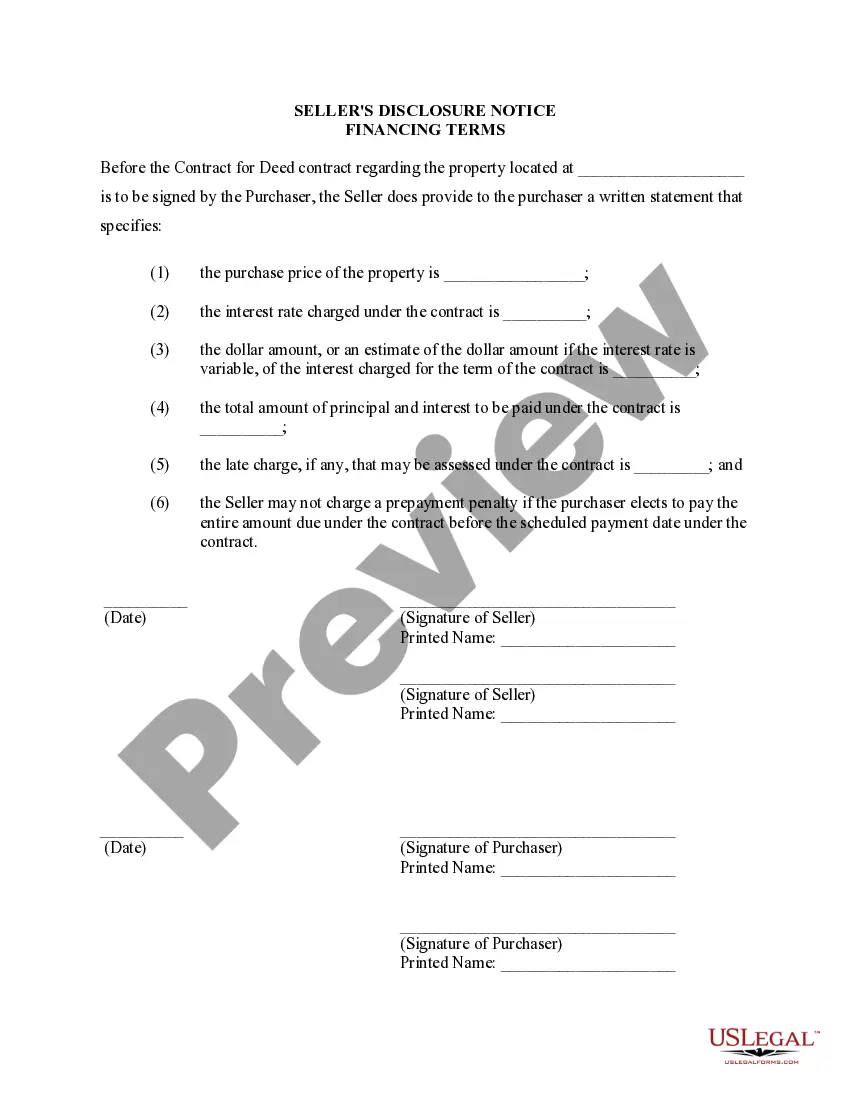

Topeka Kansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is an important document that outlines the terms and conditions related to the financing of residential property in Topeka, Kansas. This disclosure is typically provided by the seller to the buyer, allowing them to make an informed decision before entering into a contract or agreement for deed. The disclosure document includes a comprehensive description of the financing terms, key details, and important provisions that both parties need to be aware of. It is essential to understand and comply with these terms to ensure a smooth real estate transaction process. The following are some relevant keywords to be included: 1. Financing Options: The disclosure will outline the various financing options available for the residential property. This may include traditional mortgages from banks or credit unions, seller financing, or land contracts. 2. Interest Rates: The disclosure will disclose the interest rates associated with the financing options. This allows the buyer to compare rates and make an informed decision. 3. Down Payment: The document also specifies the required down payment or the initial payment that the buyer must make to secure the financing. It may vary depending on the type of financing chosen. 4. Payment Terms: The disclosure describes the payment terms and schedules, including the frequency of payments, due dates, and any late payment penalties. 5. Balloon Payments: Some land contracts or agreements for deed may include a balloon payment, which is a large, final payment due at the end of the contract term. This will be clearly explained in the disclosure. 6. Default and Termination: The disclosure will outline the consequences of defaulting on payments or breaching the contract terms, including potential foreclosure or termination of the agreement. 7. Property Condition: The document may include a section stating the condition of the residential property at the time of the agreement. This informs the buyer about any known defects or issues. 8. Buyer's Responsibilities: The disclosure may specify the buyer's responsibilities, such as maintaining insurance coverage, paying property taxes, or making necessary repairs and improvements. 9. Seller's Representations: The disclosure will include any representations or warranties made by the seller, such as clear title to the property or absence of significant liens or encumbrances. 10. Arbitration or Mediation: In some cases, the disclosure may address dispute resolution mechanisms, such as arbitration or mediation, should any disagreements arise during the contract term. It is important to note that these keywords may vary from one specific type of seller's disclosure to another. Therefore, it is crucial to review the particular disclosure document provided in Topeka, Kansas, for accurate and detailed information unique to that jurisdiction.

Topeka Kansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Topeka Kansas Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

We always strive to minimize or prevent legal damage when dealing with nuanced legal or financial matters. To accomplish this, we apply for legal services that, as a rule, are extremely costly. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of legal counsel. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Topeka Kansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Topeka Kansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Topeka Kansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract would work for your case, you can pick the subscription plan and make a payment.

- Then you can download the document in any suitable file format.

For over 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!