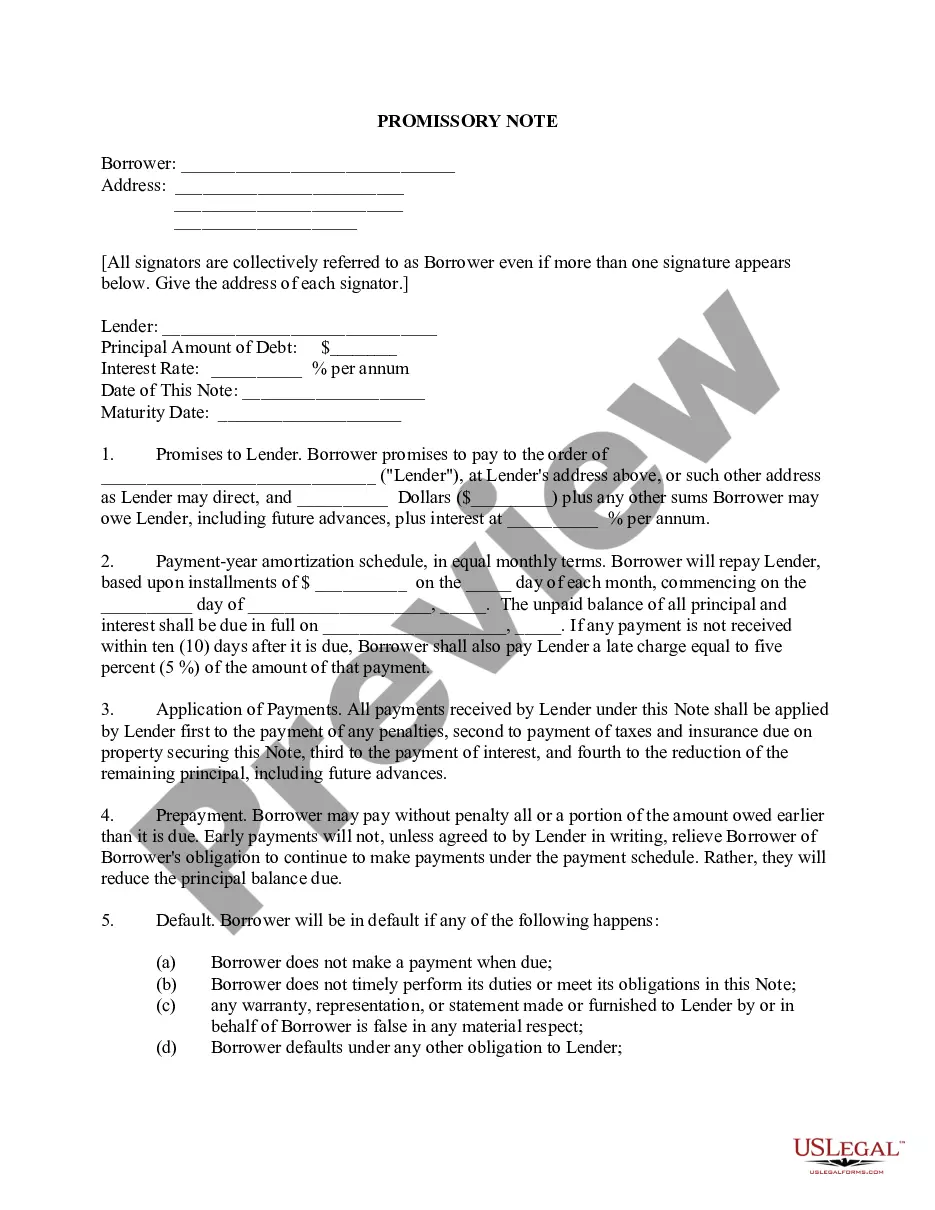

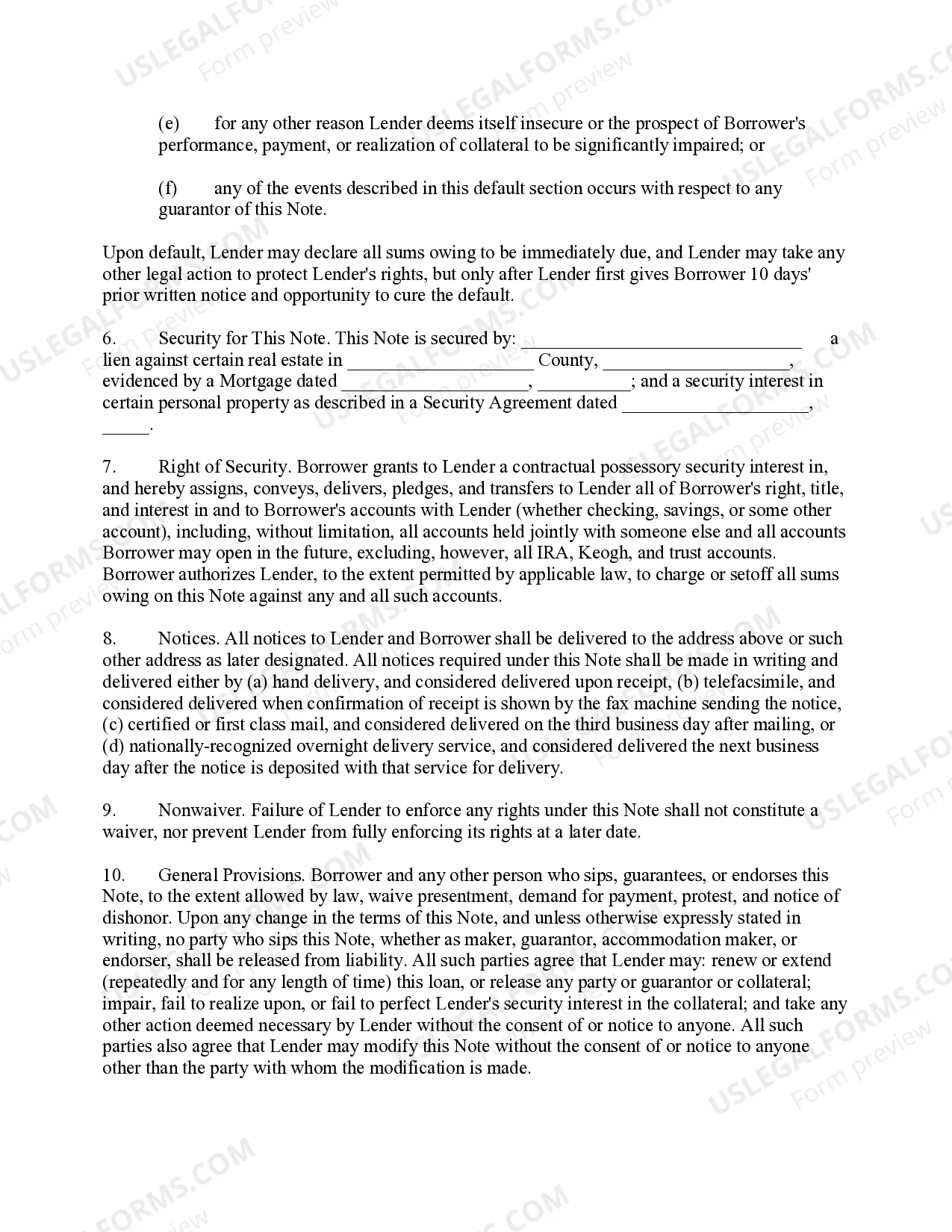

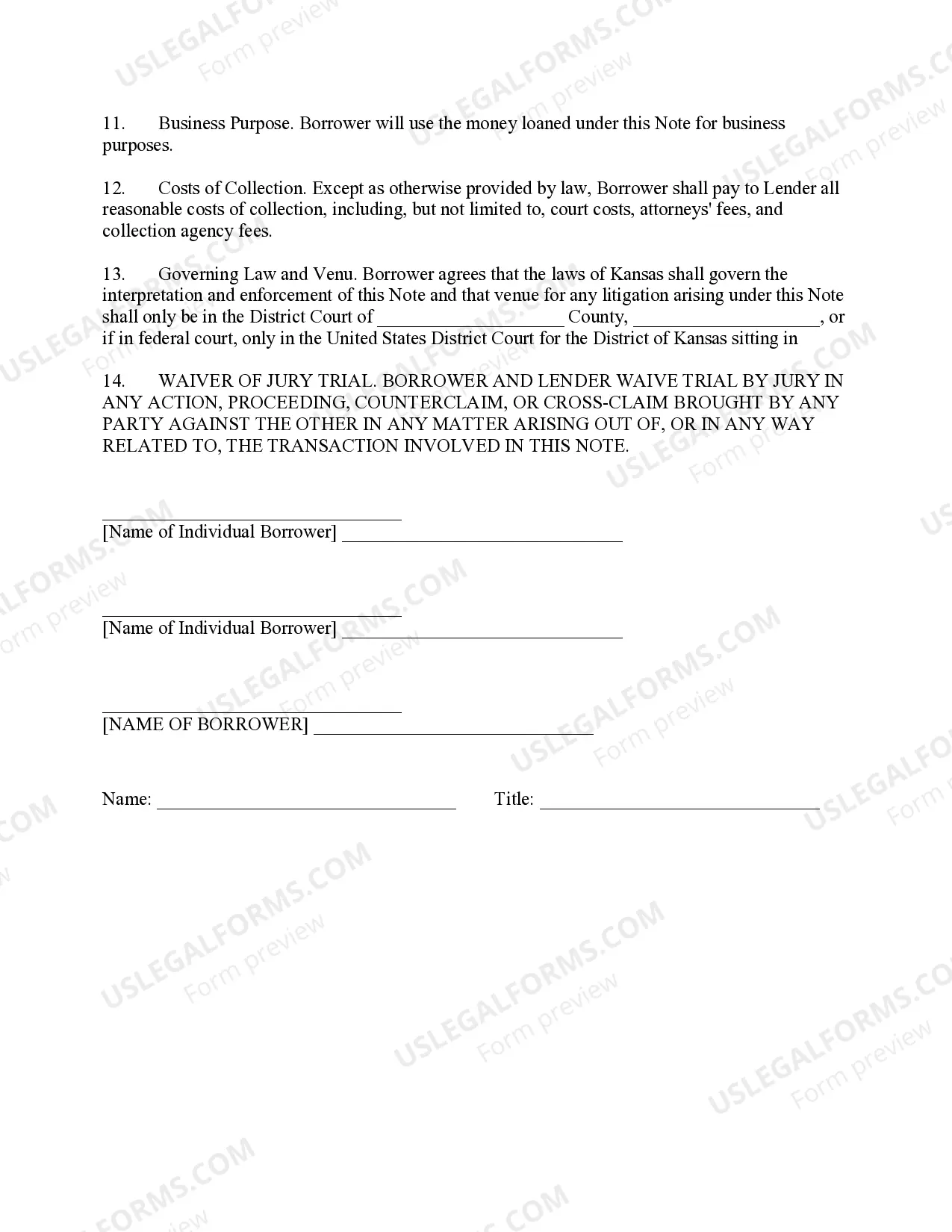

The Olathe Kansas Secured Promissory Note with Monthly Installment Payments is a legal document used in the city of Olathe, Kansas, that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note provides a secure arrangement by attaching collateral to the loan, ensuring the lender's rights and potentially reducing the risk associated with lending. The note specifies the repayment plan, with monthly installment payments being the chosen method. This repayment structure allows the borrower to repay the loan over time in fixed amounts, making it more manageable and predictable. Each installment payment includes both principal and interest components, reducing the outstanding balance incrementally until the debt is fully paid. There may be variations of the Olathe Kansas Secured Promissory Note with Monthly Installment Payments, depending on the specific terms agreed upon by the parties involved. Some possible types include: 1. Real Estate Secured Promissory Note with Monthly Installment Payments: This type of promissory note is utilized when the borrower pledges real estate property as collateral for the loan. The property serves as security, providing assurance to the lender if the borrower defaults on repayment. 2. Vehicle Secured Promissory Note with Monthly Installment Payments: This variation involves using a vehicle as collateral. The borrower pledges their vehicle to the lender, granting the lender the right to repossess and sell the vehicle to recover the outstanding loan balance if necessary. 3. Personal Property Secured Promissory Note with Monthly Installment Payments: This type of promissory note secures the loan using personal assets besides real estate or vehicles. It could include valuable personal possessions such as jewelry, electronics, or artwork, which the lender can claim in the event of non-payment. It is essential for both the lender and borrower to review and understand the terms and clauses of the Olathe Kansas Secured Promissory Note with Monthly Installment Payments before signing. Consulting legal counsel can ensure compliance with local laws and protect the rights and interests of all parties involved.

