Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal process that allows individuals in Topeka, Kansas, to renounce or disclaim their rights to property received from a life insurance or annuity contract. This renunciation and disclaimer process helps individuals avoid inheriting or receiving property from such contracts, in order to manage their financial affairs more effectively and maintain control over their assets. It enables individuals to reject any interest or benefits they may be entitled to, and ensures that the property passes on to other designated beneficiaries or parties. There are two main types of Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract: 1. Renunciation: This type of renunciation occurs when an individual knowingly chooses to surrender their rights to property received from a life insurance or annuity contract. By renouncing their claim, the individual relinquishes any ownership or entitlement to the property. This renunciation can occur due to personal reasons, financial planning needs, or other preferences. 2. Disclaimer: This type of disclaimer involves the refusal to accept property received as a result of a life insurance or annuity contract. By disclaiming the property, individuals avoid becoming legal owners, and the property then passes to the next eligible beneficiary outlined in the contract. This can be done for various reasons, such as minimizing tax liabilities, avoiding financial risks, or allowing the property to benefit someone else. To initiate the Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract process, individuals must submit a written statement expressing their intent to renounce or disclaim their rights. This statement should include details regarding the specific property, the contract from which it was received, and the individual's reasons for renunciation or disclaimer. It is crucial to follow the legal requirements and procedures outlined by the state of Kansas to ensure the renunciation or disclaimer is valid and legally binding. In conclusion, the Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal process that allows individuals to relinquish their rights to property received from life insurance or annuity contracts. By renouncing or disclaiming the property, individuals can effectively manage their finances and ensure that the property passes on to other designated beneficiaries or parties.

Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract

State:

Kansas

City:

Topeka

Control #:

KS-02-03

Format:

