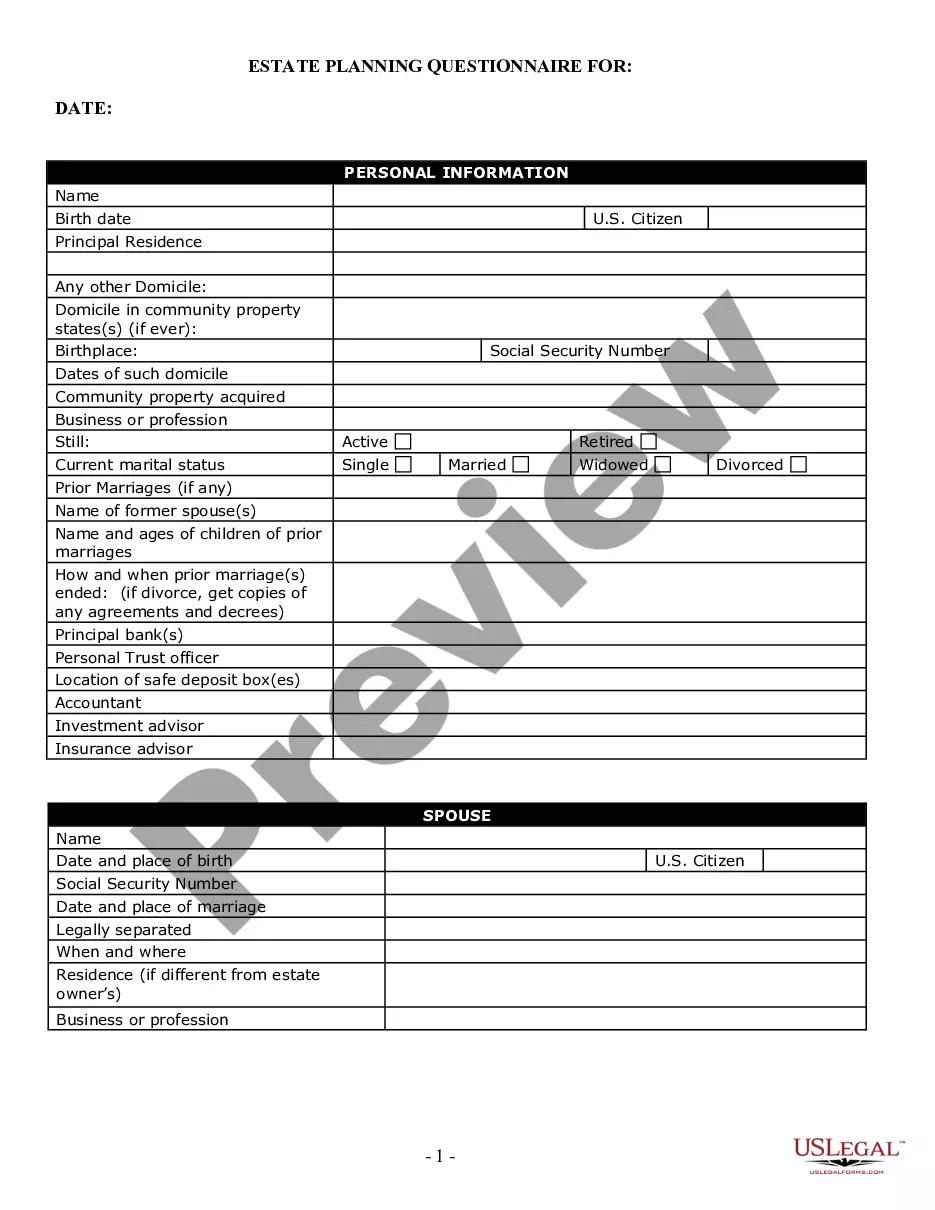

This form is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

The Indianapolis Indiana Estate Planning Questionnaire and Worksheets are comprehensive legal documents designed to assist individuals in organizing and planning their estate in the state of Indiana, specifically in the city of Indianapolis. These questionnaires and worksheets are typically used by individuals who want to ensure the smooth transfer of their assets and property to their chosen beneficiaries after their death, as well as to protect their interests during their lifetime. The Indianapolis Indiana Estate Planning Questionnaire and Worksheets contain a series of detailed questions and sections that cover various aspects of estate planning. These sections often include personal information, family details, asset inventories, and contact information of key individuals involved in the estate planning process. Some key sections within the Indianapolis Indiana Estate Planning Questionnaire and Worksheets may include: 1. Personal Information: This section gathers basic information about the individual, such as their full name, address, and contact details. It may also include information about their marital status, children, and other family members. 2. Executor and Trustee: This section focuses on identifying the person appointed to handle the administration and distribution of the estate, known as the executor or personal representative. It may also address the appointment of a trustee if there are specific trust arrangements involved. 3. Asset Inventory: This section seeks to document all the assets and property owned by the individual, providing a comprehensive overview of their financial holdings. It typically covers real estate, bank accounts, investments, retirement accounts, insurance policies, business interests, and personal possessions. 4. Beneficiaries and Distribution: This section outlines the intended beneficiaries of the estate and details the distribution plan for each asset. It may also address specific bequests, charitable donations, and any conditions or restrictions placed on the distribution of assets. 5. Guardianship: If the individual has minor children, this section will address the appointment of legal guardians and backup guardians to ensure the care and well-being of the children in the event of the individual's incapacitation or death. 6. Healthcare Directives: This section covers important healthcare decisions, including the appointment of a healthcare proxy or power of attorney for medical decisions. It may also include instructions regarding end-of-life care, organ donation, and funeral arrangements. It is important to note that the specific content and structure of the Indianapolis Indiana Estate Planning Questionnaire and Worksheets may vary depending on the attorney, law firm, or service provider offering them. Multiple versions of these documents may exist, tailored to different types of clients or estate planning needs like simple wills, trusts, or