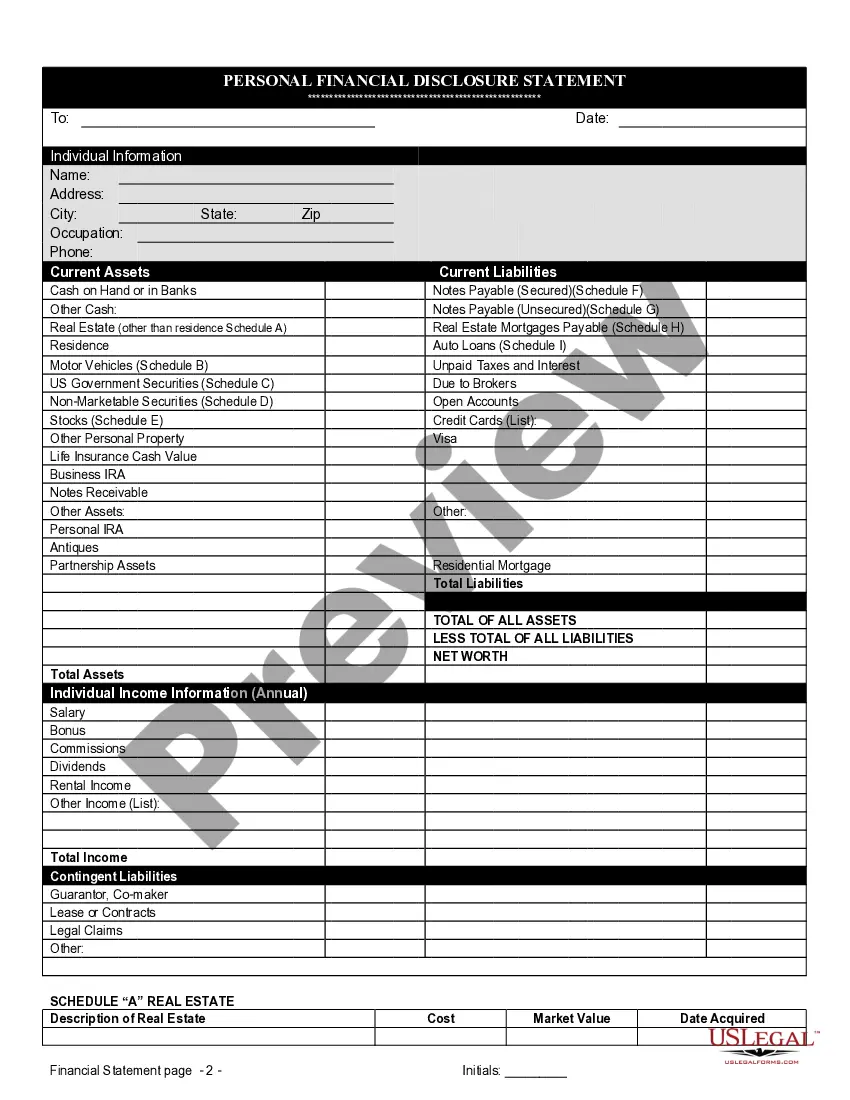

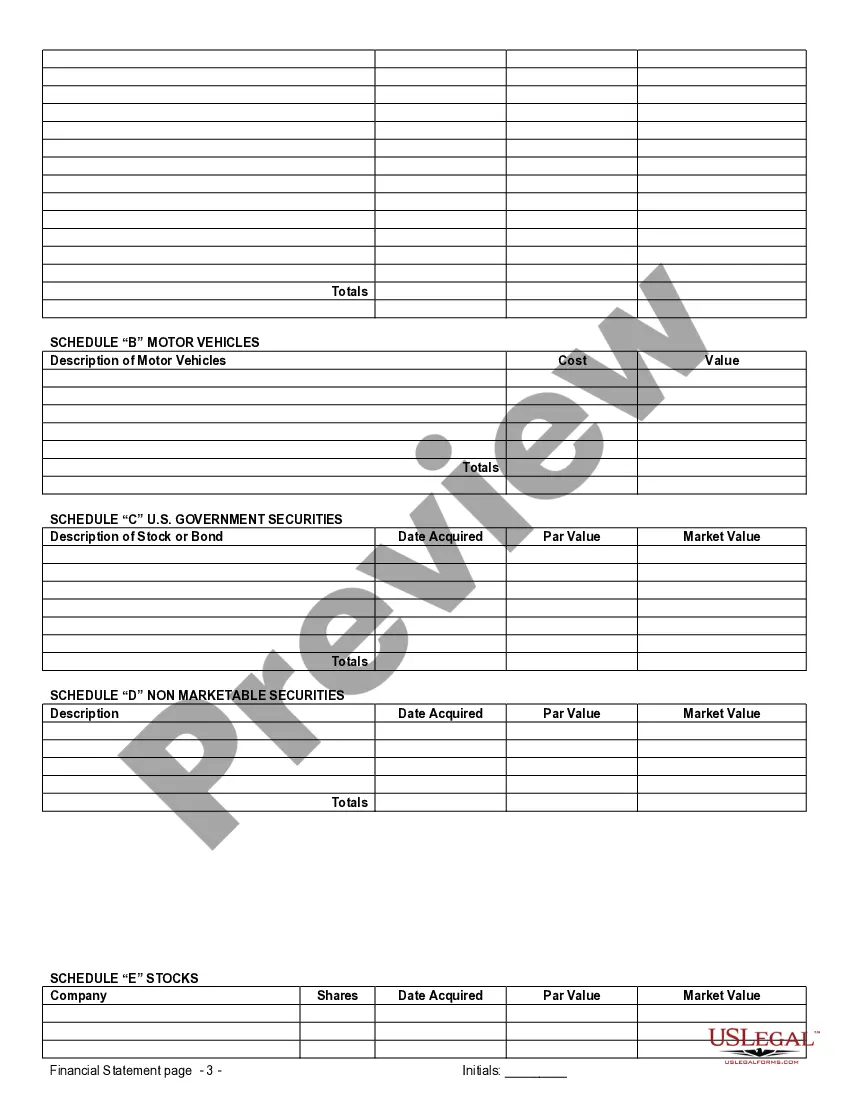

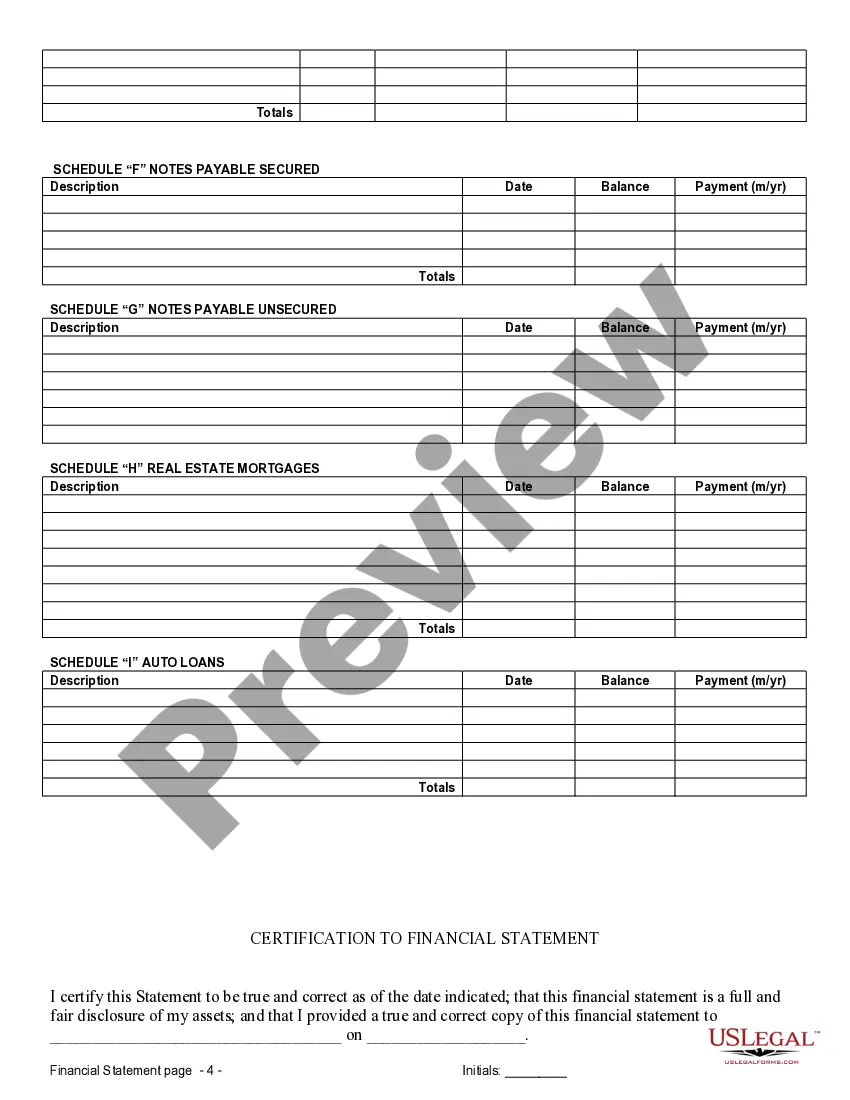

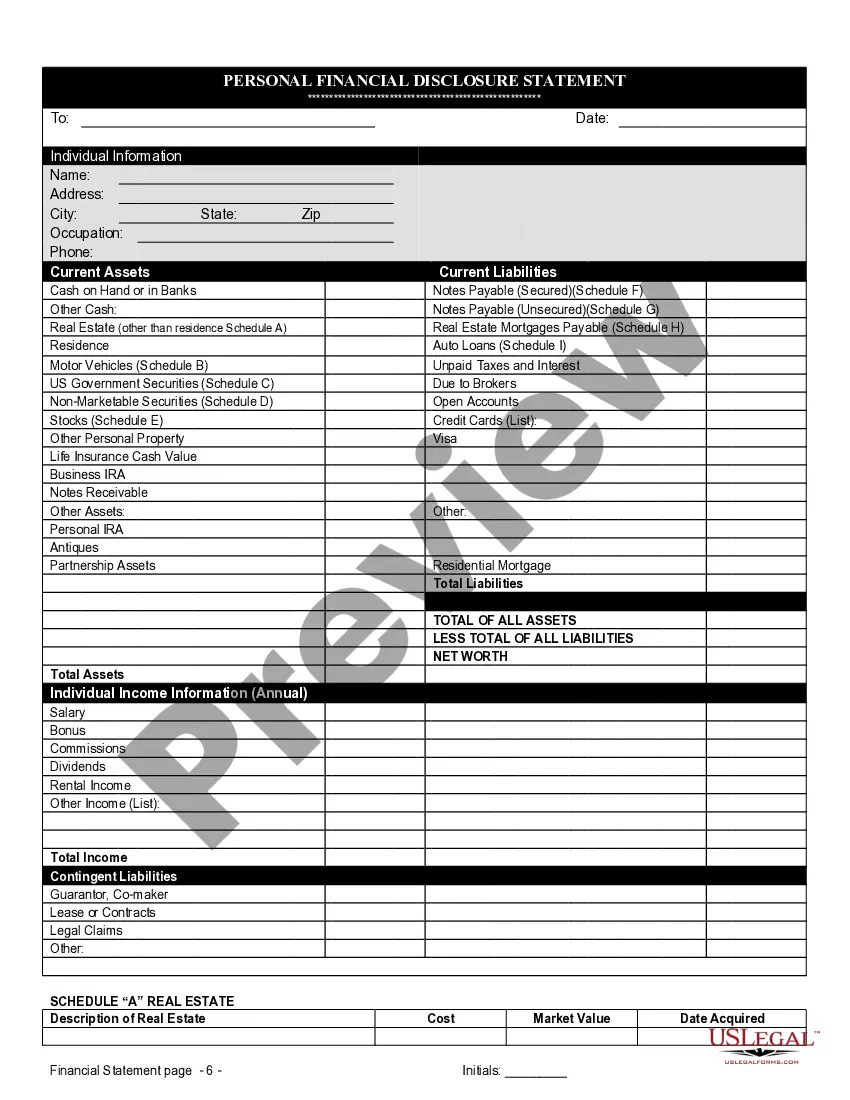

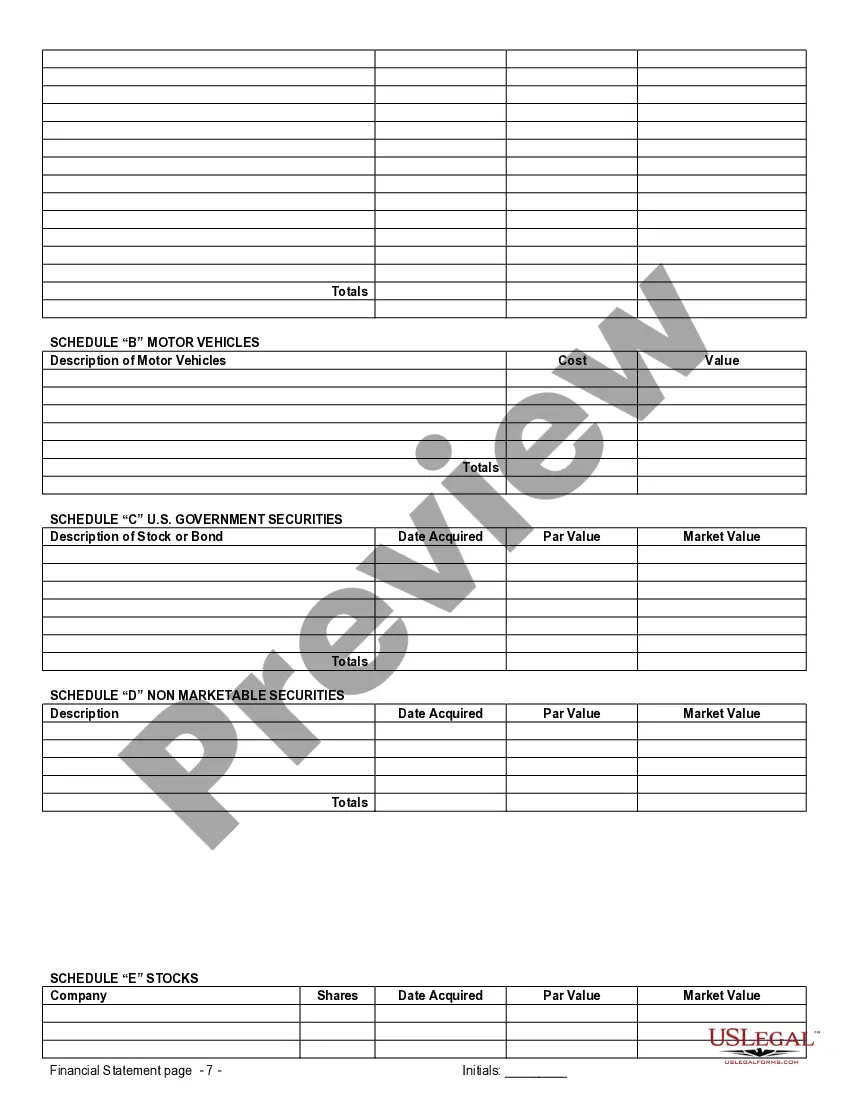

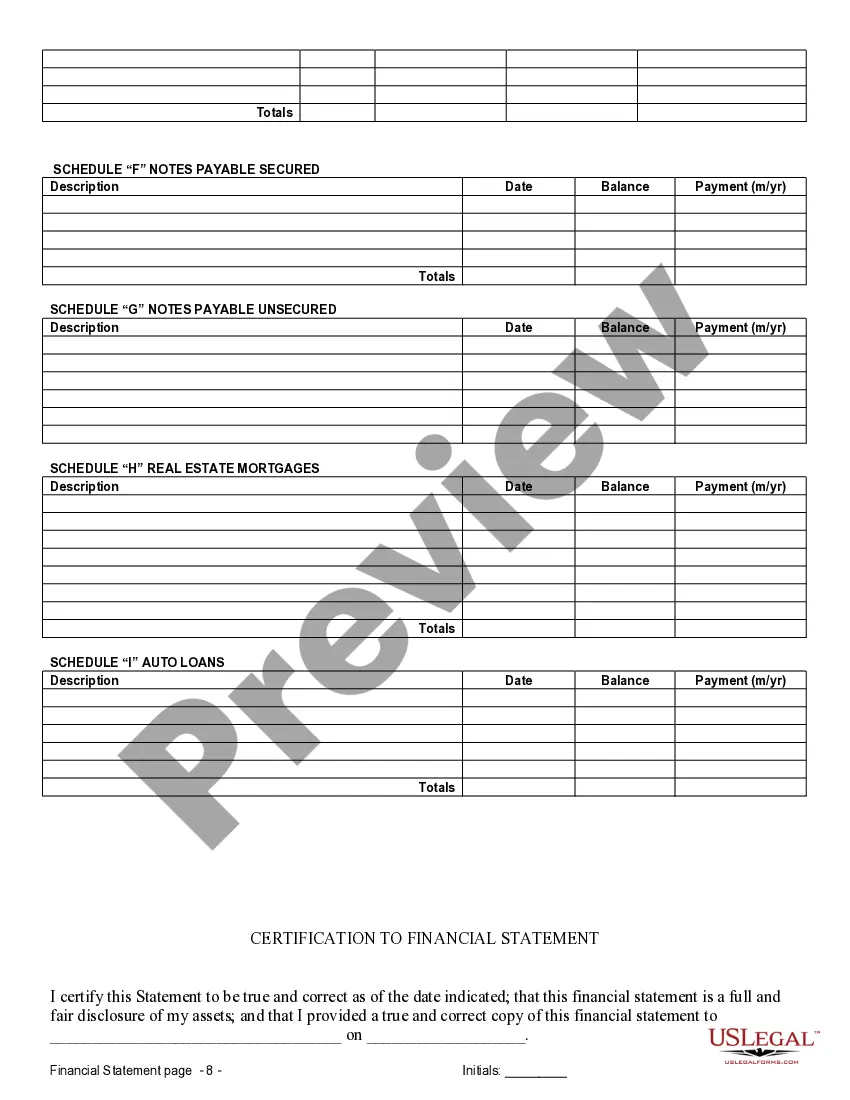

Topeka, Kansas Financial Statements in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview When entering into a prenuptial or premarital agreement in Topeka, Kansas, it is crucial to understand the significance of financial statements as they play a vital role in safeguarding the interests of both parties. Financial statements provide a clear snapshot of each spouse's assets, liabilities, income, and expenses, ensuring transparency and fairness in the agreement. Let's delve into the specifics of what these statements entail and explore any different types that are commonly used in Topeka. 