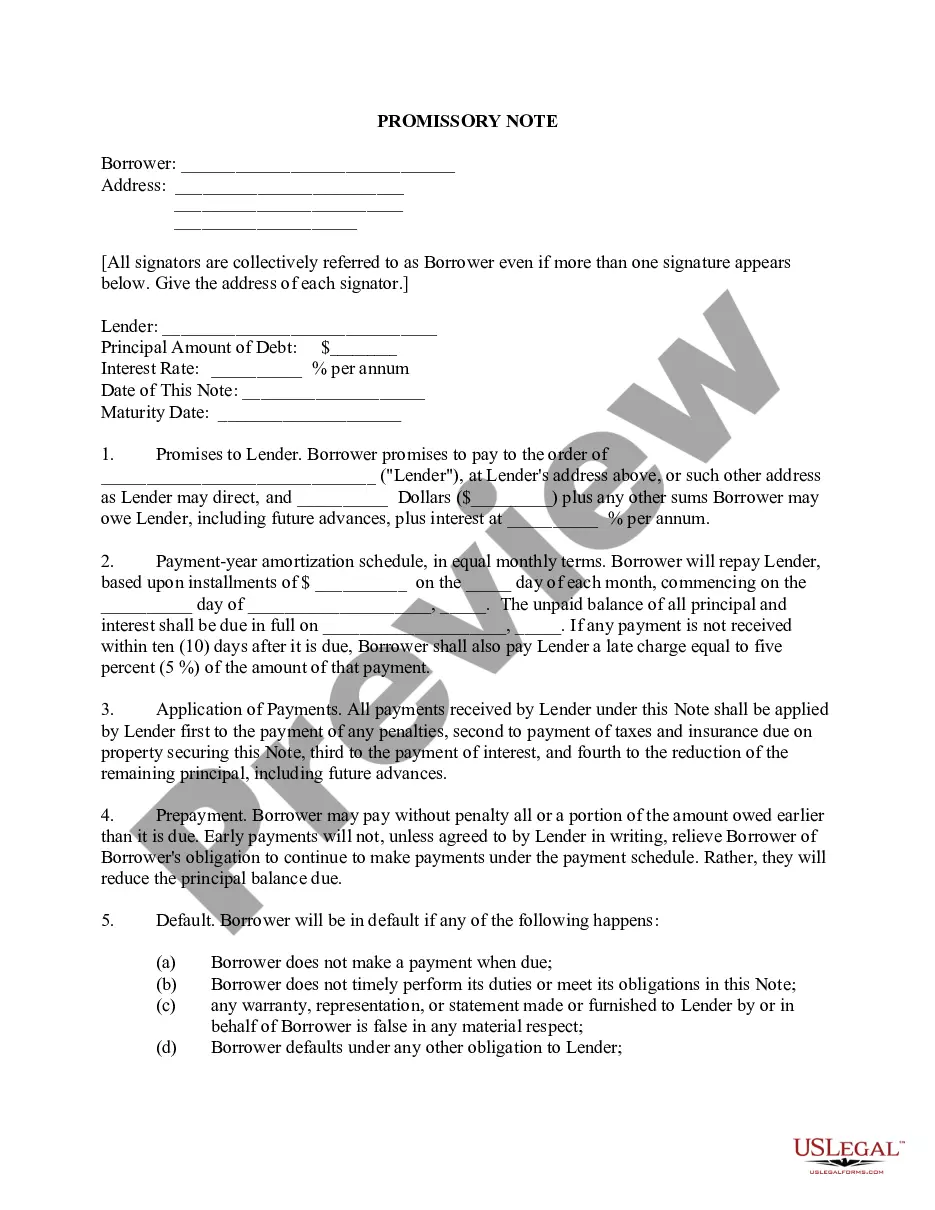

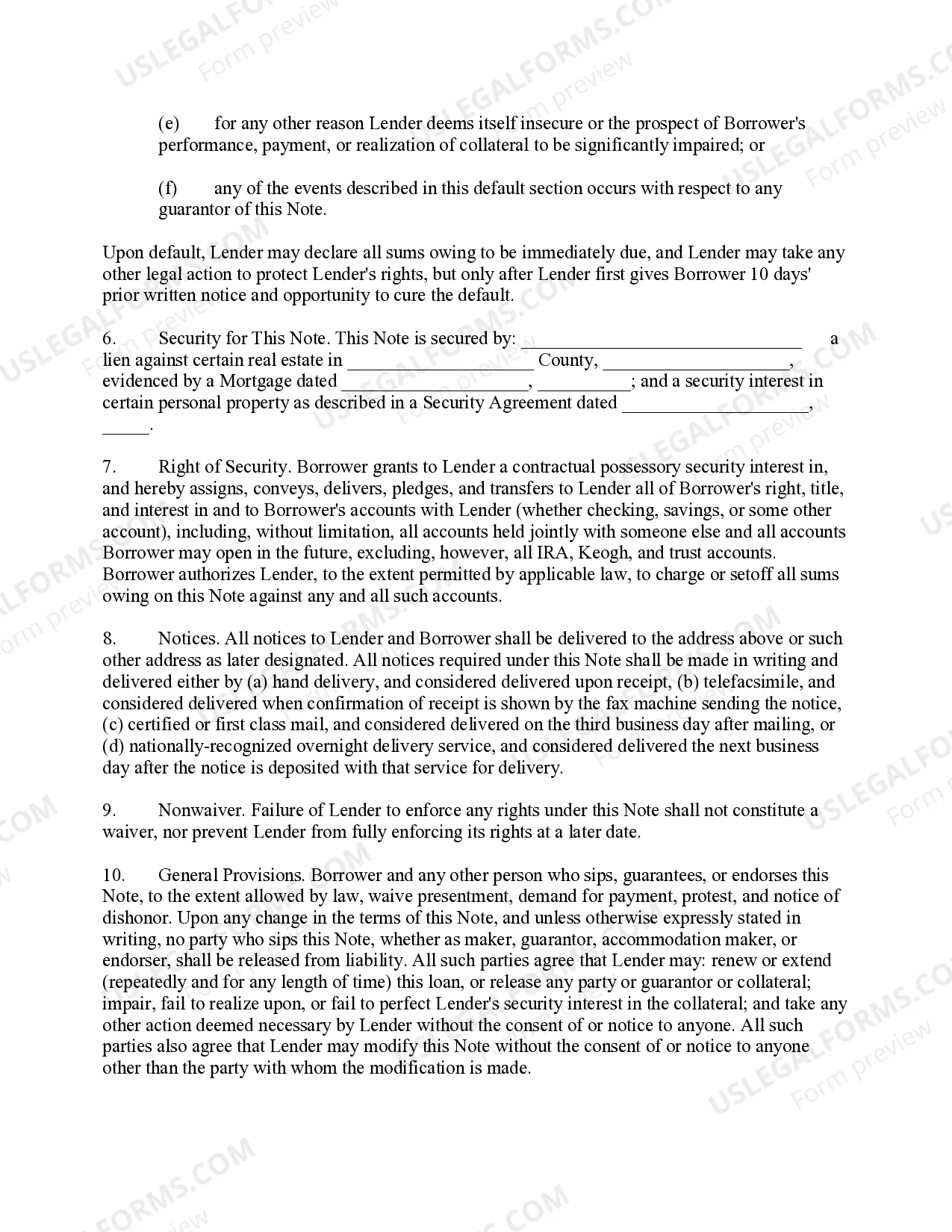

A Topeka Kansas Secured Promissory Note with Monthly Installment Payments is a legal document that outlines the terms and conditions of a loan agreement between a lender and borrower in Topeka, Kansas. This financial instrument provides security to the lender by securing the loan with collateral, which could be real estate, vehicles, or other valuable assets. The borrower agrees to make monthly installment payments to repay the loan amount, including interest, over a specified period. The Topeka Kansas Secured Promissory Note with Monthly Installment Payments is an effective way for lenders to protect their investments and ensure the borrower's commitment to repayment. By including collateral, lenders have the right to seize the assets in the event of default, minimizing their risk. This arrangement brings security and trust to both parties involved in the loan agreement. Common types of Topeka Kansas Secured Promissory Note with Monthly Installment Payments include: 1. Real Estate Secured Promissory Note: This type of promissory note is secured by a property or real estate asset, typically a house or land. 2. Vehicle Secured Promissory Note: This type of promissory note is secured by the borrower's vehicle, such as a car, motorcycle, or recreational vehicle (RV). 3. Personal Property Secured Promissory Note: This type of promissory note is secured by valuable personal property, such as jewelry, artwork, or electronics. 