This form is a Transfer on Death Deed where the grantors are husband and wife or two individuals and the grantees are two individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving grantor. The grantees take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

Wichita Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife or Two Individuals to Two Individuals

Description

How to fill out Wichita Kansas Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife Or Two Individuals To Two Individuals?

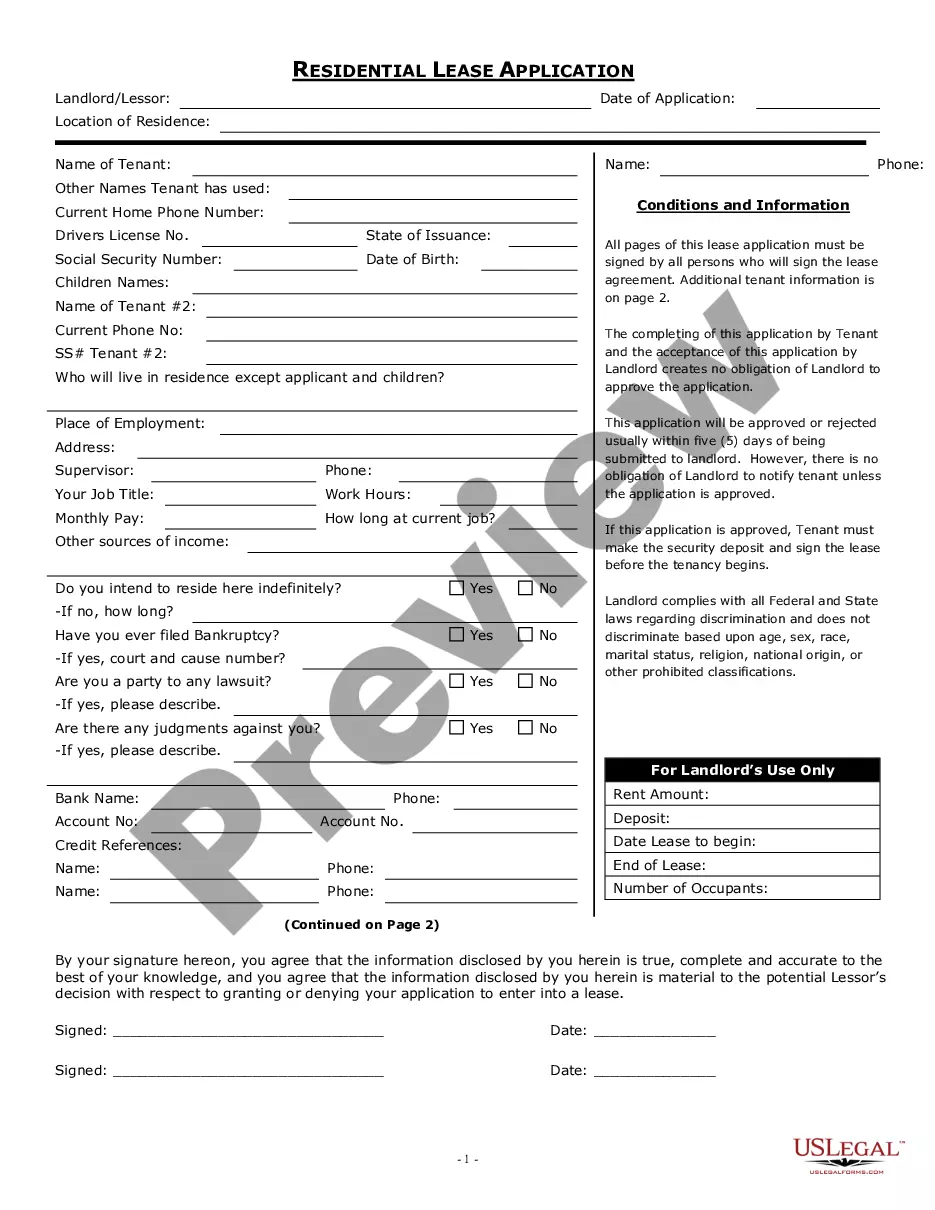

Acquiring approved templates that adhere to your regional regulations can be difficult unless you utilize the US Legal Forms database.

It is an online repository of over 85,000 legal documents catering to both personal and professional requirements along with various real-life scenarios.

All the papers are correctly categorized by usage area and jurisdiction, making it as simple as pie to find the Wichita Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Spouses or Two Individuals to Two Individuals.

Maintaining documents organized and compliant with legal standards is crucial. Take advantage of the US Legal Forms library to always have vital document templates for any requirements readily available!

- For those already familiar with our library and have utilized it previously, obtaining the Wichita Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Spouses or Two Individuals to Two Individuals requires only a few clicks.

- Simply Log In to your account, select the document, and click Download to save it to your device.

- New users will just need to take a couple more steps to complete the process.

- Follow the instructions below to begin with the most comprehensive online form catalog.

- Inspect the Preview mode and form overview. Ensure that you have selected the appropriate one that satisfies your needs and fully aligns with your regional jurisdiction requirements.

Form popularity

FAQ

If you don't have a will or a Transfer on Death Deed, your real estate must go through the probate court and your property will pass to your heirs according to Texas law. Probate can be lengthy and expensive, with attorney fees and court costs paid from your estate.

Transfer-on-Death Deeds for Real Estate North Carolina does not allow real estate to be transferred with transfer-on-death deeds.

A transfer on death deed can be a very helpful planning tool when designing an estate plan. Indiana is one of many states that allows the transfer of real property by a transfer on death deed.

Transfer-on-death deeds for real estate Kansas allows you to leave real estate with transfer-on-death deeds. These deeds are also called beneficiary deeds. You sign and record the deed now, but it doesn't take effect until your death.

Two documents are recommended for the transfer of property after death without a Will. An Affidavit of Heirship. The Affidavit of Heirship is a sworn statement that identifies the heirs. It is signed in front of a notary by an heir and two witnesses knowledgeable about the family history of the deceased.

Dying Without a Will in Kansas If there isn't a will, the court then appoints someone, usually an adult child or surviving spouse, to be the executor or personal representative. The executor or personal representative takes care of the decedent's estate.

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

This article from an ABA Journal, explains the options provided by a Transfer on Death Deed. Kansas is one of only nine states that allows this option.

A transfer on death deed, or a TOD Deed, allows for individuals to pass real property to a beneficiary upon their death.

A transfer on death (TOD) account automatically transfers its assets to a named beneficiary when the holder dies For example, if you have a savings account with $100,000 in it and name your son as its beneficiary, that account would transfer to him upon your death.