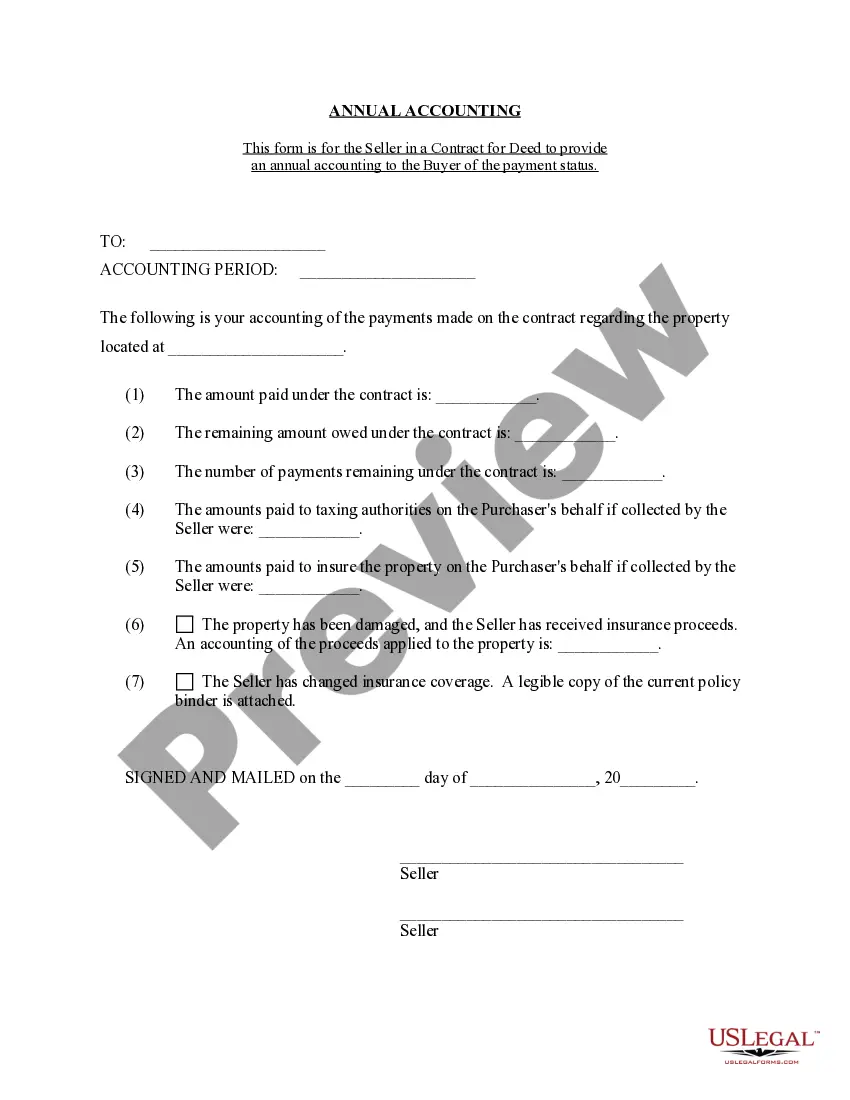

Wichita Kansas Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Kansas Contract For Deed Seller's Annual Accounting Statement?

Regardless of social or vocational standing, completing law-related paperwork is a regrettable requirement in the current professional landscape.

Often, it is nearly impossible for individuals lacking legal expertise to assemble such documents independently, primarily due to the intricate language and legal nuances they encompass.

This is where US Legal Forms steps in to assist.

Confirm that the template you found is appropriate for your area, as the regulations of one state may not apply to another.

Review the document and read through a brief overview (if available) regarding situations in which the document can be utilized.

- Our platform provides a vast array of over 85,000 ready-to-use state-specific forms applicable to nearly any legal situation.

- US Legal Forms serves as a valuable tool for associates or legal advisors aiming to conserve time by utilizing our DIY documents.

- Whether you require the Wichita Kansas Contract for Deed Seller's Annual Accounting Statement or any other form valid in your jurisdiction, US Legal Forms has everything readily accessible.

- Here's how to acquire the Wichita Kansas Contract for Deed Seller's Annual Accounting Statement in mere minutes with our dependable service.

- If you're already a member, feel free to Log In to your account to retrieve the necessary form.

- However, if you're new to our service, be sure to follow these instructions before obtaining the Wichita Kansas Contract for Deed Seller's Annual Accounting Statement.

Form popularity

FAQ

A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

Notary Fee. This refers to the negotiable cost that the buyer has to pay to have the Deed of Absolute Sale notarized, which usually hovers around 1-2% of the property value.

The rate for the deed of sale of a property is 1.5% of the selling price, fair market value, or zonal value, whichever is higher.

As a legal instrument or document evidencing a sale, the Deed of Absolute Sale should be also notarized, which requires a fee of about 1% to 1.5% of the property's selling price, but no lower than Php1,000.

The contract for deed shall contain a recital of the terms of the sale, the amount of cash paid at the sale, the amount of each of the annual installments, the date of payment of such annual installments, and the rate of interest thereon.

Contract for deed is a contract for the sale of land which provides that the buyer will acquire possession of the land immediately and pay the purchase price in installments over a period of time, but the seller will retain legal title until all payments are made.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

Disadvantages of Common Law Contracts Contracts cost time and money to write. Whether they're drafted by a lawyer or reviewed by one, or even if they are written by an HR professional, contracts require a good deal of energy and are not an inexpensive undertaking.