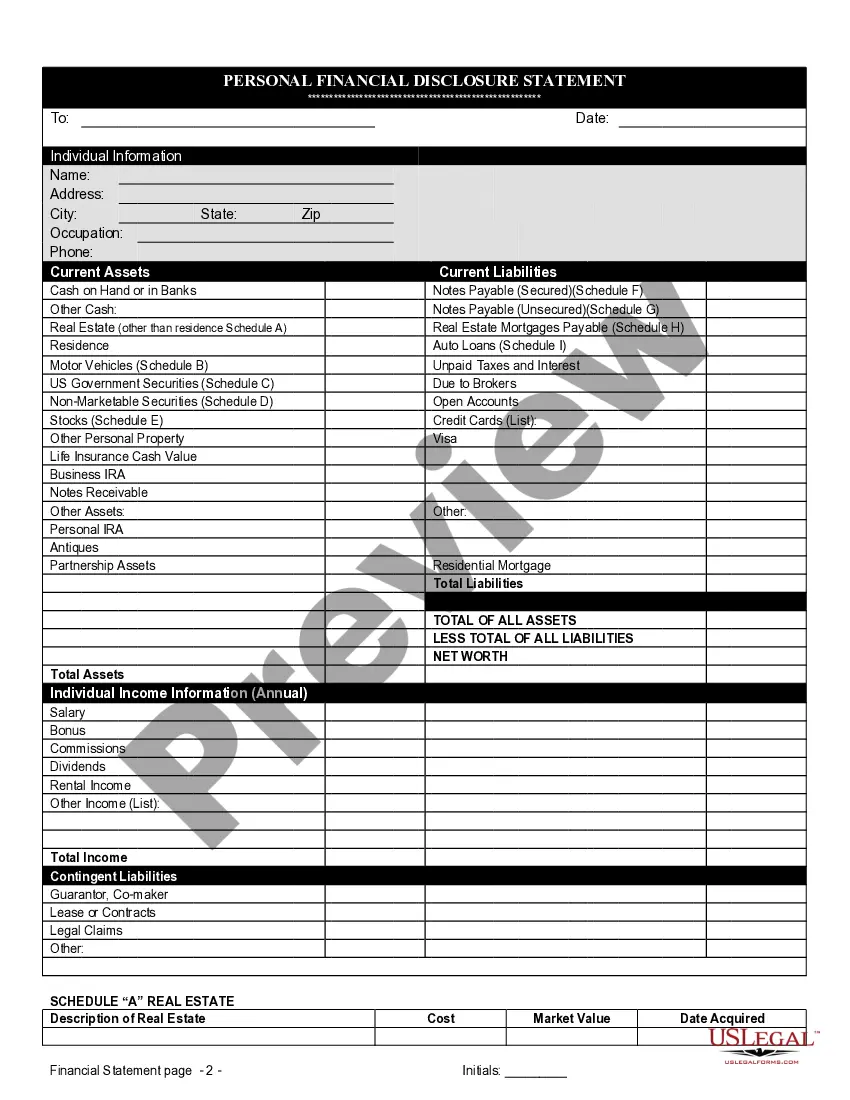

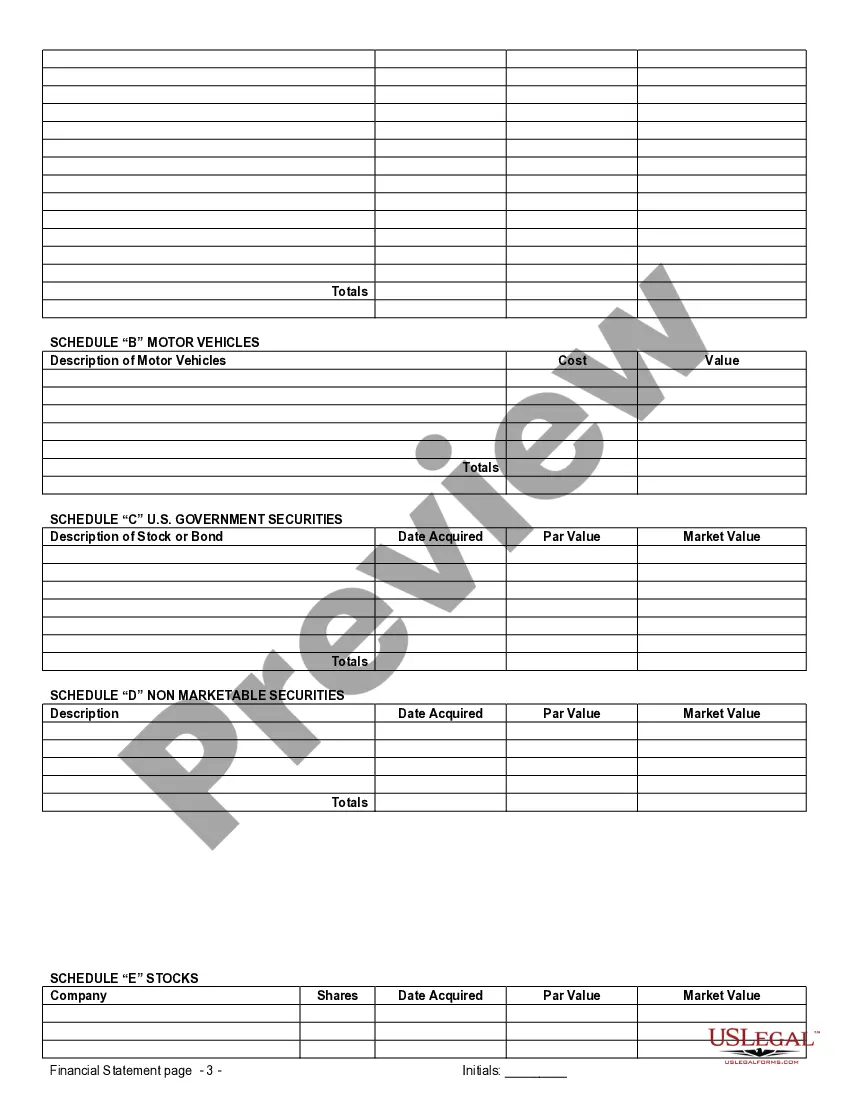

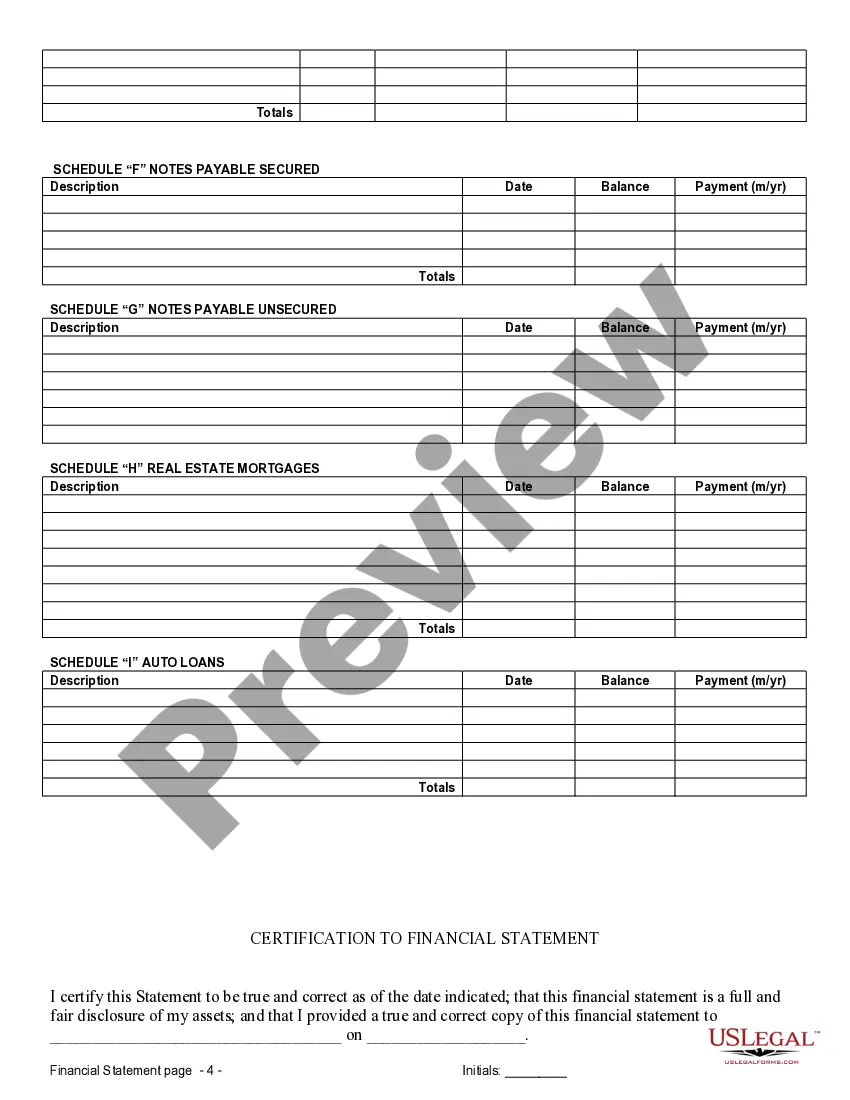

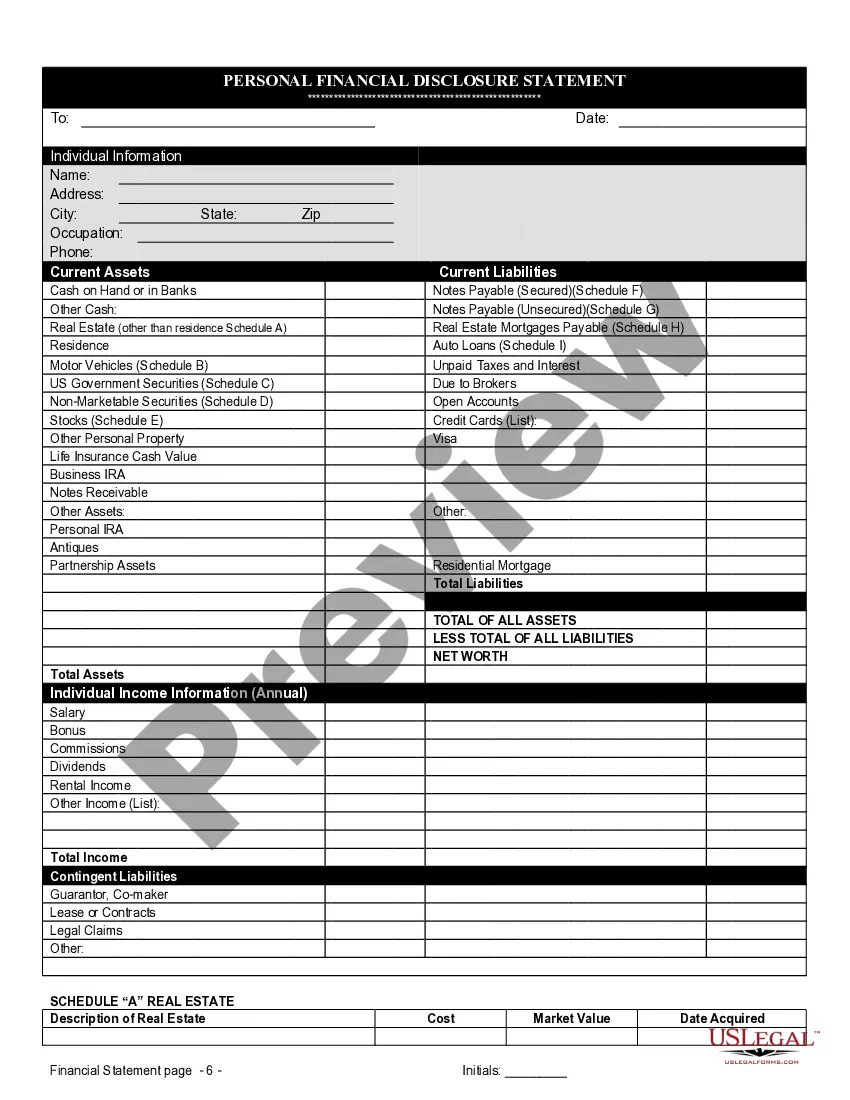

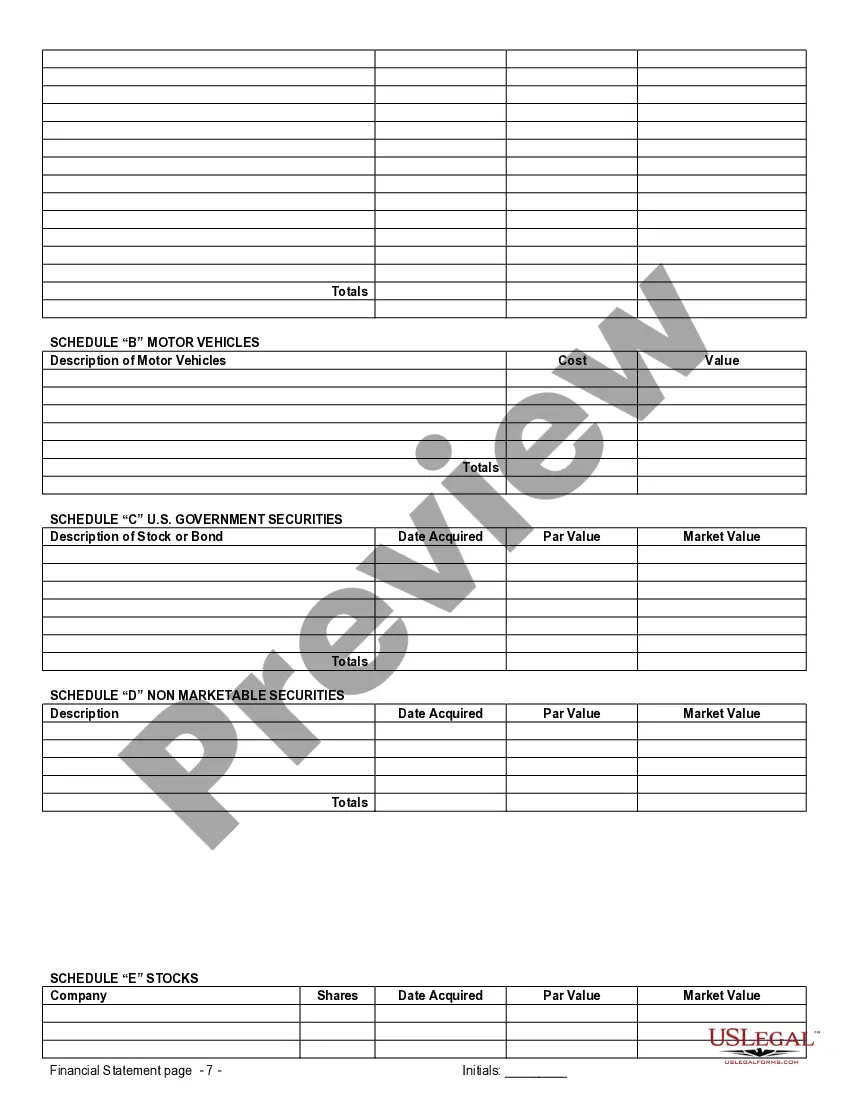

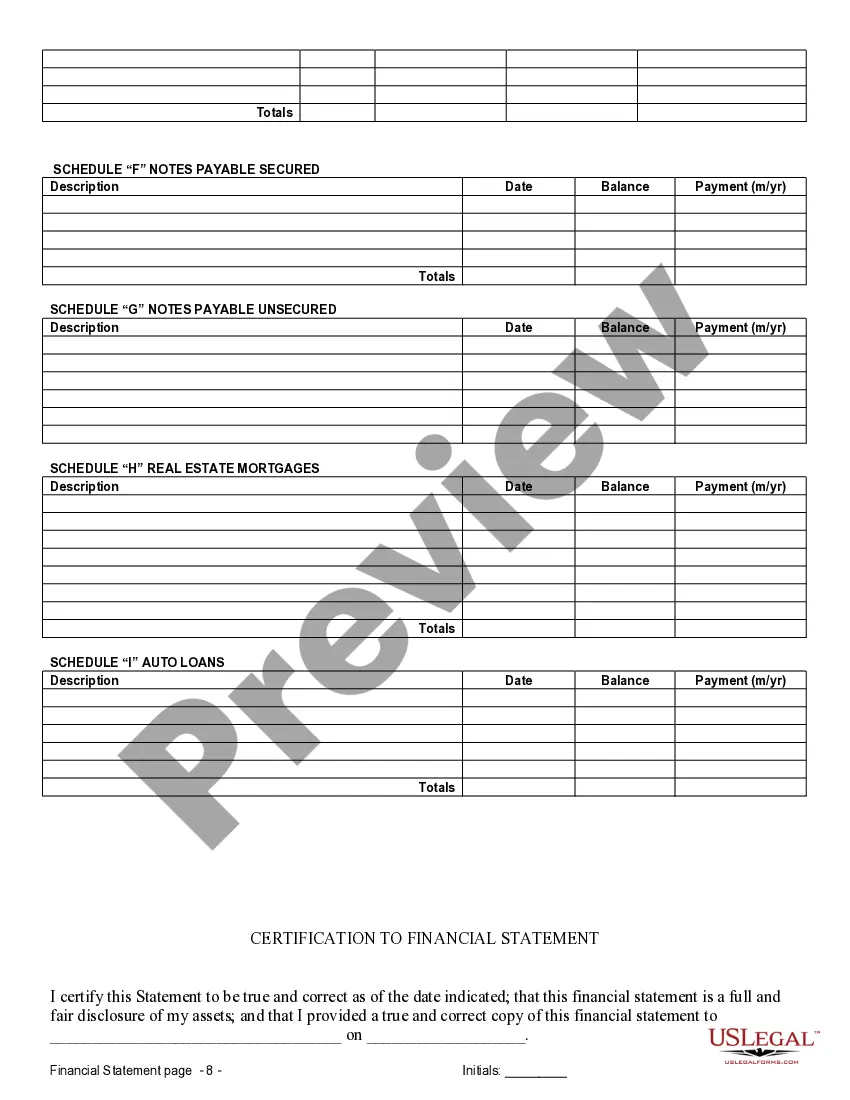

Olathe Kansas Financial Statements in Connection with Prenuptial Premarital Agreements In Olathe, Kansas, financial statements play a crucial role in the context of prenuptial or premarital agreements. These legal documents outline the financial rights, obligations, and division of assets between two individuals entering into a marriage or civil union. To ensure the agreement's validity and enforceability, accurate and detailed financial statements regarding the respective parties' financial positions must