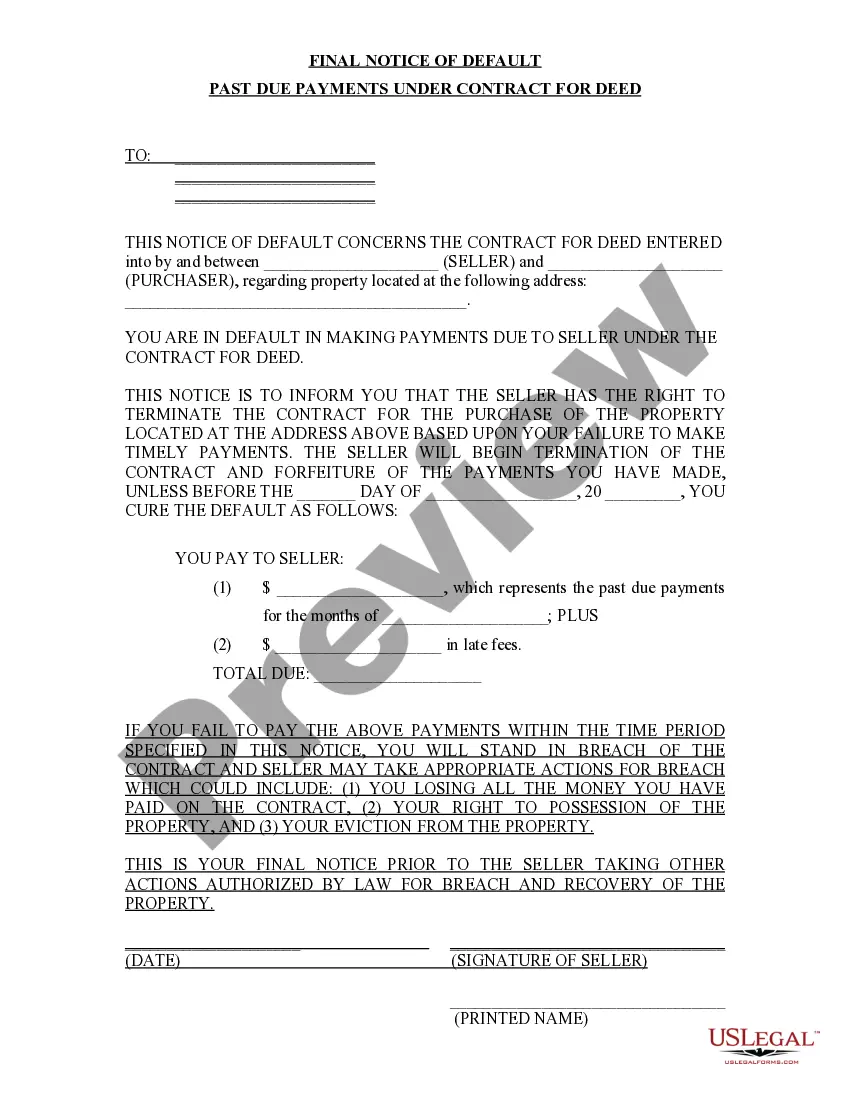

Title: Understanding Wichita Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed Keywords: Wichita Kansas, final notice of default, past due payments, Contract for Deed Introduction: A Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document sent by a lender to a borrower in Wichita, Kansas, notifying them that they have failed to make timely payments in accordance with the terms of their Contract for Deed agreement. This notice serves to inform the borrower about the consequences of non-payment and the steps that may be taken to resolve the default situation. Let's dive deeper into the specifics of these notices and explore any potential variations. Types of Wichita Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed: 1. Standard Final Notice of Default: This type of notice is sent to the borrower as a reminder that they have fallen behind on their payments under the Contract for Deed. It highlights the outstanding payment amount, the due dates missed, and any associated penalties or interest charges. The notice may provide a specific timeframe within which the borrower must take corrective action to remedy the default and prevent further legal measures. 2. Notice of Intent to Foreclose: In more severe cases, where the borrower fails to respond or rectify the default, a Notice of Intent to Foreclose may be issued. This notice informs the borrower that if they do not pay the overdue amounts within a specified time frame, the lender will initiate foreclosure proceedings on the property. It also provides information on any additional costs or fees the borrower may be responsible for if foreclosure occurs. 3. Demand for Specific Performance: Occasionally, a lender may issue a Demand for Specific Performance notice to a borrower who has persistently defaulted on their payments. This notice demands that the borrower catch up with all outstanding payments, including interest and penalties, within a specified period. Failure to comply may result in the lender terminating the Contract for Deed and exercising their legal rights to reclaim the property. 4. Request for Mediation: In some cases, both the lender and the borrower may agree to attempt mediation as an alternative to foreclosure. In such situations, a Request for Mediation notice may be sent, providing details on how to engage in the mediation process. This notice aims to facilitate negotiations between the parties in order to find a mutually agreeable solution to the default situation and prevent further legal actions. Conclusion: Receiving a Final Notice of Default for Past Due Payments in connection with a Contract for Deed can be a stressful experience for borrowers in Wichita, Kansas. It is crucial for recipients to understand the implications of such notices and take prompt action to address any payment deficiencies. Seeking legal counsel or negotiating with the lender can help explore potential resolutions and prevent further negative consequences.

Wichita Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Wichita Kansas Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Regardless of social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for a person with no law background to draft such paperwork cfrom the ground up, mostly due to the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes in handy. Our platform provides a huge library with over 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time using our DYI tpapers.

No matter if you want the Wichita Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Wichita Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed quickly using our trusted platform. In case you are presently an existing customer, you can go ahead and log in to your account to get the appropriate form.

However, in case you are new to our platform, make sure to follow these steps before obtaining the Wichita Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed:

- Ensure the form you have found is good for your location because the regulations of one state or area do not work for another state or area.

- Preview the form and go through a short outline (if available) of cases the document can be used for.

- If the form you picked doesn’t suit your needs, you can start again and look for the needed form.

- Click Buy now and pick the subscription plan that suits you the best.

- with your login information or register for one from scratch.

- Select the payment method and proceed to download the Wichita Kansas Final Notice of Default for Past Due Payments in connection with Contract for Deed once the payment is through.

You’re good to go! Now you can go ahead and print the form or complete it online. If you have any problems locating your purchased documents, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.