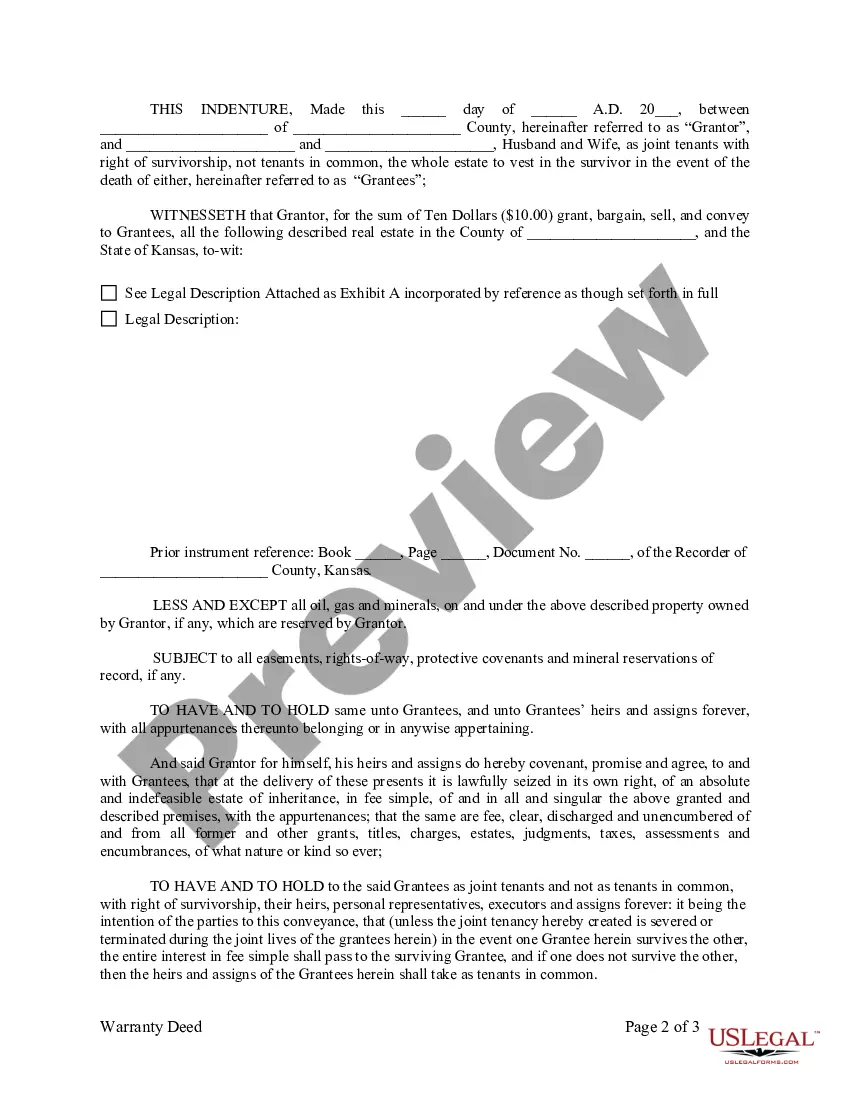

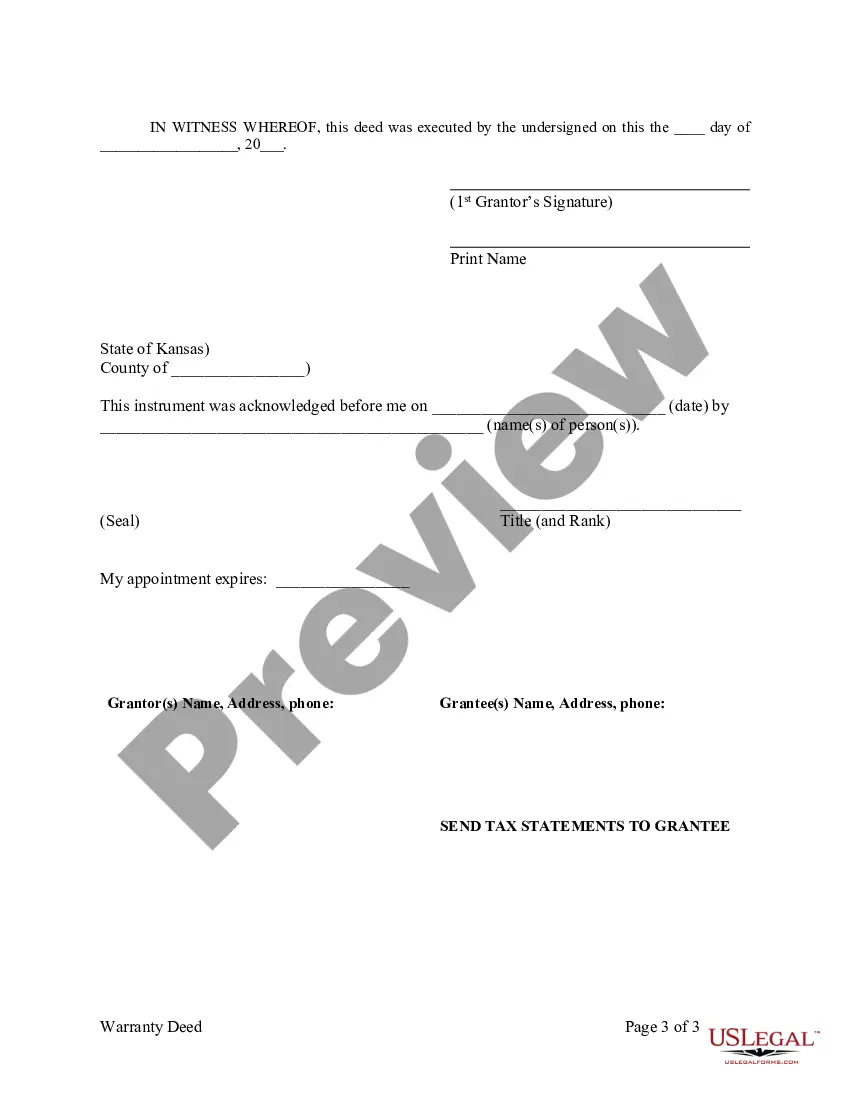

A Topeka Kansas Warranty Deed from Husband to Himself and Wife is a legal document that facilitates the transfer of property ownership from a married individual to themselves and their spouse. This type of deed ensures that the property being transferred is free of any liens or encumbrances and guarantees the granter's lawful ownership and right to transfer the property. The Topeka Kansas Warranty Deed from Husband to Himself and Wife includes key provisions to protect the grantee, such as a warranty of title, which assures the grantee that the property is being transferred without any undisclosed claims or issues. The deed often specifies the consideration or payment made for the property, which is usually the nominal amount of "love and affection." It may also outline any relevant conditions or restrictions associated with the property transfer. In Topeka, Kansas, there may be different variations or classifications of Warranty Deeds from Husband to Himself and Wife, depending on specific circumstances or objectives. Some common types of Topeka Kansas Warranty Deeds include: 1. General Warranty Deed: This is the most comprehensive form of warranty deed, guaranteeing the grantee against any title defects or claims arising at any point in the property's history. With this deed, the granter is legally responsible for defending the title and compensating the grantee for any losses incurred due to title issues. 2. Special Warranty Deed: Unlike the general warranty deed, the special warranty deed guarantees the title only against claims arising during the time the granter has owned the property. It does not cover any claims or defects that may predate the granter's ownership. This deed provides more limited protection but is commonly used in real estate transactions. 3. Quitclaim Deed: Although not specifically a warranty deed, the quitclaim deed is another type of deed regularly used in Topeka, Kansas. This deed transfers the granter's interest in the property to the grantee but does not guarantee the title. The granter makes no warranties or guarantees regarding the property's title, and the grantee assumes all risks associated with the title. To ensure a smooth and legally binding property transfer, it is essential to consult with a qualified real estate attorney or title company familiar with Topeka, Kansas, laws and regulations. This professional guidance will help you determine the appropriate type of warranty deed and ensure compliance with applicable legal requirements.

