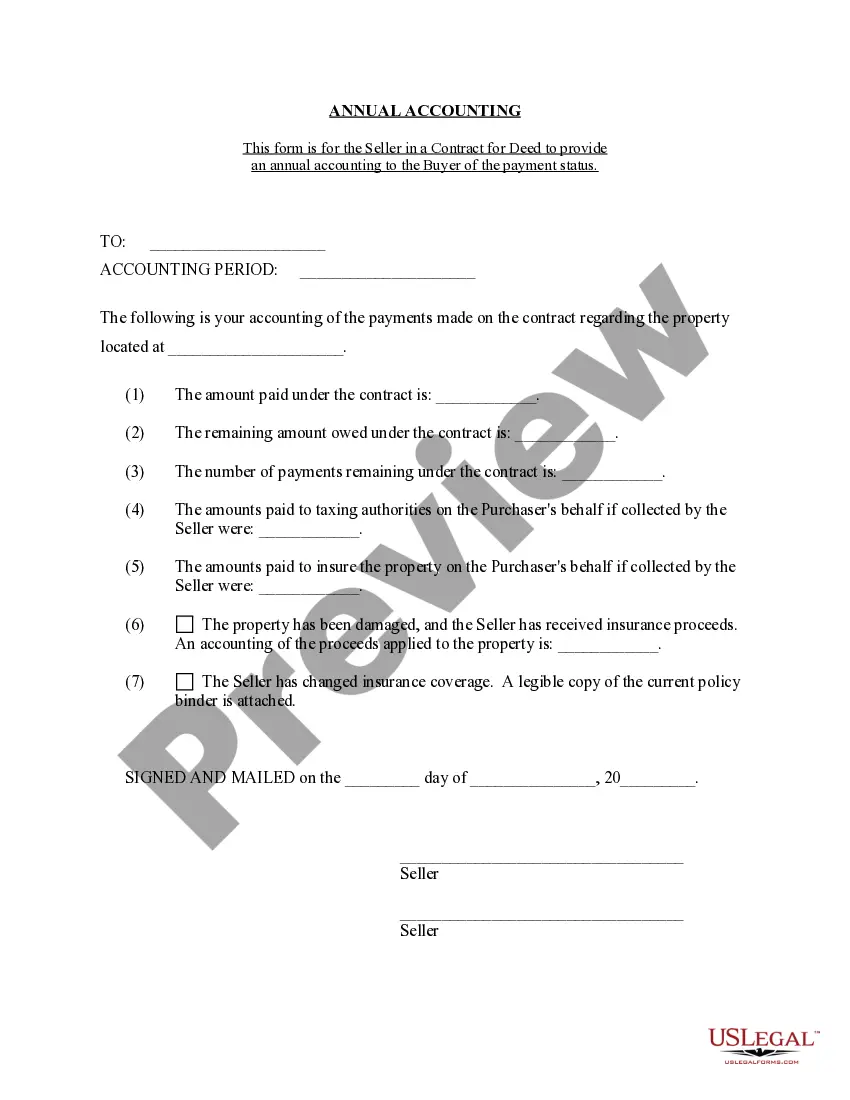

The Overland Park Kansas Contract for Deed Seller's Annual Accounting Statement serves as a vital tool in documenting and disclosing financial transactions related to a property acquired through a contract for deed in Overland Park, Kansas. This statement enables sellers to transparently report income, expenses, and other financial aspects to the buyer, ensuring a fair and reliable record of the property's financial standing. In essence, the Contract for Deed Seller's Annual Accounting Statement is a thorough financial summary prepared by the seller on an annual basis, outlining the property's financial performance during the previous calendar year. This statement plays a crucial role in maintaining accountability and facilitating a smooth transaction process. Key elements included in the Overland Park Kansas Contract for Deed Seller's Annual Accounting Statement may encompass: 1. Income: The statement should account for any income received from the property, such as rent payments or any other monetary benefits earned throughout the year. 2. Expenses: It is imperative to record all property-related expenses, including property taxes, insurance premiums, repairs and maintenance costs, utilities, management fees, and any other relevant expenditures incurred during the year. 3. Mortgage Payments: If the seller has an underlying mortgage on the property, the statement should document the mortgage payments made during the accounting period. 4. Principal Reduction: If the contract allows for principal reduction, this aspect should be outlined in the annual statement, specifying the amount of principal reduction made in the given year. 5. Miscellaneous Transactions: Any additional financial transactions that occurred during the year relating to the property, such as late fees, penalties, or other income or expenses, should be thoroughly documented. 6. Closing Balance: The statement should present a detailed calculation of the closing balance, considering all the aforementioned aspects. This closing balance reflects the property's net financial position at the end of the accounting period and is vital for maintaining accurate records. Different types of Overland Park Kansas Contract for Deed Seller's Annual Accounting Statements may be classified based on property type or specific provisions set forth in the contract for deed agreement. For example: 1. Residential Property Annual Accounting Statement: This type of statement is utilized for residential properties, including single-family homes, townhouses, duplexes, or condos acquired through a contract for deed. 2. Commercial Property Annual Accounting Statement: If the contract for deed involves the purchase of a commercial property, such as an office building, retail space, or industrial facility, a specific annual accounting statement tailored to commercial real estate may be required. 3. Income-Generating Property Annual Accounting Statement: In cases where the property is rented out and generates income, an annual accounting statement that focuses on rental income, expenses, and related financial data becomes essential. By diligently preparing and providing an accurate and detailed Overland Park Kansas Contract for Deed Seller's Annual Accounting Statement, sellers can foster transparency, build trust, and maintain a favorable business relationship with buyers, ensuring a smooth and successful transaction process.

Overland Park Kansas Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Overland Park Kansas Contract For Deed Seller's Annual Accounting Statement?

Take advantage of the US Legal Forms and have immediate access to any form you want. Our useful website with a huge number of templates makes it simple to find and obtain virtually any document sample you require. It is possible to download, complete, and sign the Overland Park Kansas Contract for Deed Seller's Annual Accounting Statement in a matter of minutes instead of surfing the Net for many hours trying to find an appropriate template.

Utilizing our catalog is an excellent way to raise the safety of your document filing. Our professional legal professionals on a regular basis review all the documents to make certain that the forms are relevant for a particular state and compliant with new laws and regulations.

How can you get the Overland Park Kansas Contract for Deed Seller's Annual Accounting Statement? If you have a profile, just log in to the account. The Download option will be enabled on all the documents you look at. Moreover, you can find all the earlier saved files in the My Forms menu.

If you don’t have an account yet, follow the instructions listed below:

- Find the template you require. Ensure that it is the template you were hoping to find: examine its headline and description, and utilize the Preview option when it is available. Otherwise, make use of the Search field to find the needed one.

- Launch the saving process. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order using a credit card or PayPal.

- Export the document. Choose the format to obtain the Overland Park Kansas Contract for Deed Seller's Annual Accounting Statement and edit and complete, or sign it according to your requirements.

US Legal Forms is probably the most extensive and reliable document libraries on the web. We are always happy to assist you in virtually any legal case, even if it is just downloading the Overland Park Kansas Contract for Deed Seller's Annual Accounting Statement.

Feel free to take advantage of our form catalog and make your document experience as efficient as possible!