Promissory Note Installment Payments

Description

How to fill out Olathe Kansas Secured Promissory Note With Monthly Installment Payments?

If you’ve previously taken advantage of our service, Log In to your account and store the Olathe Kansas Secured Promissory Note with Monthly Installment Payments on your device by clicking the Download button. Ensure your subscription is active. If it's not, renew it based on your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continuous access to all the documents you have purchased: you can find it in your profile within the My documents menu whenever you wish to reuse it. Utilize the US Legal Forms service to quickly discover and save any template for your personal or professional needs!

- Confirm you’ve located the correct document. Browse through the description and utilize the Preview option, if available, to verify if it satisfies your needs. If it's not suitable, make use of the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and finalize the payment. Use your credit card information or the PayPal option to finish the transaction.

- Receive your Olathe Kansas Secured Promissory Note with Monthly Installment Payments. Choose the file format for your document and store it to your device.

- Fill out your sample. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

To obtain a promissory note, you can either draft one yourself or choose a ready-made template. If you prefer an Olathe Kansas Secured Promissory Note with Monthly Installment Payments, consider using services like USLegalForms. Their platform provides user-friendly templates that require minimal effort to customize, making it easy for you to create a legal document that meets your specific requirements.

You can obtain a promissory note in several ways. One convenient option is to use online platforms like USLegalForms, which offer templates specifically for an Olathe Kansas Secured Promissory Note with Monthly Installment Payments. Simply choose the appropriate template, fill in your details, and customize it to fit your needs. This method saves you time and ensures legal compliance.

One disadvantage of a promissory note is that it may not provide as much protection as a mortgage, especially for large loans. If the borrower defaults, you might have limited recourse depending on the terms outlined in your Olathe Kansas Secured Promissory Note with Monthly Installment Payments. Understanding these risks is crucial in any lending situation. Utilizing resources from platforms like uslegalforms can help you navigate potential pitfalls effectively.

To record a promissory note payment, keep a detailed ledger that includes the payment date, amount, and remaining balance after each payment. This will help both parties track the financial exchange accurately, especially for an Olathe Kansas Secured Promissory Note with Monthly Installment Payments. Maintaining accurate records can prevent misunderstandings in the future. Consider utilizing online tools or legal services like uslegalforms for easy management of your records.

Alternatives to a promissory note include secured loans or mortgage agreements, depending on your situation. Each option has its benefits, like providing more detailed repayment terms or offering collateral. However, if you prefer flexibility, an Olathe Kansas Secured Promissory Note with Monthly Installment Payments can be an excellent choice for manageable payments. Evaluate your specific needs to determine the best option.

In general, it is advisable to record a secured promissory note to protect your interests, especially for an Olathe Kansas Secured Promissory Note with Monthly Installment Payments. Recording establishes a public record of your agreement and secures your claim against the borrower's assets. It can also strengthen your position if disputes arise concerning the repayment. Using a legal platform like uslegalforms can help you navigate the recording process smoothly.

A secured promissory note is backed by collateral, which means if the borrower defaults, the lender can claim the asset. In contrast, a standard promissory note may not have such backing. For those exploring an Olathe Kansas Secured Promissory Note with Monthly Installment Payments, understanding this difference is crucial for both financial security and risk management.

A promissory note does not necessarily have to be notarized to be valid, but notarization can provide additional security. In the case of an Olathe Kansas Secured Promissory Note with Monthly Installment Payments, having the document notarized can help establish authenticity and prove the agreement in court if needed. Always consult local laws for specific requirements.

Filling out a promissory note is straightforward. First, you need to include the date, names, and addresses of both the borrower and lender. Next, clearly state the amount borrowed, the interest rate, and the terms of repayment. Ensure that you mention the payment schedule, especially if you are using an Olathe Kansas Secured Promissory Note with Monthly Installment Payments.

While it is not a requirement for a secured promissory note to be notarized, doing so can be beneficial. Notarization adds an extra layer of verification, which can be helpful in legal disputes regarding an Olathe Kansas Secured Promissory Note with Monthly Installment Payments. Consider your specific needs and consult with legal resources, such as uslegalforms, to determine the best approach for your situation.