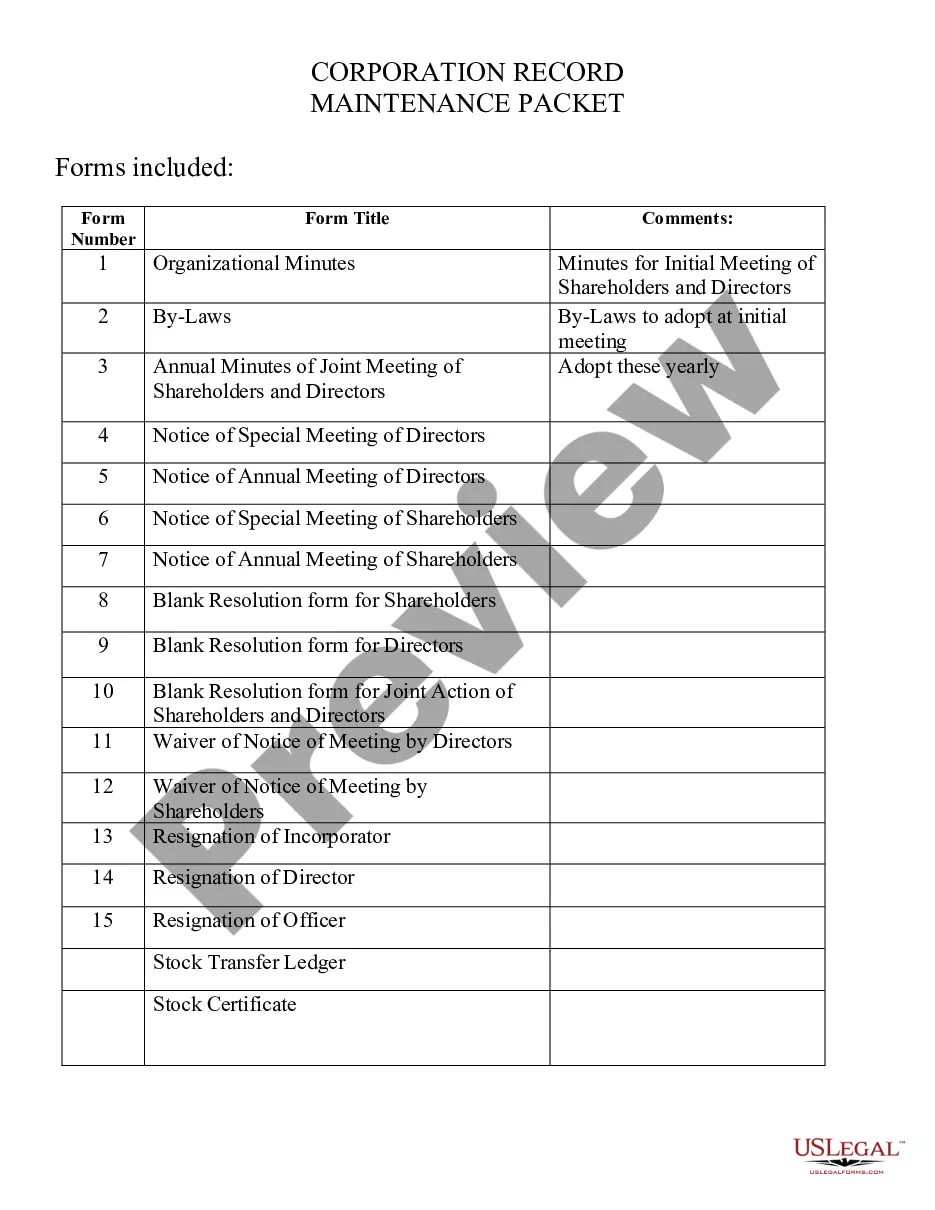

The Topeka Kansas Articles of Incorporation for a Domestic For-Profit Corporation serve as the legal foundation for establishing and operating a business entity within the state. These documents delineate crucial information about the corporation and ensure compliance with state laws and regulations. This comprehensive description will highlight the key aspects of the Topeka Kansas Articles of Incorporation for a Domestic For-Profit Corporation. 1. Topeka Kansas Articles of Incorporation: The Topeka Kansas Articles of Incorporation are the foundational documents required to establish a domestic for-profit corporation in the state. These articles outline essential details about the corporation, such as its name, purpose, registered agent, registered office address, authorized shares of stock, and duration of existence. 2. Amendment to Articles of Incorporation: In case any changes need to be made to the initial Articles of Incorporation that were filed, a corporation may file an Amendment to Articles of Incorporation. This document allows organizations to modify crucial information outlined in the original articles, such as changing the corporation's registered agent or address. 3. Restated Articles of Incorporation: If a corporation desires to consolidate amendments made over the years into a single document, they can file Restated Articles of Incorporation. This document incorporates all previous amendments and the original articles of incorporation, ensuring an up-to-date, consolidated record of the corporation's structure and purpose. 4. Articles of Dissolution: Should a corporation decide to cease operations and dissolve, they must file Articles of Dissolution. This document legally terminates the existence of the corporation, ensuring that it is no longer liable for any future obligations. 5. Certificate of Revocation for Dissolved Corporation: If a dissolved corporation wishes to continue its operations after previously filing Articles of Dissolution, it can file a Certificate of Revocation for Dissolved Corporation. This document revokes the dissolution of the corporation and reinstates its legal existence. To ensure the successful establishment and operation of a domestic for-profit corporation in Topeka Kansas, it is essential to understand the various types of Articles of Incorporation that may be relevant at different stages of the business's lifecycle. Whether it is the initial filing, making amendments, consolidation, dissolution, or revival, these documents provide a clear and consistent legal framework for the corporation's functioning. When preparing any of these articles, it is crucial to review the specific requirements and guidelines outlined by the Kansas Secretary of State to ensure compliance and a smooth operation within the state.