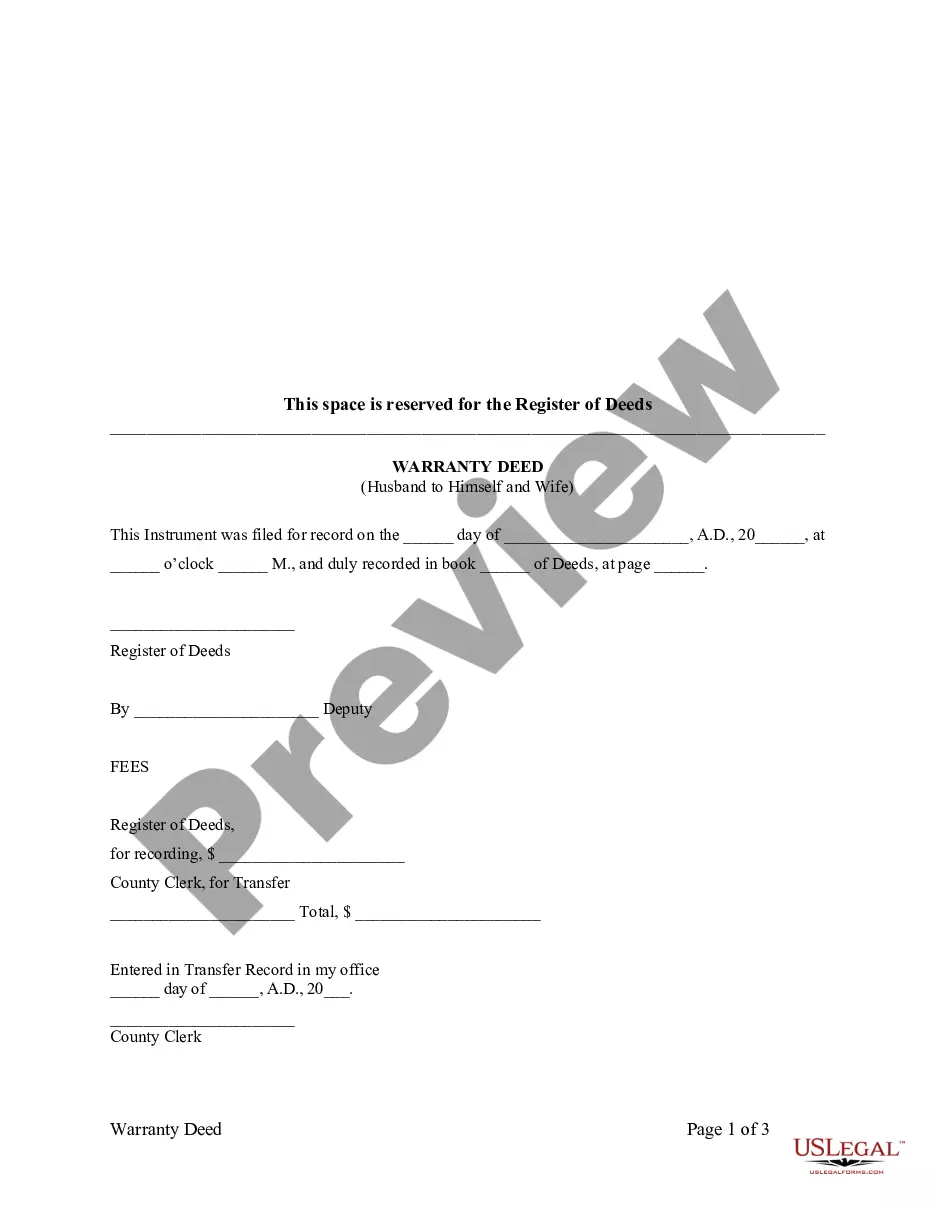

Topeka Kansas Warranty Deed from Husband to Himself and Wife

Description

How to fill out Topeka Kansas Warranty Deed From Husband To Himself And Wife?

No matter the social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Very often, it’s practically impossible for someone without any legal background to create this sort of paperwork from scratch, mainly because of the convoluted jargon and legal subtleties they come with. This is where US Legal Forms can save the day. Our platform provides a huge library with over 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you need the Topeka Kansas Warranty Deed from Husband to Himself and Wife or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Topeka Kansas Warranty Deed from Husband to Himself and Wife in minutes employing our trusted platform. In case you are already an existing customer, you can go on and log in to your account to get the appropriate form.

Nevertheless, if you are unfamiliar with our library, ensure that you follow these steps before obtaining the Topeka Kansas Warranty Deed from Husband to Himself and Wife:

- Ensure the form you have chosen is specific to your area because the regulations of one state or county do not work for another state or county.

- Preview the form and read a quick outline (if provided) of cases the paper can be used for.

- If the one you selected doesn’t meet your requirements, you can start again and search for the necessary form.

- Click Buy now and pick the subscription option that suits you the best.

- Access an account {using your login information or register for one from scratch.

- Select the payment gateway and proceed to download the Topeka Kansas Warranty Deed from Husband to Himself and Wife once the payment is done.

You’re all set! Now you can go on and print the form or fill it out online. In case you have any problems getting your purchased forms, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.