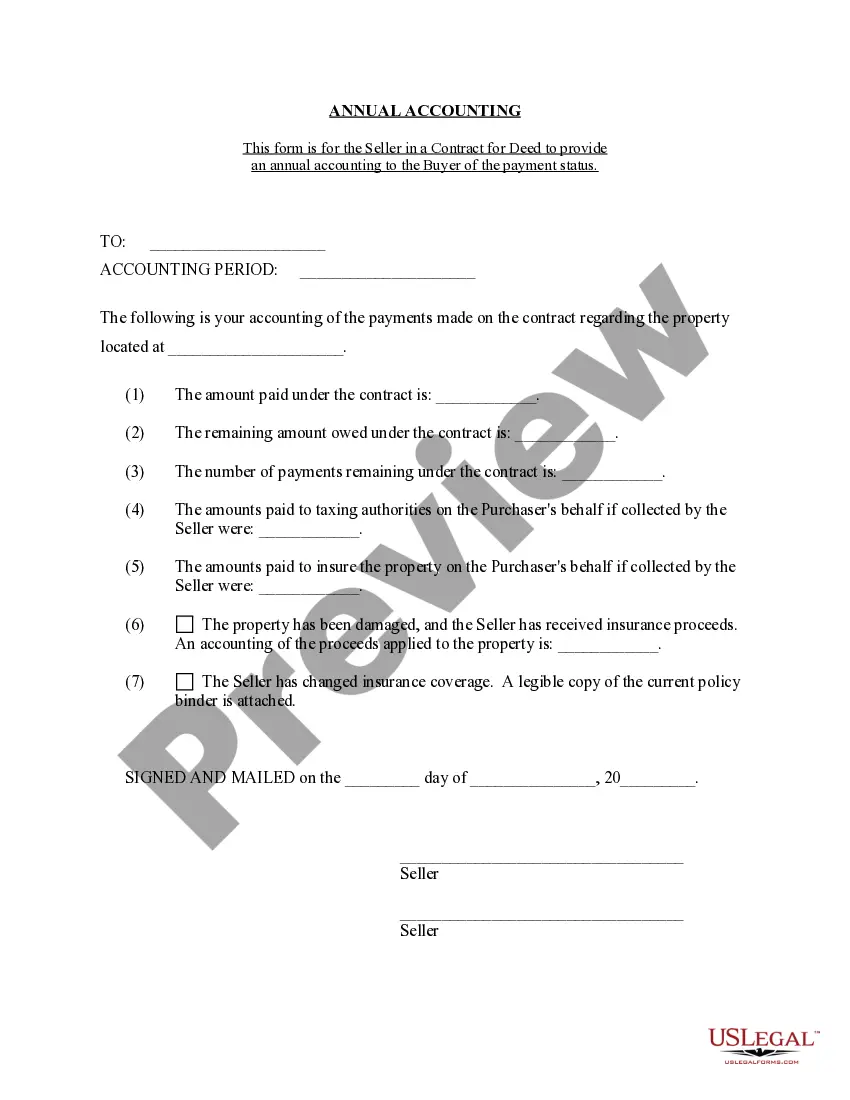

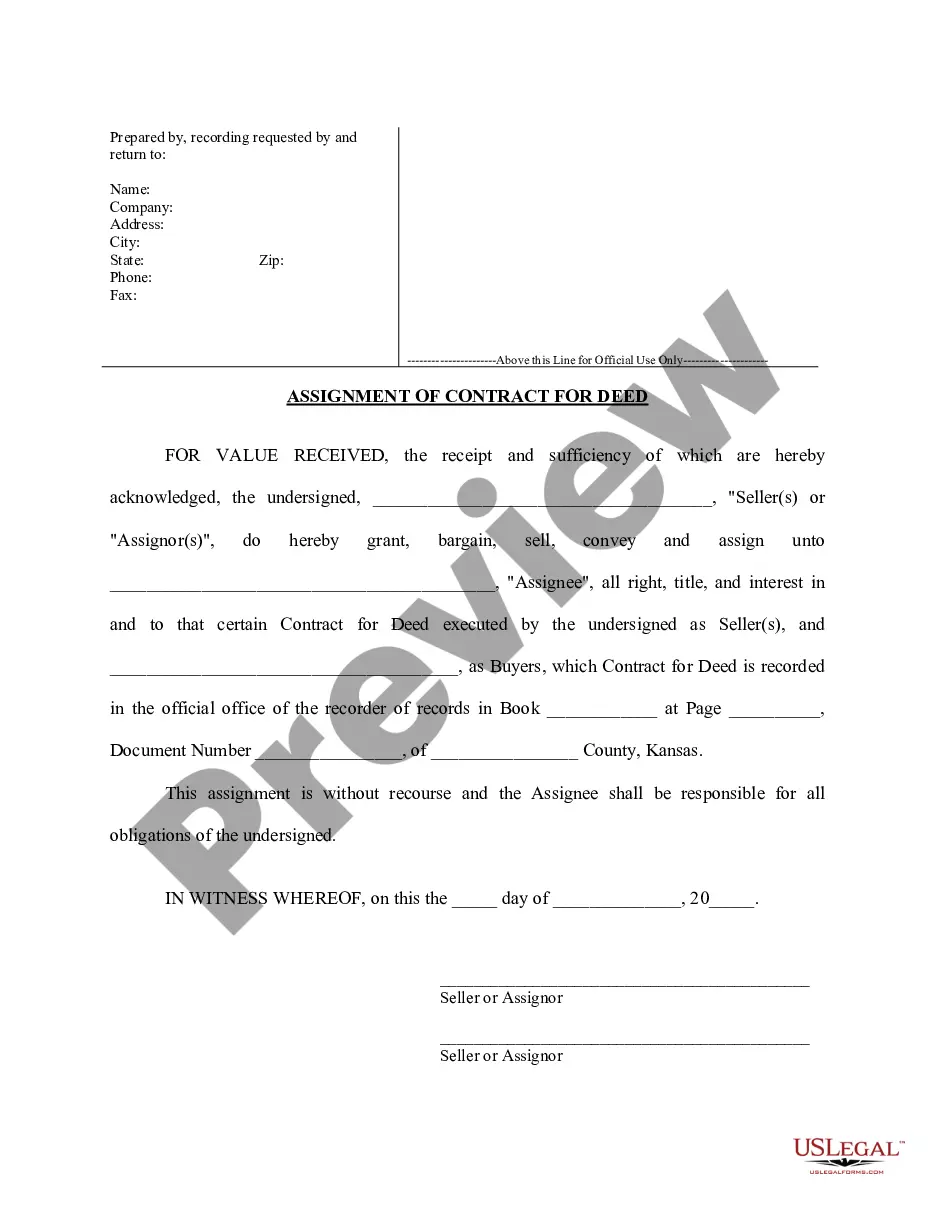

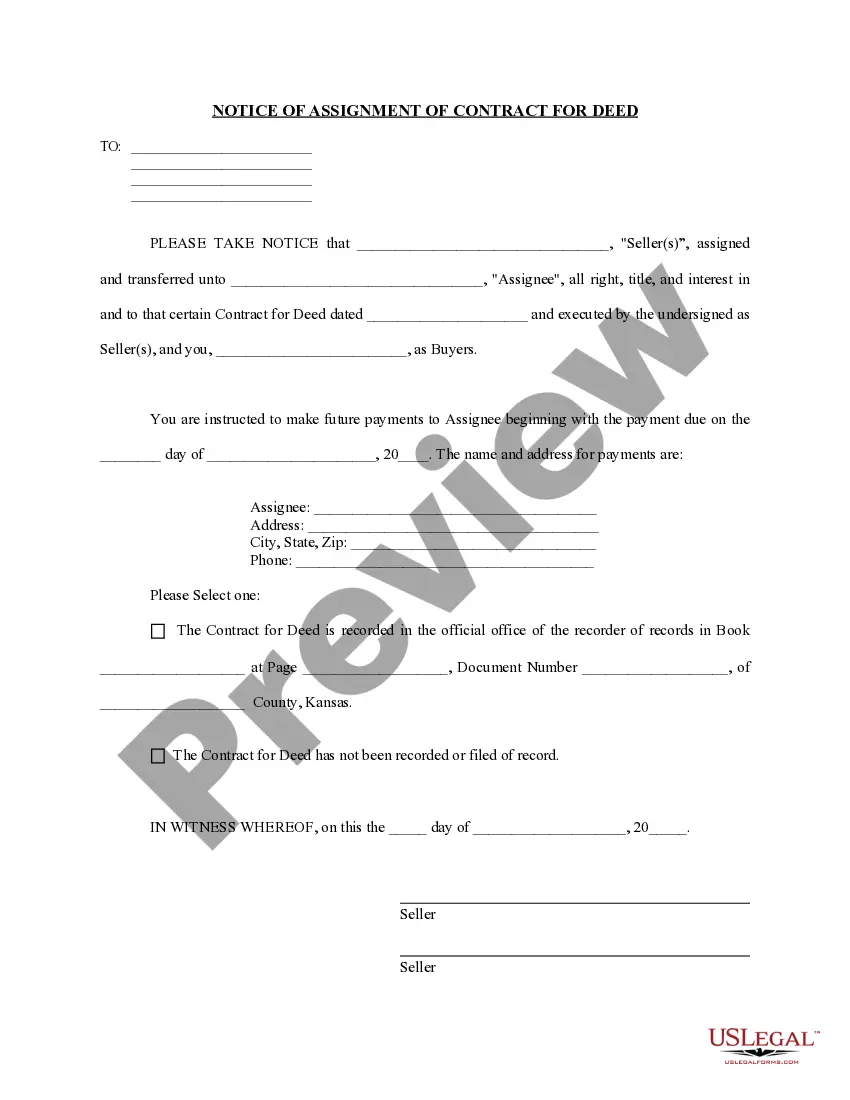

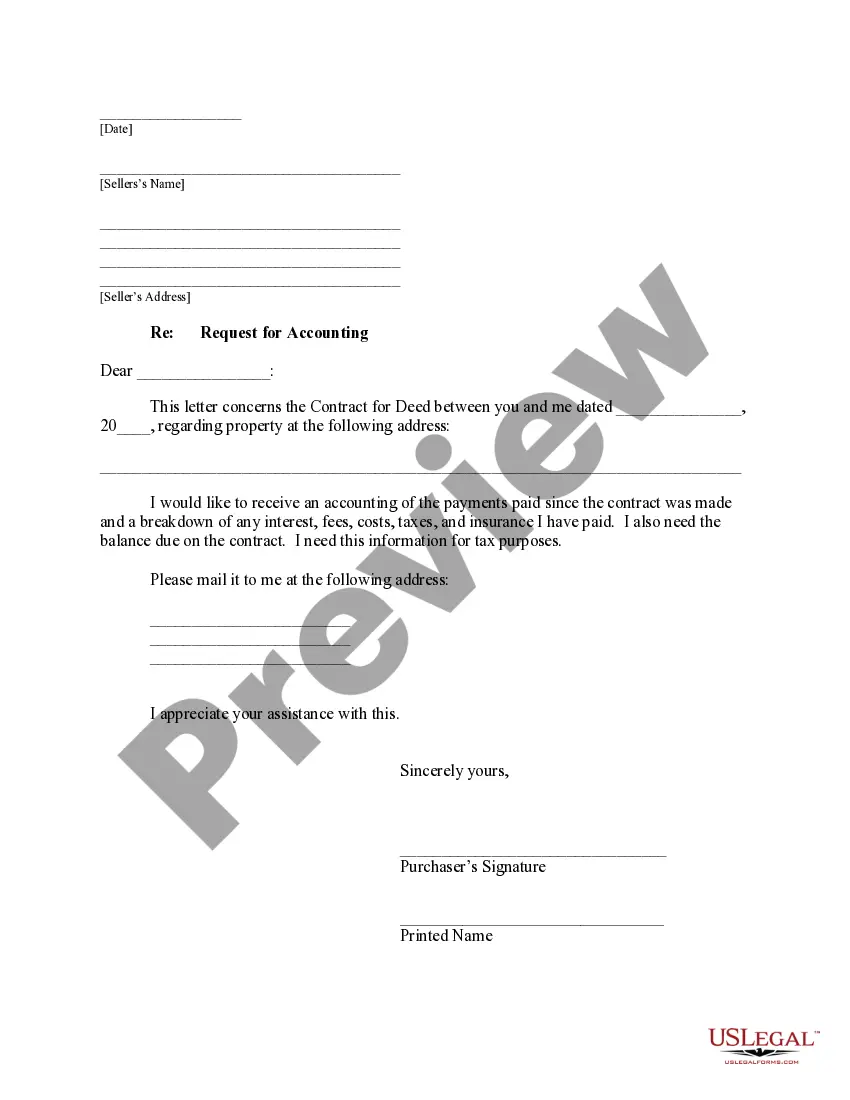

Olathe Kansas Buyer's Request for Accounting from Seller under Contract for Deed is a common inquiry raised by potential buyers who are interested in purchasing property in Olathe, Kansas through a contract for deed agreement. This request seeks detailed financial information from the seller, providing transparency and insights into the financial health of the property and the seller's obligations. By using the relevant keywords, we can better explain the different types of buyer's requests for accounting under a contract for deed in Olathe, Kansas. 1. Financial Disclosure: One type of buyer's request for accounting entails a comprehensive financial disclosure from the seller. It includes documents such as profit and loss statements, balance sheets, and cash flow statements, which offer a clear understanding of the property's financial performance, debts, and liabilities. 