Topeka Kansas Quitclaim Deed from Corporation to LLC can refer to a legal document used to transfer property ownership rights from a corporation to a limited liability company (LLC) in Topeka, Kansas. This process allows corporations to transfer assets or real estate holdings to an LLC, often chosen for its flexible management structure and liability protection. In Topeka, Kansas, there may be different types of Quitclaim Deeds that can be used in the process of transferring property from a corporation to an LLC. These may include: 1. Voluntary Transfer: This type of Quitclaim Deed is used when a corporation willingly transfers the property to an LLC. It signifies a corporate decision to place the asset under the ownership and management of the LLC. 2. Merger or Consolidation: In some cases, a corporation may merge or consolidate with an LLC, resulting in the transfer of property ownership. A Quitclaim Deed may be used to document this transfer. 3. Dissolution or Liquidation: If a corporation is dissolving or liquidating its assets, it may transfer its property to an LLC as part of the winding-up process. A Quitclaim Deed can facilitate this transfer of ownership. 4. Restructuring or Reorganization: Corporations may choose to restructure their business entities, such as converting from a corporation to an LLC. This transition involves transferring property ownership to the newly formed LLC through a Quitclaim Deed. The Topeka Kansas Quitclaim Deed from Corporation to LLC typically includes essential information such as the names and addresses of the granter (corporation) and grantee (LLC), a legal description of the property being transferred, consideration (if any), restrictions or encumbrances, and relevant signatures from authorized representatives. Executing a Quitclaim Deed ensures a transparent and legally binding transfer of property rights, protecting the interests of both the corporation and the LLC. In Topeka, Kansas, it is recommended to consult with an experienced real estate attorney or legal professional to properly prepare and execute the Quitclaim Deed, ensuring compliance with local laws and regulations.

Topeka Kansas Quitclaim Deed from Corporation to LLC

Category:

State:

Kansas

City:

Topeka

Control #:

KS-012-77

Format:

Word;

