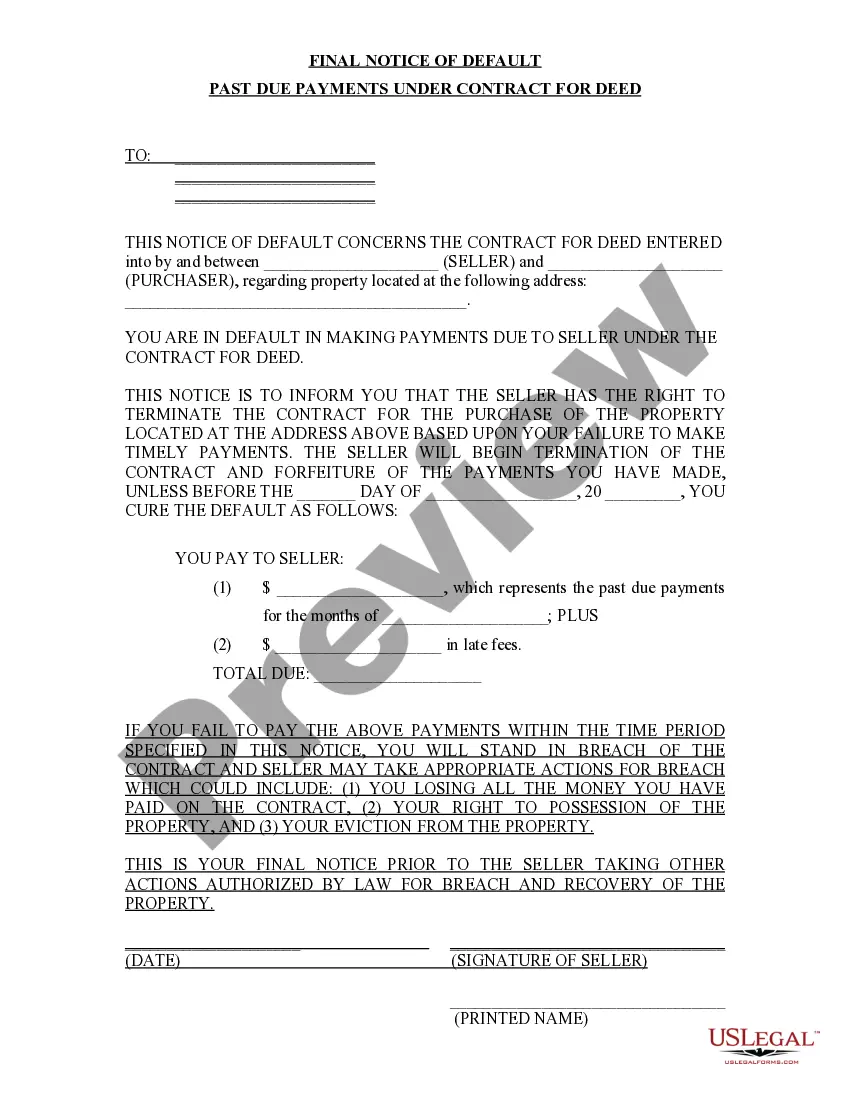

Topeka Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Kansas Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Regardless of social or occupational rank, finalizing legal documentation is an undesirable requirement in the current professional landscape.

Frequently, it’s nearly infeasible for someone lacking legal education to create such documents from the ground up, primarily due to the intricate language and legal nuances they include.

This is where US Legal Forms proves beneficial.

Ensure the template you selected is appropriate for your region, given that the laws of one state may not apply in another.

Examine the document and review a brief summary (if provided) of scenarios for which the document can be utilized.

- Our platform offers an extensive library with over 85,000 ready-to-use state-specific forms that are appropriate for almost any legal circumstance.

- US Legal Forms also acts as an excellent tool for associates or legal advisors who want to enhance their efficiency by utilizing our DIY forms.

- Whether you're in need of the Topeka Kansas Final Notice of Default for Past Due Payments in regards to Contract for Deed or any other paperwork suitable for your state or locality, with US Legal Forms, all you need is at your reach.

- Here’s how to obtain the Topeka Kansas Final Notice of Default for Past Due Payments related to Contract for Deed in just a few minutes using our reliable platform.

- If you already have a subscription, you can go ahead and Log In to your account to retrieve the necessary form.

- However, if you are not acquainted with our collection, make sure to follow these steps before acquiring the Topeka Kansas Final Notice of Default for Past Due Payments concerning Contract for Deed.

Form popularity

FAQ

Writing a notice of default requires clarity and precision. You should begin by specifying the debt details, including the amount past due and the payment dates. In a Topeka Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed, include all relevant parties' contact information and clearly state the consequences of continued non-payment. For assistance in crafting a notice that meets legal requirements, consider using uslegalforms, which offers templates and guidance to ensure that your notice effectively communicates your intent.

A default notice is a critical document indicating that your payments are overdue. Receiving a Topeka Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed signifies potential financial consequences and the risk of foreclosure. Ignoring this notice can lead to significant legal issues, impacting your credit and financial status. Therefore, addressing the notice swiftly is vital to protect your interests.

When you receive a Topeka Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed, it indicates that you are behind on your payments. This notice typically gives you a specified period to rectify the situation. If you do not respond or make the necessary payments, you may face further legal action, which could include the loss of your property. It is essential to take this notice seriously and explore your options promptly.

The purpose of a default notice is to formally communicate that a borrower has not met their repayment obligations. Specifically, the Topeka Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed alerts you to pending legal actions and encourages you to take corrective steps. This notice serves both as a wake-up call and a legal document that can initiate further action if ignored. Awareness and timely response can significantly impact your situation.

When a property goes into default, it means the owner has failed to meet their financial obligations, such as in the case of the Topeka Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed. The property may face foreclosure proceedings, where lenders seek to reclaim the property to recover the owed amounts. This situation not only affects your credit score but also limits your future financial options. Addressing the default quickly is essential to safeguard your investment.

A request for notice of default is a legal procedure that allows interested parties to receive updates about a borrower’s default status. If you are involved in a Contract for Deed in Topeka, this request will keep you in the loop about any missed payments. By understanding the implications of this request, you can prepare accordingly and possibly negotiate solutions with the other party. Being proactive can mitigate potential risks associated with defaults.

A request for notice of default signifies that a party wants to be informed if there are any defaults on a contract or payment plan. In the context of the Topeka Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed, this request helps parties stay informed about potential legal actions. It functions as a safeguard for parties involved, ensuring they have the opportunity to act before drastic measures are taken. Understanding this process can save you from unexpected challenges.

Receiving a Topeka Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed indicates that you are behind on your payments. This notice serves as an official warning, prompting you to take immediate action to remedy the situation. Ignoring the notice could lead to severe consequences, including foreclosure or eviction. It's crucial to address the issue promptly to protect your home and financial stability.

Terminating a contract for deed in Illinois requires a clear understanding of the terms outlined in your agreement. You typically need to provide written notice to the other party, including the reasons for termination. If there are outstanding payments, referencing something similar to the Topeka Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed will be crucial in articulating your position. For assistance in navigating this process, uslegalforms offers templates and guidance to help you take the right steps.

One disadvantage of a contract for deed is that the seller retains legal title to the property until the buyer pays off the contract. This can lead to potential complications if the buyer defaults on payments, potentially resulting in a Topeka Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed. Additionally, buyers may face limited recourse to protect their investment, making it crucial to assess these risks before entering a contract.