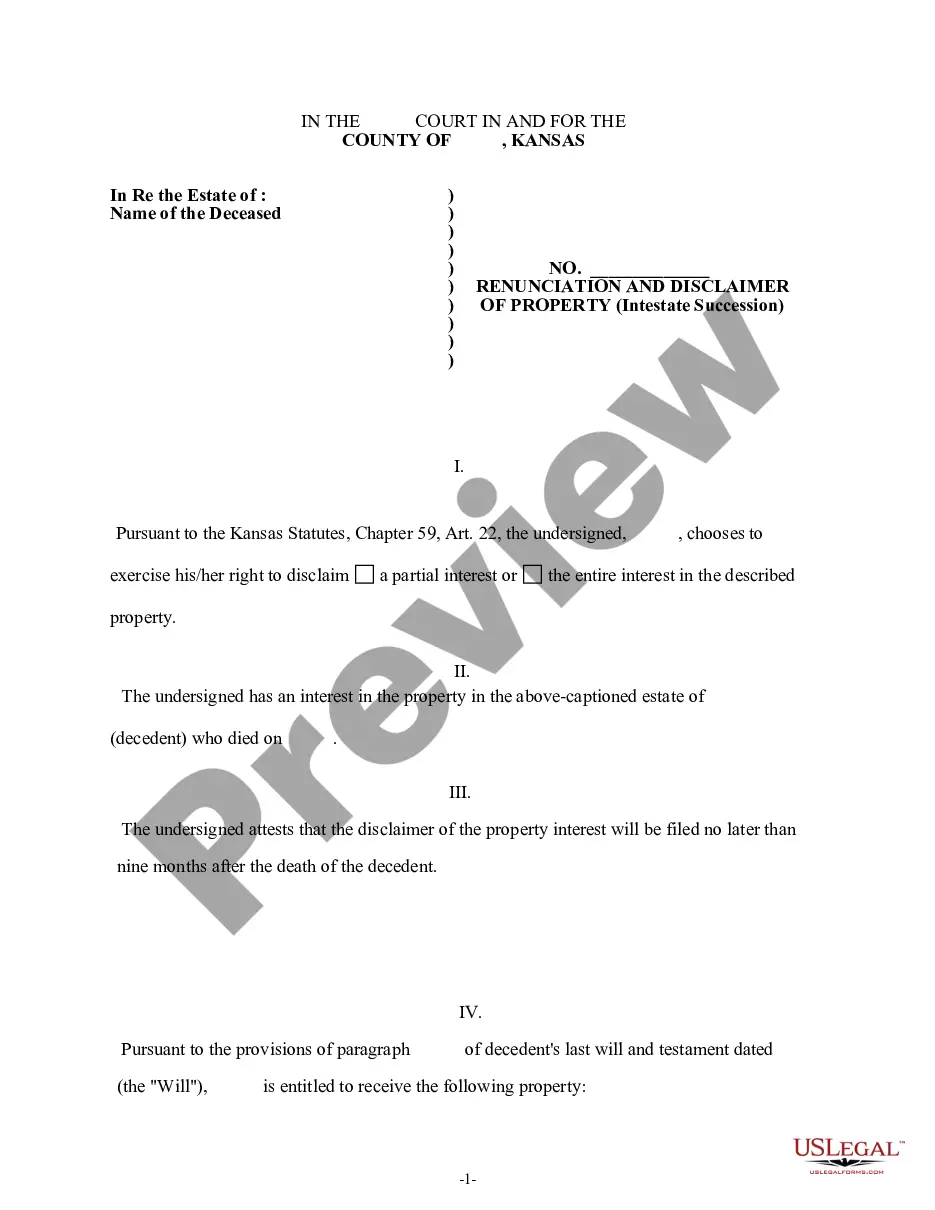

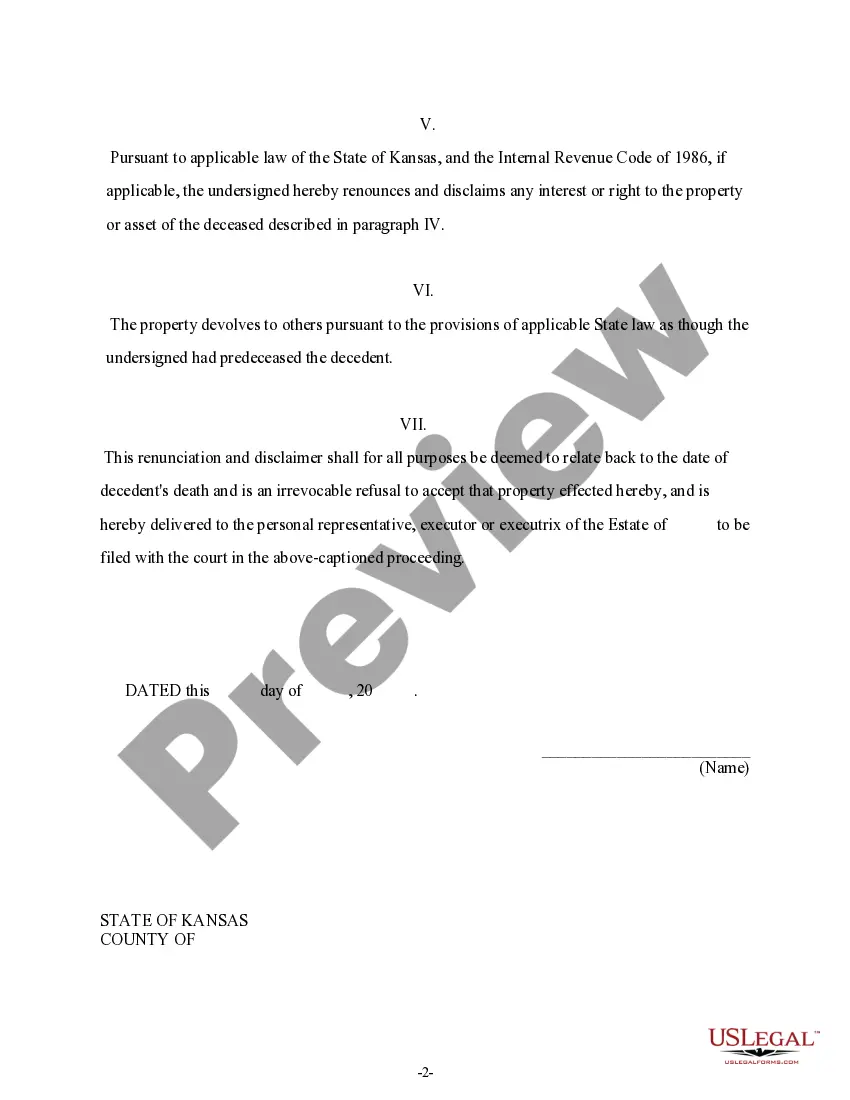

Overland Park Kansas Renunciation and Disclaimer of Property received by Intestate Succession is a legal process that allows an individual to decline or relinquish their right to inherit property from a deceased person who passed away without a valid will (intestate). This renunciation and disclaimer can be executed by individuals who do not wish to accept their share of the deceased person's estate. It is important to understand the implications and procedures involved in this process to ensure legal compliance. Key Points: 1. Understanding Renunciation and Disclaimer: Renunciation refers to the act of refusing or turning down an inheritance, while a disclaimer involves giving up or disclaiming the inherited property. This can be done through a legally binding document known as Renunciation and Disclaimer of Property received by Intestate Succession. 2. Estate Distribution Laws: In the absence of a valid will, the state of Kansas follows intestate succession laws to determine how a deceased person's estate will be distributed among the surviving family members. Renunciation and disclaimer allow individuals to opt out of this distribution and pass on their share to other beneficiaries. 3. Legal Requirements: To execute a renunciation and disclaimer, specific legal requirements must be met. This includes filing the renunciation document with the appropriate probate court in Overland Park, Kansas within a specified timeframe following the decedent's death. 4. Voluntary Decision: Renunciation and disclaimer should be voluntary decisions made by an individual. It is important to carefully consider the potential consequences of relinquishing the rights to inherit, such as the distribution among other beneficiaries and possible tax implications. 5. Qualified Beneficiaries: Renunciation and disclaimer can apply to various individuals who are considered qualified beneficiaries, including spouses, children, grandchildren, parents, siblings, or any other relative entitled to inherit under Kansas intestacy laws. Types of Renunciation and Disclaimer: 1. Renunciation of Intestate Succession: This type of renunciation involves refusing the entirety of the inheritance from the decedent's estate. The renouncing individual will have no claim or right to any portion of the estate. 2. Partial Renunciation: In some cases, an individual may choose to renounce only a specific portion or asset of the estate, while still accepting other parts. This allows for more selective decision-making based on personal circumstances. 