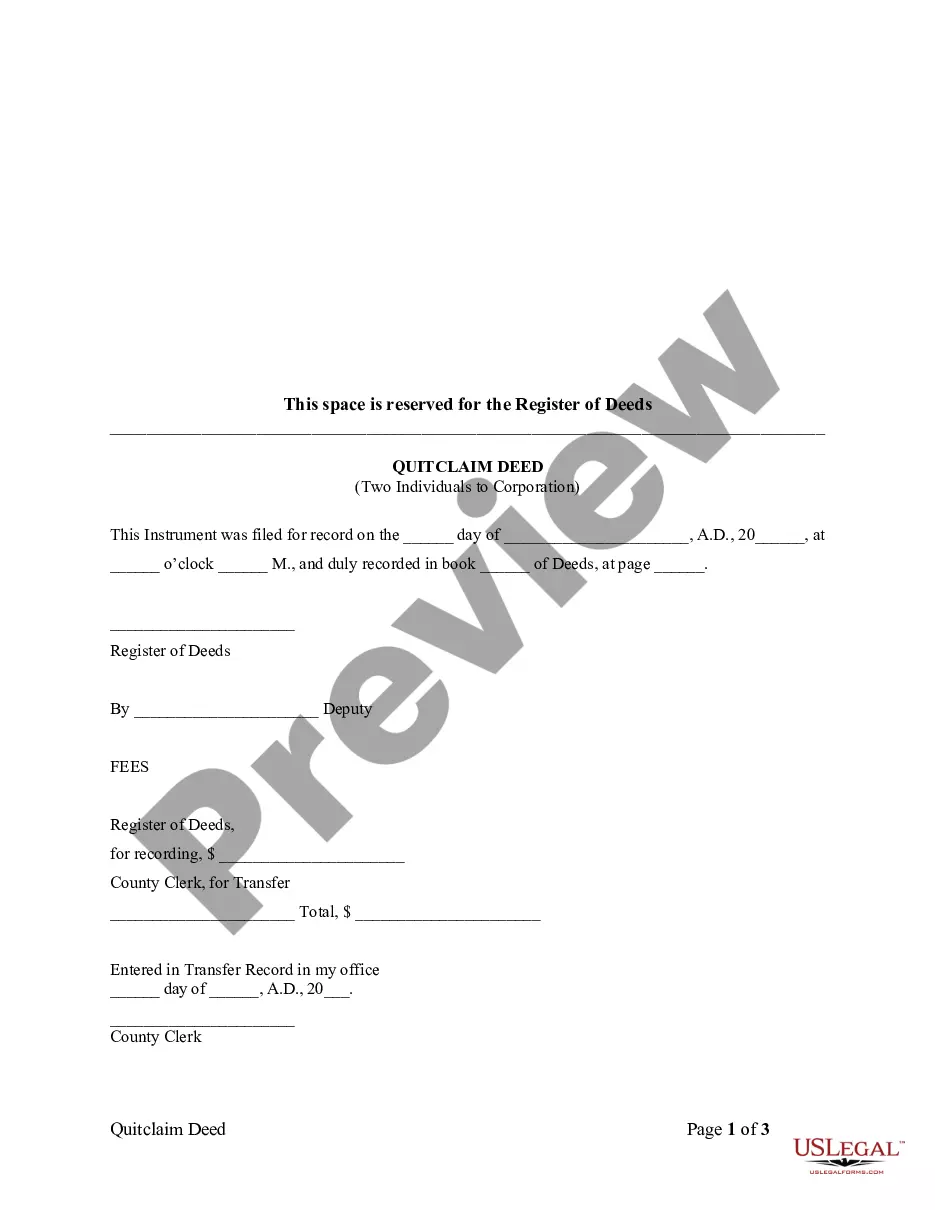

Overland Park Kansas Quitclaim Deed by Two Individuals to Corporation

Description

How to fill out Kansas Quitclaim Deed By Two Individuals To Corporation?

Do you require a reliable and economical legal documents provider to acquire the Overland Park Kansas Quitclaim Deed by Two Individuals to Corporation? US Legal Forms is your best choice.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a collection of documents to facilitate your separation or divorce through the judicial system, we are here to assist you. Our platform features over 85,000 current legal document samples for both personal and business purposes. All templates we provide access to are tailored specifically to the laws of particular states and counties.

To obtain the document, you must Log In to your account, find the required template, and click the Download button next to it. Please remember that you can download your past purchased document templates any time from the My documents tab.

Is this your first visit to our platform? No problem. You can create an account quickly, but before that, ensure you do the following.

Now you can register your account. Then choose a subscription plan and proceed to checkout. After the payment is confirmed, download the Overland Park Kansas Quitclaim Deed by Two Individuals to Corporation in any file format available. You can revisit the website whenever necessary and redownload the document at no additional charge.

Acquiring the latest legal forms has never been simpler. Try US Legal Forms now, and stop wasting your precious time learning about legal documentation online for good.

