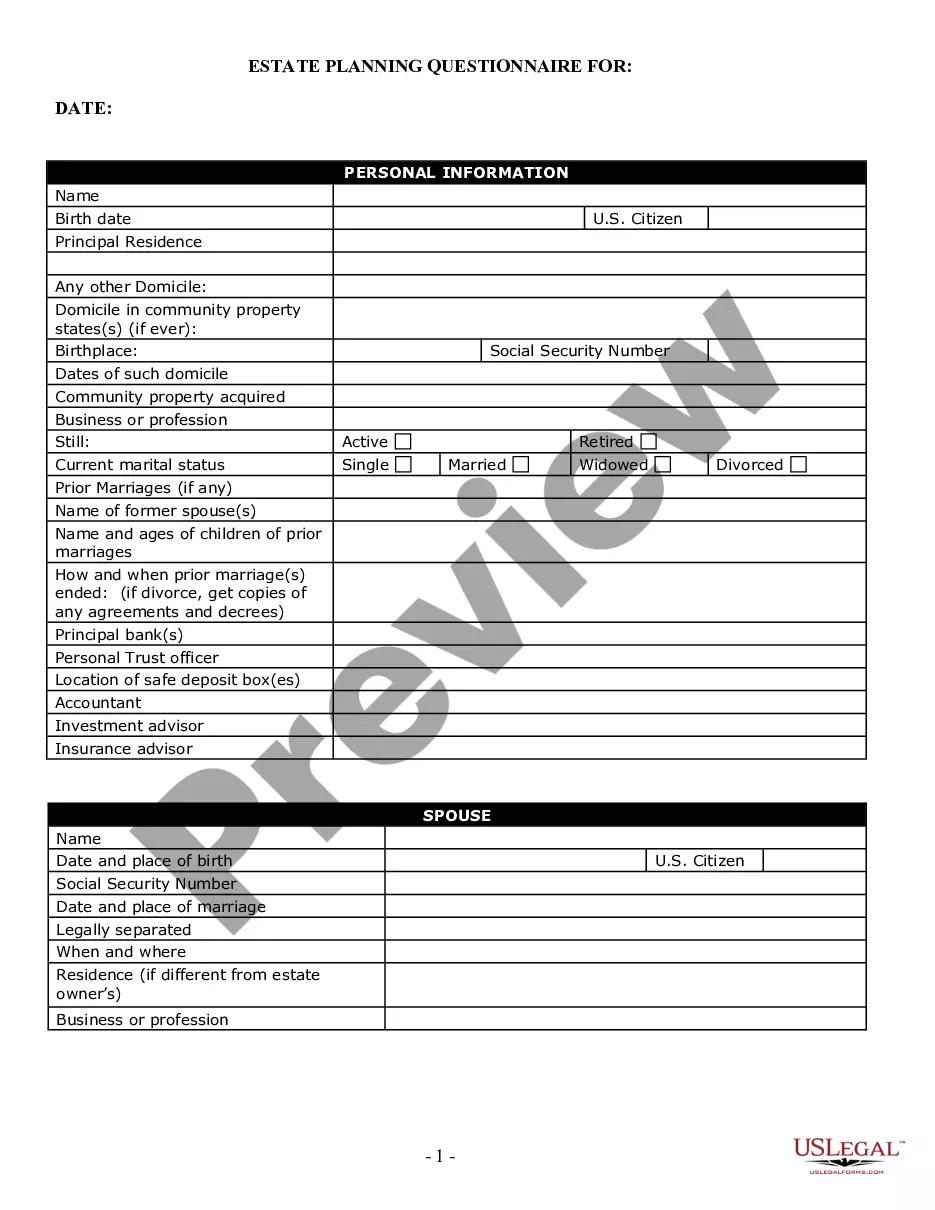

This form is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

South Bend Indiana Estate Planning Questionnaire and Worksheets are comprehensive tools designed to aid individuals in the process of creating an effective estate plan. These documents gather important information necessary for establishing a personalized estate plan to protect and distribute assets according to the individual's wishes. The South Bend Indiana Estate Planning Questionnaire and Worksheets ensure that no crucial details are overlooked and provide a structured framework for discussing estate planning decisions with an attorney. The questionnaire and worksheets cover various aspects of estate planning, including asset inventory, beneficiary designations, financial accounts, real estate, life insurance policies, retirement plans, and any outstanding debts or loans. By gathering information on these elements, the questionnaire and worksheets help individuals evaluate their current financial situation and plan for the future. Different types of South Bend Indiana Estate Planning Questionnaire and Worksheets may include: 1. Basic Estate Planning Questionnaire: This document covers essential details, such as personal information, marital status, and family structure. It also addresses key elements like healthcare directives, powers of attorney, and preferences for end-of-life decisions. 2. Asset Inventory Worksheet: This worksheet focuses on identifying and cataloging all the assets an individual owns, including bank accounts, investments, real estate properties, vehicles, valuables, and personal belongings. It helps individuals ascertain their net worth and facilitates the distribution process. 3. Beneficiary Designation Worksheet: This worksheet assists in designating beneficiaries for various assets, such as life insurance policies, retirement accounts, and payable-on-death accounts. It ensures that individuals can specify who will receive specific assets upon their passing. 4. Digital Assets Worksheet: With the increasing importance of digital assets, this worksheet helps individuals compile information about their online accounts, usernames, passwords, and instructions for accessing and managing these assets after their demise. 5. Charitable Giving Worksheet: For those interested in philanthropy, this worksheet allows individuals to outline their charitable objectives and include details about preferred organizations, donation amounts, and specific charitable intentions in their estate plan. It is essential to consult with an experienced estate planning attorney while utilizing the South Bend Indiana Estate Planning Questionnaire and Worksheets. This legal professional can guide individuals through the process, provide advice based on their specific goals, and ensure