be provided. These financial statements serve as a foundation for transparent and fair prenuptial negotiations. Here, we explore the different types of Olathe Kansas Financial Statements commonly associated with prenuptial or premarital agreements: 1. Personal Financial Statement: This type of financial statement gives a comprehensive overview of an individual's financial situation. It includes details on assets, liabilities, income, expenses, investments, debts, and any other relevant financial information. Both parties to the prenuptial agreement must provide their personal financial statements to ensure a fair understanding of their financial positions. 2. Income Statement: An income statement presents an individual's revenue, expenses, and net income over a specified period. It highlights the regular income sources, such as salaries, investments, rental income, or business profits. The income statement is crucial to review the earnings capacity and financial stability of both parties involved. 3. Bank Statements: Bank statements provide a record of an individual's transactions within a specified period. They showcase account balances, deposits, withdrawals, and any overdrafts, ensuring transparency in financial matters. These statements prove vital in verifying income sources, tracking spending habits, and evaluating overall financial health. 4. Tax Returns: Tax returns reflect an individual's annual income, deductions, and tax liabilities. They provide insight into the parties' earnings and can reveal additional financial obligations, like alimony or child support payments. Tax returns help in determining the accuracy of the financial statements and identifying any potential discrepancies or undisclosed assets. 5. Investment Statements: Investment statements include details of an individual's holdings, such as stocks, bonds, mutual funds, real estate investments, or retirement accounts. These statements reveal the value of investments, dividends received, and any changes in a person's net worth over time. Understanding the investment landscape is essential to ensure the fair division of assets in case of a prenuptial agreement's activation. 6. Debt Statements: Debt statements outline any debts an individual carries, such as mortgages, credit cards, loans, or outstanding liabilities. These statements help in assessing the financial burden one party may bring into the marriage or civil union. By disclosing all existing debts, the parties can agree on how they will manage or allocate these obligations if the need arises. By providing these various financial statements, parties to a prenuptial or premarital agreement in Olathe Kansas can ensure transparency, fairness, and a thorough understanding of each other's financial circumstances. It is essential to consult with legal professionals experienced in family law to ensure compliance with state laws and maximize the enforceability of the prenuptial agreement.

Olathe Kansas Financial Statements only in Connection with Prenuptial Premarital Agreement