4. Business Asset Secured Promissory Note: This type of promissory note is secured by the borrower's business assets, including equipment, inventory, or accounts receivable. Regardless of the type, a Topeka Kansas Secured Promissory Note with Monthly Installment Payments provides a clear and legally binding agreement between the lender and borrower. It outlines the loan amount, interest rate, repayment schedule, consequences of default, and terms for collateral release. This document ensures a smooth and transparent borrowing process while minimizing the risks for both parties involved.

Topeka Kansas Secured Promissory Note with Monthly Installment Payments

Description

How to fill out Topeka Kansas Secured Promissory Note With Monthly Installment Payments?

Are you looking for a trustworthy and inexpensive legal forms supplier to get the Topeka Kansas Secured Promissory Note with Monthly Installment Payments? US Legal Forms is your go-to choice.

No matter if you require a basic arrangement to set rules for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of particular state and county.

To download the document, you need to log in account, find the needed form, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Topeka Kansas Secured Promissory Note with Monthly Installment Payments conforms to the laws of your state and local area.

- Read the form’s details (if provided) to learn who and what the document is good for.

- Restart the search if the form isn’t suitable for your legal situation.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Topeka Kansas Secured Promissory Note with Monthly Installment Payments in any provided format. You can get back to the website at any time and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time researching legal papers online for good.