Rich Text

Instant download

Description

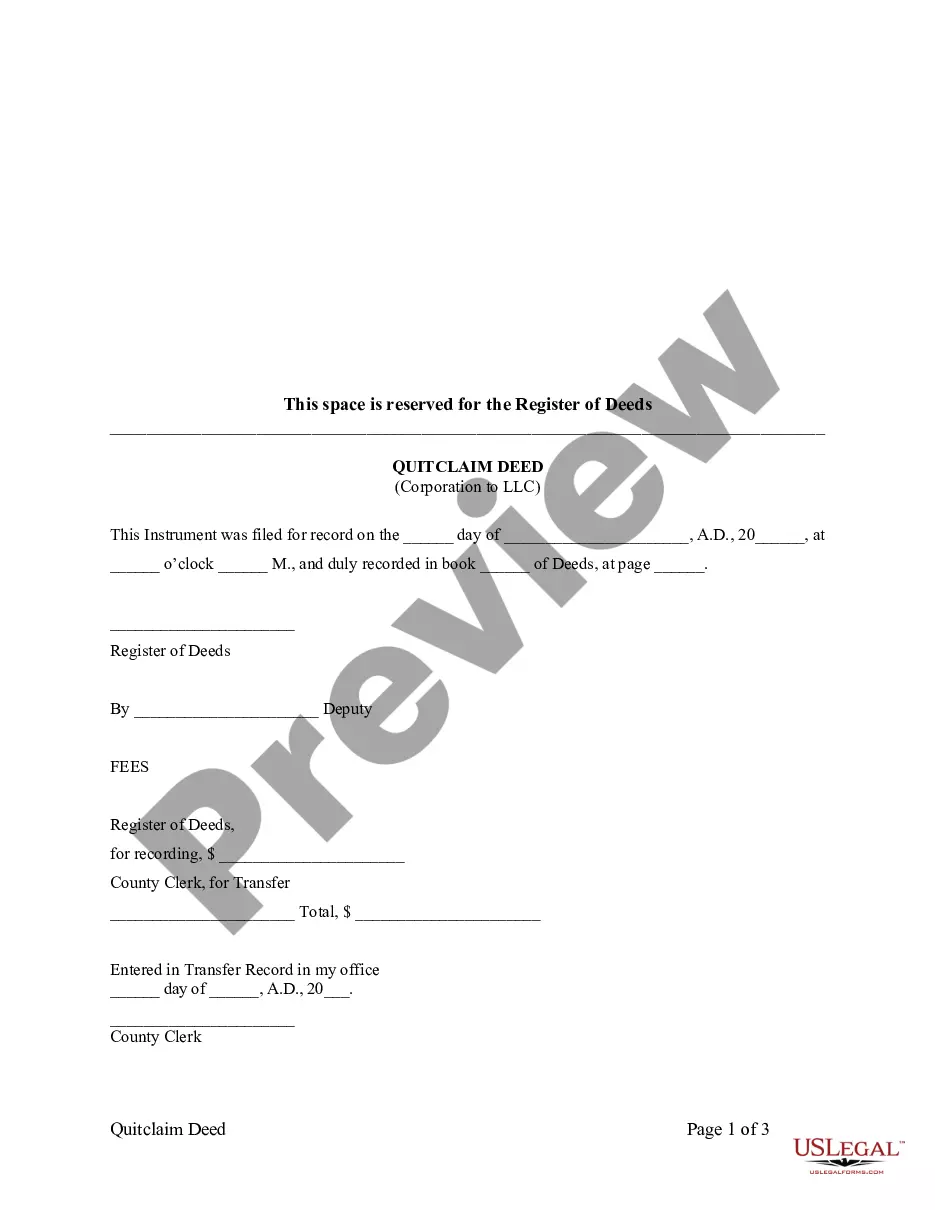

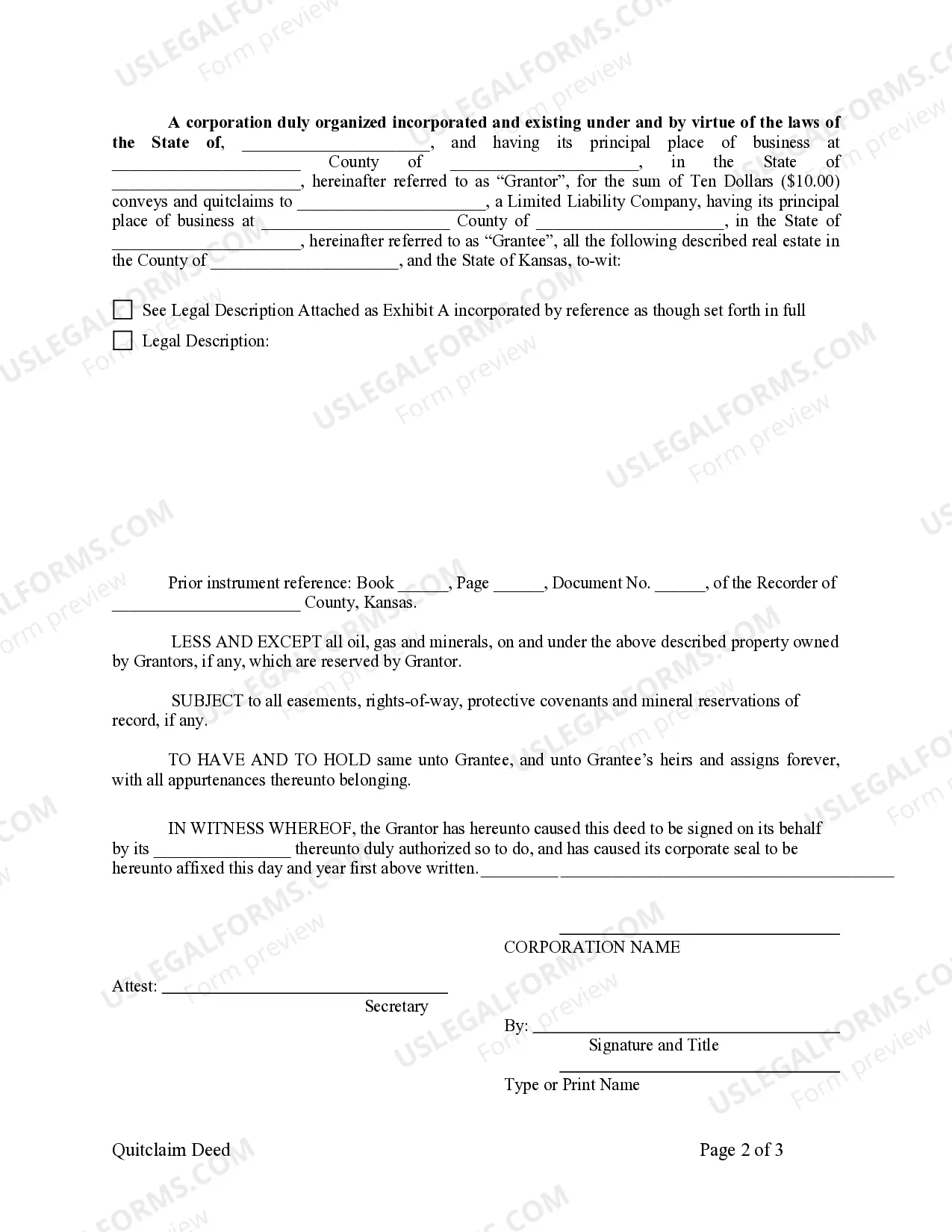

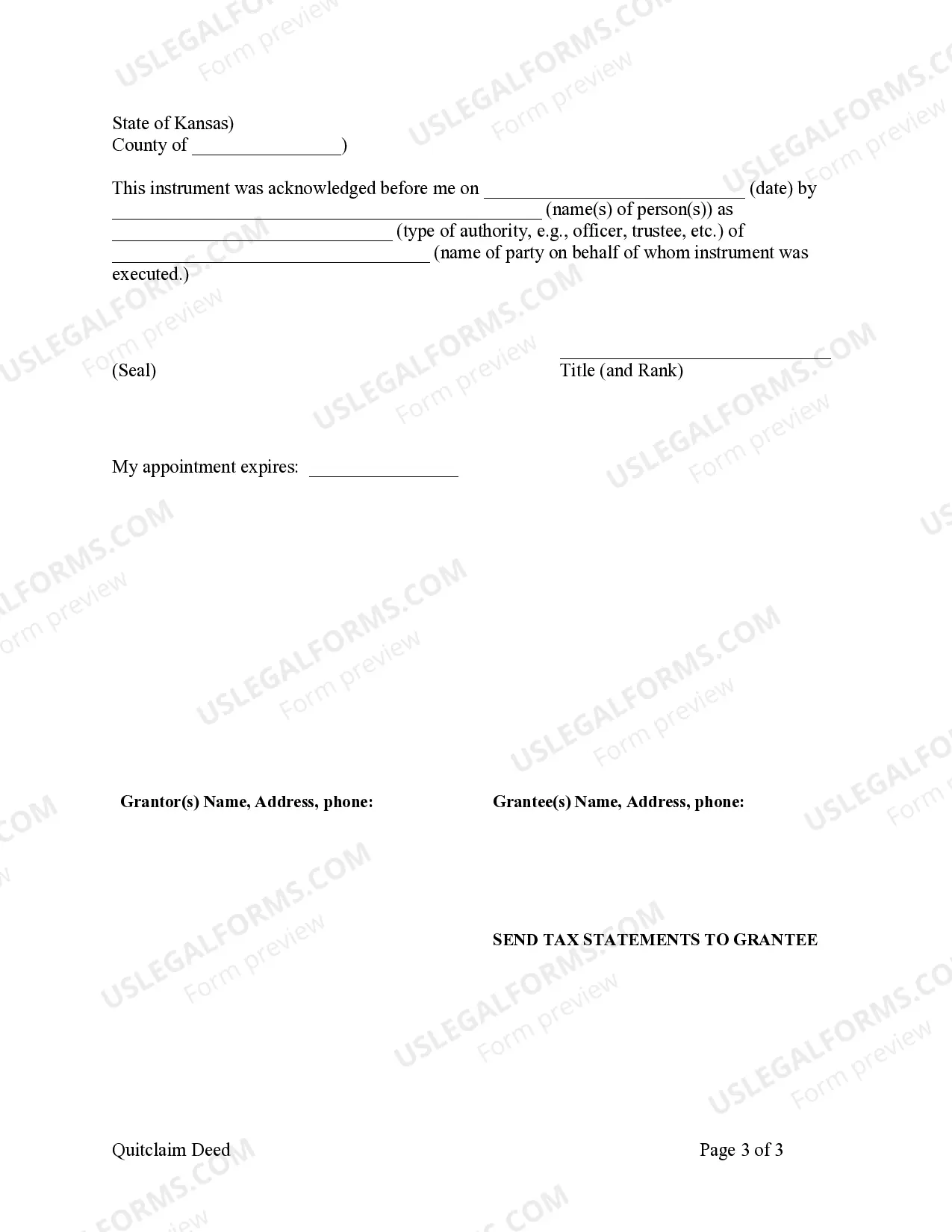

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Topeka Kansas Quitclaim Deed from Corporation to LLC can refer to a legal document used to transfer property ownership rights from a corporation to a limited liability company (LLC) in Topeka, Kansas. This process allows corporations to transfer assets or real estate holdings to an LLC, often chosen for its flexible management structure and liability protection. In Topeka, Kansas, there may be different types of Quitclaim Deeds that can be used in the process of transferring property from a corporation to an LLC. These may include: 1. Voluntary Transfer: This type of Quitclaim Deed is used when a corporation willingly transfers the property to an LLC. It signifies a corporate decision to place the asset under the ownership and management of the LLC. 2. Merger or Consolidation: In some cases, a corporation may merge or consolidate with an LLC, resulting in the transfer of property ownership. A Quitclaim Deed may be used to document this transfer. 3. Dissolution or Liquidation: If a corporation is dissolving or liquidating its assets, it may transfer its property to an LLC as part of the winding-up process. A Quitclaim Deed can facilitate this transfer of ownership. 4. Restructuring or Reorganization: Corporations may choose to restructure their business entities, such as converting from a corporation to an LLC. This transition involves transferring property ownership to the newly formed LLC through a Quitclaim Deed. The Topeka Kansas Quitclaim Deed from Corporation to LLC typically includes essential information such as the names and addresses of the granter (corporation) and grantee (LLC), a legal description of the property being transferred, consideration (if any), restrictions or encumbrances, and relevant signatures from authorized representatives. Executing a Quitclaim Deed ensures a transparent and legally binding transfer of property rights, protecting the interests of both the corporation and the LLC. In Topeka, Kansas, it is recommended to consult with an experienced real estate attorney or legal professional to properly prepare and execute the Quitclaim Deed, ensuring compliance with local laws and regulations.

Free preview

How to fill out Topeka Kansas Quitclaim Deed From Corporation To LLC?

If you’ve already used our service before, log in to your account and download the Topeka Kansas Quitclaim Deed from Corporation to LLC on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make sure you’ve located an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Topeka Kansas Quitclaim Deed from Corporation to LLC. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!