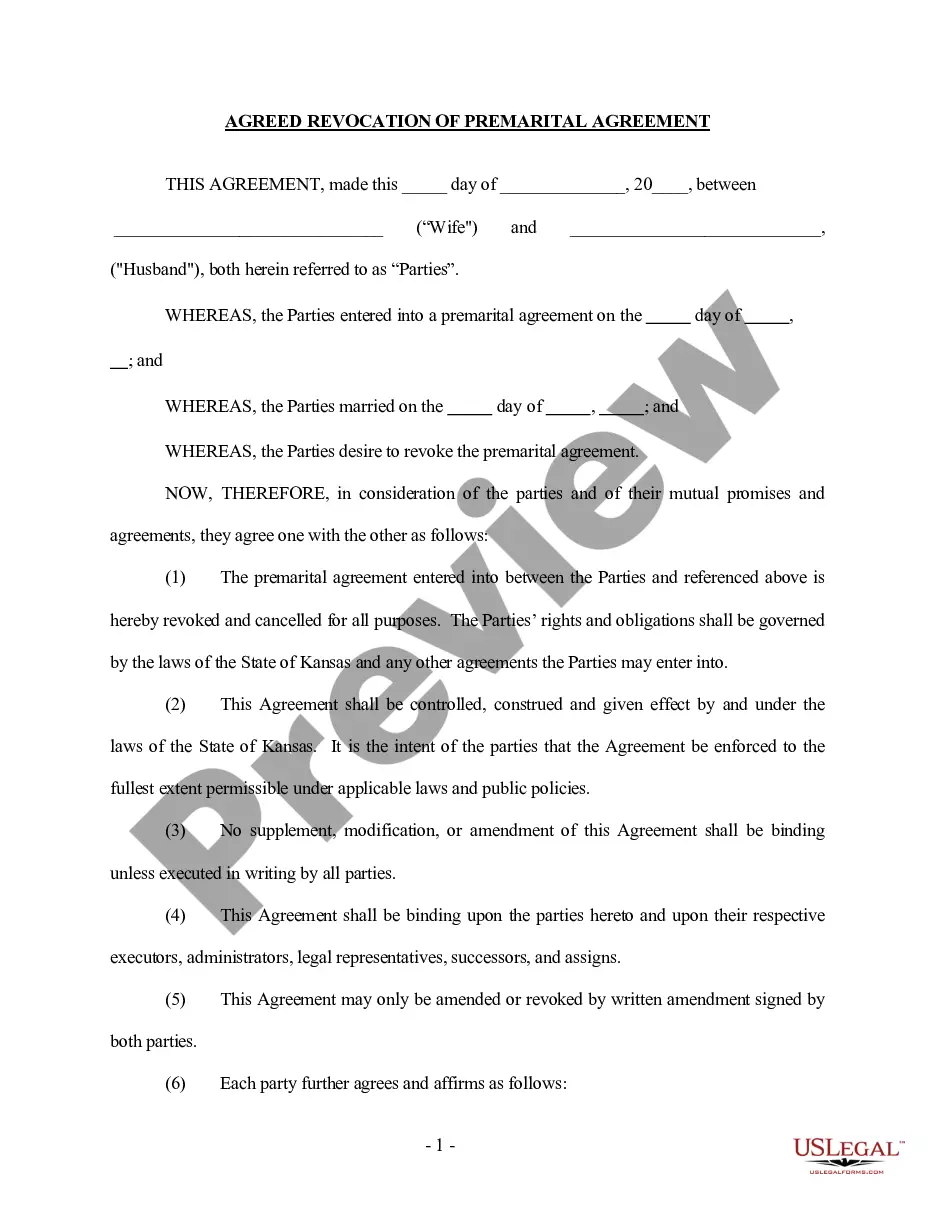

Description

How to fill out Olathe Kansas Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Take advantage of the US Legal Forms and get instant access to any form template you need. Our beneficial website with a huge number of templates makes it easy to find and obtain almost any document sample you require. It is possible to save, fill, and sign the Olathe Kansas Financial Statements only in Connection with Prenuptial Premarital Agreement in just a couple of minutes instead of surfing the Net for hours looking for the right template.

Using our catalog is a great way to raise the safety of your record filing. Our experienced legal professionals regularly review all the records to make certain that the forms are appropriate for a particular region and compliant with new acts and regulations.

How do you obtain the Olathe Kansas Financial Statements only in Connection with Prenuptial Premarital Agreement? If you already have a profile, just log in to the account. The Download button will appear on all the documents you view. Moreover, you can find all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, stick to the tips below:

- Open the page with the form you need. Ensure that it is the template you were hoping to find: verify its headline and description, and utilize the Preview feature when it is available. Otherwise, make use of the Search field to find the needed one.

- Launch the downloading procedure. Select Buy Now and select the pricing plan that suits you best. Then, create an account and process your order using a credit card or PayPal.

- Download the document. Choose the format to get the Olathe Kansas Financial Statements only in Connection with Prenuptial Premarital Agreement and edit and fill, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy template libraries on the internet. Our company is always ready to help you in any legal case, even if it is just downloading the Olathe Kansas Financial Statements only in Connection with Prenuptial Premarital Agreement.

Feel free to take advantage of our platform and make your document experience as convenient as possible!