2. Detailed Expense Breakdown: Another type of buyer's request for accounting is a detailed breakdown of the property's expenses. This may include a list of monthly mortgage payments, taxes, insurance premiums, maintenance costs, homeowner association fees, and utility bills. Buyers want to ensure they have a complete picture of ongoing financial obligations related to the property. 3. Income Verification: Buyers may request the seller to provide documentation that verifies the income streams associated with the property. This may include tenant rental agreements, lease agreements, and detailed rent rolls. Verification of income helps buyers assess the potential return on investment and evaluate the property's earning capacity. 4. Tax Records Review: In certain cases, buyers may want to review the seller's tax records in order to gain insights into the property's tax history and potential tax liabilities. This information can be valuable for buyers when determining if the property's financial situation aligns with their investment goals. 5. Outstanding Liabilities: Buyers may also request information regarding any outstanding liens, judgments, or encumbrances on the property. Understanding these potential liabilities helps buyers evaluate the legal and financial risks they may be assuming when purchasing the property. Overall, the Olathe Kansas Buyer's Request for Accounting from Seller under Contract for Deed encompasses various types of inquiries seeking detailed financial information. By utilizing relevant keywords such as financial disclosure, expense breakdown, income verification, tax records review, and outstanding liabilities, buyers can make informed decisions while considering a property purchase in Olathe, Kansas.

