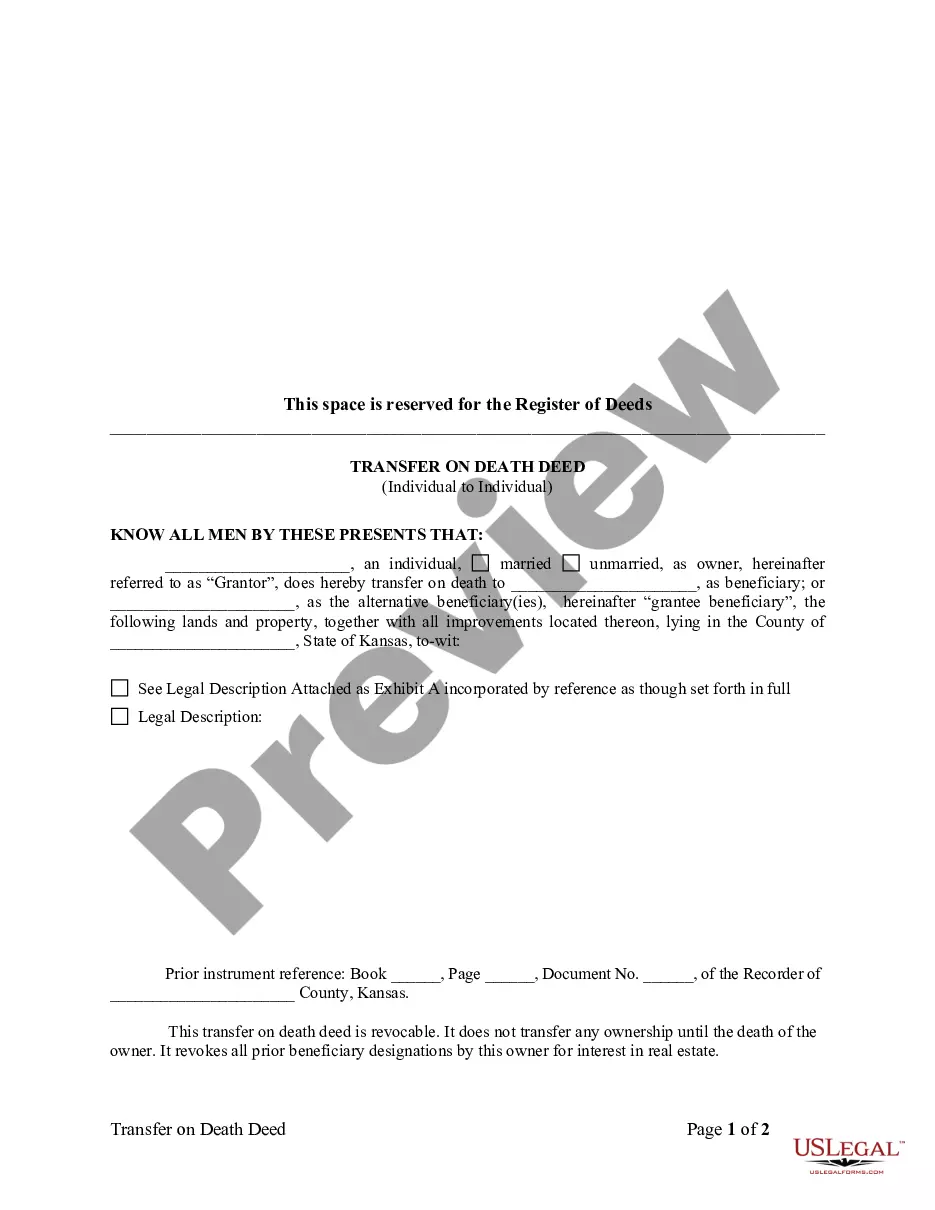

Olathe Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual

Description

How to fill out Kansas Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To Individual?

Regardless of social or professional standing, completing legal documents is an unfortunate obligation in today’s society.

It is frequently nearly impossible for individuals lacking any legal experience to generate such paperwork independently, primarily due to the complicated terminology and legal nuances that accompany them.

This is where US Legal Forms comes to assist.

Confirm that the template you selected is appropriate for your region, recognizing that laws differ from one state or county to another.

Examine the document and review a brief summary (if available) of situations for which the form can be utilized.

- Our platform offers an extensive collection with over 85,000 ready-to-utilize state-specific forms that are suitable for nearly any legal matter.

- US Legal Forms is also invaluable for lawyers or legal advisors seeking to conserve time by using our DIY forms.

- Whether you require the Olathe Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual, or any other document valid in your jurisdiction, US Legal Forms ensures everything is easily accessible.

- Here’s how to obtain the Olathe Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual in minutes by utilizing our reliable service.

- If you are a current subscriber, you can proceed to Log In to your account to download the relevant form.

- However, if you are not acquainted with our collection, make sure you follow these instructions before acquiring the Olathe Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual.