Topeka Kansas Articles of Incorporation for Domestic For-Profit Corporation

Description

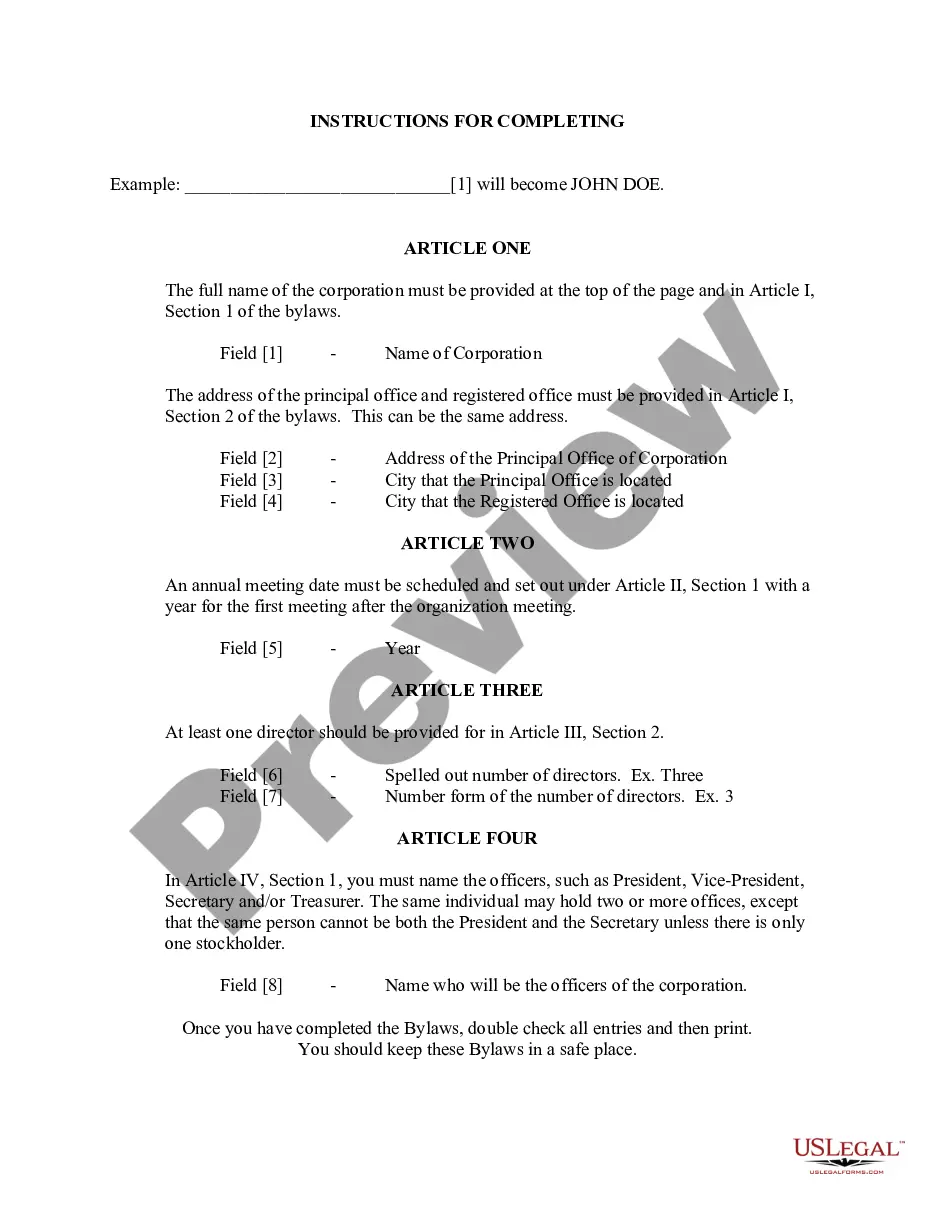

How to fill out Topeka Kansas Articles Of Incorporation For Domestic For-Profit Corporation?

Take advantage of the US Legal Forms and obtain immediate access to any form sample you require. Our helpful website with a huge number of document templates makes it easy to find and get virtually any document sample you will need. You can export, fill, and sign the Topeka Kansas Articles of Incorporation for Domestic For-Profit Corporation in just a few minutes instead of browsing the web for many hours looking for a proper template.

Using our catalog is a wonderful way to improve the safety of your document submissions. Our professional attorneys regularly review all the documents to ensure that the forms are appropriate for a particular region and compliant with new acts and polices.

How do you get the Topeka Kansas Articles of Incorporation for Domestic For-Profit Corporation? If you have a subscription, just log in to the account. The Download option will be enabled on all the documents you look at. Moreover, you can get all the previously saved files in the My Forms menu.

If you don’t have an account yet, follow the tips listed below:

- Open the page with the form you need. Ensure that it is the template you were seeking: examine its headline and description, and utilize the Preview feature when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Launch the downloading process. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Download the file. Select the format to obtain the Topeka Kansas Articles of Incorporation for Domestic For-Profit Corporation and revise and fill, or sign it according to your requirements.

US Legal Forms is probably the most significant and trustworthy form libraries on the internet. We are always happy to help you in virtually any legal procedure, even if it is just downloading the Topeka Kansas Articles of Incorporation for Domestic For-Profit Corporation.

Feel free to make the most of our platform and make your document experience as convenient as possible!