complex estate planning involving business succession.The Indianapolis Indiana Estate Planning Questionnaire and Worksheets are comprehensive legal documents designed to assist individuals in organizing and planning their estate in the state of Indiana, specifically in the city of Indianapolis. These questionnaires and worksheets are typically used by individuals who want to ensure the smooth transfer of their assets and property to their chosen beneficiaries after their death, as well as to protect their interests during their lifetime. The Indianapolis Indiana Estate Planning Questionnaire and Worksheets contain a series of detailed questions and sections that cover various aspects of estate planning. These sections often include personal information, family details, asset inventories, and contact information of key individuals involved in the estate planning process. Some key sections within the Indianapolis Indiana Estate Planning Questionnaire and Worksheets may include: 1. Personal Information: This section gathers basic information about the individual, such as their full name, address, and contact details. It may also include information about their marital status, children, and other family members. 2. Executor and Trustee: This section focuses on identifying the person appointed to handle the administration and distribution of the estate, known as the executor or personal representative. It may also address the appointment of a trustee if there are specific trust arrangements involved. 3. Asset Inventory: This section seeks to document all the assets and property owned by the individual, providing a comprehensive overview of their financial holdings. It typically covers real estate, bank accounts, investments, retirement accounts, insurance policies, business interests, and personal possessions. 4. Beneficiaries and Distribution: This section outlines the intended beneficiaries of the estate and details the distribution plan for each asset. It may also address specific bequests, charitable donations, and any conditions or restrictions placed on the distribution of assets. 5. Guardianship: If the individual has minor children, this section will address the appointment of legal guardians and backup guardians to ensure the care and well-being of the children in the event of the individual's incapacitation or death. 6. Healthcare Directives: This section covers important healthcare decisions, including the appointment of a healthcare proxy or power of attorney for medical decisions. It may also include instructions regarding end-of-life care, organ donation, and funeral arrangements. It is important to note that the specific content and structure of the Indianapolis Indiana Estate Planning Questionnaire and Worksheets may vary depending on the attorney, law firm, or service provider offering them. Multiple versions of these documents may exist, tailored to different types of clients or estate planning needs like simple wills, trusts, or complex estate planning involving business succession.