1. Personal Financial Statements: Personal financial statements outline an individual's net worth, including their personal assets, such as real estate, vehicles, investments, and bank accounts. They also disclose liabilities, such as mortgages, loans, credit card debts, and other outstanding obligations. These statements paint a comprehensive picture of an individual's financial health. 2. Business Financial Statements: In cases where one or both parties have business interests, providing business financial statements becomes necessary. These statements detail the financial performance, assets, debts, and overall value of the business. Evaluating business financial statements ensures that all business assets and income are accurately accounted for and appropriately protected. 3. Income Statements: Income statements showcase an individual's current income and expenditures. Going beyond a simple paycheck, these statements account for all sources of revenue, such as investments, rental income, dividends, and more. Additionally, they include all regular expenses, enabling a clear understanding of an individual's ongoing financial commitments. 4. Tax Returns: Tax returns are essential components of financial statements as they reflect an individual's income, deductions, credits, and tax liabilities. Additionally, they provide insights into any potential tax obligations and any complications related to merger or separation of assets. 5. Investment Statements: Investment statements capture detailed information about an individual's investments, such as stocks, bonds, mutual funds, retirement accounts, and more. These statements offer an accurate assessment of assets and verify the value of any investments held. 6. Bank Statements: Bank statements exhibit an individual's daily financial transactions. They provide evidence of income deposits, expenses, and any outstanding loans or liabilities. Reviewing bank statements ensures that no financial assets or obligations are overlooked during the process of creating a prenuptial agreement. Precision, accuracy, and thoroughness are crucial when preparing financial statements for a prenuptial or premarital agreement in Topeka, Kansas. It is highly recommended seeking professional guidance from a qualified attorney or financial advisor experienced in family law and prenuptial agreements. They will ensure compliance with Topeka's specific laws and regulations, guaranteeing that the financial statements provide a reliable foundation for a fair and equitable prenuptial agreement tailored to the unique circumstances of the involved parties.

Topeka Kansas Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Topeka Kansas Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Topeka Kansas Financial Statements only in Connection with Prenuptial Premarital Agreement becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Topeka Kansas Financial Statements only in Connection with Prenuptial Premarital Agreement takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a few more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve selected the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Topeka Kansas Financial Statements only in Connection with Prenuptial Premarital Agreement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!