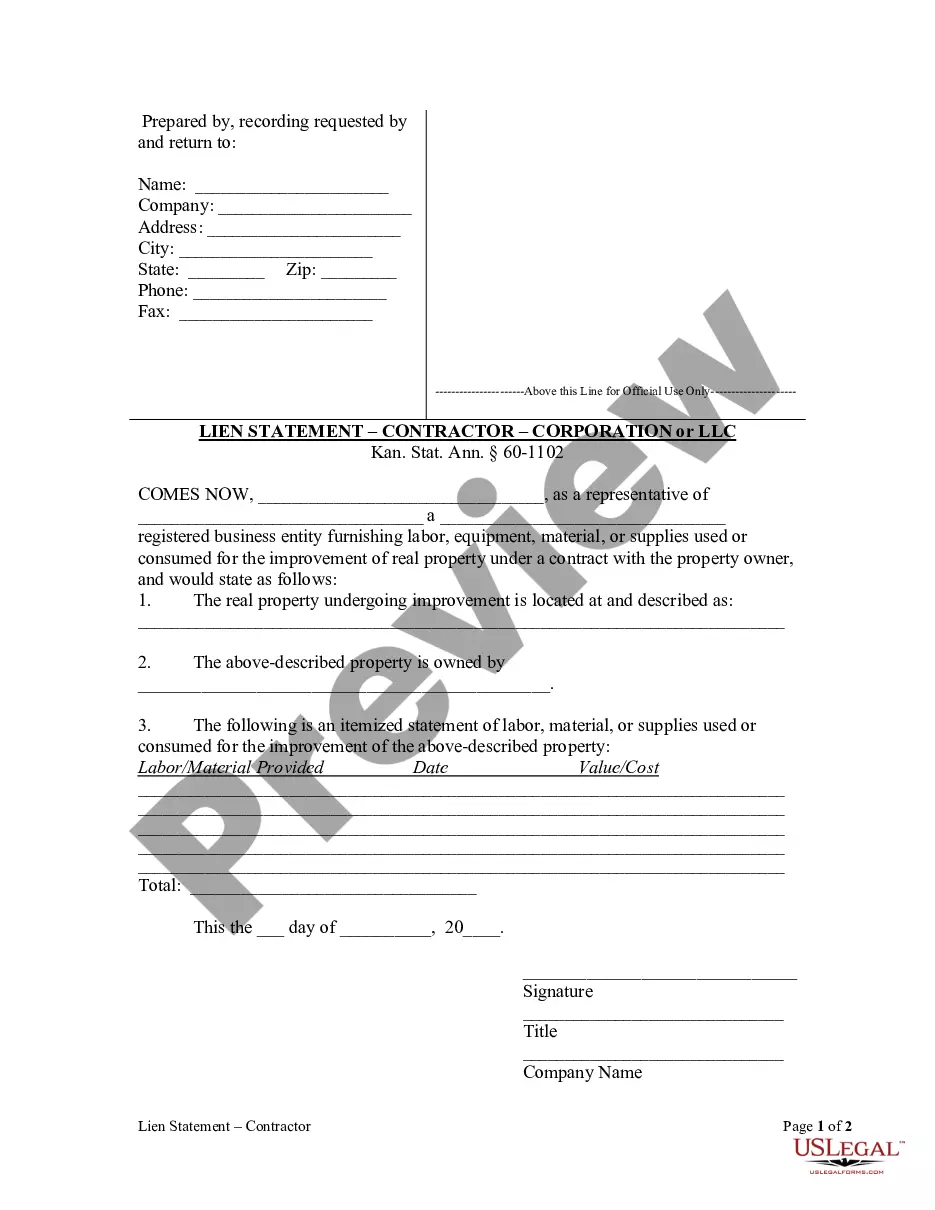

Kansas law makes a distinction between the lien statement to be filed by a contractor and a subcontractor. Both lien statements serve to inform the property owner that a lien is being claimed against his property for labor or materials provided. A contractor must file his lien statement within four months after the date the last labor was performed or material furnished.