3. Disclaimer of Property: This type of disclaimer occurs when a beneficiary disclaims or gives up their rights to specific property received through intestate succession. It may be relevant when the property has certain restrictions, liabilities, or undesirable attributes that the beneficiary does not wish to assume. In conclusion, the process of Overland Park Kansas Renunciation and Disclaimer of Property received by Intestate Succession allows qualified beneficiaries to voluntarily decline or relinquish their right to inherit property from a deceased person who passed away without a will. Understanding the legal requirements, implications, and different types of renunciation and disclaimer is crucial to make informed decisions regarding estate assets. Consultation with a qualified attorney is recommended to navigate this process effectively.

Overland Park Kansas Renunciation and Disclaimer of Property received by Intestate Succession

Description

How to fill out Overland Park Kansas Renunciation And Disclaimer Of Property Received By Intestate Succession?

Regardless of social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone with no law background to draft such paperwork from scratch, mostly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our service provides a huge catalog with more than 85,000 ready-to-use state-specific documents that work for practically any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you want the Overland Park Kansas Renunciation and Disclaimer of Property received by Intestate Succession or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Overland Park Kansas Renunciation and Disclaimer of Property received by Intestate Succession in minutes employing our trusted service. In case you are presently a subscriber, you can proceed to log in to your account to download the needed form.

Nevertheless, in case you are new to our platform, make sure to follow these steps prior to downloading the Overland Park Kansas Renunciation and Disclaimer of Property received by Intestate Succession:

- Be sure the form you have found is suitable for your area because the rules of one state or area do not work for another state or area.

- Review the document and read a quick outline (if available) of scenarios the document can be used for.

- If the form you selected doesn’t meet your requirements, you can start over and search for the needed document.

- Click Buy now and pick the subscription plan you prefer the best.

- utilizing your credentials or register for one from scratch.

- Choose the payment method and proceed to download the Overland Park Kansas Renunciation and Disclaimer of Property received by Intestate Succession once the payment is through.

You’re good to go! Now you can proceed to print out the document or complete it online. Should you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.