Olathe Kansas Buyer's Request for Accounting from Seller under Contract for Deed

Description

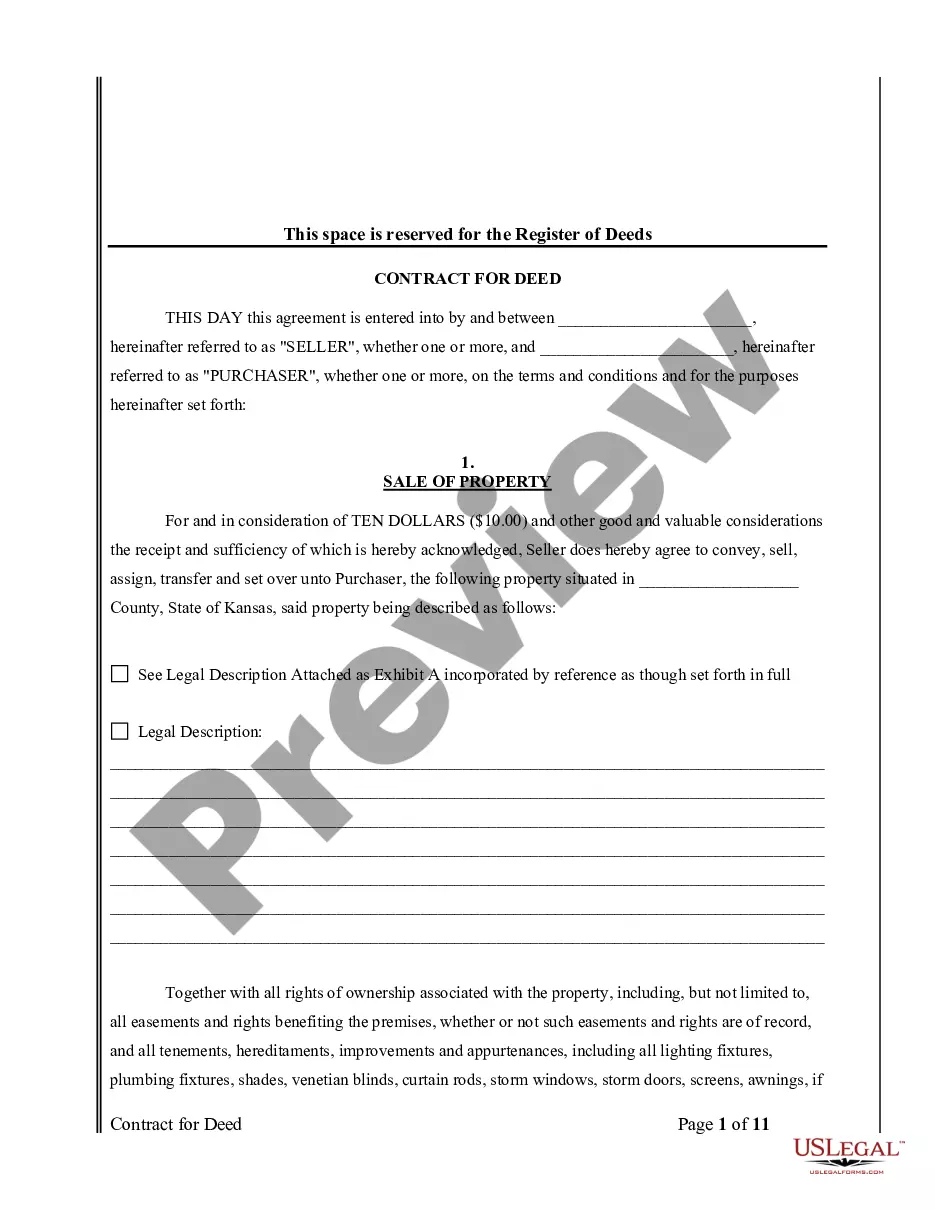

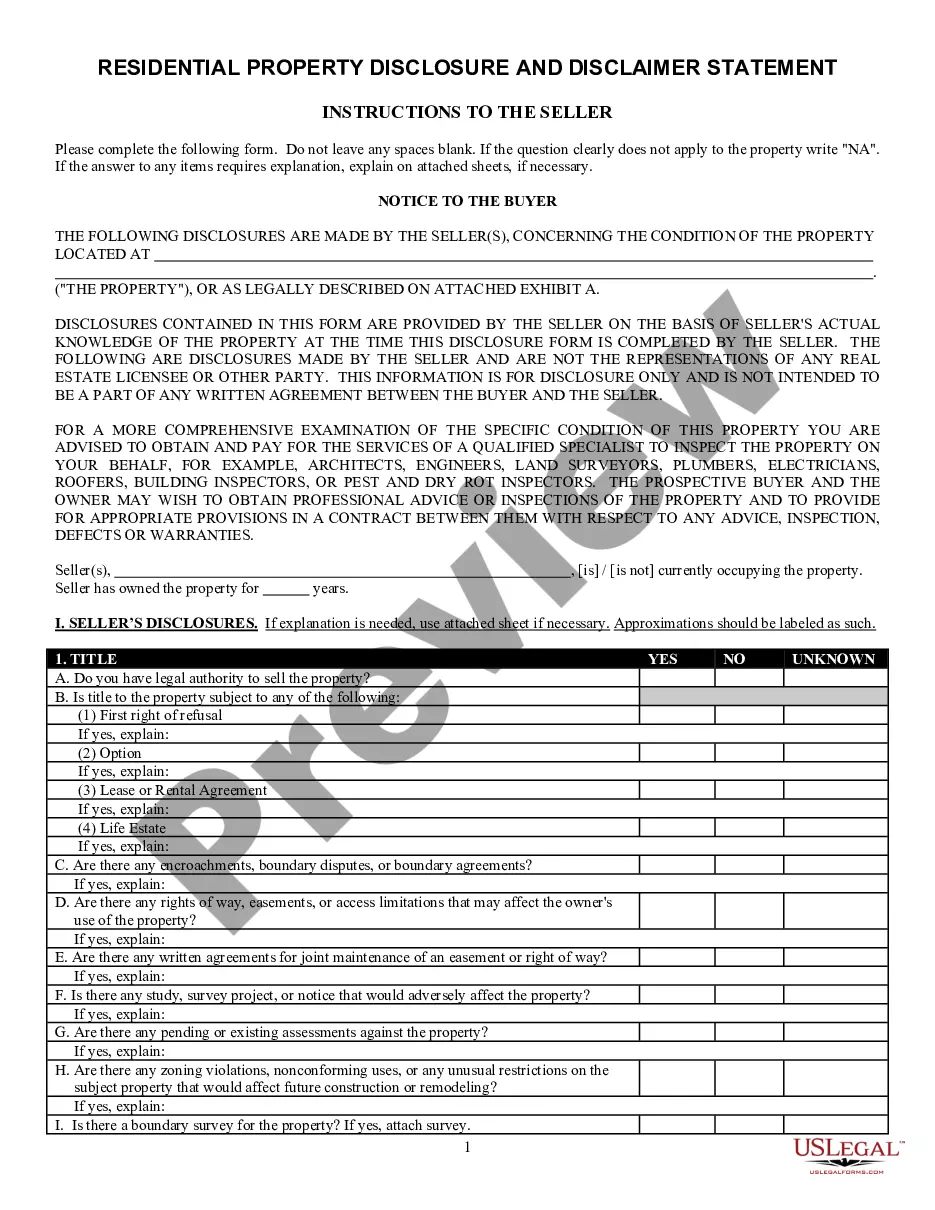

How to fill out Olathe Kansas Buyer's Request For Accounting From Seller Under Contract For Deed?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Olathe Kansas Buyer's Request for Accounting from Seller under Contract for Deed gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Olathe Kansas Buyer's Request for Accounting from Seller under Contract for Deed takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few more steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve selected the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Olathe Kansas Buyer's Request for Accounting from Seller under Contract for Deed. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!