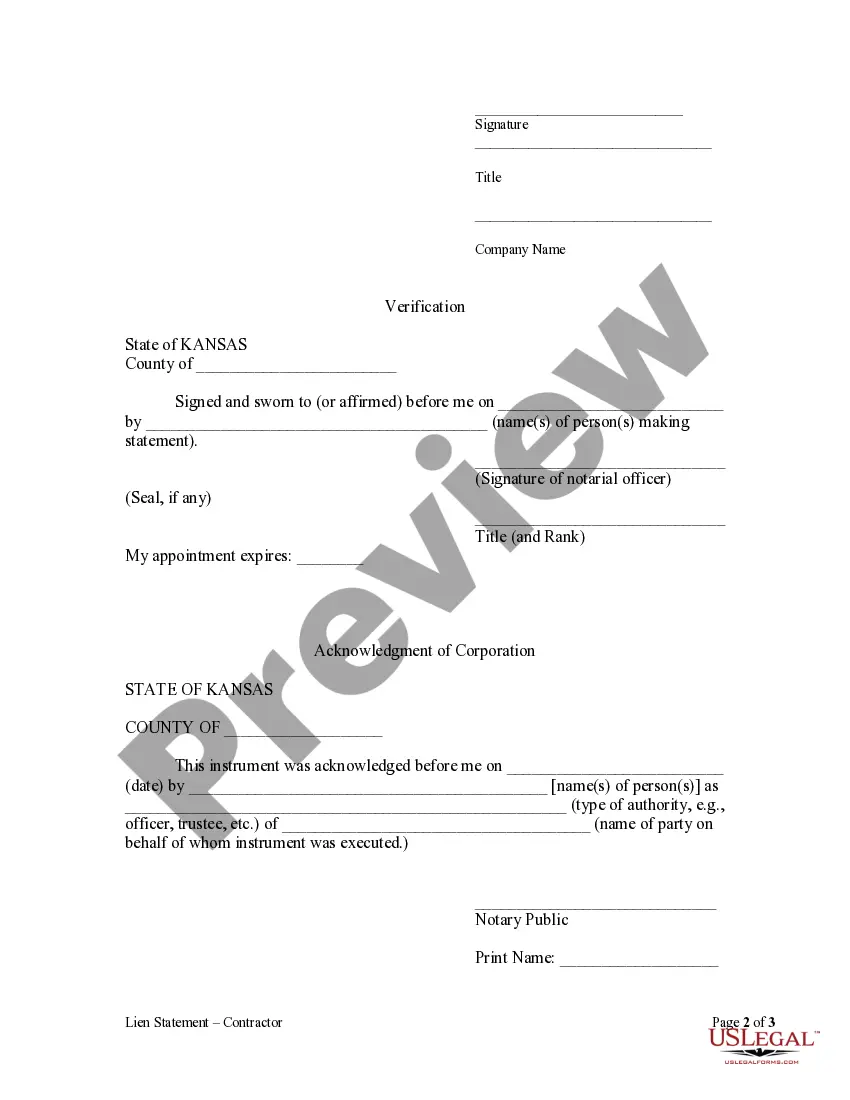

The Topeka Kansas Lien Statement by Contractor as Corporation or LLC is a legal document filed to protect contractors' rights to payment for services rendered or materials provided in the construction industry. This statement is specifically tailored for contractors operating as a corporation or LLC in the city of Topeka, Kansas. This lien statement serves as evidence that a contractor has performed work or provided materials on a property, and it outlines the amount owed to the contractor. By filing this statement, contractors establish a legal claim, known as a mechanic's lien, on the property where the work was completed. This claim ensures that contractors are financially protected and have a right to compensation for their services rendered. Topeka Kansas recognizes several types of lien statements for contractors operating as a corporation or LLC, including: 1. Preliminary Notice Lien Statement: Contractors may file a preliminary notice lien statement before commencing work or providing materials on a property. This notice serves as a warning to property owners, informing them of the contractor's intent to file a lien if payment issues arise. 2. Notice of Intent to File Lien Statement: If a contractor has not received payment for their services within the agreed-upon timeframe, they may submit a Notice of Intent to File Lien Statement. This notice notifies the property owner that the contractor intends to file a lien if payment is not received promptly. 3. Final Lien Statement: This is the most common type of lien statement filed by contractors operating as a corporation or LLC. It is submitted after the completion of work or delivery of materials, but payment remains outstanding. This statement outlines the contractor's claim against the property and demands payment for services provided. 4. Release of Lien Statement: Once payment has been received in full, contractors file a Release of Lien Statement to cancel the lien claim on the property. This document acknowledges that all financial obligations have been fulfilled, and the property is no longer encumbered by the contractor's claim. It is important for contractors operating as a corporation or LLC in Topeka, Kansas, to understand the specific requirements and timelines for filing these lien statements. Failing to comply with the necessary procedures and deadlines may result in the forfeiture of their right to claim payment through a mechanic's lien. In summary, the Topeka Kansas Lien Statement by Contractor as Corporation or LLC is a vital legal document that protects contractors' rights to payment. By utilizing the various types of lien statements available, contractors can establish their claim on a property, notify property owners of their intent to file a lien if necessary, demand payment for services rendered, and ultimately release the lien once payment is received.The Topeka Kansas Lien Statement by Contractor as Corporation or LLC is a legal document filed to protect contractors' rights to payment for services rendered or materials provided in the construction industry. This statement is specifically tailored for contractors operating as a corporation or LLC in the city of Topeka, Kansas. This lien statement serves as evidence that a contractor has performed work or provided materials on a property, and it outlines the amount owed to the contractor. By filing this statement, contractors establish a legal claim, known as a mechanic's lien, on the property where the work was completed. This claim ensures that contractors are financially protected and have a right to compensation for their services rendered. Topeka Kansas recognizes several types of lien statements for contractors operating as a corporation or LLC, including: 1. Preliminary Notice Lien Statement: Contractors may file a preliminary notice lien statement before commencing work or providing materials on a property. This notice serves as a warning to property owners, informing them of the contractor's intent to file a lien if payment issues arise. 2. Notice of Intent to File Lien Statement: If a contractor has not received payment for their services within the agreed-upon timeframe, they may submit a Notice of Intent to File Lien Statement. This notice notifies the property owner that the contractor intends to file a lien if payment is not received promptly. 3. Final Lien Statement: This is the most common type of lien statement filed by contractors operating as a corporation or LLC. It is submitted after the completion of work or delivery of materials, but payment remains outstanding. This statement outlines the contractor's claim against the property and demands payment for services provided. 4. Release of Lien Statement: Once payment has been received in full, contractors file a Release of Lien Statement to cancel the lien claim on the property. This document acknowledges that all financial obligations have been fulfilled, and the property is no longer encumbered by the contractor's claim. It is important for contractors operating as a corporation or LLC in Topeka, Kansas, to understand the specific requirements and timelines for filing these lien statements. Failing to comply with the necessary procedures and deadlines may result in the forfeiture of their right to claim payment through a mechanic's lien. In summary, the Topeka Kansas Lien Statement by Contractor as Corporation or LLC is a vital legal document that protects contractors' rights to payment. By utilizing the various types of lien statements available, contractors can establish their claim on a property, notify property owners of their intent to file a lien if necessary, demand payment for services rendered, and ultimately release the lien once payment is received.