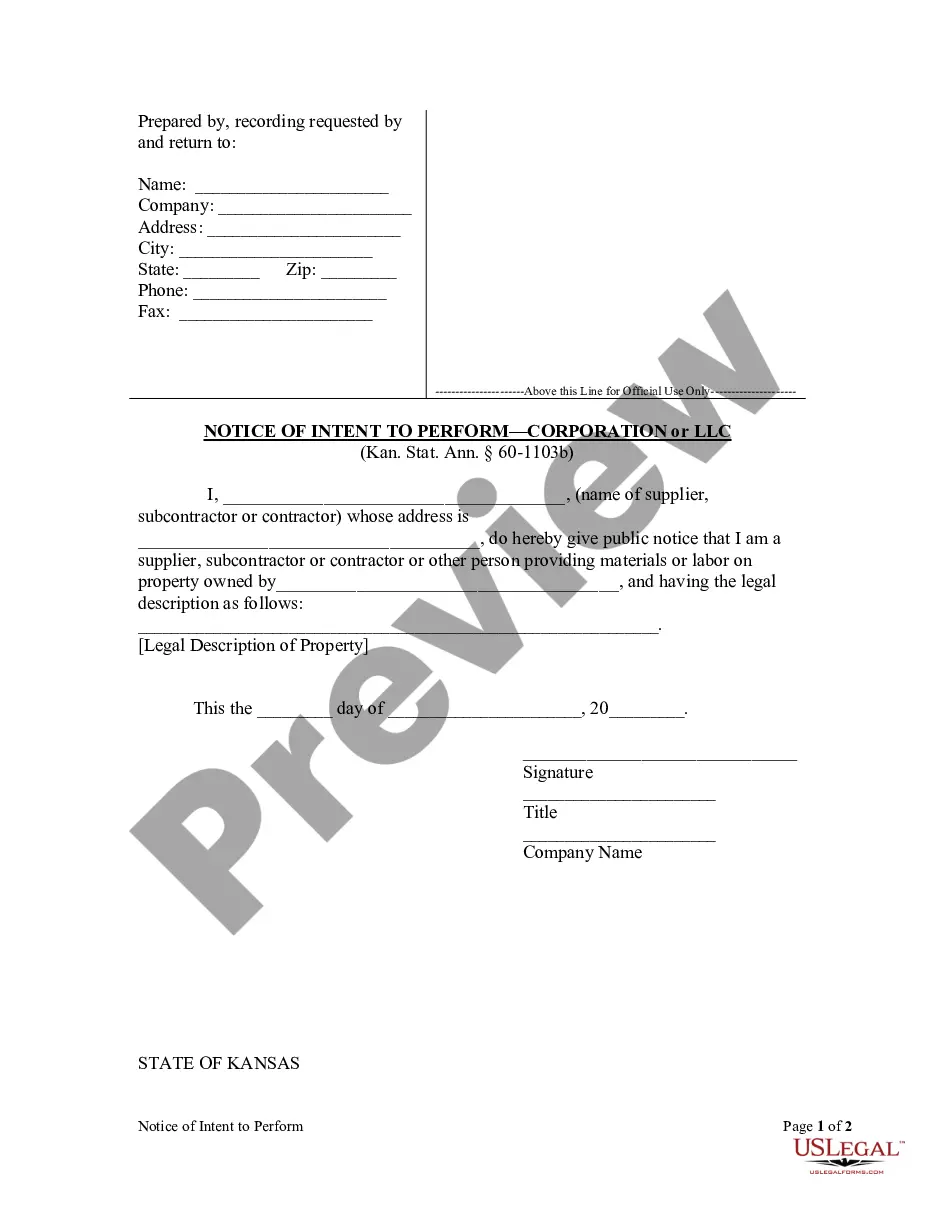

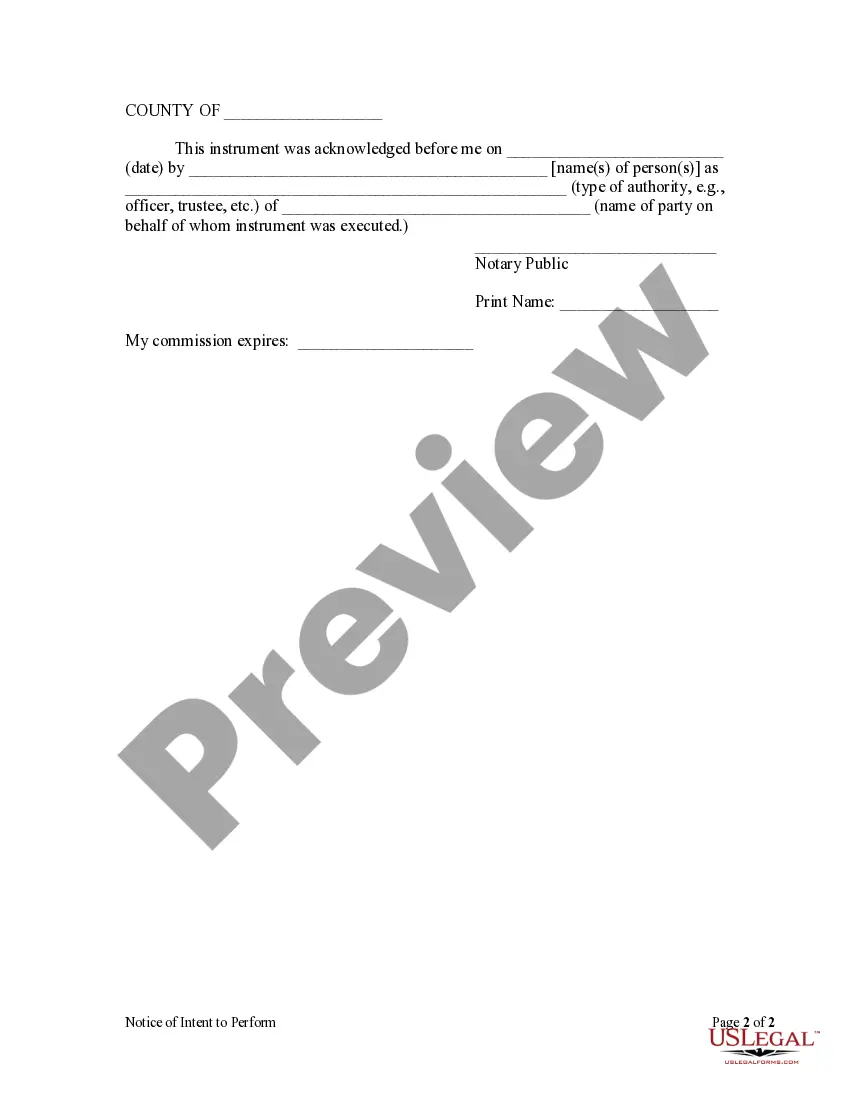

Kansas law provides a form with which a subcontractor may claim a lien for labor and/or materials provided to new residential property. This Notice of Intent to Provide is filed in the office of the clerk of the district court of the county where the property is located. After the lien claimant is paid in full, the lien claimant is required to also file a form releasing the previous Notice and waiving any lien.

Topeka Kansas Notice of Intent to Perform by Corporation or LLC: In Topeka, Kansas, when a corporation or limited liability company (LLC) intends to conduct business or engage in specific activities, it is required to file a Notice of Intent to Perform. This notice serves as an official notification to the state authorities, stakeholders, and the community about the corporation or LLC's intentions. The Topeka Kansas Notice of Intent to Perform by Corporation or LLC is a crucial legal document that provides transparency and accountability for businesses operating in the state. By filing this notice, corporations and LCS demonstrate their commitment to fulfill regulatory and statutory requirements while contributing to the economic growth of Topeka. The Notice of Intent to Perform by Corporation or LLC includes essential details that identify the business entity, such as the legal name, registered agent, and principal address. It also outlines the intended activities or services that the corporation or LLC plans to perform within the state. There are several types of Topeka Kansas Notice of Intent to Perform by Corporation or LLC, depending on the purpose of the business entity's activities. Some notable types include: 1. Notice of Intent to Perform Business Activities: This type of notice is filed when a corporation or LLC plans to establish a physical presence in Topeka, conduct regular business operations, or provide services within the city or surrounding areas. 2. Notice of Intent to Perform Construction Activities: If the corporation or LLC intends to engage in construction-related activities, such as building, renovating, or contracting services in Topeka, they must file this specific notice. It ensures compliance with local building codes and regulations. 3. Notice of Intent to Perform Professional Services: When a professional services corporation (e.g., legal, medical, accounting) or LLC wants to offer their specialized services within Topeka, they must file this notice. This ensures transparency and adherence to professional standards in their respective fields. 4. Notice of Intent to Perform Trade or Manufacturing Activities: Corporations or LCS engaged in manufacturing, production, or trade-related activities in Topeka are required to file this specific notice. It indicates their compliance with state regulations and ensures the safety and quality of their products. The Topeka Kansas Notice of Intent to Perform by Corporation or LLC plays a crucial role in establishing legal compliance, monitoring business activities, and safeguarding the rights and interests of the state, stakeholders, and the public. By filing this notice, corporations and LCS contribute to an efficient and regulated business environment, thereby promoting economic growth and maintaining the reputation of Topeka as a business-friendly city.