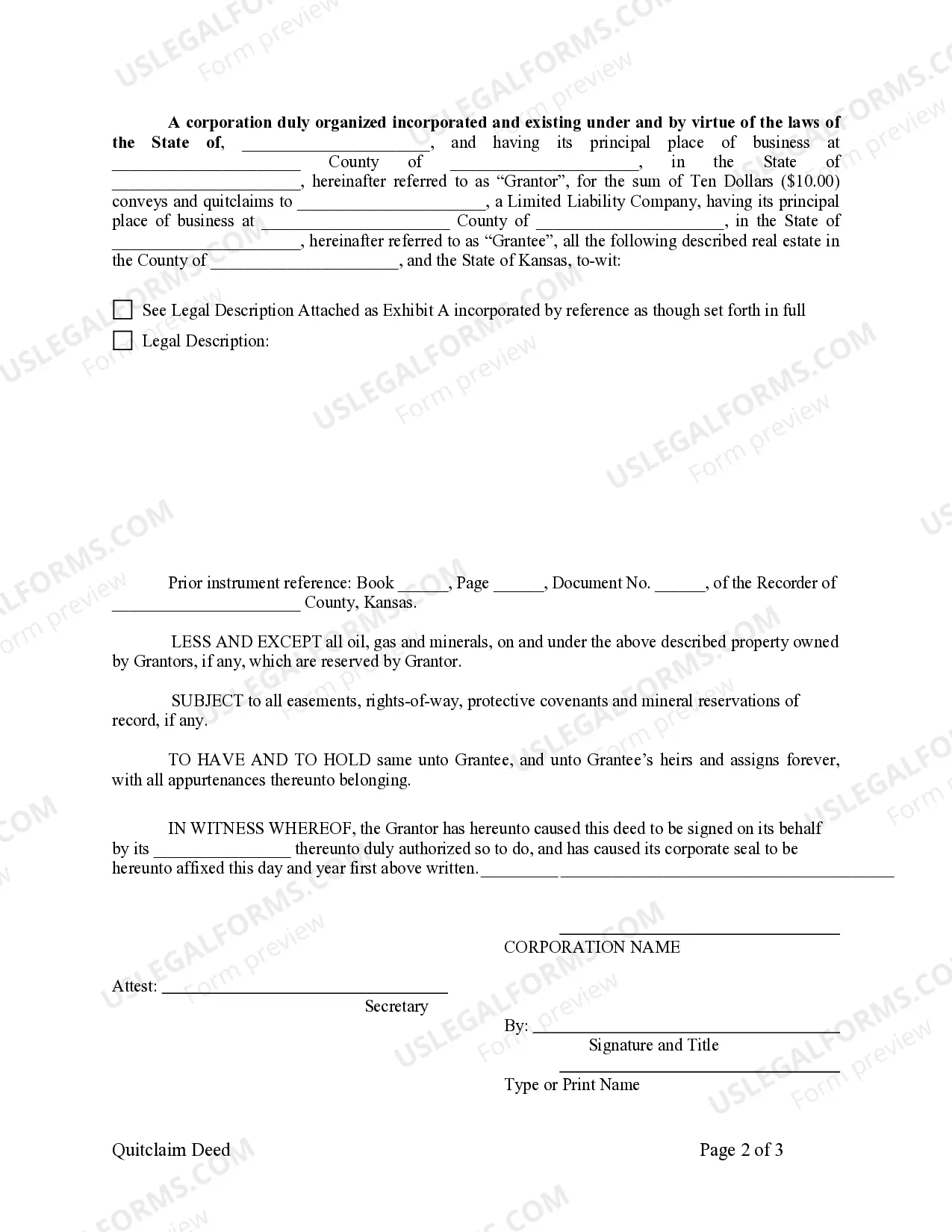

The Overland Park Kansas Quitclaim Deed from Corporation to LLC is a legal document used to transfer ownership rights of property from a corporation to a limited liability company (LLC). This deed is commonly employed when a corporation decides to restructure its asset ownership or when a subsidiary corporation wants to transfer property to an LLC owned by the same parent company. It is essential to accurately complete this deed to ensure a smooth and legally compliant transfer process. The Overland Park Kansas Quitclaim Deed from Corporation to LLC holds significant importance in documenting the transfer of ownership rights. By executing this deed, the corporation relinquishes all claims and interest in the property, transferring its legal ownership to the LLC. This deed excludes any warranties or guarantees regarding the property's title, making it primarily suitable for intercompany transfers or when the property's title is known and trusted. Different types of Overland Park Kansas Quitclaim Deed from Corporation to LLC can include: 1. Voluntary Quitclaim Deed: In this case, the corporation willingly transfers the property's ownership from itself to the LLC. Such transfers often occur due to strategic business planning, asset restructuring, or the need to consolidate all company assets under one entity. 2. Involuntary Quitclaim Deed: This type of deed occurs when the property's transfer is mandated by external factors, such as a court order or legal proceedings. In such situations, a corporation may be required to transfer ownership to an LLC as a result of a legal settlement or compliance with regulatory requirements. 3. Interspousal Quitclaim Deed: This refers to a quitclaim deed executed when a spouse who holds property as a corporate entity wishes to transfer ownership to an LLC owned jointly with their spouse. This type of deed can be useful in estate planning, asset protection, or tax management. 4. Family Transfer Quitclaim Deed: When a family-owned corporation decides to transfer a property to an LLC owned by family members, this type of quitclaim deed is used. Such transfers often aim to consolidate family assets, distribute property among family members, or facilitate estate planning. It is crucial to consult legal professionals and adhere to the specific procedures and requirements outlined by the state and local authorities when preparing a Quitclaim Deed from Corporation to LLC in Overland Park, Kansas. Additionally, performing a thorough title search and obtaining any necessary permissions or consents before executing the deed ensures a smooth and valid transfer of property rights.

Overland Park Kansas Quitclaim Deed from Corporation to LLC

Description

How to fill out Overland Park Kansas Quitclaim Deed From Corporation To LLC?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Overland Park Kansas Quitclaim Deed from Corporation to LLC becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Overland Park Kansas Quitclaim Deed from Corporation to LLC takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve selected the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Overland Park Kansas Quitclaim Deed from Corporation to LLC. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!