Form popularity

FAQ

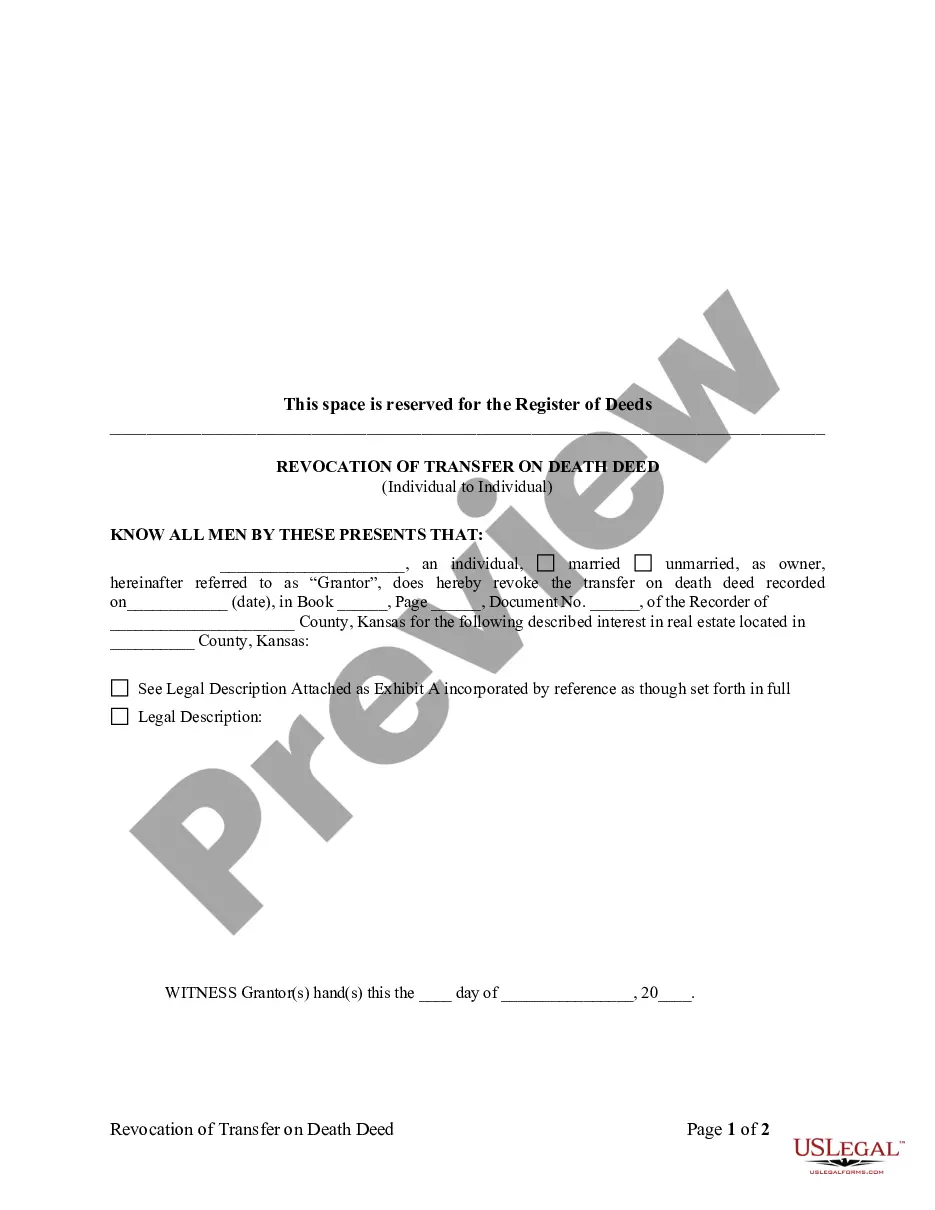

While a Transfer on Death (TOD) offers advantages, it also comes with a few drawbacks. Beneficiaries cannot access the assets until the transfer occurs, which can create financial strain in some cases. Moreover, if you change your mind about beneficiaries, you must update the deed accordingly to avoid unwanted outcomes. Considering the Olathe Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual will help you make informed decisions on your estate.

Establishing a Transfer on Death (TOD) can be a beneficial choice for many individuals. It allows your property to pass directly to your beneficiaries without going through probate, saving time and reducing costs. However, it's important to weigh your personal circumstances and consult with an expert. The Olathe Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual can simplify your estate planning process.

A Transfer on Death (TOD) does not inherently avoid capital gains tax, but it can affect how taxes are handled. The beneficiary may receive a step-up in basis, which could help reduce capital gains tax liabilities upon selling the inherited property. Therefore, when considering the Olathe Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual, it's wise to consult a tax advisor to understand the implications fully.