that all legal requirements and regulations are met.South Bend Indiana Estate Planning Questionnaire and Worksheets are comprehensive tools designed to aid individuals in the process of creating an effective estate plan. These documents gather important information necessary for establishing a personalized estate plan to protect and distribute assets according to the individual's wishes. The South Bend Indiana Estate Planning Questionnaire and Worksheets ensure that no crucial details are overlooked and provide a structured framework for discussing estate planning decisions with an attorney. The questionnaire and worksheets cover various aspects of estate planning, including asset inventory, beneficiary designations, financial accounts, real estate, life insurance policies, retirement plans, and any outstanding debts or loans. By gathering information on these elements, the questionnaire and worksheets help individuals evaluate their current financial situation and plan for the future. Different types of South Bend Indiana Estate Planning Questionnaire and Worksheets may include: 1. Basic Estate Planning Questionnaire: This document covers essential details, such as personal information, marital status, and family structure. It also addresses key elements like healthcare directives, powers of attorney, and preferences for end-of-life decisions. 2. Asset Inventory Worksheet: This worksheet focuses on identifying and cataloging all the assets an individual owns, including bank accounts, investments, real estate properties, vehicles, valuables, and personal belongings. It helps individuals ascertain their net worth and facilitates the distribution process. 3. Beneficiary Designation Worksheet: This worksheet assists in designating beneficiaries for various assets, such as life insurance policies, retirement accounts, and payable-on-death accounts. It ensures that individuals can specify who will receive specific assets upon their passing. 4. Digital Assets Worksheet: With the increasing importance of digital assets, this worksheet helps individuals compile information about their online accounts, usernames, passwords, and instructions for accessing and managing these assets after their demise. 5. Charitable Giving Worksheet: For those interested in philanthropy, this worksheet allows individuals to outline their charitable objectives and include details about preferred organizations, donation amounts, and specific charitable intentions in their estate plan. It is essential to consult with an experienced estate planning attorney while utilizing the South Bend Indiana Estate Planning Questionnaire and Worksheets. This legal professional can guide individuals through the process, provide advice based on their specific goals, and ensure that all legal requirements and regulations are met.