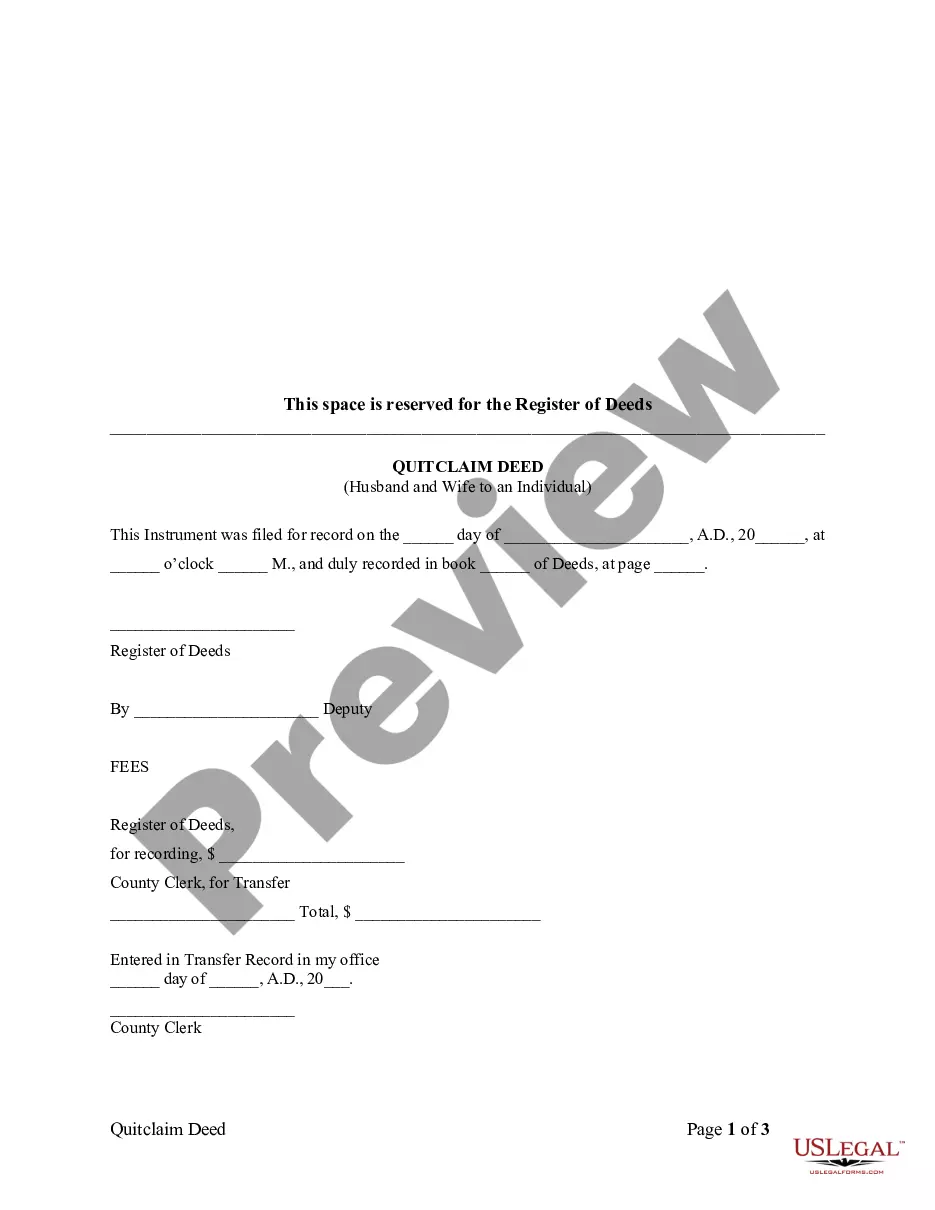

The Overland Park Kansas Quitclaim Deed from Husband and Wife to an Individual is a legal document that transfers any ownership or interest in a property from a married couple to a specific person. This type of deed grants the grantee, the individual, whatever interest the husband and wife have in the property. There are different variations of the Overland Park Kansas Quitclaim Deed from Husband and Wife to an Individual that may be used depending on the specific circumstances. Some of these types include: 1. Sole Ownership Deed: This type of quitclaim deed is used when one spouse transfers their interest in a property solely to another individual. In this case, the transferring spouse relinquishes their entire ownership stake to the grantee. 2. Partial Interest Deed: If both spouses want to transfer only a portion of their interest in the property to an individual, a partial interest deed can be utilized. This type of deed specifies the exact percentage or fractional share being transferred. 3. Joint Tenancy Deed: A joint tenancy quitclaim deed allows both spouses to transfer their undivided interest in the property to the grantee. This means that the grantee becomes a joint owner with the remaining spouse, sharing equal rights and responsibilities. 4. Tenancy in Common Deed: This type of deed enables the husband and wife to transfer their individual shares in the property to an individual, creating a tenancy in common. Unlike joint tenancy, tenants in common hold separate and distinct shares, which may not be equal. 5. Life Estate Deed: A life estate quitclaim deed allows the husband and wife to retain a life estate in the property while transferring the remainder interest to an individual. This means that they have the right to use and enjoy the property for the duration of their lives, but upon their passing, the property will fully belong to the grantee. In Overland Park, Kansas, executing a quitclaim deed from husband and wife to an individual requires the completion of certain legal formalities and filing with the appropriate county office. It is always advisable to consult with a qualified attorney or real estate professional to ensure compliance with local laws and to protect the interests of all parties involved.

Overland Park Kansas Quitclaim Deed from Husband and Wife to an Individual

Description

How to fill out Overland Park Kansas Quitclaim Deed From Husband And Wife To An Individual?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Overland Park Kansas Quitclaim Deed from Husband and Wife to an Individual gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Overland Park Kansas Quitclaim Deed from Husband and Wife to an Individual takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a few additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve chosen the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Overland Park Kansas Quitclaim Deed from Husband and Wife to an Individual. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!