- Verify if the Overland Park Kansas Quitclaim Deed by Two Individuals to Corporation adheres to the regulations of your state and locality.

- Review the form's description (if available) to understand who and what the document is intended for.

- Initiate the search again if the template does not fit your legal circumstances.

Form popularity

FAQ

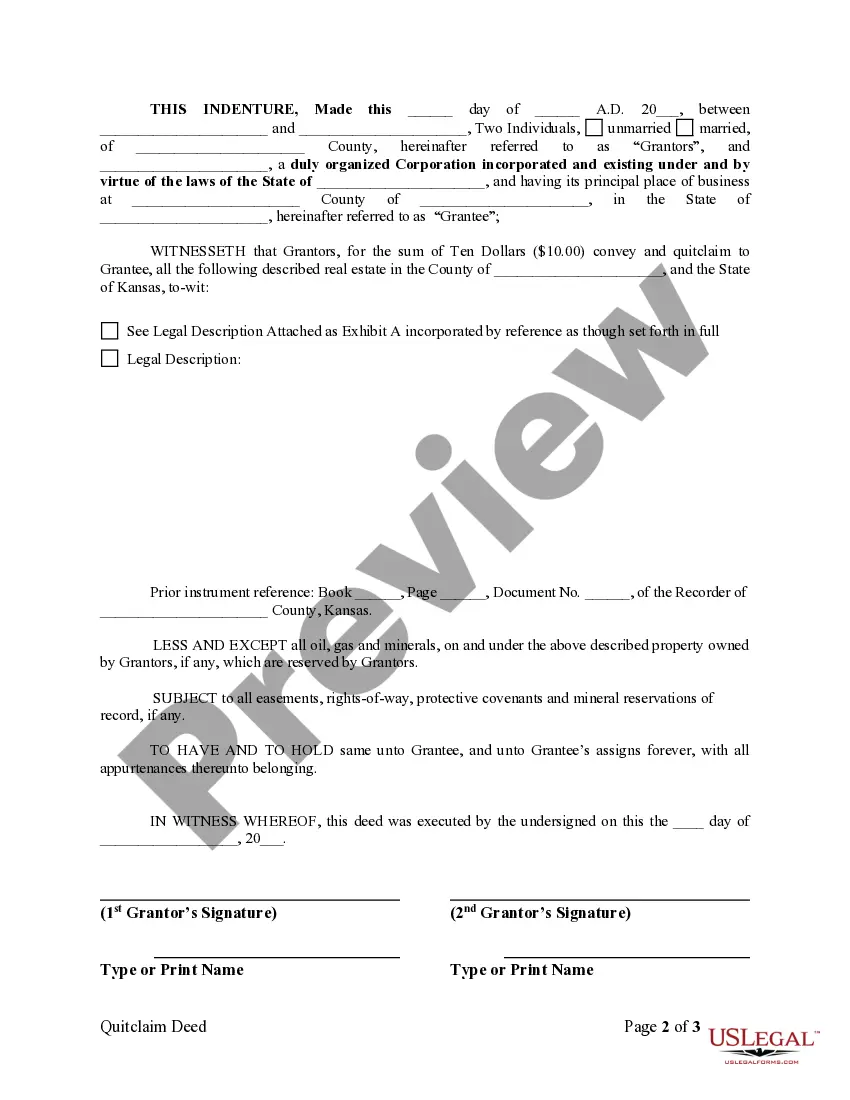

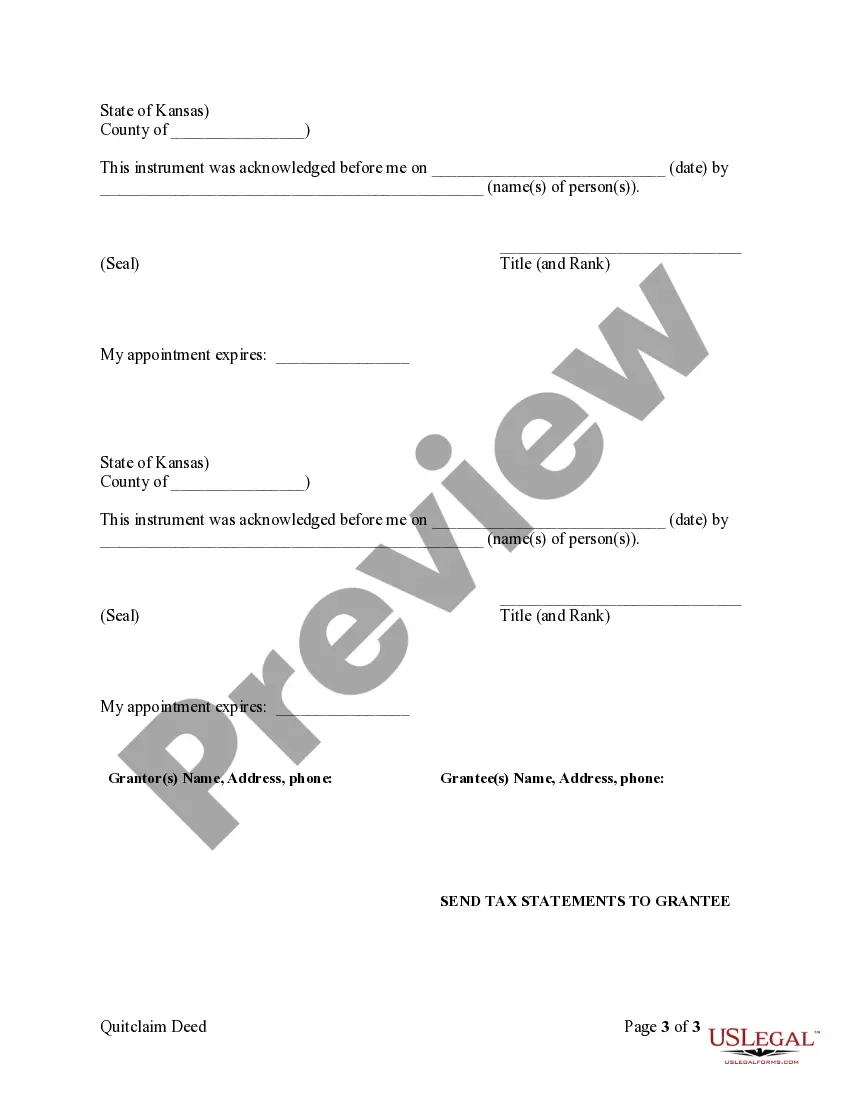

Creating an Overland Park Kansas Quitclaim Deed by Two Individuals to Corporation requires specific details to ensure validity. First, the deed must include the names of both individuals transferring the property and the corporation receiving it. Additionally, a legal description of the property, including its address, is essential. Lastly, both grantors need to sign the deed in the presence of a notary public to complete the transaction.

Filing a quitclaim deed in Kansas requires that you first complete the deed with accurate property details and both parties' names. After signing the deed in front of a notary, you must file it at your local county office. Choosing to use an Overland Park Kansas Quitclaim Deed by Two Individuals to Corporation can streamline this filing process by providing all necessary legal assurances. Always keep a copy for your personal records after filing.

To execute a transfer on death deed in Kansas, you will first need to prepare a deed that indicates your intent to transfer property upon your death. This deed must be signed and notarized, then recorded at the county's register of deeds office. If you are considering an Overland Park Kansas Quitclaim Deed by Two Individuals to Corporation, this method can ensure a smooth transition of property to your desired beneficiaries. It's advisable to consult legal assistance to ensure proper execution.

Filing a quitclaim deed in Kansas involves completing the deed form, signing it in front of a notary, and then submitting it to the appropriate county office. Ensure that you include any necessary details, such as property descriptions and the names of the individuals involved. Utilizing an Overland Park Kansas Quitclaim Deed by Two Individuals to Corporation can simplify the process significantly. After filing, you will receive a stamped copy for your records.