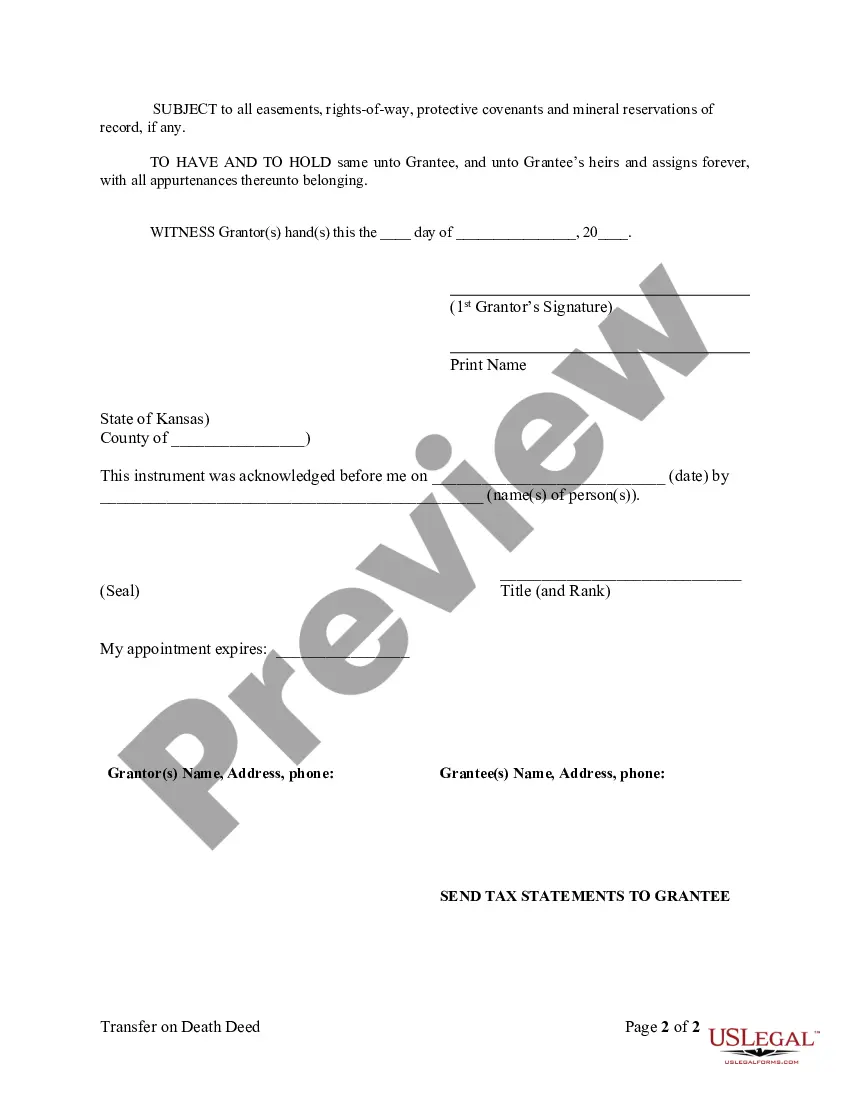

To obtain a Transfer on Death Deed in Kansas, you must prepare the deed according to state regulations. Legal forms can often be found through resources such as US Legal Forms, which provides templates and guidance. Once completed, the deed needs to be signed and notarized, followed by recording it with the county register of deeds. The Olathe Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual is a powerful tool for ensuring your estate transfers smoothly.

In Kansas, transferring title after death involves a few essential steps. First, you need to locate the deceased's Transfer on Death Deed or TOD. If a valid deed exists, it must be recorded with the county to formally transfer the title to the beneficiary. Thus, utilizing the Olathe Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual can streamline this process and prevent confusion.

Transfer on Death (TOD) accounts can present various challenges. One of the main issues is the risk of disputes among beneficiaries, especially if the deceased did not clearly communicate their wishes. Additionally, the lack of comprehensive planning can lead to complications with assets not covered by the TOD. Understanding these potential drawbacks is essential when considering the Olathe Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual.

In Kansas, you typically do not need insurance in place before transferring a vehicle title. However, keeping insurance active is essential to legally drive and protect your interests. When using the Olathe Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual, ensure that insurance is updated under the new owner's name once the transfer is completed. This approach ensures compliance with Kansas laws and provides peace of mind.

Generally, cars in Kansas can bypass probate if certain conditions are met, particularly if a Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual is used. If the vehicle is solely owned and no other complications exist, you may transfer the title directly to the beneficiary. Using this deed can save time and reduce the stress of the probate process. Always check specific rules and follow proper procedures to avoid delays.

In Kansas, transferring a car title when the owner has passed away requires specific documentation. You will need a certified copy of the death certificate, the original title, and possibly a completed Kansas Affidavit for Transfer of Motor Vehicle. Consider utilizing the Olathe Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual to simplify the transfer process. This method can help ensure that all transfers are handled correctly and efficiently.

Yes, Minnesota does allow transfer on death deeds. This legal mechanism provides a way to transfer property without going through probate. If you're considering such an arrangement, it's essential to understand state-specific regulations and how they differ from Olathe Kansas Transfer on Death Deeds, ensuring you take the right steps.