Word

Instant download

Description

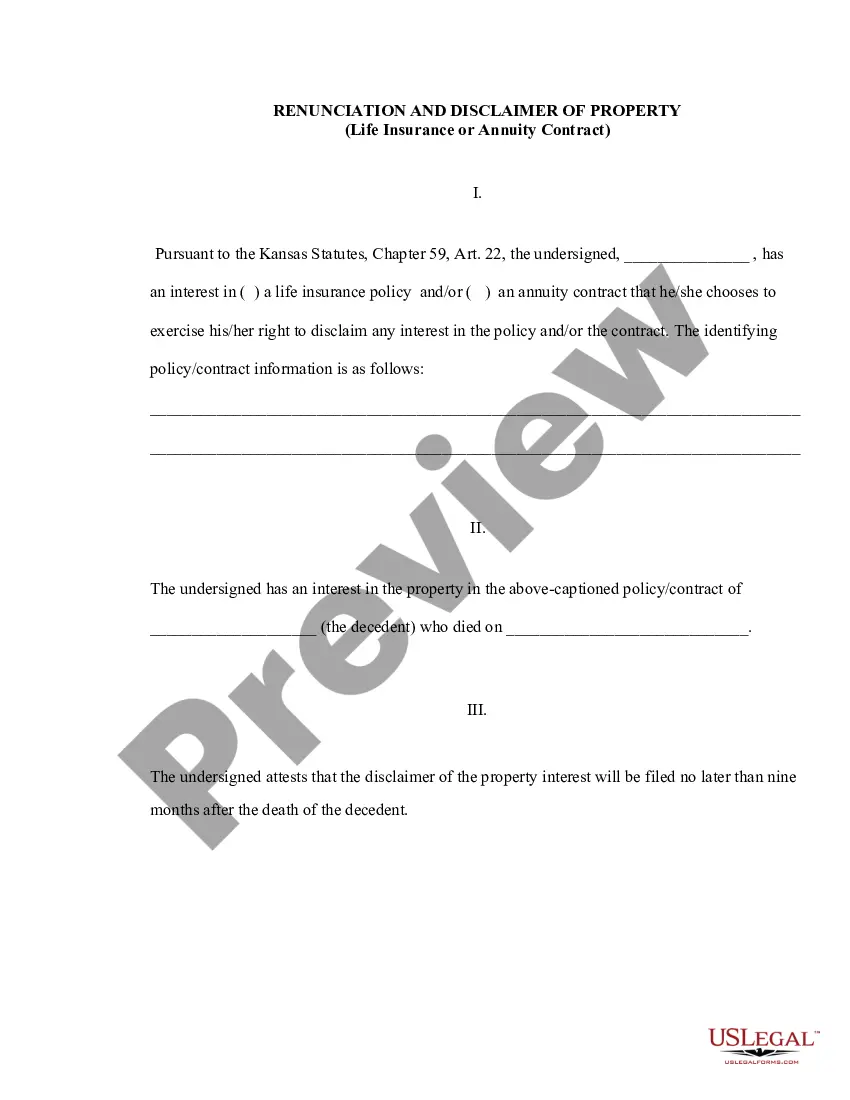

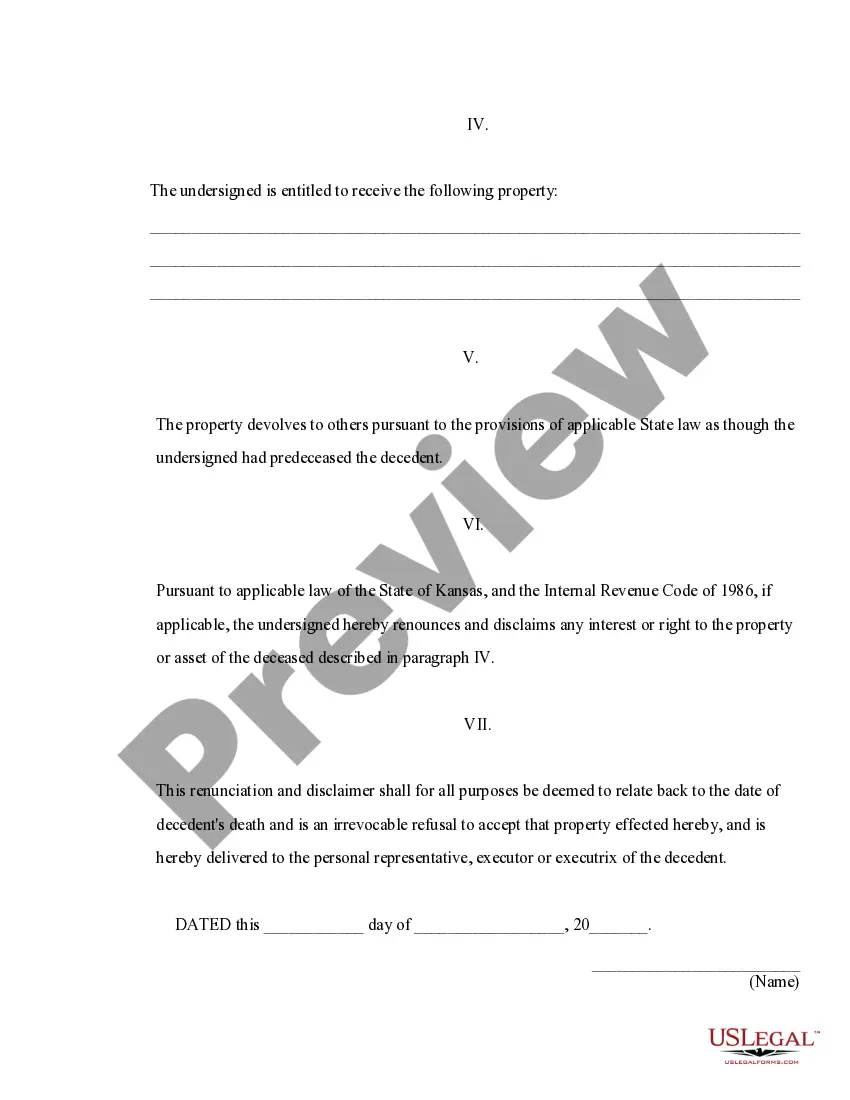

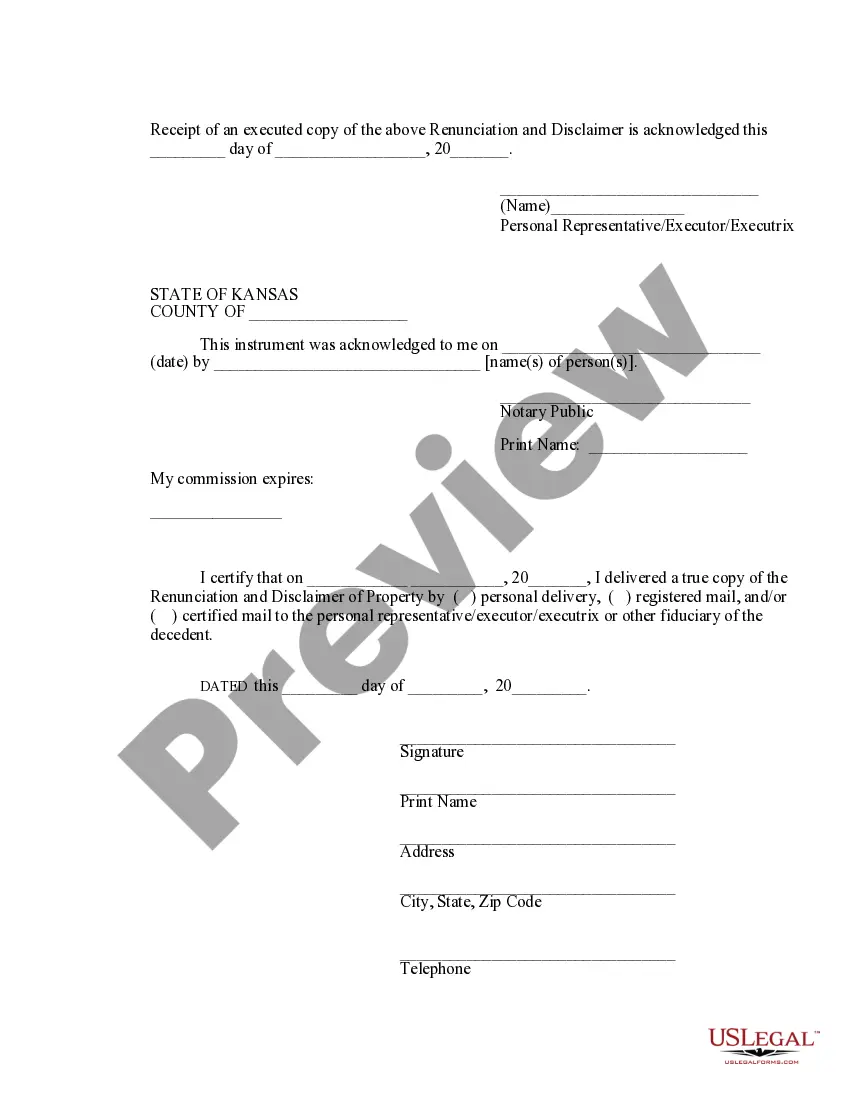

This form is a Renunciation and Disclaimer of Life Insurance or Annuity Contract proceeds. The beneficiary has gained an interest in the life insurance and/or annuity contract proceeds due to the death of the decedent. However, according to the Kansas Statutes, Chapter 59, Art. 22, the beneficiary has chosen to disclaim his/her entire interest in the proceeds. The beneficiary attests to the fact that the disclaimer will be filed no later than nine months after the death of the decedent. The form also includes a state specific acknowledgment and a certificate to verify delivery.

Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal process that allows individuals in Topeka, Kansas, to renounce or disclaim their rights to property received from a life insurance or annuity contract. This renunciation and disclaimer process helps individuals avoid inheriting or receiving property from such contracts, in order to manage their financial affairs more effectively and maintain control over their assets. It enables individuals to reject any interest or benefits they may be entitled to, and ensures that the property passes on to other designated beneficiaries or parties. There are two main types of Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract: 1. Renunciation: This type of renunciation occurs when an individual knowingly chooses to surrender their rights to property received from a life insurance or annuity contract. By renouncing their claim, the individual relinquishes any ownership or entitlement to the property. This renunciation can occur due to personal reasons, financial planning needs, or other preferences. 2. Disclaimer: This type of disclaimer involves the refusal to accept property received as a result of a life insurance or annuity contract. By disclaiming the property, individuals avoid becoming legal owners, and the property then passes to the next eligible beneficiary outlined in the contract. This can be done for various reasons, such as minimizing tax liabilities, avoiding financial risks, or allowing the property to benefit someone else. To initiate the Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract process, individuals must submit a written statement expressing their intent to renounce or disclaim their rights. This statement should include details regarding the specific property, the contract from which it was received, and the individual's reasons for renunciation or disclaimer. It is crucial to follow the legal requirements and procedures outlined by the state of Kansas to ensure the renunciation or disclaimer is valid and legally binding. In conclusion, the Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal process that allows individuals to relinquish their rights to property received from life insurance or annuity contracts. By renouncing or disclaiming the property, individuals can effectively manage their finances and ensure that the property passes on to other designated beneficiaries or parties.

Free preview

How to fill out Topeka Kansas Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

If you’ve already utilized our service before, log in to your account and download the Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make certain you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!