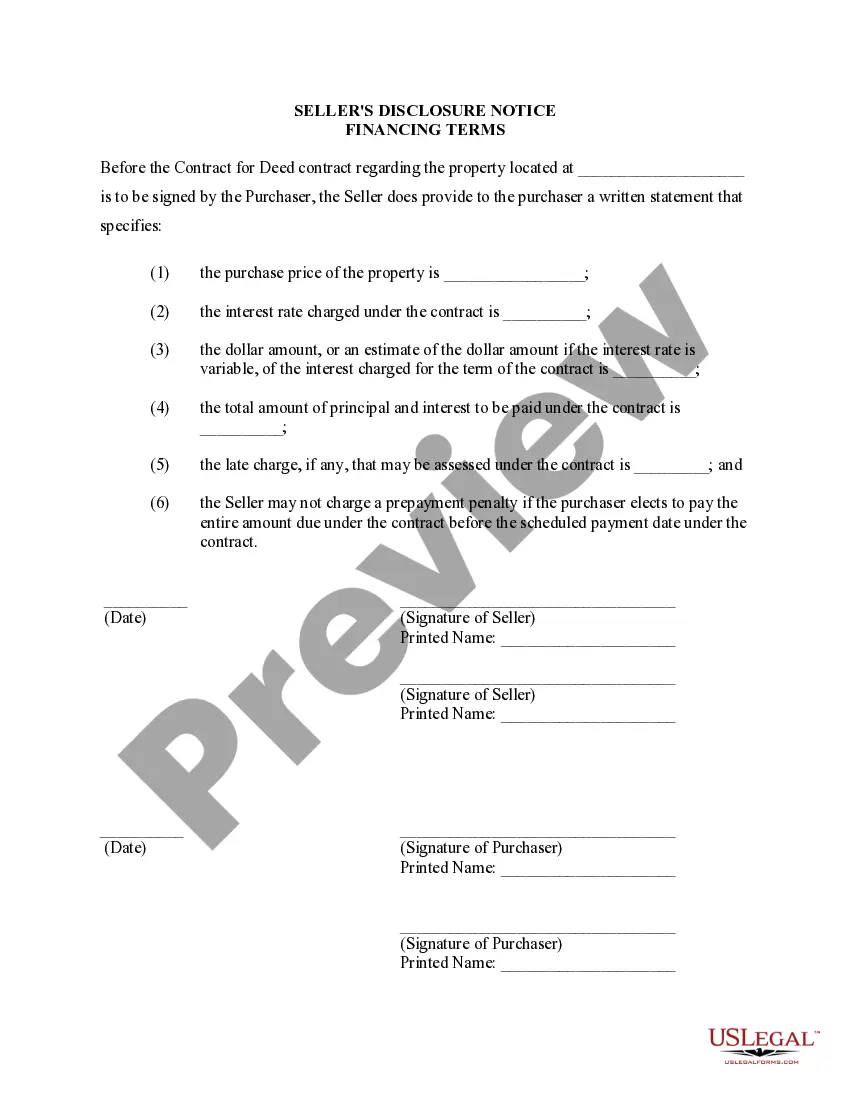

In Wichita, Kansas, the Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as Land Contract, is a crucial document that outlines the specific financing terms and conditions associated with the purchase of a residential property. This disclosure is important as it ensures transparency and protects the interests of both the seller and the buyer. There are several types of Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed in Wichita, Kansas, and understanding their distinctions is essential for both sellers and buyers. Here are a few common variations: 1. Standard Financing Terms Disclosure: This type of disclosure document provides the standard financing terms typically utilized in residential property transactions in Wichita, Kansas. It may include information regarding the principal amount, interest rate, repayment period, any prepayment penalties, and the expected monthly payment amount. 2. Adjustable-Rate Mortgage (ARM) Disclosure: This specific disclosure is applicable when the financing terms involve an adjustable-rate mortgage. It outlines the initial fixed-rate period, subsequent adjustment intervals, and provides details about how the interest rate will be determined during each adjustment period. 3. Balloon Payment Disclosure: If the financing terms involve a balloon payment, this disclosure will clarify the exact amount of the balloon payment, when it is due, and any other relevant details. A balloon payment is a larger, lump-sum payment that becomes due at the end of a specific period, often used to reduce monthly payment amounts during the loan term. 4. Owner Financing Disclosure: In cases where the seller acts as the lender and offers financing directly to the buyer instead of a traditional mortgage from a financial institution, an Owner Financing Disclosure is required. This disclosure will outline the terms, including the interest rate, repayment schedule, and any additional charges or fees. 5. Subordination Agreement Disclosure: A subordination agreement is relevant when the seller's financing terms are subordinate to an existing mortgage or lien on the property. This disclosure explains the relationship between the seller's financing terms and the primary mortgage or lien, ensuring that the buyer is aware of any potential risks or limitations. Whether you are a seller or a buyer, it is crucial to review the Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed thoroughly. Seek legal guidance if necessary, and ensure that all the terms and conditions are clearly understood and agreed upon before entering into any transaction involving residential property in Wichita, Kansas.

Wichita Kansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Wichita Kansas Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Are you looking for a reliable and affordable legal forms provider to get the Wichita Kansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract? US Legal Forms is your go-to solution.

No matter if you require a simple agreement to set rules for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed in accordance with the requirements of specific state and county.

To download the document, you need to log in account, find the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Wichita Kansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the document is intended for.

- Restart the search if the template isn’t suitable for your specific situation.

Now you can register your account. Then select the subscription plan and proceed to payment. As soon as the payment is done, download the Wichita Kansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract in any provided format. You can return to the website at any time and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time researching legal paperwork online for good.