To add a name to your house deed in Kansas, you will need to prepare a new deed that transfers ownership. You can use a quitclaim deed, which allows one party to transfer their interest to another. For the best results, consider looking into an Overland Park Kansas Quitclaim Deed by Two Individuals to Corporation to ensure all legal aspects are covered. It's essential to file the new deed with your county's register of deeds office.

An Overland Park Kansas Quitclaim Deed by Two Individuals to Corporation works by allowing the individuals to convey any interest they may have in the property without guaranteeing that they hold good title. This means that if there are any liens or issues tied to the property, the new owner takes on those risks. Utilizing a quitclaim deed can simplify ownership transfers, making platforms like US Legal Forms extremely helpful in accessing accurate forms and instructions for your specific needs.

To file an Overland Park Kansas Quitclaim Deed by Two Individuals to Corporation, you first need to complete the deed form with accurate property details. After signing it in front of a notary, you will need to file it with the appropriate county office where the property is located. While you can do this independently, US Legal Forms offers user-friendly templates and guidance, streamlining the process for a smooth filing experience.

The most common use of an Overland Park Kansas Quitclaim Deed by Two Individuals to Corporation is to transfer property ownership without warranty. This type of deed allows individuals to relinquish their interest in a property to a corporation, simplifying the transfer process. It's often utilized during family transactions, or in the case of joint ownership, making it a valuable tool for those looking to manage real estate efficiently.

You can obtain the deed to your house in Kansas by requesting a copy from your local county clerk's office. If you need to transfer or update ownership, you might consider using the Overland Park Kansas Quitclaim Deed by Two Individuals to Corporation. When using this form, ensure all required details are filled in accurately. Platforms like uslegalforms can provide necessary templates and instructions for your convenience.

To add a name to a deed in Kansas, you typically need to execute a new quitclaim deed. This process would involve using the Overland Park Kansas Quitclaim Deed by Two Individuals to Corporation as a resource. Ensure you include all current owners' names and the new owner's name in the document. Once signed and notarized, file this updated deed with the local county office to record the change.